- Maker surges with 8.93% in 24 hours after a week of bull run.

- Market sentiment, and key technical indicators suggest a bull run

As a seasoned crypto investor with a knack for analyzing market trends and identifying potential gains, I’m bullish on MakerDAO’s MKR token. The recent surge of 8.93% in just 24 hours, following a week-long bull run, is an exciting development that I believe holds significant promise.

In the past week, MakerDAO’s MKR token has shown a robust performance, gaining approximately 4.80%. More recently, within the last day, there has been a significant rise of around 8.93% for this digital asset.

As a crypto investor, I’d say: At the moment of writing this, Maker is being traded at a price of $2414.47, with a 24-hour trading volume amounting to $109 million. Notably, MKR has surged by 61% above its all-time high (ATH), leading to a significant uptrend that has boosted the current prices to an astounding 11,475% above their previous lowest levels.

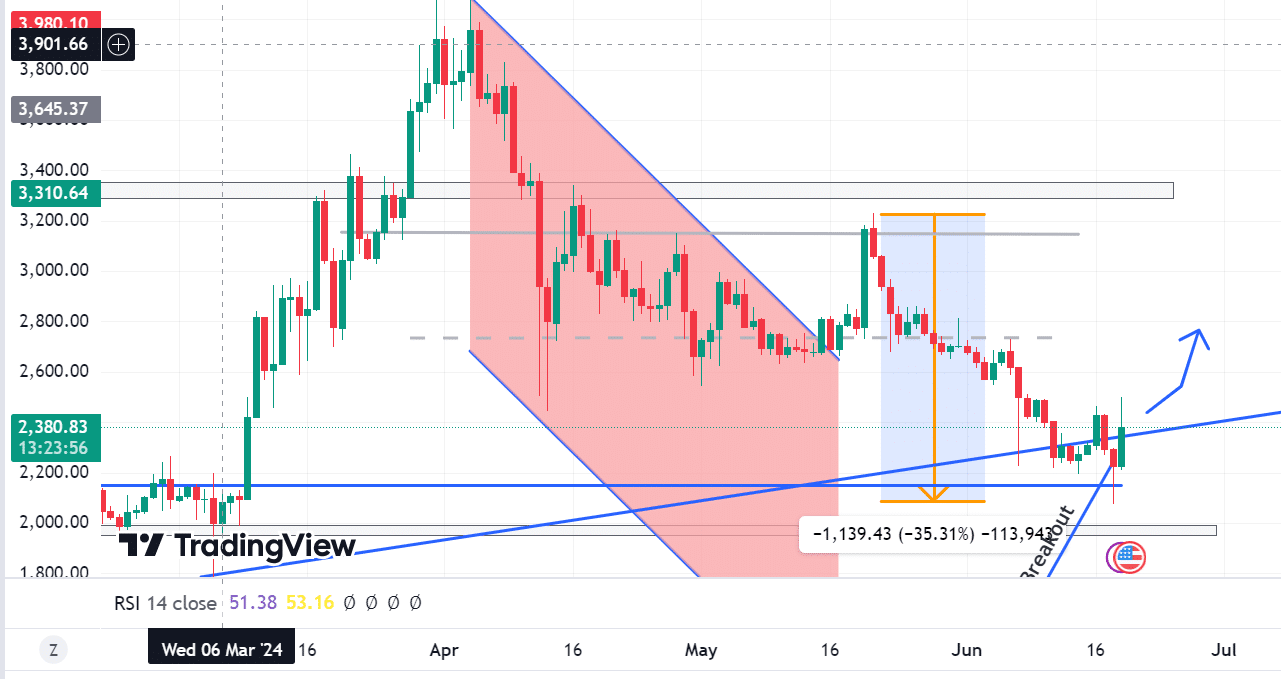

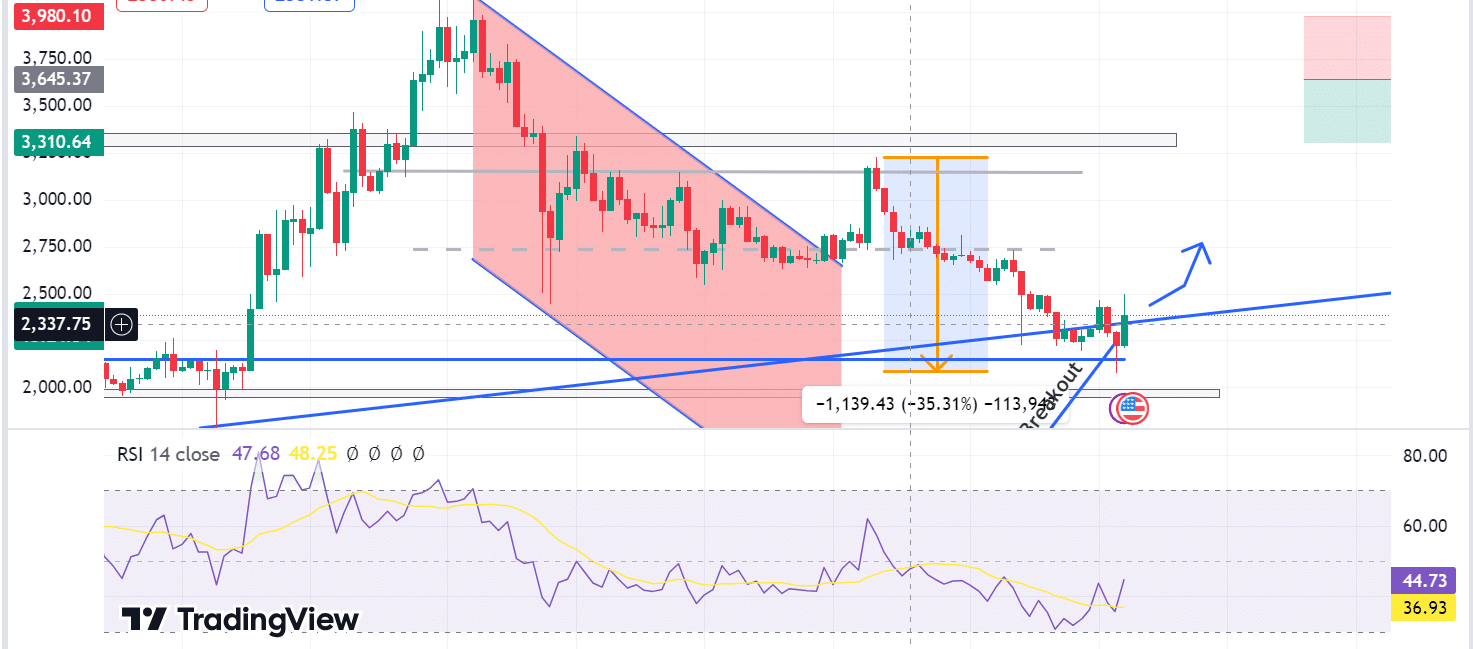

Based on AMBCrypto’s analysis, the momentum of MRK is leaning bullish as it makes an effort to surpass the nearby resistance of approximately $2729. Should it fail to do so, its next objective would be the $3145 mark.

The present support for MKR hovers near the $2150 mark, with a minimum at approximately $1945. Given the indicators’ indication that the $2150 support holds strong, MKR aspires to surmount the resistance at around $2745.

MKR would break out with only a 2.7% change and aim for more gains.

The Relative Strength Index (RSI) shows a robust uptrend over the past week, with a current value of 44.68 that surpasses its moving average of 36.93.

When the Relative Strength Index (RSI) value is higher than its moving average, this is often interpreted as a bullish sign. This means that recent gains in the market have been more pronounced than losses, suggesting a positive trend or uptrend.

With an RSI of 46, it indicates that Maker has been oversold and could be a good candidate for a buy or long position, as there is potential for further price growth.

