- Notcoin’s falling wedge breakout pattern and strong RSI and MACD indicators suggest bullish momentum.

- Mixed on-chain signals and high short interest hint at potential for a short squeeze.

As a seasoned researcher with over two decades of experience in analyzing cryptocurrency markets, I must say that Notcoin [NOT] presents an intriguing scenario right now. The falling wedge breakout pattern coupled with strong RSI and MACD indicators suggest a bullish momentum that is hard to ignore. However, the mixed on-chain signals and high short interest hint at potential for a short squeeze, which could further fuel price action.

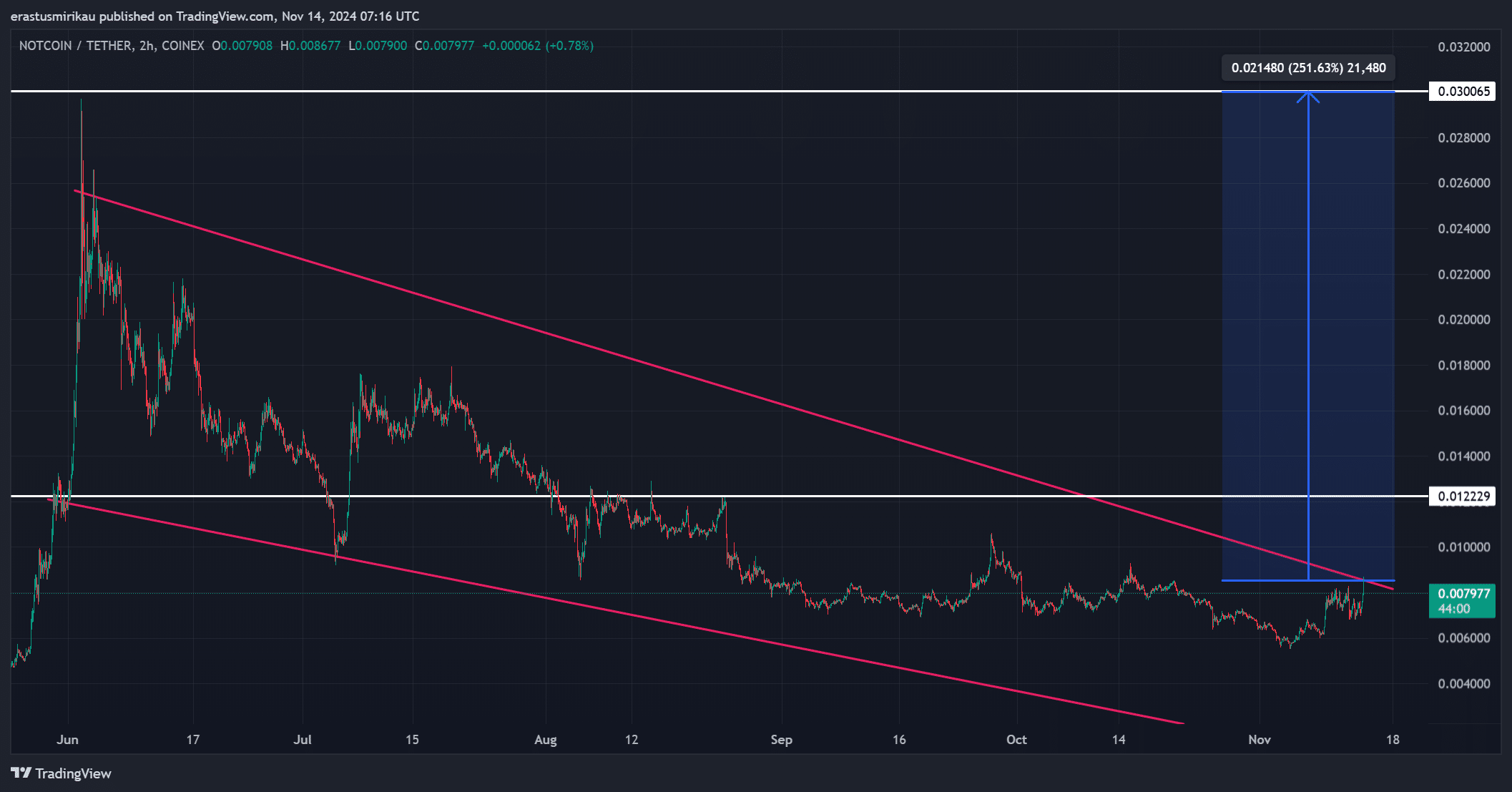

It seems that Notcoin is showing signs of a potential breakout from a falling wedge formation, as it has risen by 12.89% over the last 24 hours to currently stand at $0.008007. This pattern often suggests a bullish reversal, sparking speculation about potential future growth.

If the breakout proves successful, it could potentially drive the price back to its initial resistance point of $0.01222, and even beyond to an extended goal of $0.030. This lofty target suggests a potential increase of 251%, raising questions about whether NOT is equipped to leverage this bullish opportunity.

