-

Moonwell, as at press time, was one of the best performers in the past week.

Volume, TVL and active loans adding to WELL’s momentum.

As a seasoned crypto investor with over a decade of experience in this wild, ever-evolving digital jungle, I must admit that Moonwell [WELL] has caught my attention like a luminous beacon amidst the crypto night. With its impressive 100% surge in just seven days, WELL is not merely outperforming; it’s outrunning the competition.

Moonwell [WELL], a rapidly expanding lending platform, is excelling in not only its lending operations but also in the appreciation of its token’s value.

Based on data from CoinMarketCap, the native token of Moonwell, WELL, has experienced a remarkable increase of more than 100% in the last week, sparking considerable interest within the cryptocurrency community.

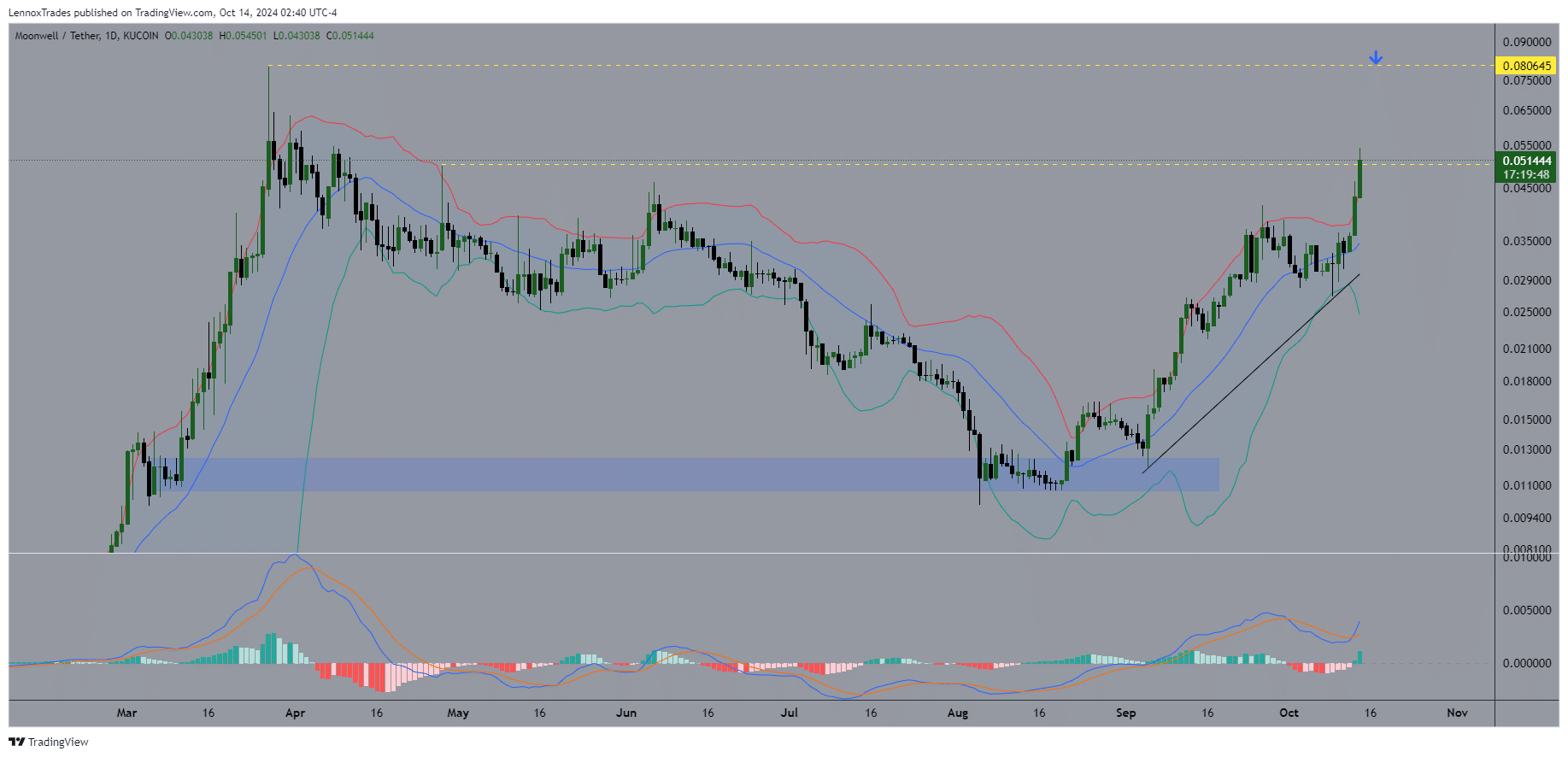

Moonwell price action and prediction

At present, the trend for Moonwell’s price is on an upward trajectory, as the WELL token trades over $0.05. Since August 20th, the WELL/USDT pair has been steadily ascending following a confirmation of the low during the market downturn, which signaled the bottom.

