- MKR was showing strong upward momentum after breaking out of a bullish pattern, though it was facing a minor resistance level.

- Market metrics suggested high trader interest, with increased buying activity signaling confidence in further gains.

As a seasoned researcher with over two decades of experience under my belt, I can confidently say that MKR’s current surge is more than just a blip on the radar. The bullish pattern breakout and increased buying activity are strong indicators of further gains. However, it’s important to remember that even the mighty MKR can face minor resistance levels (like the 1,418 mark).

Over the past day, Maker’s price increased by 11.20%, peaking at $1,416.32 as of this writing. The trends in indicators such as Funding Rates and Open Interest suggest that there could be further growth ahead.

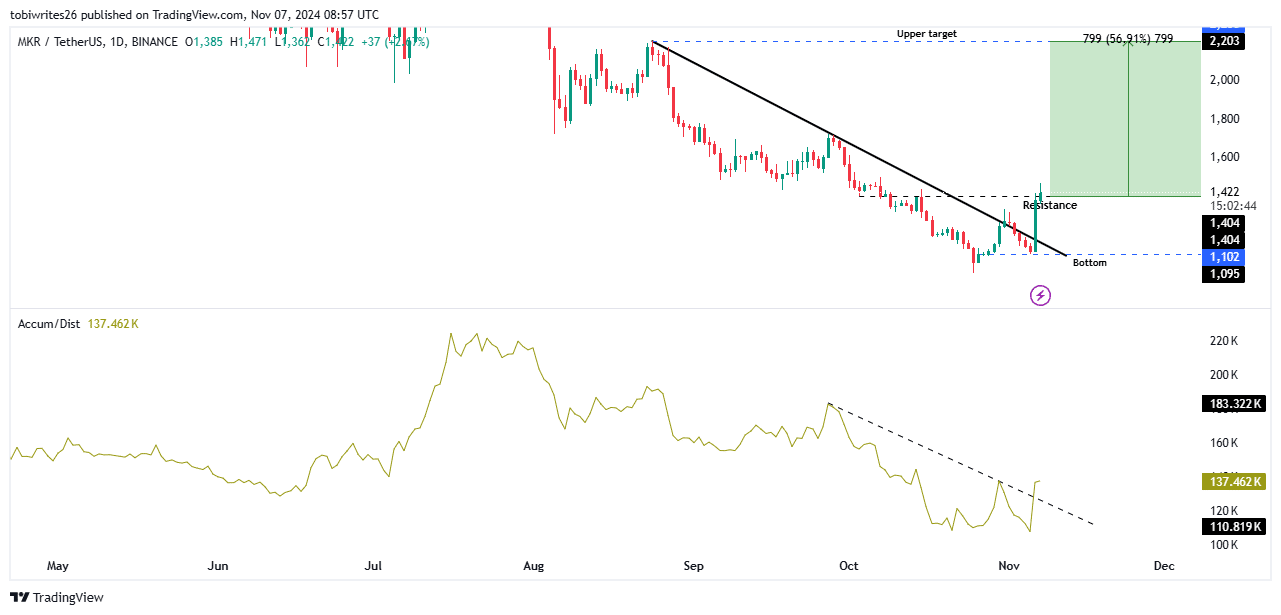

Consistent accumulation reflected sustained demand from market participants.

MKR set for 54% gain?