NOT approaching a crucial breakout level

On NOT’s graph, the descending triangle pattern (a type of falling wedge) offers optimism for bullish investors, as this configuration often triggers a shift in trend direction. At present, NOT is approaching a potential breakout, which might push it towards testing the nearby resistance at approximately $0.01222.

Consequently, reaching this price level serves as a significant milestone. Not only does it verify a breakthrough, but surpassing it might propel NOT towards its long-term objective of $0.030.

Reaching beyond $0.01222 might stimulate more purchases, potentially driving the price upward as the momentum gains strength.

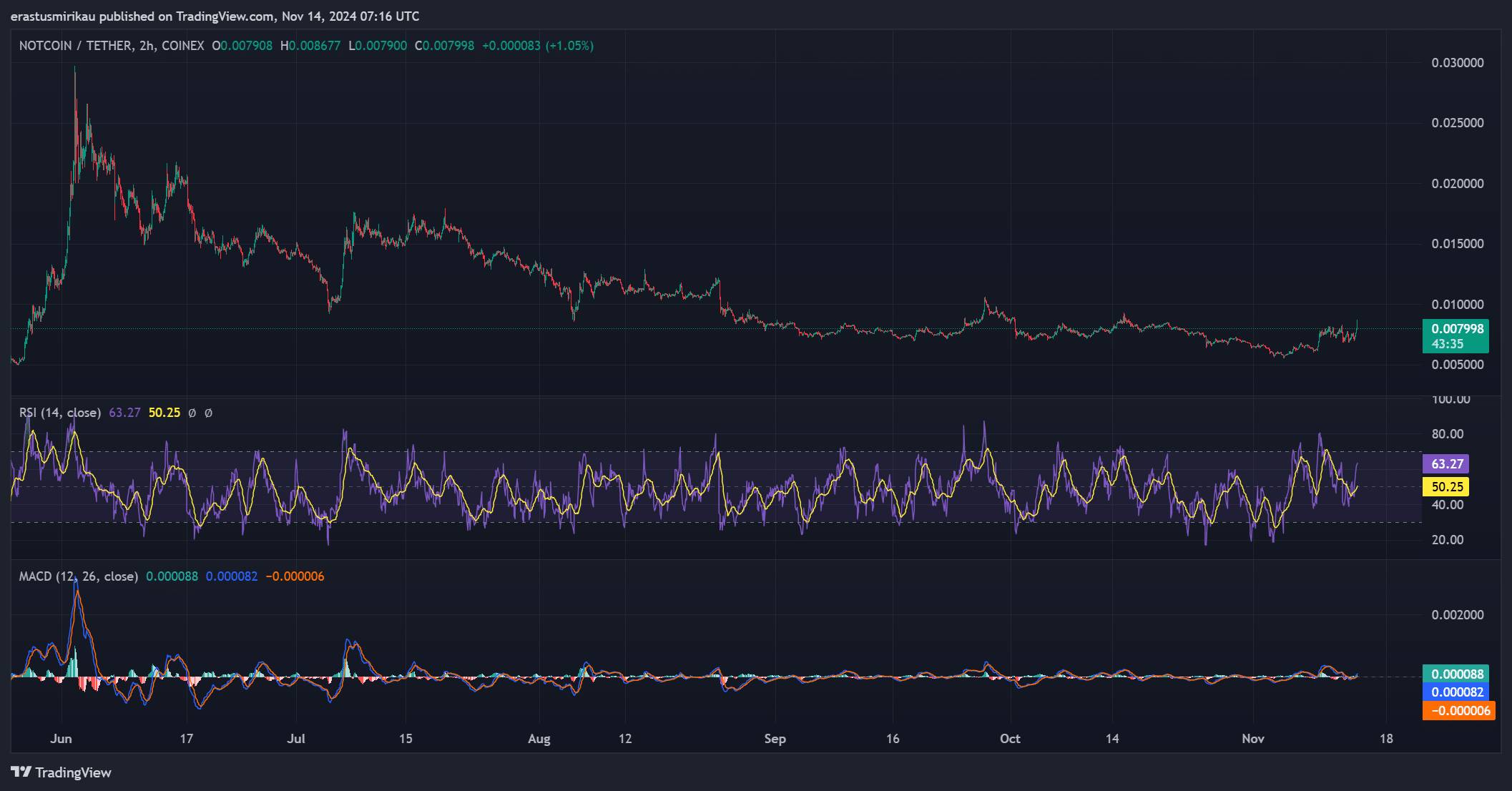

Bullish signals from RSI and MACD

In simpler terms, the technical analysis supports a positive outlook for NOT. The Relative Strength Index (RSI), at 63.27, suggests that the stock is showing strong momentum but hasn’t yet reached levels that could be considered ‘overbought’.

