- Monero’s price has risen over the last 2 months

- Greater long term investments and low liquidations resulting in market stability

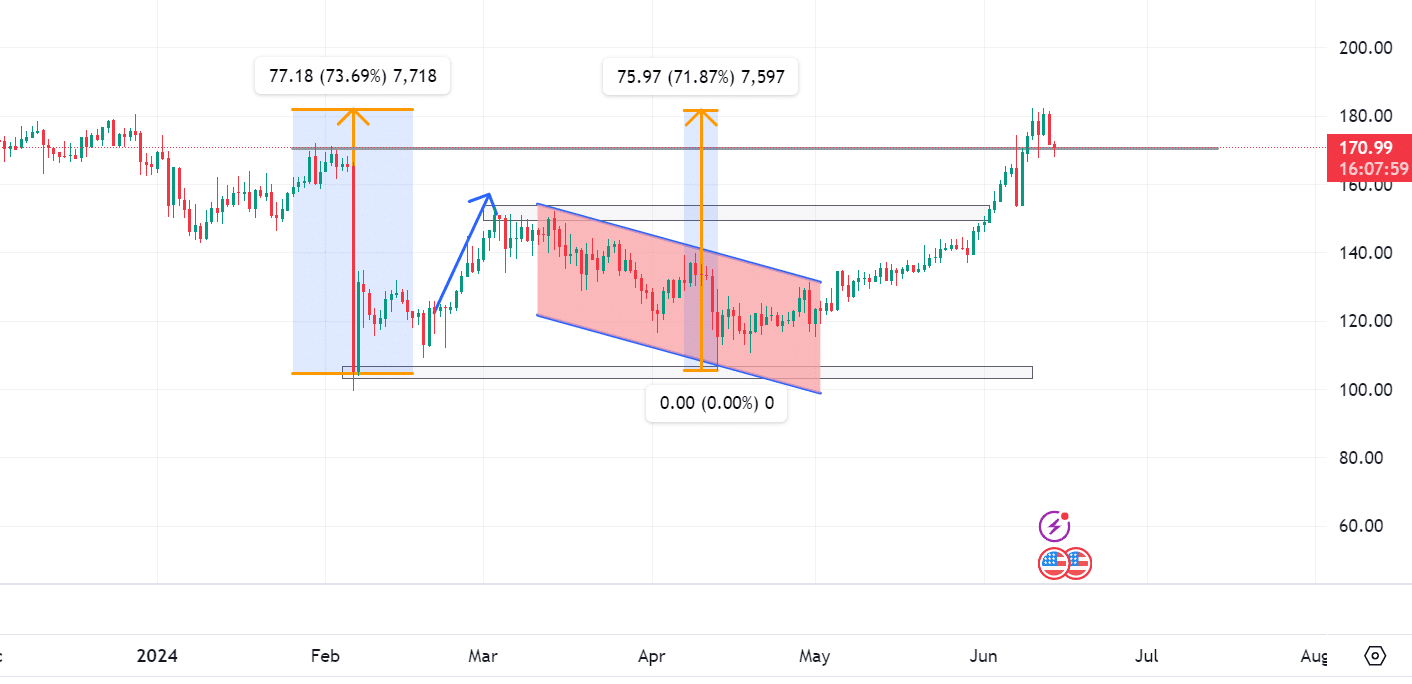

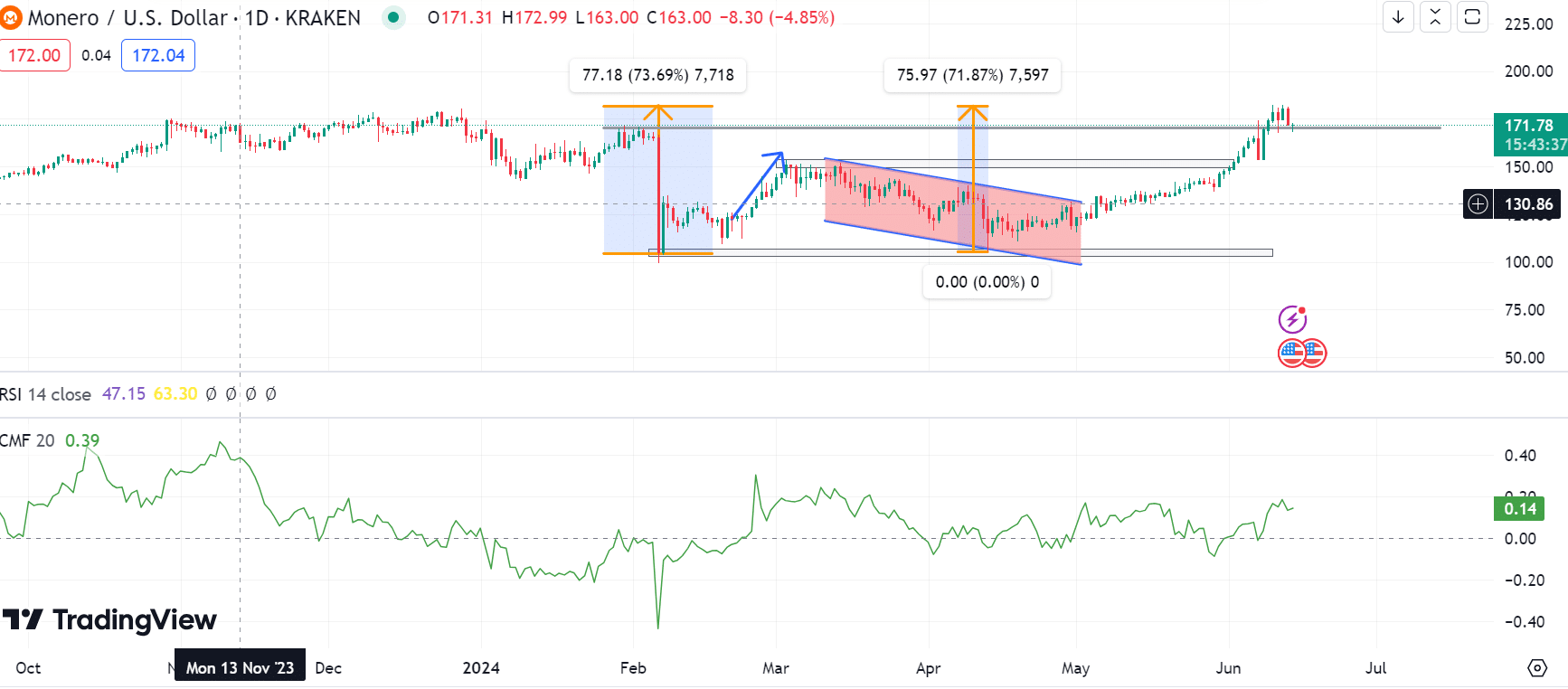

As an analyst with a background in cryptocurrency markets, I’ve noticed some interesting trends in Monero (XMR) over the past two months. Based on my analysis of the data, it appears that XMR has been on a sustained uptrend, with its price appreciating by over 70% during this period.

As a crypto investor, I’ve noticed that Monero, the go-to cryptocurrency for privacy enthusiasts, hasn’t shown much price movement on the charts during the past week. However, I was taken aback when I checked CoinMarketCap this morning and saw that XMR had dipped by over 3% within the last 24 hours.

Currently, the value of the altcoin is at $171 during this report’s creation, marking a notable increase of more than 7.60% in its trading activity over the past 24 hours.

From a broader perspective, it appears that the altcoin has been making an effort to challenge its closest resistance point as depicted on the graphs.

Bullish metrics are signs of…?

I’ve observed an impressive 70% price increase in the crypto market over the past two months. As a result, the altcoin now hovers around the $170 mark. This persistent uptrend indicates a robust and optimistic market sentiment.

At present, the market appeared to signal a potential reversal as it formed a hammer figure at the bottom of its downward trend during my writing. This suggested that buyers had strongly rejected the bearish pressure, which could become beneficial considering the market’s decline over the previous day.