Since that time, WELL has been steadily ascending with an ambition to surpass and sustain above the significant $0.05 threshold. If successful, this move might propel the token toward its projected goal of $0.08, potentially yielding returns exceeding 63%.

Moonwell’s increasing market capitalization indicates a surge in investor interest. If Well manages to reach its goal, it might set a brand-new record high (ATH).

In simpler terms, the Bollinger Bands suggest a rise in momentum, while the Moving Average Convergence Divergence (MACD) suggests there’s sufficient trading volume for the price to keep climbing and potentially reach or even exceed the $0.08 threshold.

Analysis based on blockchain data and shareholder updates have demonstrated a promising upward trend, further fueling the surge of WELL.

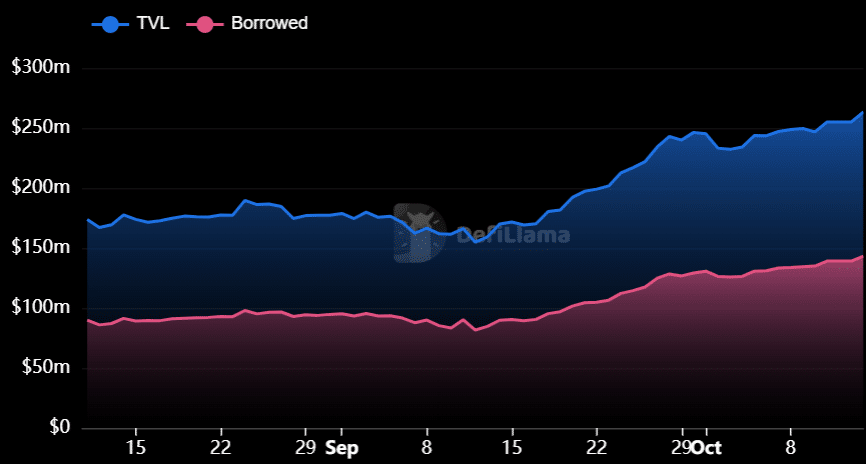

TVL and active loans

Technically speaking, Moonwell’s shift to the Base blockchain has led to an uptick in its Total Value Locked (TVL) and the quantity of loans being taken out, indicating a rise in user interaction and involvement.

Currently, the Total Value Locked (TVL) amounts to approximately $263.36 million, of which $143 million is borrowed. Notably, active loans have surged by 56% monthly, and TVL has increased by a substantial 72%. This significant growth represents an additional $102 million in the TVL.

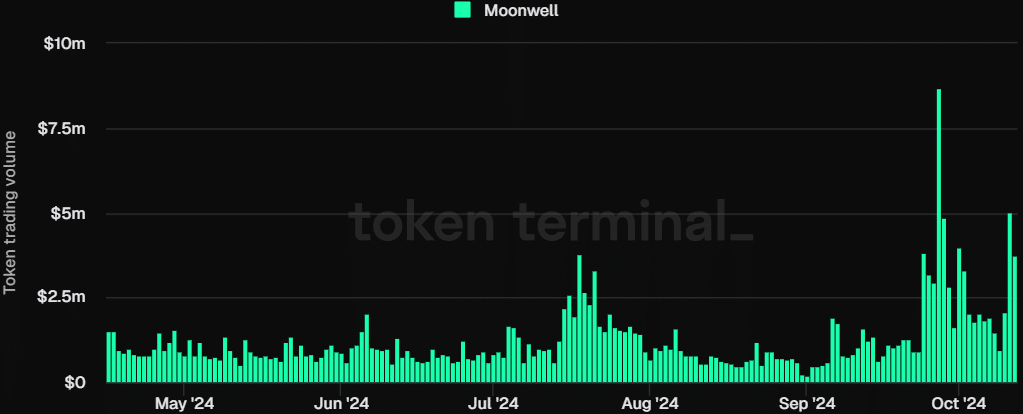

The data provided by Token Terminal underscores a substantial rise in revenue generated through Moonwell’s protocol, which points to the consistent development of this platform.

WELL volume and net deposits

Over the last month, trading activity for WELL has risen significantly, showing a surge of around 204%, which translates to roughly $70 million in total.

1) In the last month, net deposits have surged by an impressive 63%, amounting to a total of $229 million. Moreover, the market capitalization has grown by 41%, suggesting that Moonwell’s future prospects are indeed promising.

For investors looking for both short-term gains and long-term growth, Moonwell’s price action presents a strong opportunity.

Should Bitcoin and Ethereum maintain their growth trajectory, it’s possible that Moonwell’s staking benefits and liquidity might experience an even more substantial increase, potentially elevating the token’s worth further.

Looking ahead, WELL‘s optimistic stance seems poised for further growth, possibly hitting record heights within the next few months.

Read More

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

2024-10-15 05:11