As a crypto investor, I’m optimistic about the market trend right now. It seems like we might still see some upward momentum before encountering pressure that could potentially cause a pullback.

Furthermore, the Moving Average Convergence Divergence (MACD) has displayed a bullish intersection. In this instance, the MACD line has crossed above the signal line, which typically signifies increased buying activity and lends credence to the breakout hypothesis.

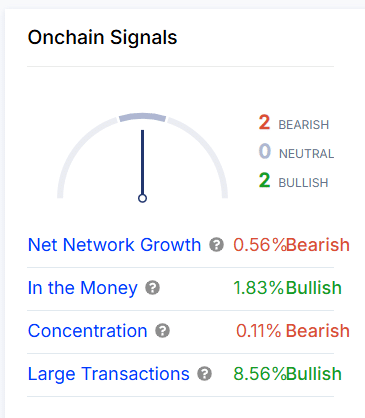

NOT on-chain activity shows mixed sentiment

By analyzing blockchain data, we see a mix of positive and negative signals regarding NOT. A slight drop of 0.56% in network growth might indicate a bearish trend, as it seems to suggest a decline in the number of new users joining the platform.

From my analysis perspective, while certain aspects show a downturn, it’s encouraging to note a rise of 1.83% in our “In the Money” metric. This suggests an increase in profitable holders, potentially boosting investor confidence.

Furthermore, there’s been an 8.56% increase in significant transactions, indicating increased activity from institutional or high-value investors. Although there was a minor decrease (0.11%) in concentration, this trend, along with the other data, suggests a generally optimistic perspective.

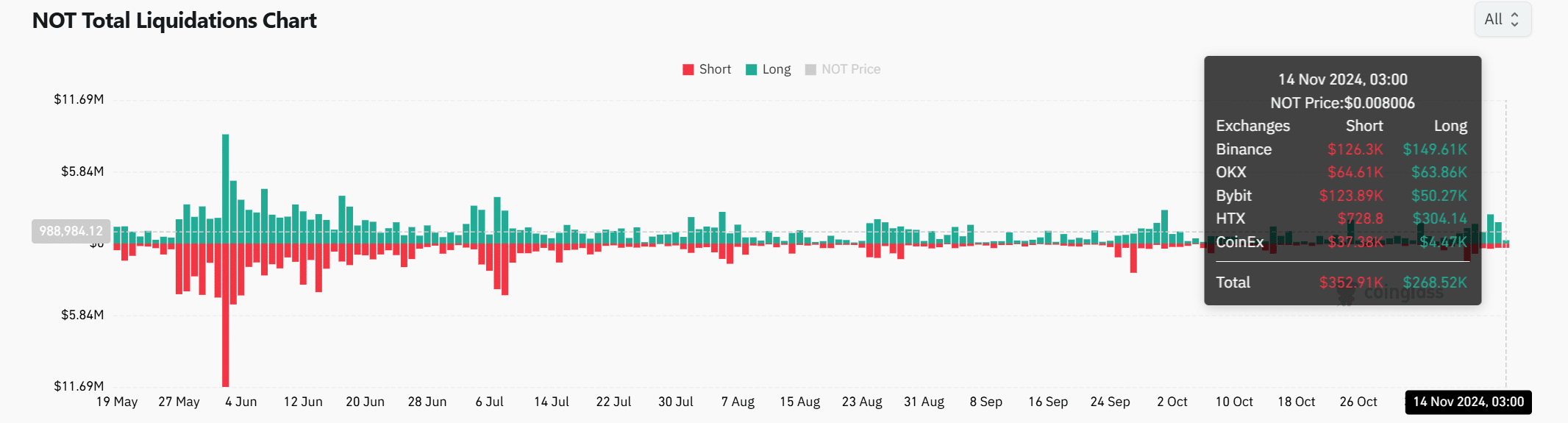

Liquidation data hints at possible short squeeze

Looking at the breakdown of liquidation figures, it appears that more traders are taking short positions ($352,910) than long positions ($268,520). This suggests a degree of cautiousness or pessimism in the market, as a higher number of participants seem to be betting against a bullish trend.

However, this setup could also lead to a short squeeze if

Notcoin manages a breakout, causing those who bet against it to exit their positions, which drives the price up. Binance shows significant long position liquidations worth $149,610, suggesting robust buying activity. Meanwhile, short positions are prevalent on major exchanges, hinting at the possibility of quick price fluctuations.

Read Notcoin’s [NOT] Price Prediction 2024–2025

Given a favorable configuration in its chart, positive technical markers, and generally hopeful on-chain signals (though somewhat divided), Notcoin seems poised for a surge. Overcoming the $0.01222 resistance might initiate a rally, with a feasible trajectory leading to a potential goal of $0.030.

With the current pace and possibilities for a short squeeze, IT is likely to make significant progress towards realizing its lofty goals.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-11-15 04:08