- DOT’s price faces a key threshold; if it can break through the current supply level, a rally could follow.

- Technical indicators are sending mixed signals—some suggest a bullish shift, while others hint at continued bearish pressure.

After years of navigating the crypto market, I can tell you that predicting the exact movements of tokens like DOT is akin to trying to foretell the weather using yesterday’s forecast. However, based on the current analysis, it seems we have a situation where technical indicators are playing a game of tug-of-war with DOT’s price direction.

Over the last four weeks, the price action of Polkadot‘s [DOT] token has been underwhelming, as a predominant bearish attitude has resulted in a drop of approximately 18.97%.

The future actions of DOT are unclear since contrasting data points continue to split the market’s opinion, potentially leading to price fluctuations during forthcoming trading periods.

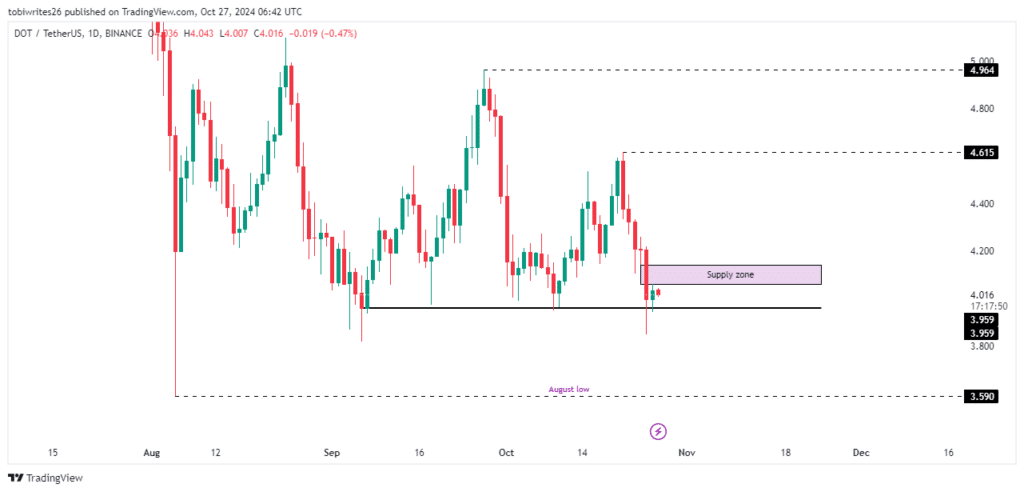

DOT stuck between key levels

At the moment, DOT’s price movement is sandwiched between two important markers which may influence its trend during the forthcoming trading periods.

Following a recent rebound from a support level at 3.959, DOT might surge towards either 4.615 or 4.964 if this support remains strong. Yet, an area of increased supply hovers overhead, which may instigate selling activity and drive the price downward, possibly causing DOT to revisit its August lows.

When examining possible future movements, AMBCrypto considered various technical signals, however, these signs were inconclusive, resulting in an unclear forecast.

No clear pattern from traders: mixed signals for DOT

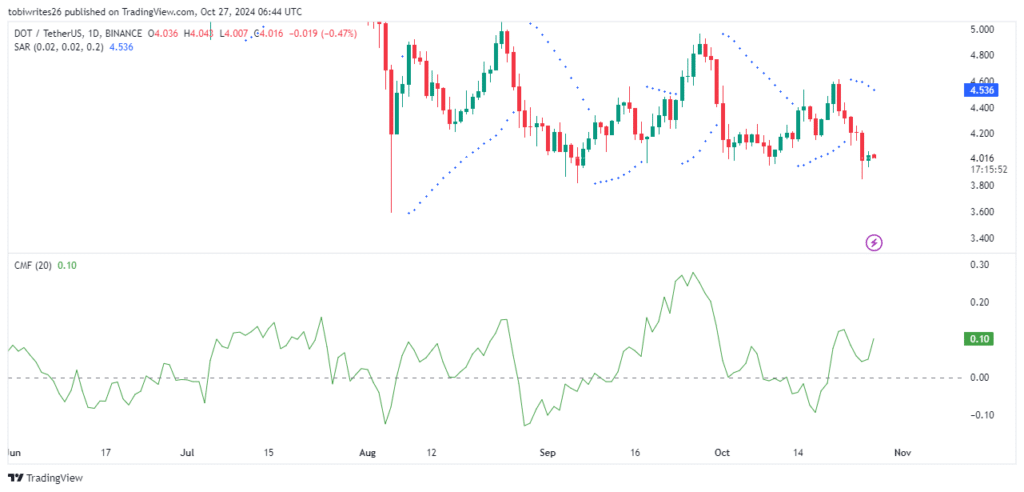

The Chaikin Money Flow (CMF) and Parabolic SAR (Stop and Reverse) are providing mixed signals for DOT, suggesting both optimistic and pessimistic trends, which makes it challenging to predict its upcoming trajectory with certainty.

The Chaikin Money Flow (CMF), a tool that measures the inflow and outflow of funds in an asset, has risen slightly, currently standing at 0.11. A positive CMF value usually indicates growing buying interest, often signaling a possible price rise for DOT, suggesting potential upward momentum.

As a researcher, I’m observing that if the current trend persists, it seems plausible for DOT to breach its existing supply region, which could prolong an upward price movement.

Instead, when the Parabolic Stop and Reverse (PSAR) – a trend-focused indicator that signals changes in direction – shows numerous dots positioned above a stock’s price, it suggests a bearish outlook. This indicates persistent selling pressure and a probable prolongation of the downward trend.

If you see the Parabolic SAR dots floating above the asset’s current value, this often indicates a barrier or resistance and suggests that there may be more downward price movements to come.

Using on-chain activity as a supplementary source of information, AMBCrypto seeks to shed light on the potential direction for DOT’s future, given that these two indicators appear to be pointing in opposite directions.

Gradual buying pressure emerges for Polkadot

Data from Coinglass indicates a positive funding rate for DOT, suggesting an increase in long interest from traders.As of the latest reading, DOT’s funding rate stands at 0.0109%.

Read Polkadot’s [DOT] Price Prediction 2024-25

In simpler terms, when the funding rate is positive, it’s like long-position holders are compensating short-position holders for their service in maintaining a balanced market price. This usually indicates a general optimism among traders who believe prices will rise (a bullish sentiment), potentially driving up the value of DOT.

Should the purchasing activity persist, it’s possible that DOT could surge beyond its present resistance level, potentially leading to a continued upward trajectory.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-27 20:08