- Mantle was unable to continue the uptrend it began earlier this month- showcasing a lack of conviction.

- It remains to be seen whether Mantle can outperform other popular large-cap altcoins, but there is some hope.

As a seasoned analyst with over two decades of experience in the crypto market, I find myself intrigued by Mantle [MNT]. The rapid 74% surge it witnessed earlier this month was indeed impressive, but the subsequent pullback is concerning. It seems that Mantle lacks conviction to maintain its uptrend amidst Bitcoin’s dominance and the general attention drawn towards large-cap altcoins.

Over a mere five-day span, beginning on November 4th, Mantle [MNT] surged by an impressive 74%, climbing from $0.541 to $0.94. However, this rapid ascent was followed by a significant retreat shortly afterward.

In this stage, numerous altcoins experienced significant price increases. The dip in MNT occurred at a moment when Bitcoin [BTC] surpassed the $75k mark and continued to rise, thus attracting greater focus towards Bitcoin, causing altcoins such as Mantle to remain relatively obscure.

Buying opportunity for Mantle bulls?

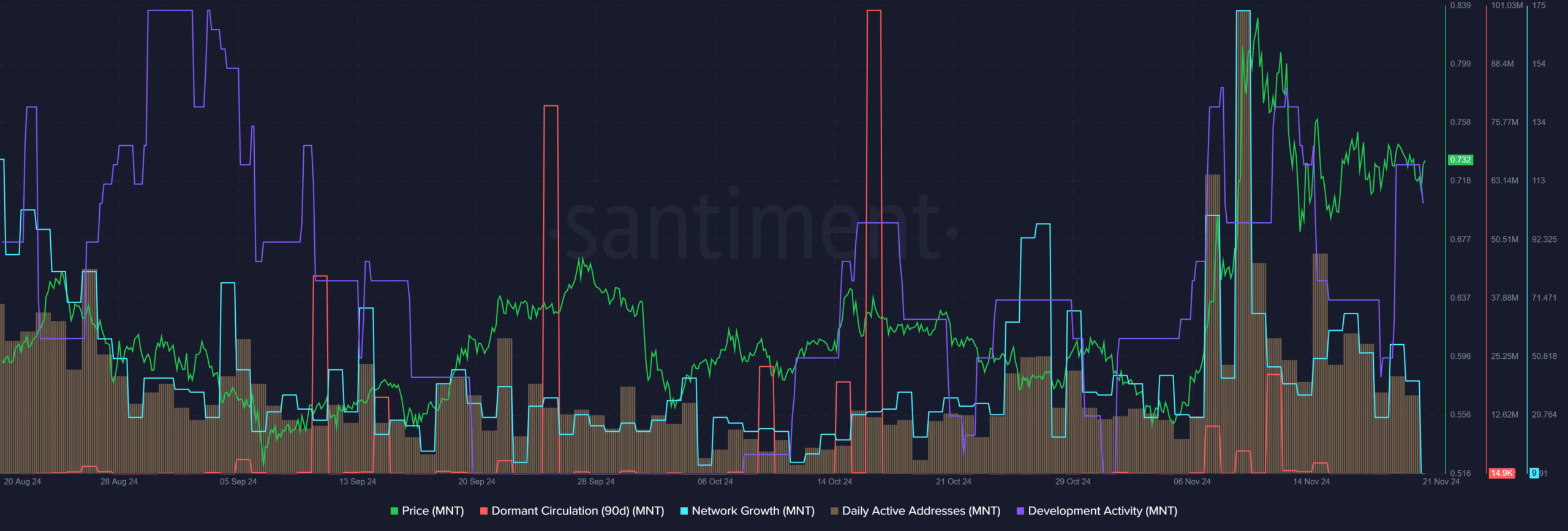

In the past few days, as the price exceeded $0.9, we witnessed both daily active addresses and network growth reaching their highest points in the last 3 months. The last time such a surge in activity occurred was around mid-August, when Mantle’s price dipped to its lowest range of $0.6.