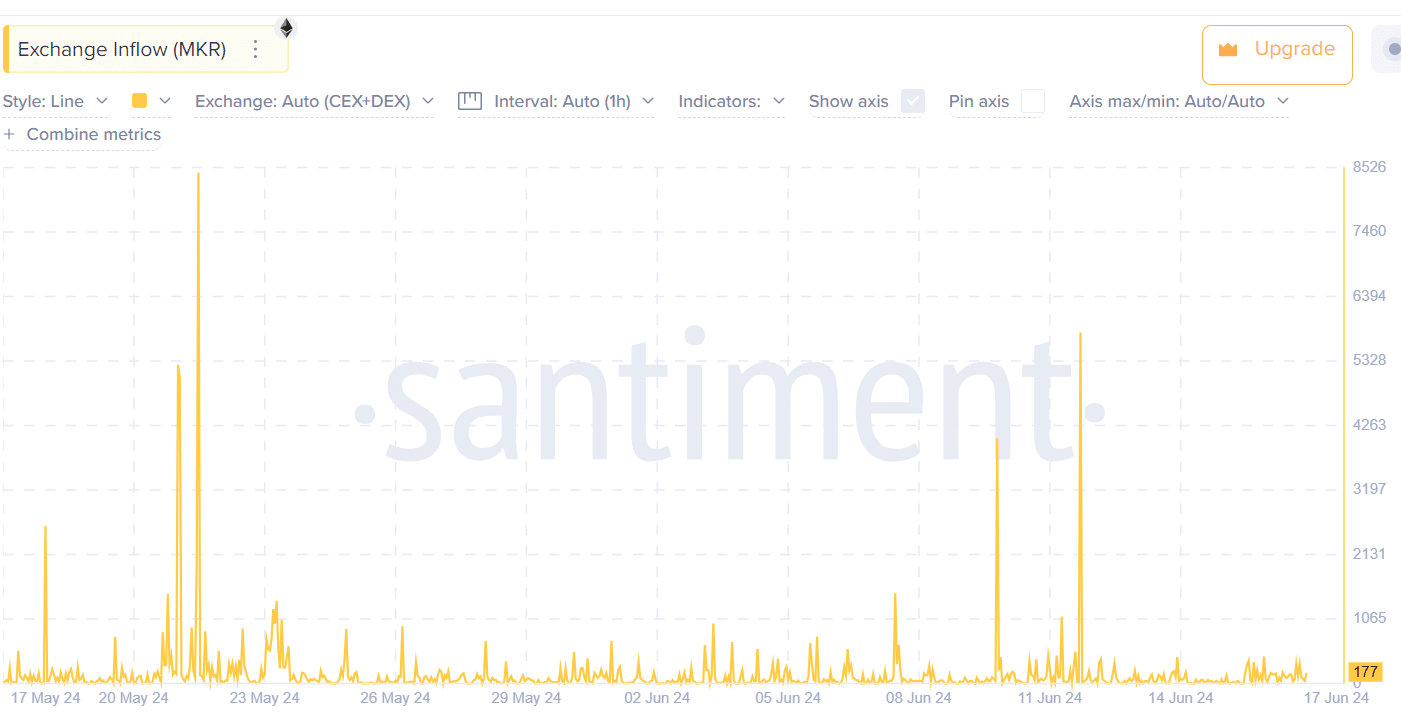

Over the last week, Santiment reports that the amount of MKR tokens entering exchanges for trading has decreased significantly. The inflow peaked at 5799 on June 12th, but dropped to a mere 177 by June 17th.

Normally, an increase in the volume of exchanges indicates that traders are getting ready to sell their assets, leading to increased downward price pressure.

In simpler terms, when MKR reports a smaller amount of assets coming in through exchanges, it indicates that there is a limited supply of assets. This lack of availability puts downward pressure on sales, leading to increased prices.

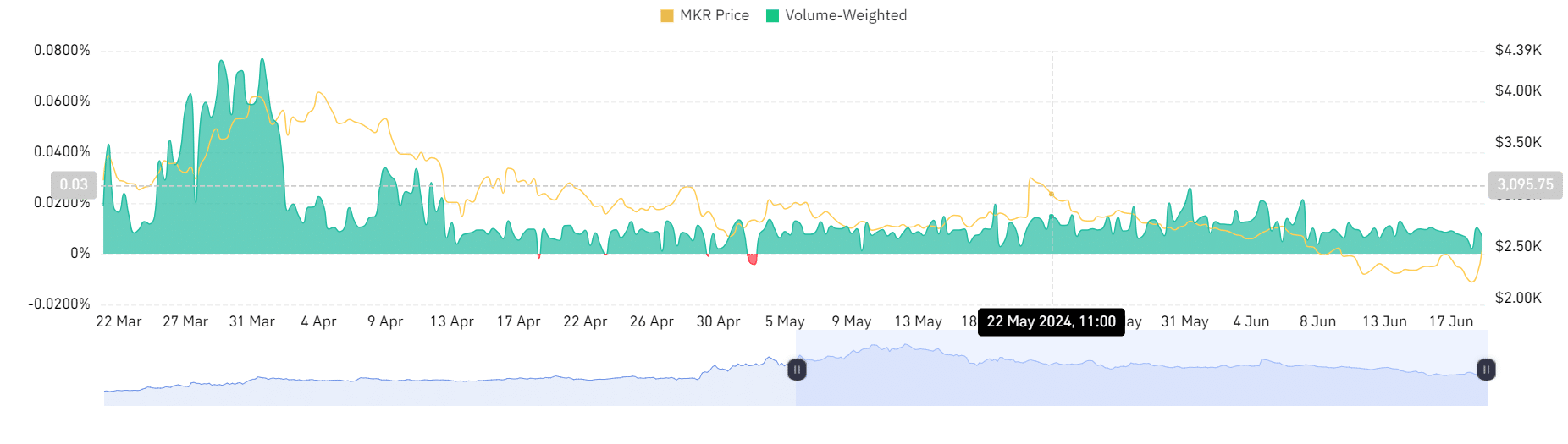

Interestingly, according to Coinglass, MKR has reported a balanced volume-weighted funding rate.

“Long and short positions are evenly balanced in the market, indicating a stable condition where neither bears nor bulls have significant influence.”

Realistic or not, here’s MKR’s market cap in BTC terms

Will MKR’s recent surge hold?

Over the past week, MKR has seen significant price increases. Important signs point to a continuing upward trend following the strong hold at the support level of $2150.

MKR is poised to test the resistance at approximately $2729 as it prepares to break free from its downtrend. Moreover, the market mood is optimistic, reflected in a climbing Relative Strength Index (RSI) and diminishing exchange outflows.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-06-20 03:03