- Mog Coin approached the range highs with bullish intent

- On-chain metrics did reflect firm accumulation that’s necessary for a breakout

As a seasoned analyst with over two decades of experience in the cryptosphere, I must admit that Mog Coin [MOG] has shown some intriguing movements recently. The coin’s approach to the mid-range level at $0.00156 and subsequent rebound higher from the demand zone is a pattern not uncommon in this volatile market. However, the average trading volume hinting at a lack of faith among traders raises a red flag.

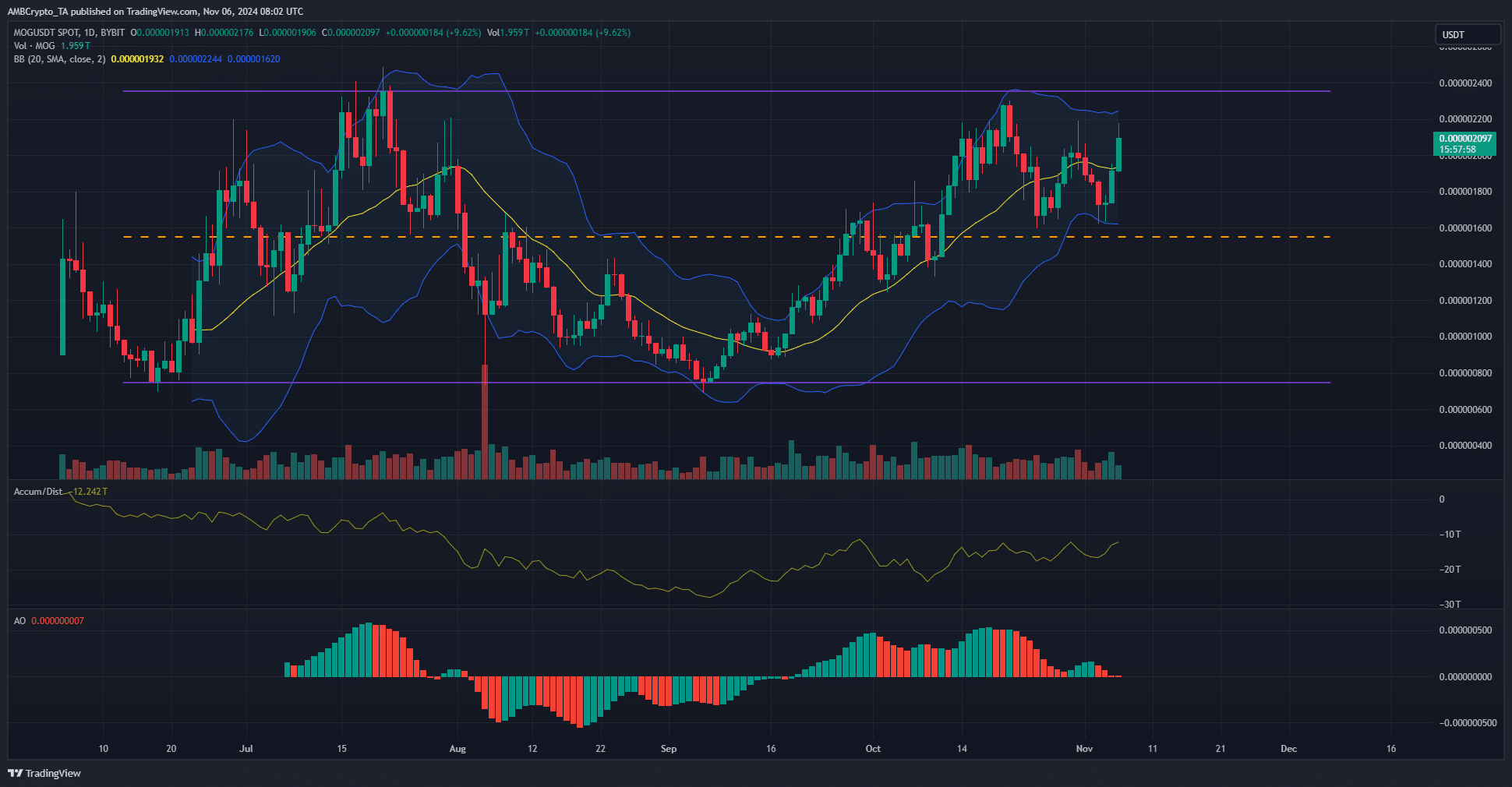

Mog Coin, represented as MOG, was moving between a price span that ranged from 0.00021 cents to 0.000075 cents (for easier reading, we’ll refer to these values multiplied by 1000 as Mog Coin prices). The value of the meme coin got close to the middle point at $156 and bounced back upward from a strong buying area.

