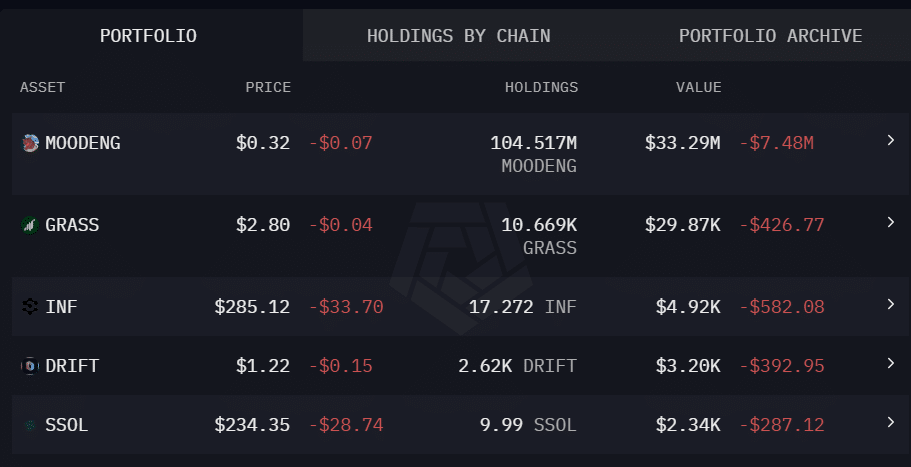

- The latest MOODENG top whale holder increased his long position to $33M.

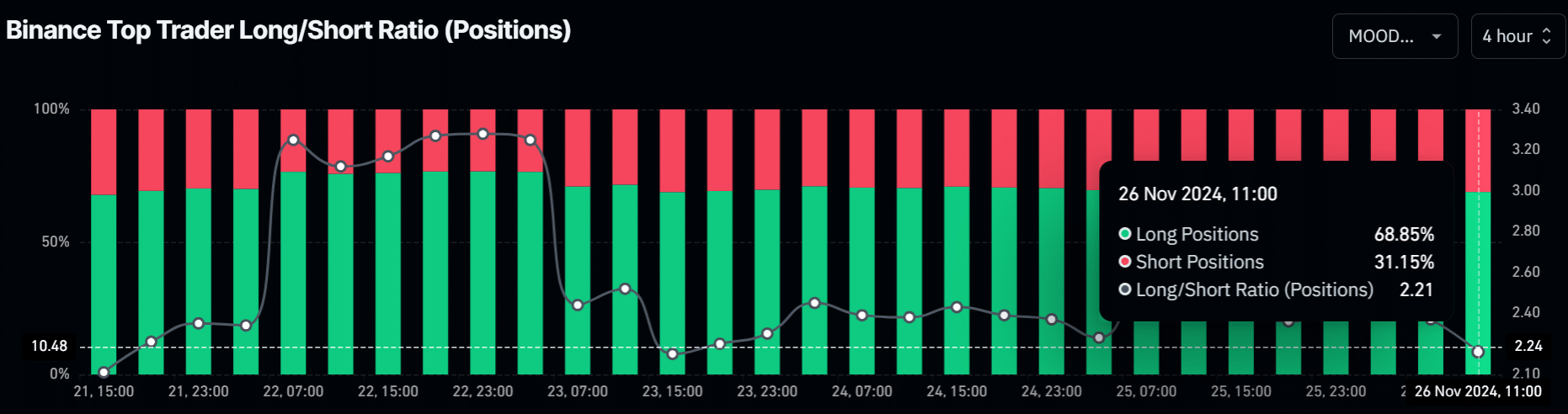

- Nearly 70% of Binance’s top traders were net long on MOODENG.

As a seasoned analyst with over two decades of experience in the crypto market, I find myself intrigued by this recent development in Moo Deng [MOODENG]. The $33M bet by a large player indicates confidence in the memecoin’s recovery, which is a bullish sign. However, the decline in trading volume and the 55% pullback in price since mid-November suggest otherwise.

Trump Tariffs Shock Incoming! EUR/USD in the Crosshairs!

Trump Tariffs Shock Incoming! EUR/USD in the Crosshairs!

Massive forex shifts expected — don't miss the crucial insights now unfolding!

View Urgent ForecastAs an analyst, I’ve noticed a significant move by a major player who has capitalized on the recent market downturn and significantly boosted their MOODENG holdings to exceed $33 million.

Based on information from Arkham, a whale has amassed approximately 11.8 million Moodeng (valued at more than $5.37 million) across Gate and OKX trading platforms within the last fortnight.

A $33M MOODENG bet

At the current moment, a whale owns approximately 104.52 million units of Moodeng, which equates to around $33.3 million. This whale now represents the largest stakeholder, owning about 10.5% of the entire supply, as per the latest news updates.

Such a huge bet meant that the whale was confident of market recovery.

