- Moo Deng had a bullish structure on the 12-hour chart and strong upward momentum.

- The high speculative interest but negative CMF reading raised doubts about the rally.

As a seasoned researcher with years of experience navigating the crypto market’s volatile tides, I find myself intrigued by Moo Deng (MOODENG). The 12-hour chart paints a bullish picture, yet the recent rally has me raising an eyebrow.

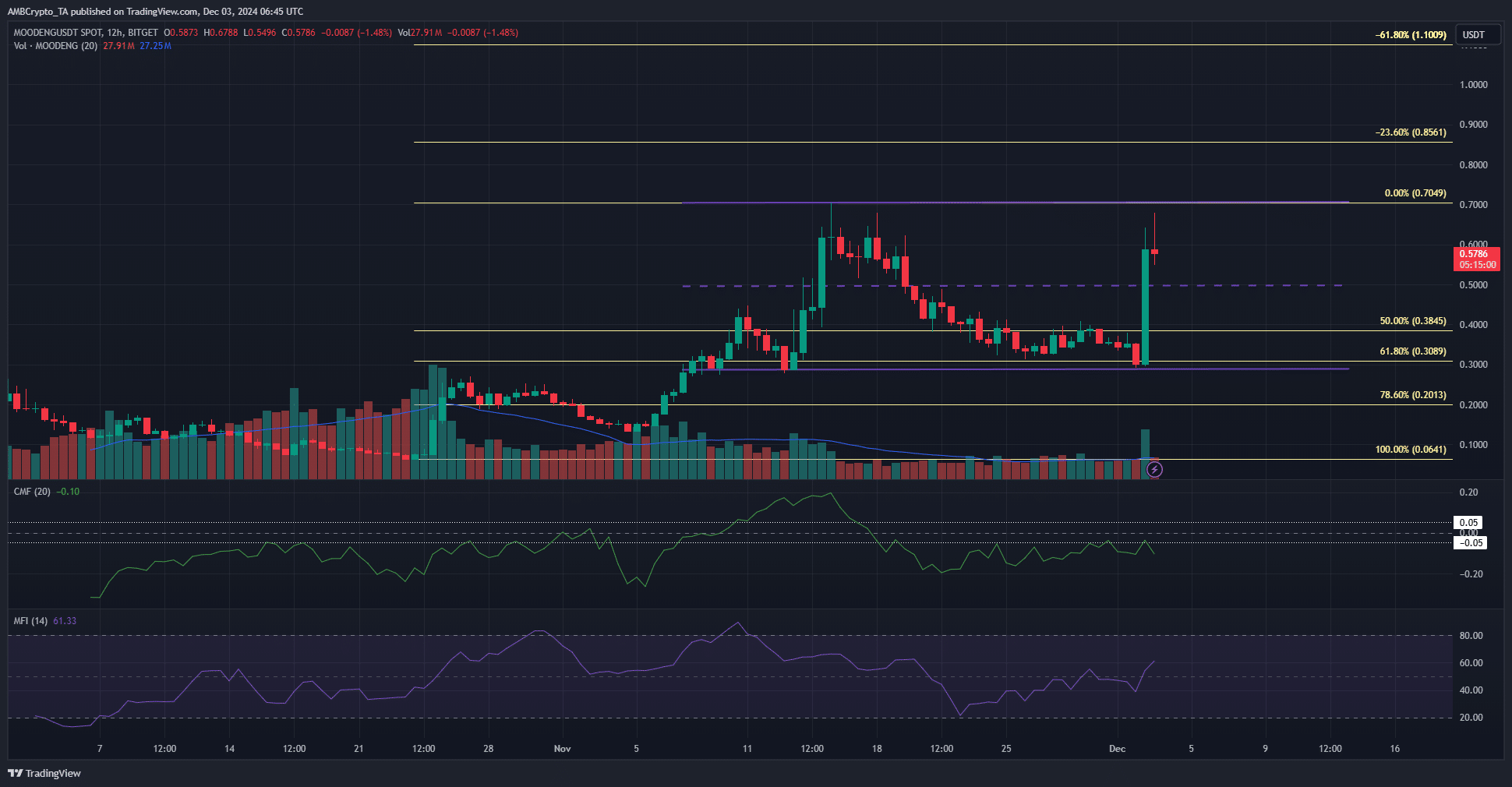

In just 20 hours, Moo Deng (MOODENG) cryptocurrency has seen a staggering 91.5% surge in value, and the daily trading volume increased by an impressive almost 800%. This significant price jump occurred following a test of the 61.8% Fibonacci retracement level as a support base.