On November 4th (Monday), there was yet another upward movement in the price of Mog Coin. Since its recent lows, it has surged by 27.5%. In addition, it experienced an almost 10% increase on that very day. Could we be on the verge of observing a breakout from this current range?

Average trading volume hints at a lack of faith

On a day-to-day basis, the Awesome Oscillator is trending towards the neutral point (zero line), indicating only slightly bullish momentum. Meanwhile, the volume bars have been consistently around the average trading volume of the last 20 days.

At this point, the $0.00165 resistance area was successfully protected by the bulls. Furthermore, the A/D indicator gradually increased, suggesting that the buyers were in control.

In simple terms, this price advantage led to some growth within the range pattern, but it didn’t prove that we would exceed previous highs. At this point, traders might consider selling around the $0.0023 area.

Moving back towards the middle of the price range, or attempting a new breakout and testing the highest points within that range, could serve as an opportunity for resuming long positions.

On-chain metrics signal distribution for Mog Coin

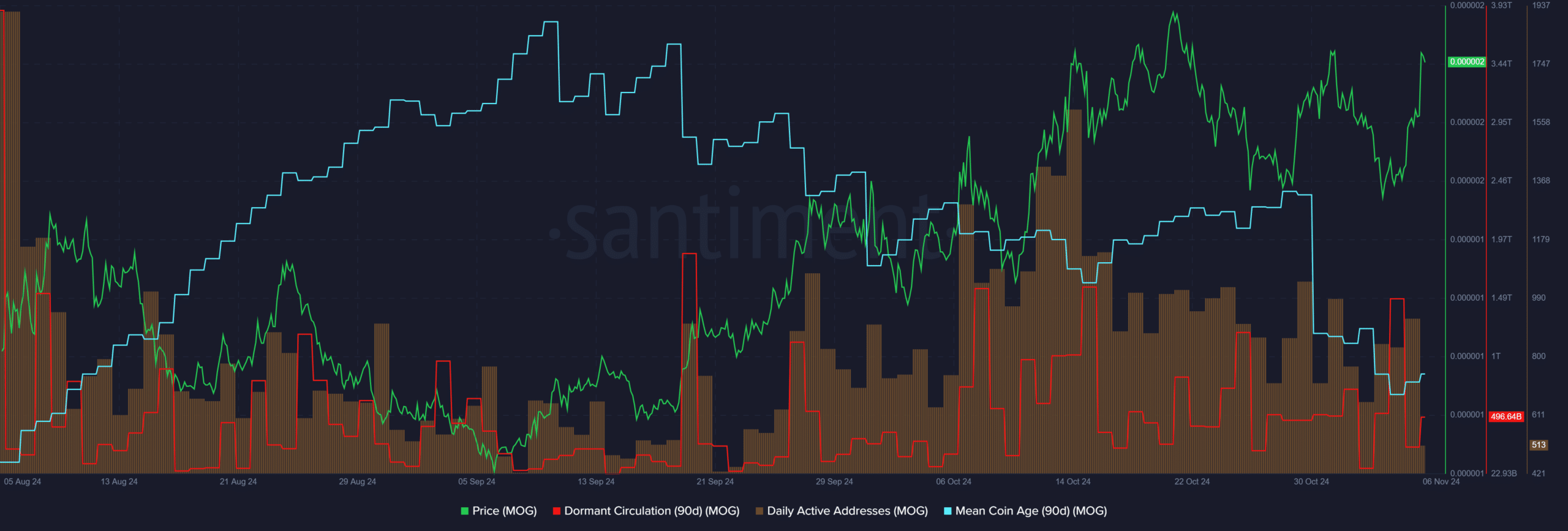

Since late September, the size of dormant surges in circulation has remained roughly similar. A comparable surge happened on November 4th, coinciding with the price hitting its local low on various shorter timeframes.

Realistic or not, here’s MOG’s market cap in BTC’s terms

Over the last three weeks, there’s been a consistent drop in the number of daily active addresses. This trend has raised some concerns among long-term holders, as they’ve also observed a gradual decrease in the average age of coins for the past two months.

This downtrend indicated Mog Coin movement and likely profit-taking activity. It highlighted a lack of bullish belief among holders.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-11-07 02:15