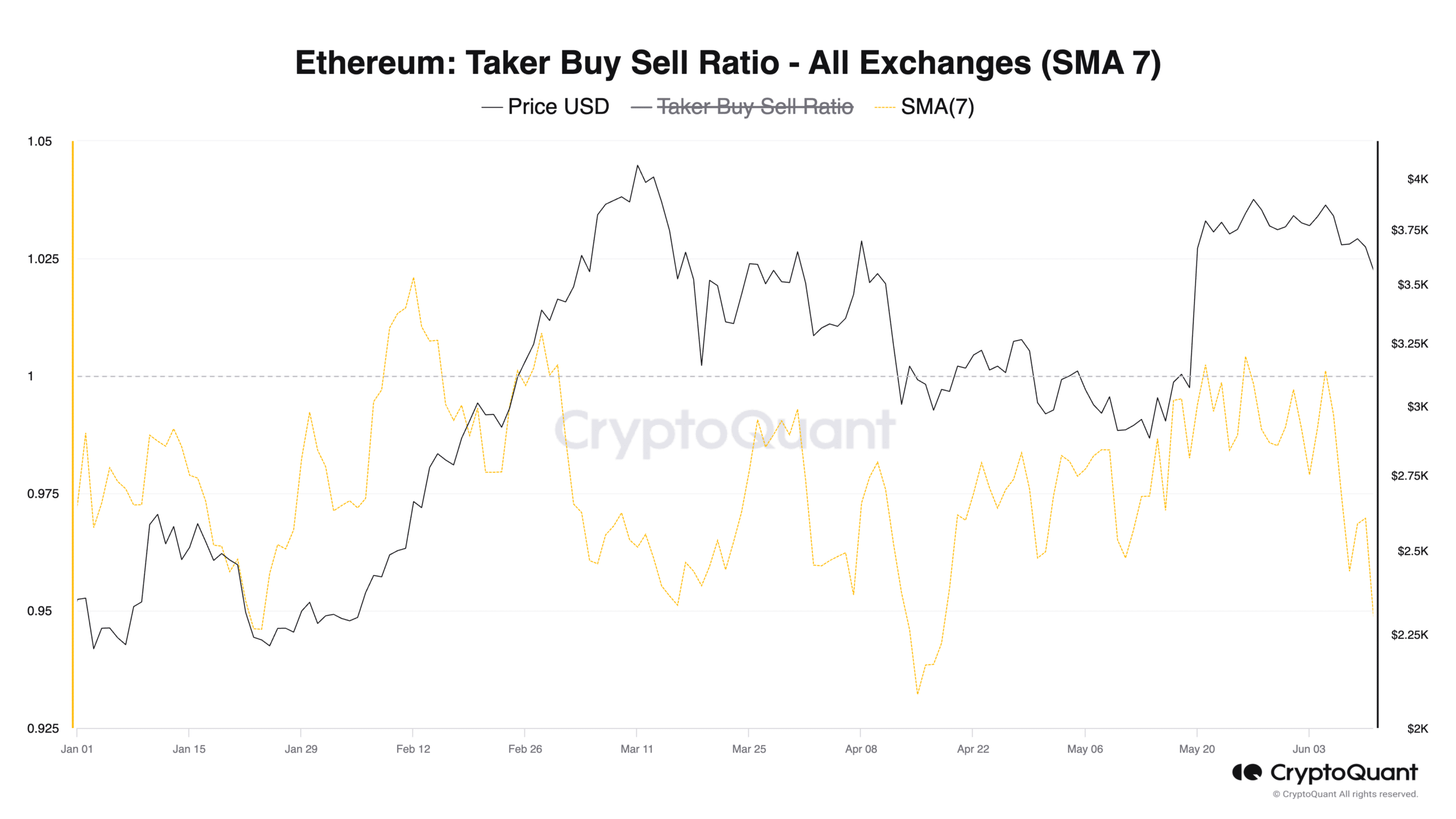

- Ethereum’s Taker Buy Sell Ratio has remained below 1 since the 5th of June.

- This means there is more sell volume than buy volume in its Futures market.

As an experienced analyst, I believe that Ethereum’s (ETH) Taker Buy Sell Ratio remaining below 1 since June 5th is a bearish signal for the cryptocurrency. This trend indicates that there has been more sell volume than buy volume in ETH’s Futures market, suggesting that most futures traders have been selling Ethereum aggressively to realize profits or for speculative purposes.

The ratio of buy-to-sell transactions on Ethereum’s [ETH] market, as calculated using a seven-day moving average, has been decreasing since June 5th, according to information from CryptoQuant.

Based on the information from the on-chain data supplier, the ratio in question has been below 1 since that point. At present, Ethereum’s Taker Buy Sell Ratio is recorded as 0.96.