Despite the strong buying activity observed recently, the last few weeks have seen a clear upper hand with the sellers, challenging the bulls’ progress in the $0.7 area.

Is MOODENG crypto in a range formation?

On Monday, the 2nd of December, the Relative Strength Index (RSI) surpassed the neutral 50 level on a 12-hour chart, indicating a strong upward trend.

The market’s structure switched positively as the meme coin surpassed its latest higher low of $0.408.

As I examine the current market trends, it appears that the mid-range level at $0.5 is poised to serve as a supportive barrier in case of any potential price declines. Over the past 16 hours, the mid-November highs, roughly between $0.62 and $0.7, have proven resilient against bullish attempts to push prices higher.

In simpler terms, despite the trend and framework being advantageous for the buyers, the Cash-to-Market Factor (CMF) remained steadfastly below -0.05, suggesting that money was leaving the market rather than flowing into it.

In summary, the selling side had an advantage over these past few trading days, but a significant surge in trading volume during the opening of New York on Monday contributed to a dramatic increase in Moodeng cryptocurrency prices.

Bullish sentiment grows

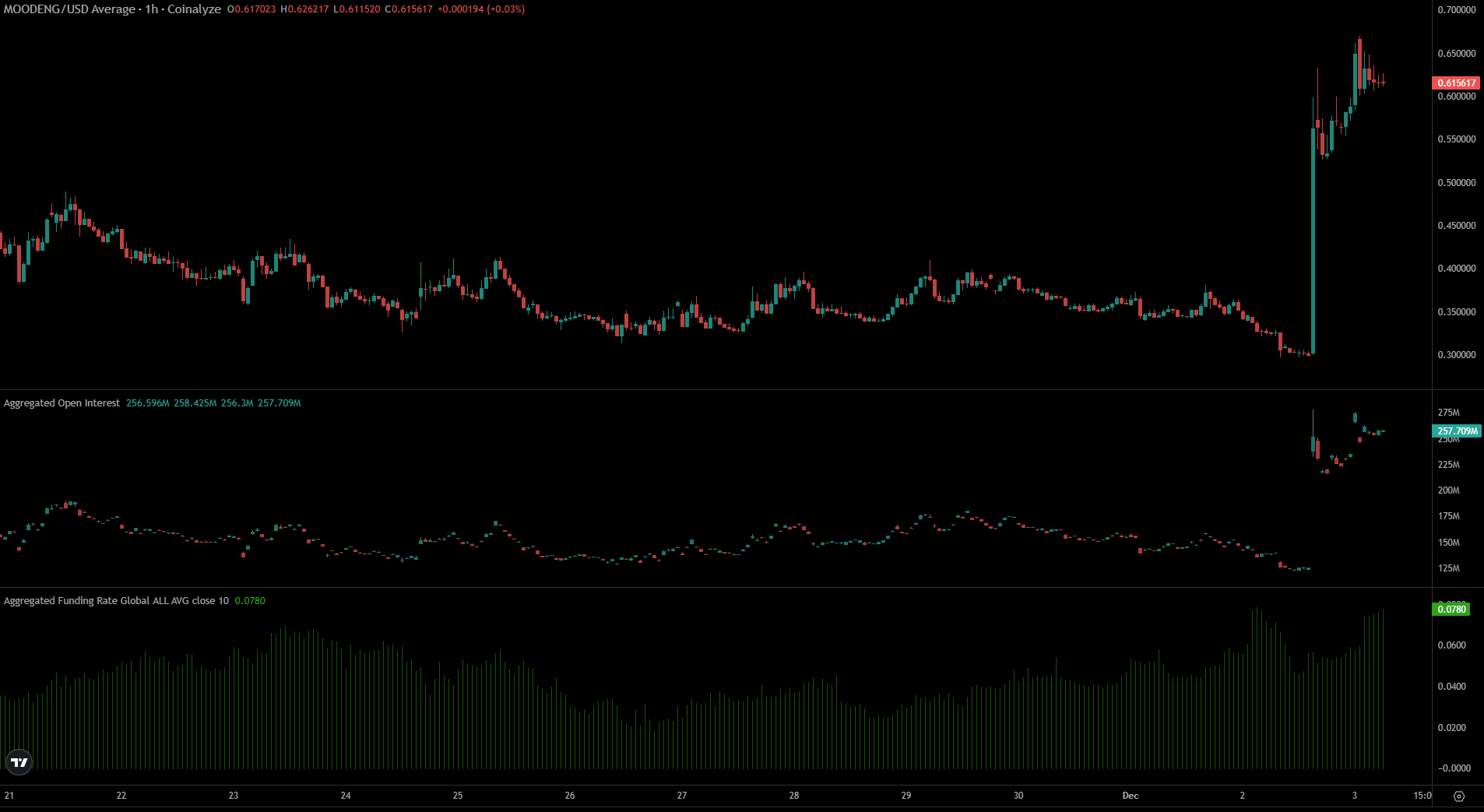

Over the last several days, the Funding Rate has noticeably increased. Yesterday’s powerful surge led to a significant rise in Open Interest, which stood at $257 million as of the press time, having started at $125 million.

This suggested that the speculative market was keen on going long on the memecoin.

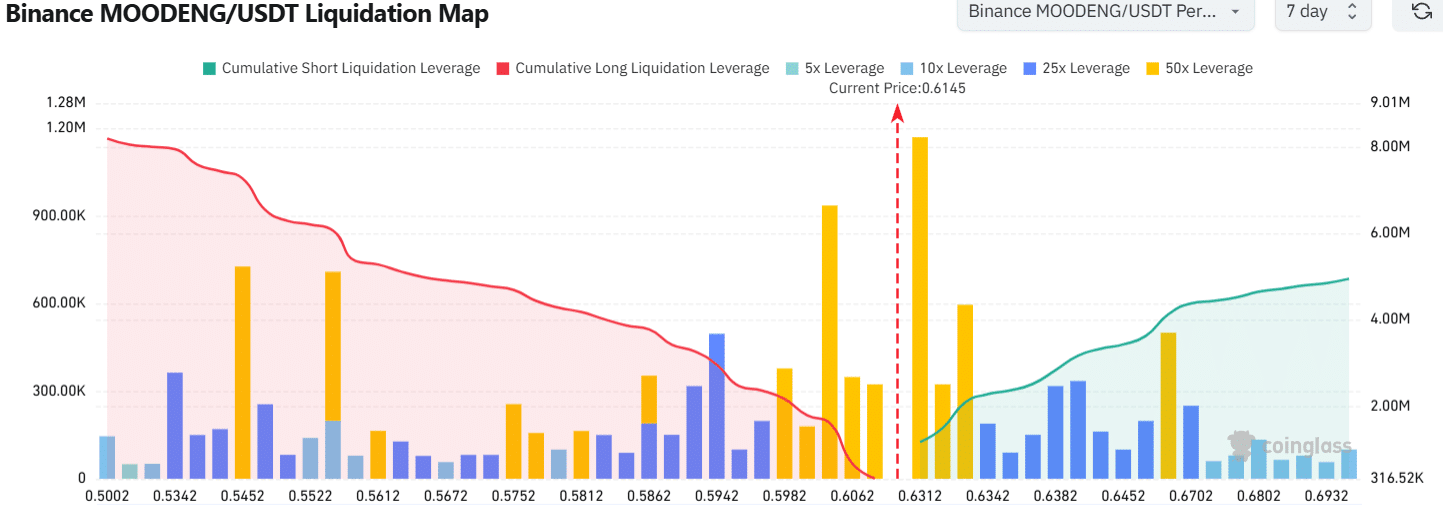

The liquidation chart indicated a significant concentration of high-risk sell orders in the range between $0.6145 and $0.6312. On Monday, the price encountered resistance at $0.64.

Is your portfolio green? Check the Moo Deng Profit Calculator

In simple terms, it’s possible that the price of MOODENG crypto may experience a turnaround following the clearing out of this specific group of sell orders. The Choppy Money Flow (CMF) and liquidation chart suggest that there could be a short-term pullback for MOODENG in the upcoming days.

However, it’s important to exercise caution since the overall mood among altcoins is strongly optimistic. If the price surpasses $0.64, it might indicate that buyers are regaining control, potentially signaling that the upward trend may persist further.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-12-03 21:11