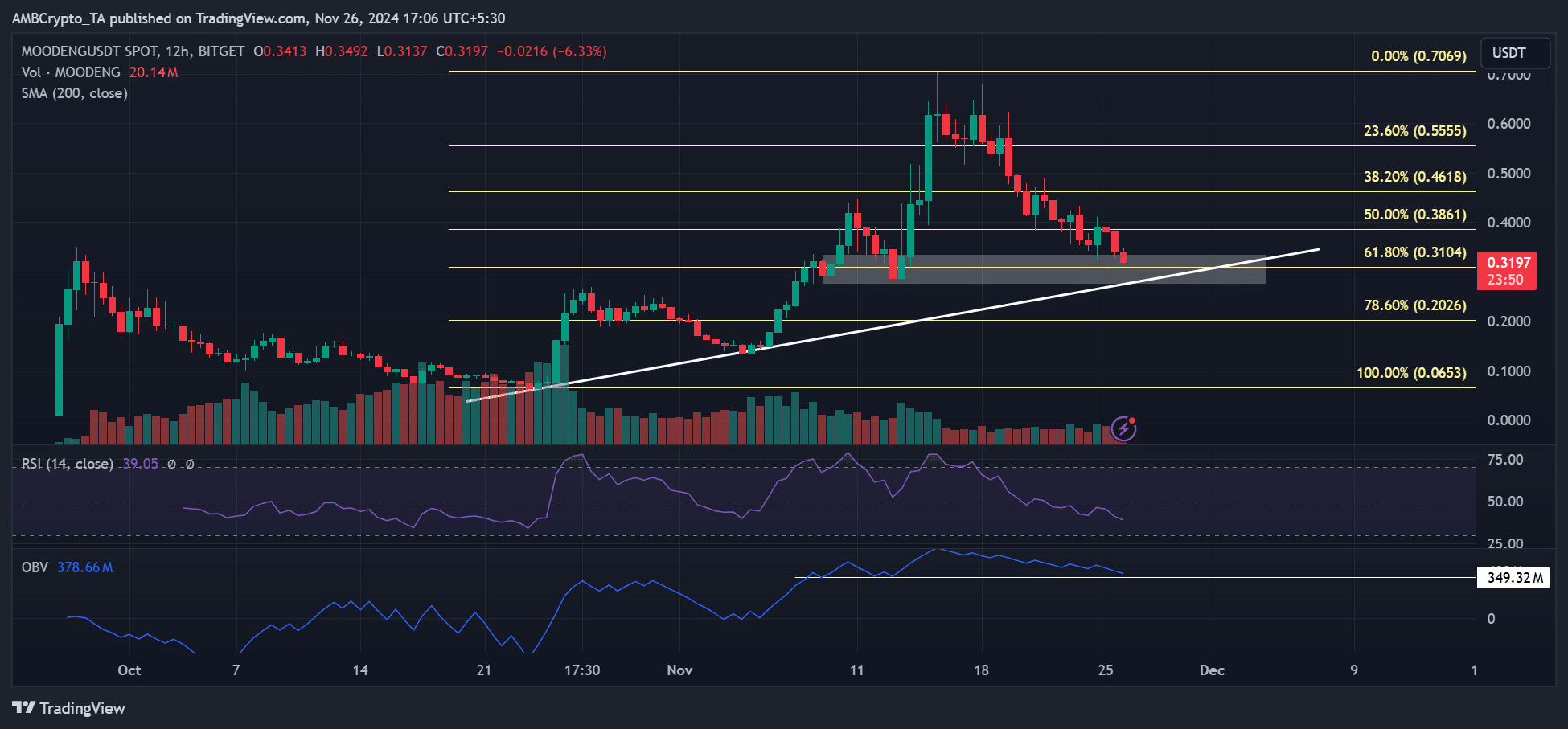

Over the past few weeks, I’ve noticed a significant drop in MOODENG trading volume on decentralized exchanges (DEXes). As of now, the volume has dipped down to roughly $50 million, having initially been around $250 million mid-November.

1) The cost has mirrored the drop in popularity, with a 55% reduction as of the latest report, bringing Moodeng’s price down from $0.7 to $0.3.

Apart from the significant $33 million wager on the memecoin, approximately 50,000 users continue to hold it. This could potentially indicate a possible price upturn for MOODENG in the future.

That would hinge on the broader market’s recovery and possible redistribution of funds toward meme coin concepts.

On the price graph, Moodeng experienced a significant pullback which coincided with a key convergence area acting as potential support. This convergence might spark a possible price upturn.

Remarkably, the Golden Ratio at approximately 61.8%, represented by the Fibonacci level $0.3, coincided with a significant bullish order block (a ‘white zone’), preventing a minor reversal during early November.

The current level coincides with the trendline’s support point, making it a robust area of potential support. If market sentiments improve over the coming days, there’s a good chance we might see a price rebound originating from this level.

That said, the market positioning amongst top exchanges like Binance was arguably bullish.

Read Moo Deng [MOODENG] Price Prediction 2024-2025

Currently, approximately 68 out of every 100 positions held on MOODENG are bullish, indicating that a larger number of traders anticipate an increase in MOODENG’s price.

As a researcher, I find that keeping tabs on the largest whale investor could provide valuable insights into market trends, particularly when they decide to sell. This knowledge might aid in strategizing profitable exit points.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-11-27 04:40