- Mode commenced its airdrop on the 7th of May.

- It has declined significantly after its airdrop.

As a seasoned crypto investor with a keen interest in decentralized finance (DeFi) and non-fungible tokens (NFTs), I’ve closely followed the progress of Mode [MODE]. The anticipation surrounding the project reached new heights when it announced its airdrop on the 7th of May.

On May 7th, [MODE] shifted into “Distribution mode,” dispersing vast quantities of its tokens to qualified recipients.

Prior to the airdrop event, there was a noticeable increase in the Total Value Locked (TVL) within the network. Likewise, on the actual day of the airdrop, the trading volume saw a substantial hike.

However, following the token release, the value of the MODE token experienced a decline.

Mode crypto commences airdrop

On May 7th, Mode commenced a token airdrop, dispensing a total of 550 million tokens to qualified recipients.

As a data analyst, I would describe it this way: I’ve discovered that the distribution of points among users is influenced by the Mode points they hold. Users accrue these Mode points through their active participation in various Decentralized Finance (DeFi) applications, Non-Fungible Tokens (NFTs), and other Layer 2 networks.

Approximately 5.5% of the overall token supply, equating to around 10 billion tokens, is represented by this distribution of 550 million tokens.

According to the team’s token economics, investors and core contributors are set to obtain a 38% share of the overall token supply.

The foundation’s treasure house will control 27%, whereas the rest, amounting to 35%, is earmarked for community and developer giveaways.

TVL takes off

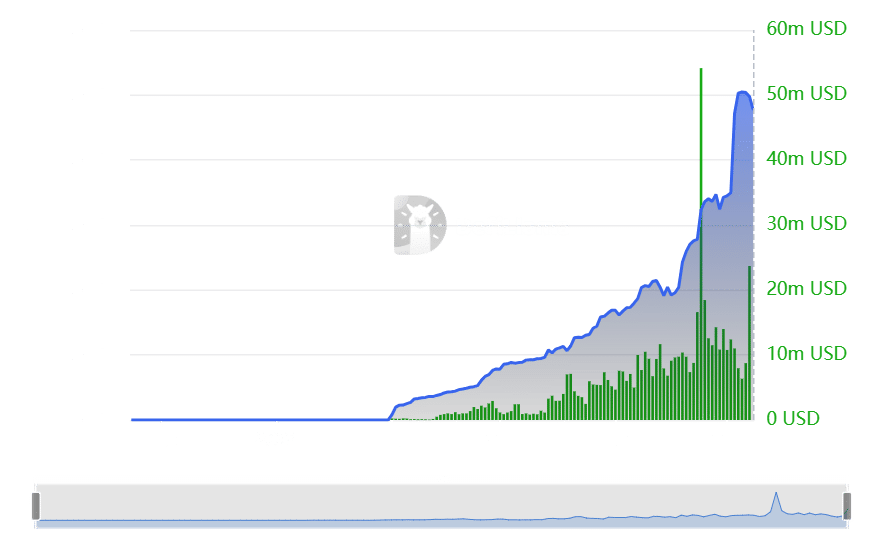

Examining the Mode Total Value Locked (TVL) data on DefiLlamas showed a notable increase, commencing in February.

In January, the project attracted notice following its receipt of a 2 million OP token grant, valued approximately $5.4 million, from the Optimism Foundation to facilitate its progression.

Built using the OP Stack, Mode is an integral part of the Optimism Superchain ecosystem.

Since February, the TVL chart showed a steady rise. Starting from the 1st of May, there was a significant uptick in TVL, and by the 5th of that month, the TVL had exceeded half a billion dollars ($500 million).

Afterward, the total value locked (TVL) had decreased, reaching approximately $477 million during the assessment period.

Although there was a decrease, the project experienced its second-most significant increase in volume on May 7th, amounting to nearly $24 million on the very day of the airdrop event.

Despite a recent decrease in TVL, according to L2 Beats data, Mode continues to rank among the top Layer 2 networks in terms of TVL.

Based on L2 Beats’ findings, Mode held the position of the tenth largest decentralized finance (DeFi) project in terms of Total Value Locked (TVL), accounting for approximately 1.4% of the entire L2 market capitalization.

Post airdop

As a crypto investor, I’ve closely monitored Mode’s performance based on AMBCrypto’s analysis. Following its airdrop event, there was a significant downturn in Mode’s value. The token, which was initially priced at $0.1, dropped down to around $0.055 by the 7th of May.

At press time, it was trading at around $0.048, reflecting an over 11% decline.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-05-09 06:15