Over the past week, I’ve noticed a decrease in network activity which suggests reduced involvement and demand for MNT. Moreover, the circulating supply has been relatively low, indicating that there isn’t an immediate high selling pressure on the market.

The development activity was also relatively high and should bolster long-term holders’ conviction.

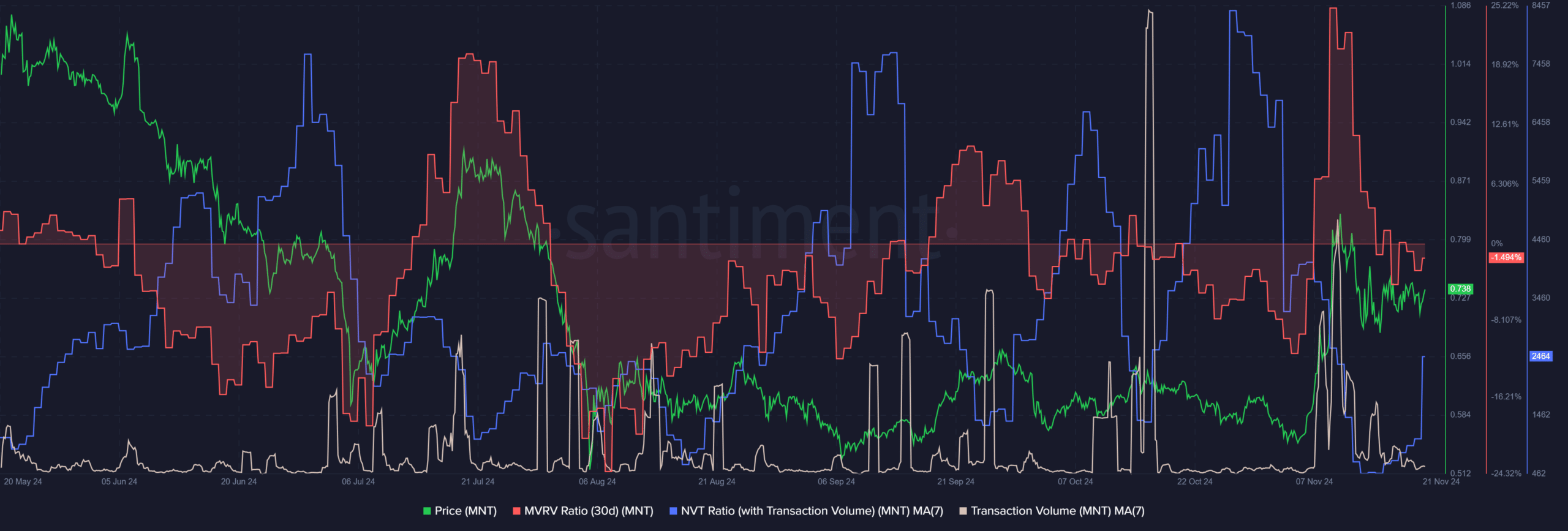

In simpler terms, the latest drop in price has resulted in an average short-term holder experiencing a loss of 1.4% on their investments, as indicated by the MNT’s 30-day MVRV ratio. Additionally, this price shift has caused the Network Value to Transactions (NVT) ratio to decrease as well.

Over the last three days, the pattern of Network Value to Transactions (NVT) has shifted, with transaction activity steadily decreasing thanks to less network activity. This change has caused the NVT ratio to climb, suggesting that the asset might be overpriced relative to the amount of on-chain transactions it’s handling.

