-

An early Maker investor sold $408,000 MKR barely two weeks after the project rebranded to Sky.

At press time, MKR was trading at an eight-month low, as bearish pressure persisted.

As a seasoned researcher with years of experience in the crypto market, I can’t help but feel a sense of deja vu when I see such sell-offs. The Maker [MKR] rebrand to Sky was indeed an exciting move, but it seems that some investors are still grappling with the transition.

The recent rebranding of Maker [MKR] to Sky was intended to increase network activity and maintain regulatory standards. Yet, it seems that this change has not been favorably received by some financial backers.

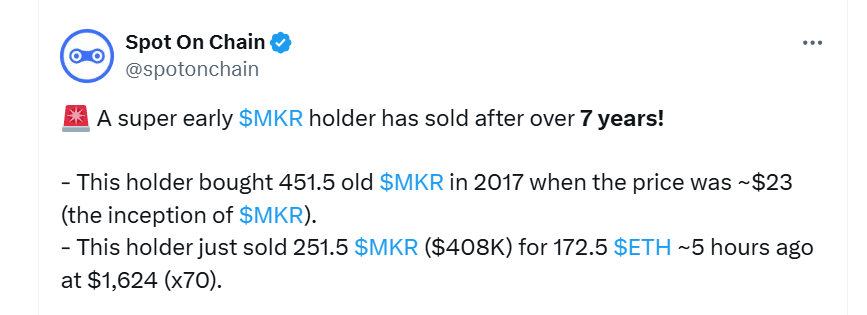

As per Spot On Chain’s report, one of the initial backers of the project has offloaded more than half of their MKR holdings. They acquired 451 MKR tokens way back in 2017 at approximately $23 each.

On the 5th of September, they sold 251 tokens for $408,000 and still hold 200 MKR.

In light of recent events, the sale occurs as Maker finds itself under increasing bearish influence. Specifically on August 27th, the day the rebrand was launched, MKR was exchanging hands at approximately $2,175.

Since then, the token has dropped by over 24%, to trade at $1,628 at the time of writing.

