- Token breached a descending channel and at press time, was testing a major support level that could serve as a price catalyst

- More sellers in the derivative market will affect MKR’s rally

As a seasoned analyst with a knack for deciphering market trends and a soft spot for MKR, I find myself at a crossroads when it comes to this token. On one hand, the descending channel breach and the major support level test offer an enticing opportunity for a potential rebound. The presence of a large buy order at a key support level bolsters my optimistic outlook, as does the emergence of bullish divergence hinting at waning selling pressure.

Over the past month, MKR’s performance in the market has been relatively weak compared to others, only managing to increase by 25%. In recent days, there have been some significant price swings for MKR, and this trend continued with a 0.25% drop over the last 24 hours. However, current market sentiment hints at a possible recovery from its current position.

Based on AMBCrypto’s assessment, it seems that major investors are responsible for MKR’s current downturn. If the crucial support level endures, a rebound could occur, possibly leading to more growth opportunities.

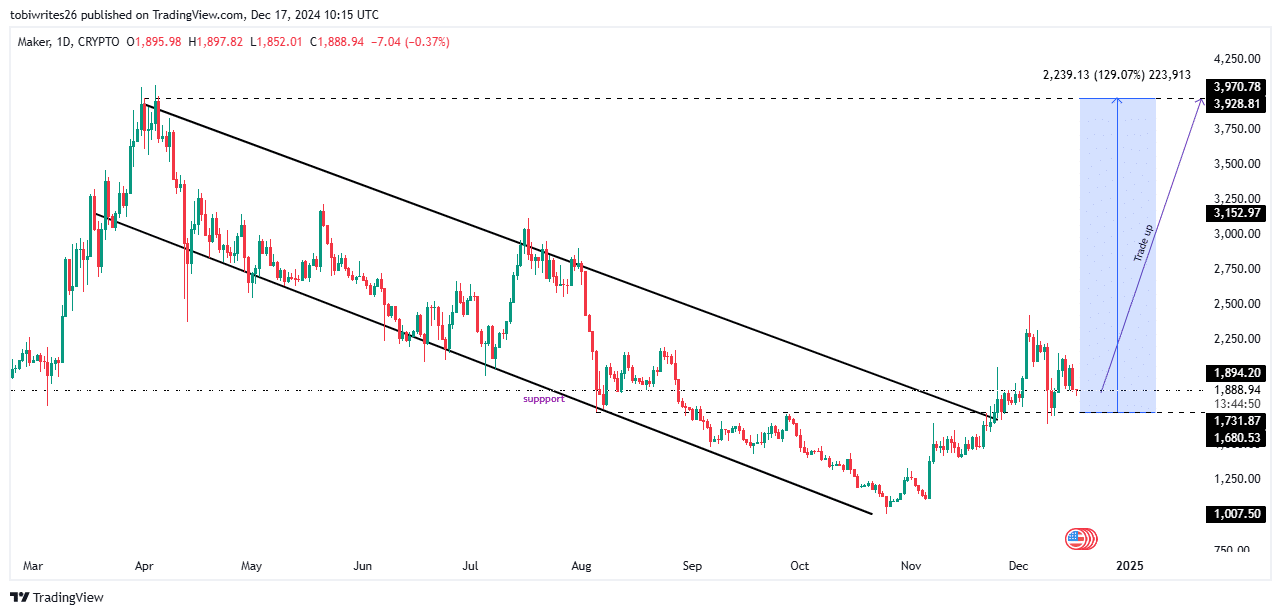

Can MKR reach $3,970 in the coming sessions?

Recently, MKR managed to break free from a downward trending channel where it had been moving since March. Yet, despite this breakout, the token has found it challenging to build significant positive movement, and it continues to hover beneath the expected levels.

Currently, MKR is being exchanged at a significant support area approximately $1,854.09. The trading range extends to as low as $1,656.55. This area has proven resilient in the past, and if it maintains its strength, MKR could potentially surge up to around $3,970.