Mantle still below the mid-range resistance

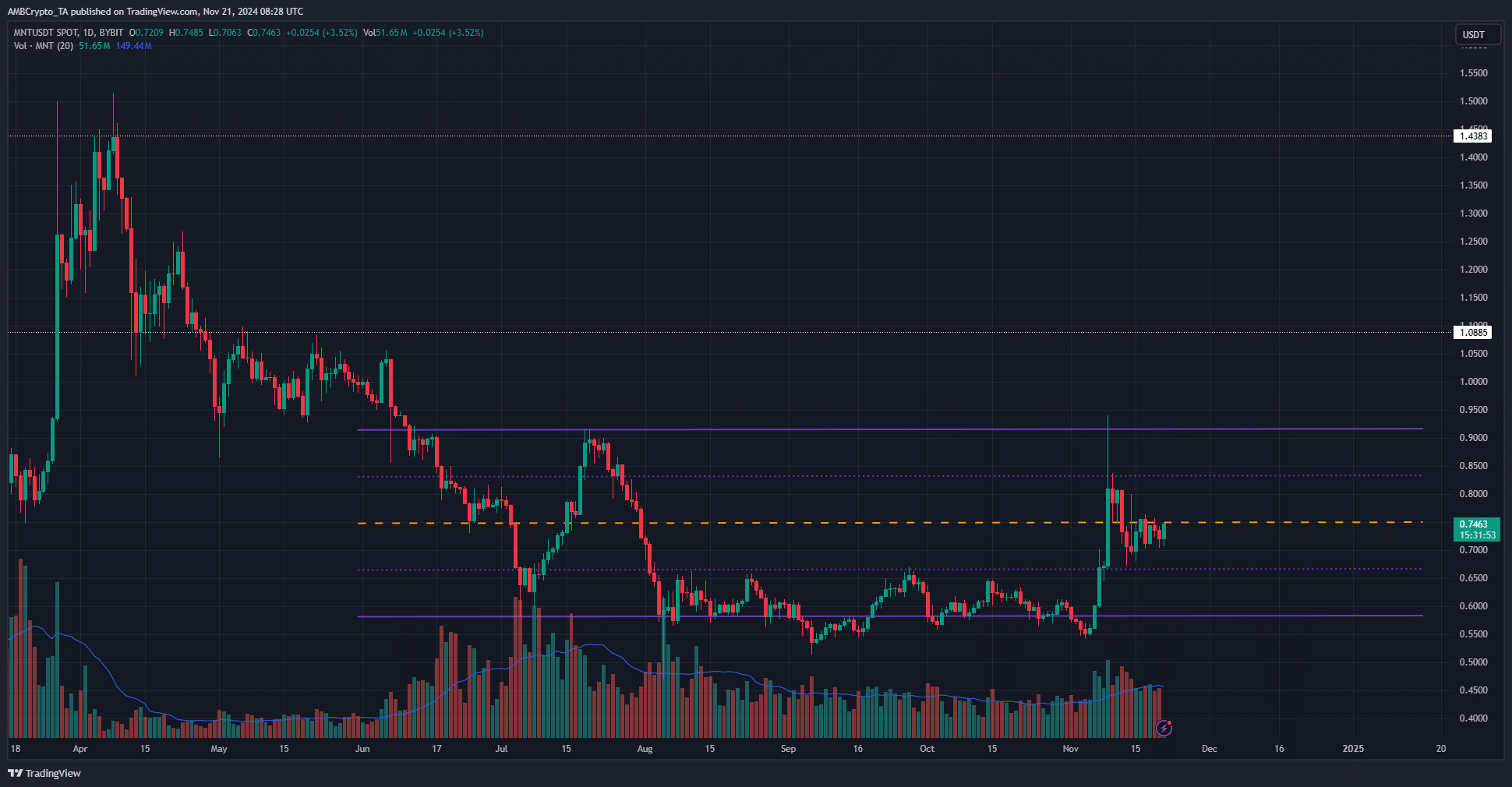

Based on technical analysis, it appears that Mantle is presenting a good chance for purchase. Its price has fluctuated between $0.58 and $0.91 since June, and currently, it’s slightly below the middle of that range at $0.75.

Read Mantle’s [MNT] Price Prediction 2024-25

As an analyst, I find myself noting that the $0.668 level represents a robust support zone, both from a technical and historical perspective. This means that if prices remain above this point, it gives the bulls a clear advantage in the market dynamics.

Rising demand for the token can spur a move beyond the range highs and toward $1.1 and $1.45.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-22 07:03