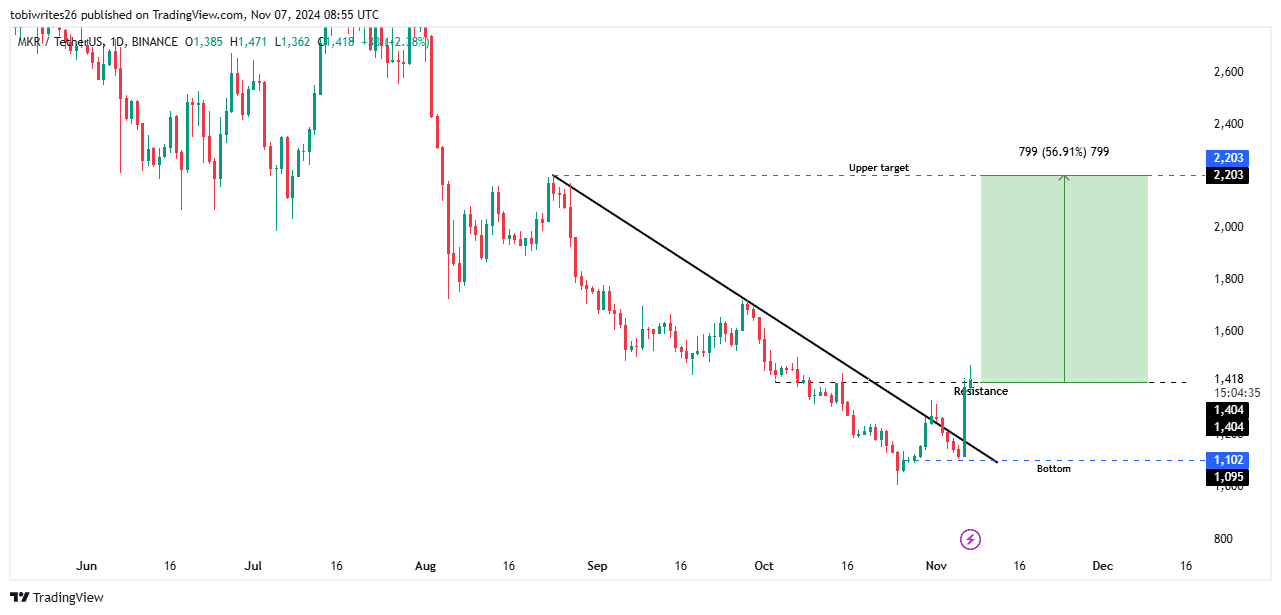

For about three months now, MKR has been confined to a downward sloping channel which prevented significant price increases. Lately, however, it managed to break free from this channel, causing its market cap to surge by approximately 11.48%, reaching a value of $1.24 billion.

Currently, MKR is encountering resistance at the $1,418 mark, with a significant wave of selling activity arising. Should it successfully break past this point, MKR might experience an impressive increase of approximately 56.91%, potentially reaching towards $2,203.

If the downward trend strengthens, there could be a minor retreat for MKR, potentially reaching a level close to $1,102. This area has historically shown robust support due to significant past buying activity.

AMBCrypto’s analysis of broader market activity indicates an overall bullish outlook for MKR.

Trader bids fuel uptrend

Trader bids are supporting MKR’s upward momentum, driving notable gains in the market.

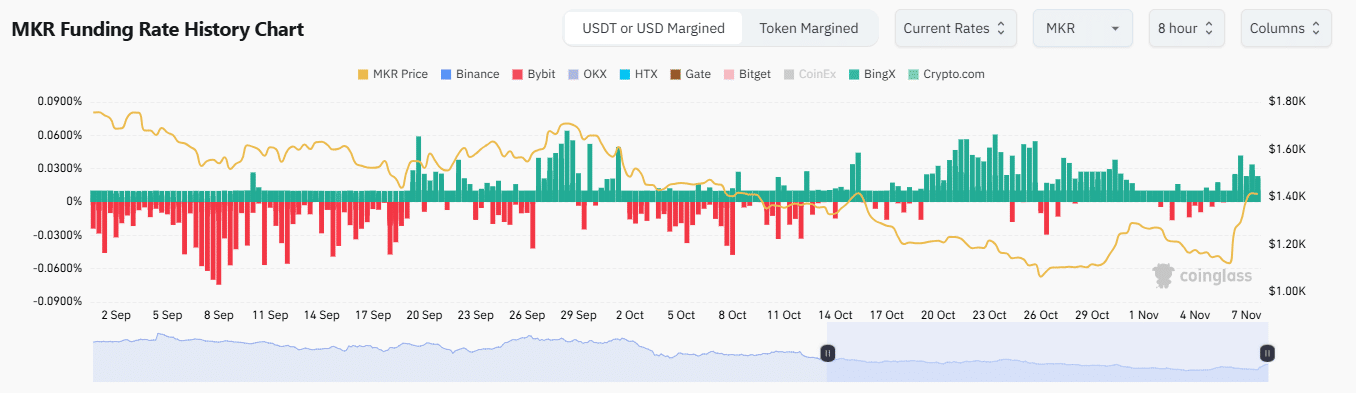

In the last day, the Open Interest (OI) for MKR has increased by approximately 13.67%, reaching a level of around $120.30 million, as reported by Coinglass. This suggests that more and more bullish traders are gradually gaining control in the market.

Tracking the number of open, unresolved derivative contracts, an uptick suggests that long-term investors are holding more positions at present. This could lead to a rise in the asset’s price due to increased buying pressure.

Moreover, the Funding Rate, which indicates which part of the market holds positions to keep the balance between the spot and futures markets, is likewise influenced by long-term traders.

Based on the most recent statistics I’ve gathered, the current Funding Rate has risen to 0.0211%. This substantial uptick indicates a growing bullish trend in the market, which I find quite intriguing.

Should this pattern continue, it suggests that there’s ongoing possibility for upward growth, given that investors anticipate more profits.

Accumulation phase underway

The coin’s upward trend was validated when its Accumulation/Distribution line surpassed a significant resistance trendline, indicating a potential for continued growth in the price.

Read Maker’s [MKR] Price Prediction 2024–2025

After this surge, it’s expected that there will be more buildup, potentially leading to further growth as MKR keeps rising.

This sustained buying interest is expected to have a positive impact on the asset’s price.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-08 03:03