In order for this move to occur, it’s crucial that MKR stays inside its specified boundaries and continues to attract buyers at these price points.

Therefore, AMBCrypto analyzed trading behavior to determine if the support area would likely be maintained, with a focus on where traders were placing their bids for MKR.

Large buy order placed for MKR at key support level

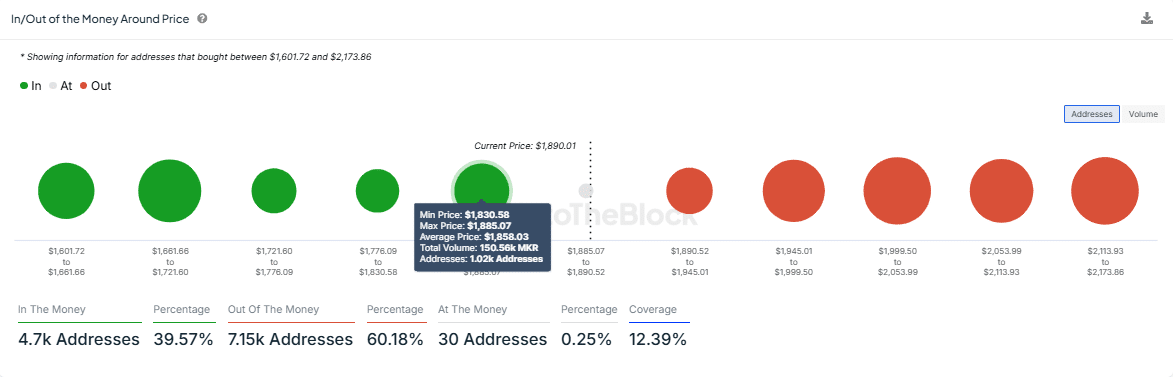

As per observations from IntoTheBlock, a substantial buy order has surfaced for MKR at a crucial support point, as determined by the In/Out of Money Around Price (IOMAP) indicator. This IOMAP tool pinpoints vital support and resistance points, allowing traders to predict possible price fluctuations more effectively.

As a crypto investor, I’ve noticed a robust area of potential support at approximately $1,858.03, which seems to line up rather neatly with the technical chart’s underlying support level. What’s intriguing is that over 1,020 addresses have collectively placed buy orders totaling around 150,560 MKR at this price point. This pattern suggests a significant concentration of buying interest, hinting that the market might be gearing up for a potential surge in this crypto’s value.

As an analyst, I’ve noticed that recent buying activity indicates a strong possibility of the $1,858 area acting as a significant support for MKR. If this support zone manages to hold firm, it might trigger a bullish reaction, potentially leading to a price recovery.

At the same time, it appears that bullish tendencies might be developing. For example, the number of substantial transactions has dropped dramatically, plummeting from 124 to only 27. This decrease led to a significant reduction in total transaction volume to approximately 9,270 MKR during the same timeframe, aligning with a recent price drop.

When big transactions significantly decrease, it’s usually an indication that the selling force is diminishing. As MKR nears its support area, the weakening of selling power makes it more probable for a surge towards higher prices, possibly reaching around $3,970.

Derivative market issues warning

In simpler terms, the trend in the futures market suggests that more traders are expecting MKR to decrease instead of increasing, as shown by the rising number of bets against MKR compared to those for its rise. This is indicated by the growing imbalance in the number of long (buy) positions versus short (sell) positions.

Currently, when I’m composing this text, the long-to-short ratio is around 0.75 – a considerable decrease below the neutral level of 1. This indicates a substantial increase in the number of short positions taken on MKR.

Should this trend continue, it might decrease the chances of a price surge from its current support level. For a turnaround to occur, there needs to be a change in investor attitude, leading to an increase in long positions taken by derivatives traders on MKR.

Read More

2024-12-18 12:08