The Taker Buy-Sell Ratio of an asset in the Futures market signifies the proportion of buy and sell transactions. A figure above 1 implies a higher volume of buying activity, whereas a number below 1 represents a larger quantity of selling activity.

When the value of this metric decreases in such a fashion, it indicates that there have been more sell requests than buy requests in the Futures market for the specified asset.

In a recent analysis, an anonymous cryptocurrency expert named ShayanBTC shared his insights on how this factor influenced Ethereum’s pricing.

The decline in Ethereum sales by futures traders indicates a predominant pattern of selling Ethereum, possibly for profit-taking or speculative reasons. This marked decrease is a warning sign, implying that the ongoing price drop may prolong if this trend persists.

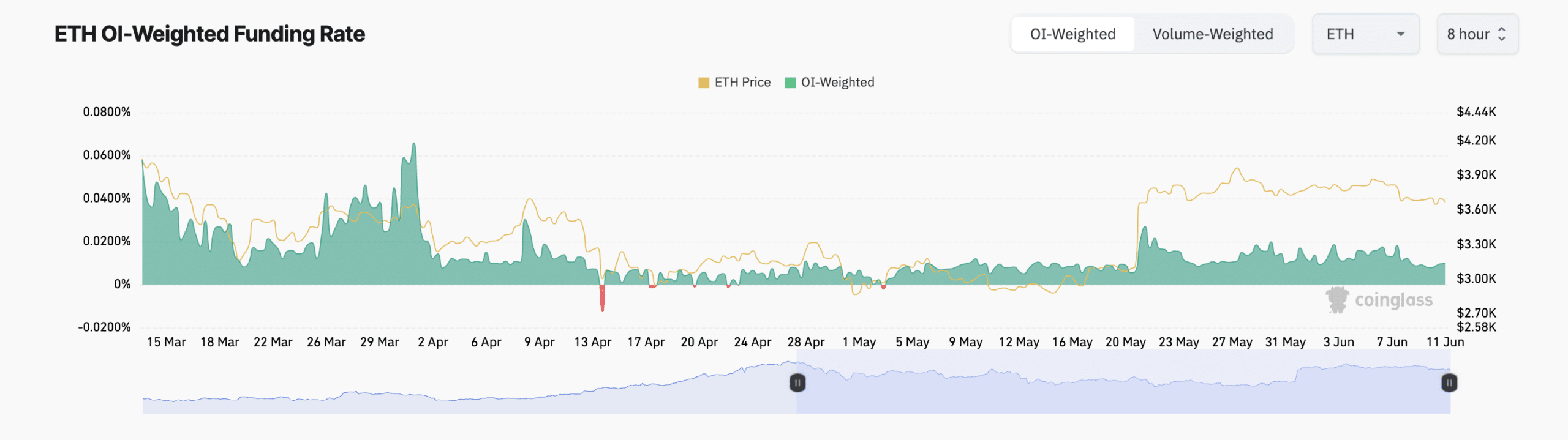

ETH Funding Rate remains positive

The decrease in ETH‘s Futures Open Interest since June 5th supports the notion that its current price position is valid.

Currently, the open interest for Ethereum futures contracts on the market stood at $16.37 billion based on Coingeasiness data, marking a 2% decrease since that figure was last reported.

As a crypto investor, I would explain that the Futures Open Interest of a particular coin refers to the current tally of unfilled Futures contracts in the market. These contracts represent agreements between two parties to buy or sell a specific amount of the coin at a predetermined price and date in the future. Since these positions have yet to be closed or settled, the Open Interest serves as an indicator of the level of ongoing market activity and the potential volume of future transactions.

As a researcher observing the markets, when I notice a significant decrease in the number of new positions being opened by Futures traders while existing ones are being closed, it’s a sign that some traders may be adopting a more cautious stance. This shift can be interpreted as a transition from bullish sentiment, which is optimistic about market growth, to bearish sentiment, which is pessimistic and anticipates a market downturn.

Read Ethereum’s [ETH] Price Prediction 2024-25

Despite the pessimistic views held by certain market players regarding Ethereum’s cryptocurrency, most traders in the futures market have taken positions expecting further price increases for Ethereum.

Based on Coinglass data, the funding rate of the coin has consistently yielded positive values since May 3rd.

In the context of perpetual futures contracts, Funding Rates serve as a mechanism to keep the contract’s price aligned with the current market price (spot price). A positive Funding Rate indicates strong demand for investors holding long positions in the contract.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Ethereum ETF Day 1 beats ‘20% of BTC’ estimate – What’s next?

- Solana memecoin BODEN feels the heat after Biden’s exit: Will SOL suffer?

2024-06-11 14:15