Maker drops to an eight-month low

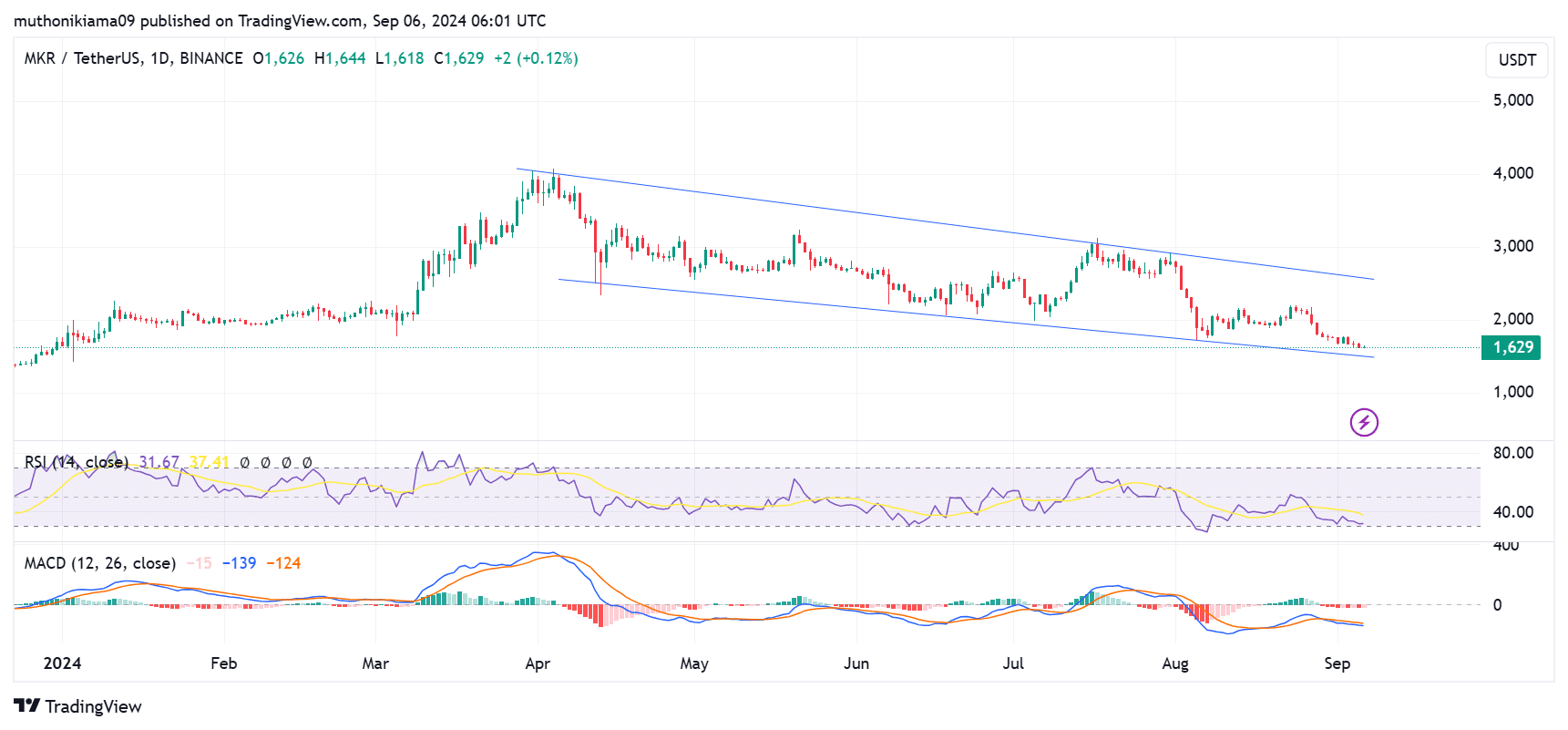

As an analyst, I’ve observed that the value of Maker has reached its lowest point since early January 2024. This token, having followed a bearish downward trajectory, is now approaching the potential test of its lower trendline. If this support level fails to hold, it could signal a continuation of the bearish trend, leading to potential further price drops.

As a crypto investor, I noticed that the Moving Average Convergence Divergence (MACD) added credence to my bearish viewpoint. The MACD had turned negative and dropped beneath the signal line, signaling that the downward trend was gaining traction, suggesting it might be prudent to consider selling or hedging positions.

Additionally, the MACD histogram bars turned red, indicating a potential continuation of falling prices, prompting traders to prepare for further decreases.

As a cryptocurrency investor, I’m finding myself in a challenging position given the current downtrend. It seems like there’s a scarcity of buyers in the market, which could be prolonging this bearish phase. Interestingly, the Relative Strength Index (RSI) reading at 31 suggests that sellers are overwhelmingly active right now, indicating a strong selling pressure.

Additionally, the RSI line has moved below the signal line and was making lower lows.