Additionally, there are various indicators pointing towards a potential turnaround.

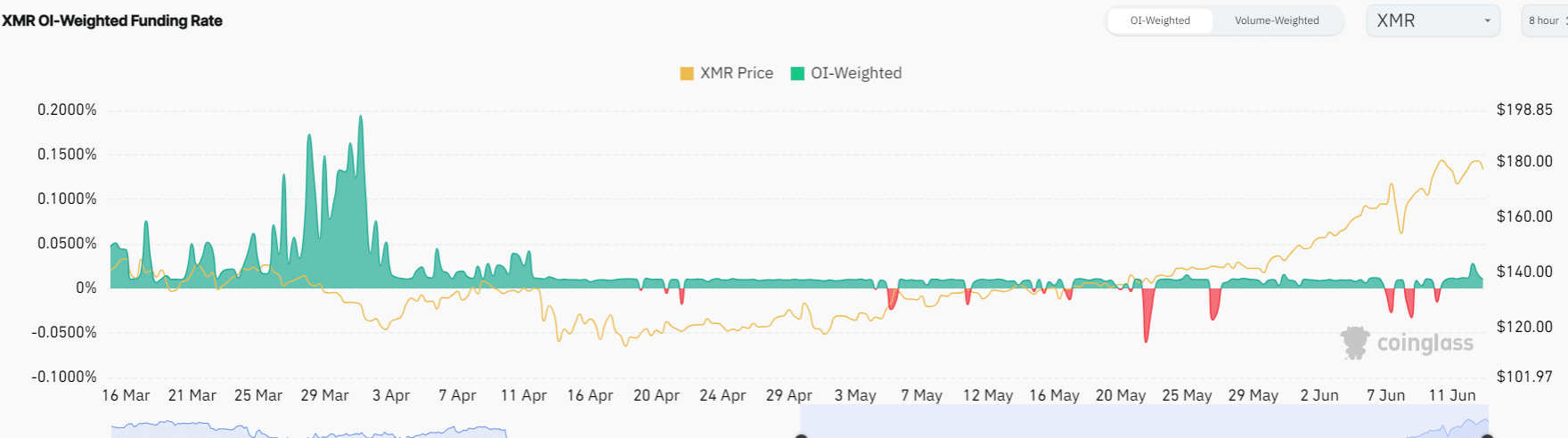

Based on Coinglass’ data, XMR‘s weighted funding rate indicates a steady moderate investor sentiment towards the cryptocurrency, suggesting market stability. This observation implies a potential for another price surge based on current market conditions.

As an analyst, I would advise examining Monero’s (XMR) liquidation thresholds for both long and short contracts. Analyzing these levels provided insights into the market’s uncertainty, indicating a lack of clear direction.

In simpler terms, when the market is steady, intermediate-sized losses from selling assets for both major investors and smaller players due to market conditions occur frequently. For instance, during the past 24 hours, there were sales of $2,390 worth of long positions and $1,890 worth of short positions.

As an analyst, I would interpret the Composite Moving Average (CMA) reading of 0.14 as a sign of buying pressure emerging in the market. This implies that there is a higher tendency for stocks to accumulate in the upper price ranges.

What’s next for XMR?

As a researcher, I have observed some noteworthy trends over the past two months based on multiple indicators. These signs suggest an upward trajectory. Additionally, from a metric standpoint, the price has exhibited a bullish behavior as well.

With the demand to purchase privacy coins increasing, Monero may challenge and potentially surpass its current resistance points according to chart analysis.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-15 03:35