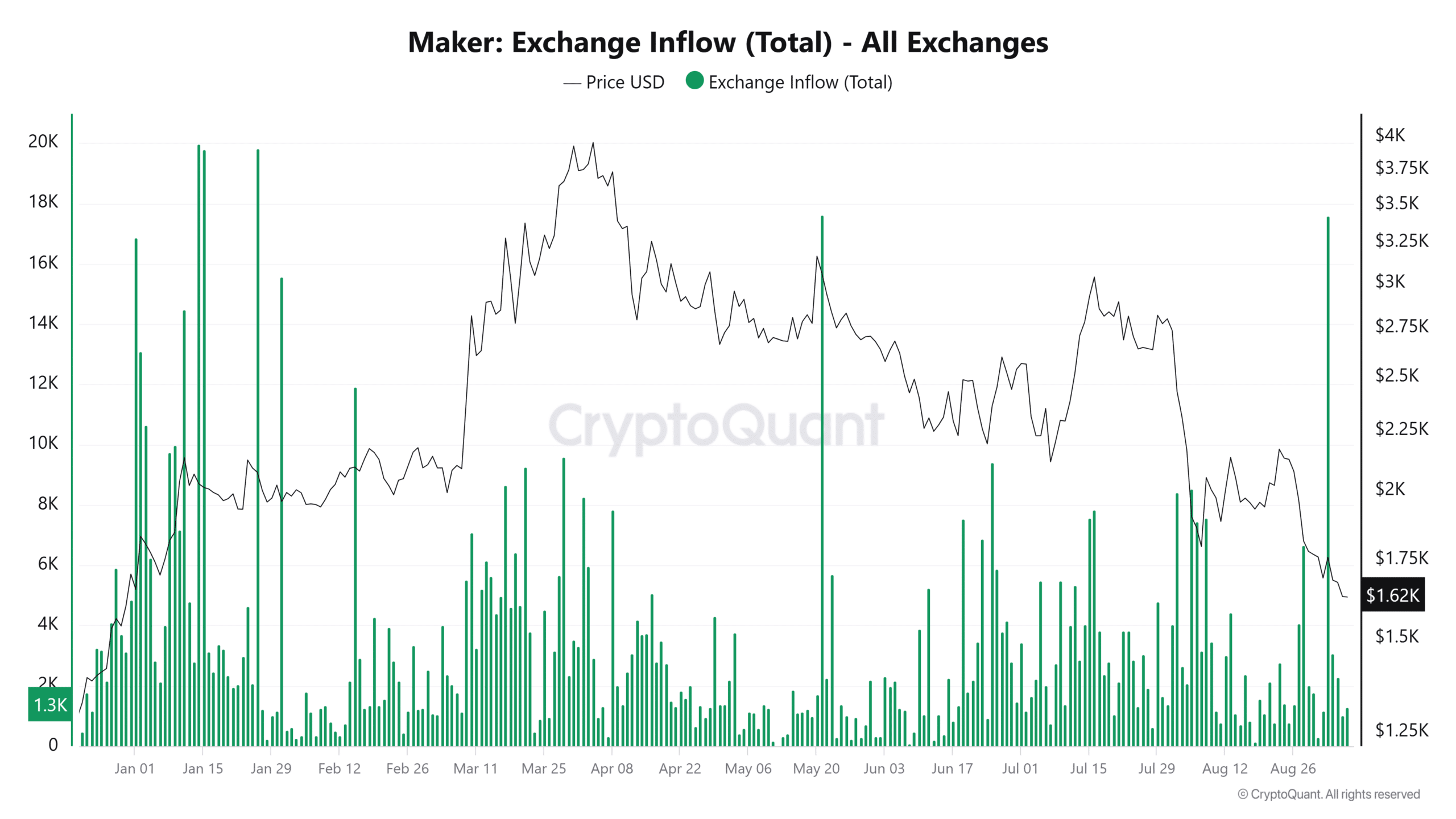

In simple terms, when there are more sellers than buyers, and this continues over time, it’s reflected in the data about money flowing into exchanges. This situation can indicate market instability or bearish sentiment among traders.

According to CryptoQuant, Maker’s MKR exchange inflows hit their peak since May just a week following its rebranding to Sky on the 2nd of September.

According to AMBCrypto, there’s been an increase in MKR‘s available supply on trading platforms, despite a lack of interest from buyers. This trend, indicated by the Relative Strength Index (RSI), makes a bearish argument for MKR even stronger and suggests potential further price drops might occur.

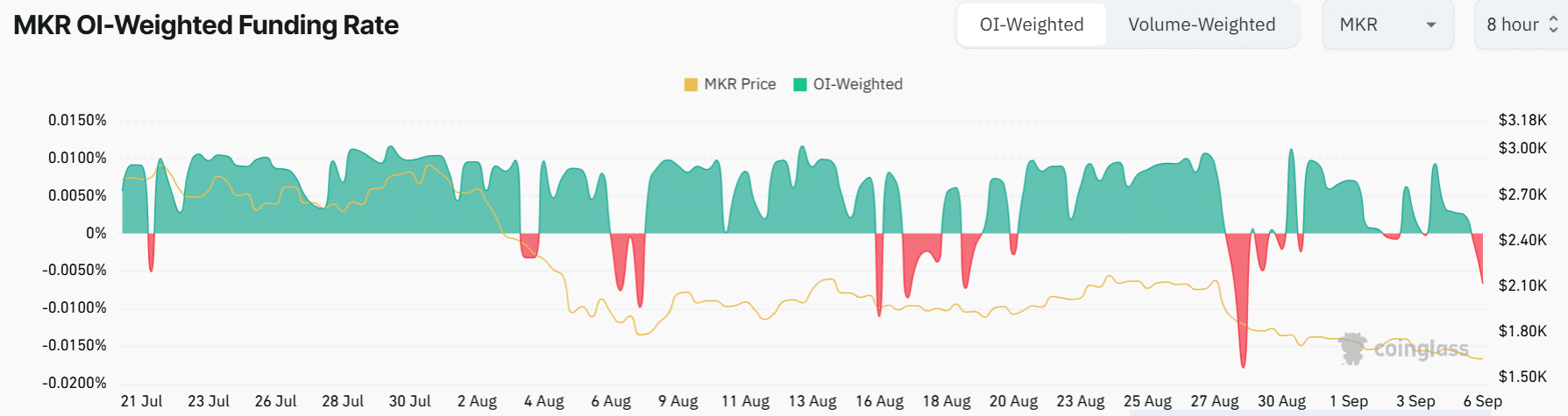

In simpler terms, the forecast for the derivatives market is looking quite dim. As per Coinglass, the amount of Maker’s Open Interest has decreased to $82M, which is the lowest it’s been since July.

This indicated that traders were closing their existing positions because of uncertainty.

Read Maker’s [MKR] Price Prediction 2024–2025

Despite the steep decline in Open Interest, there might just be a hint of optimism, as Funding Rates have dipped into the negative territory.

This might indicate that short-term traders were closing their positions and cashing out their gains, demonstrating a lessening of the negative trend.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

2024-09-07 01:11