- One of Ethereum’s top whales has dumped seven thousand tokens, making over $16 million in profits.

- Ethereum’s price has seen very minute increases; Analysts expect bulls to take control back.

As a researcher with a background in cryptocurrencies and blockchain technology, I find the recent developments in the Ethereum [ETH] market particularly intriguing. The news that one of Ethereum’s top whales has sold off 7,000 tokens, making over $16 million in profits, is a significant indication of the current market sentiment among large investors (One of Ethereum’s top whales has dumped seven thousand tokens, making over $16 million in profits.).

As an analyst, I would rephrase it this way: I, as an observer of the crypto market, notice that Ethereum [ETH], currently ranked second in size, has been battling to recover following a significant price drop. Holding onto investments becomes a nerve-wracking experience for those connected to this digital currency.

But now, it would seem that the largest holders of the token are starting to give up.

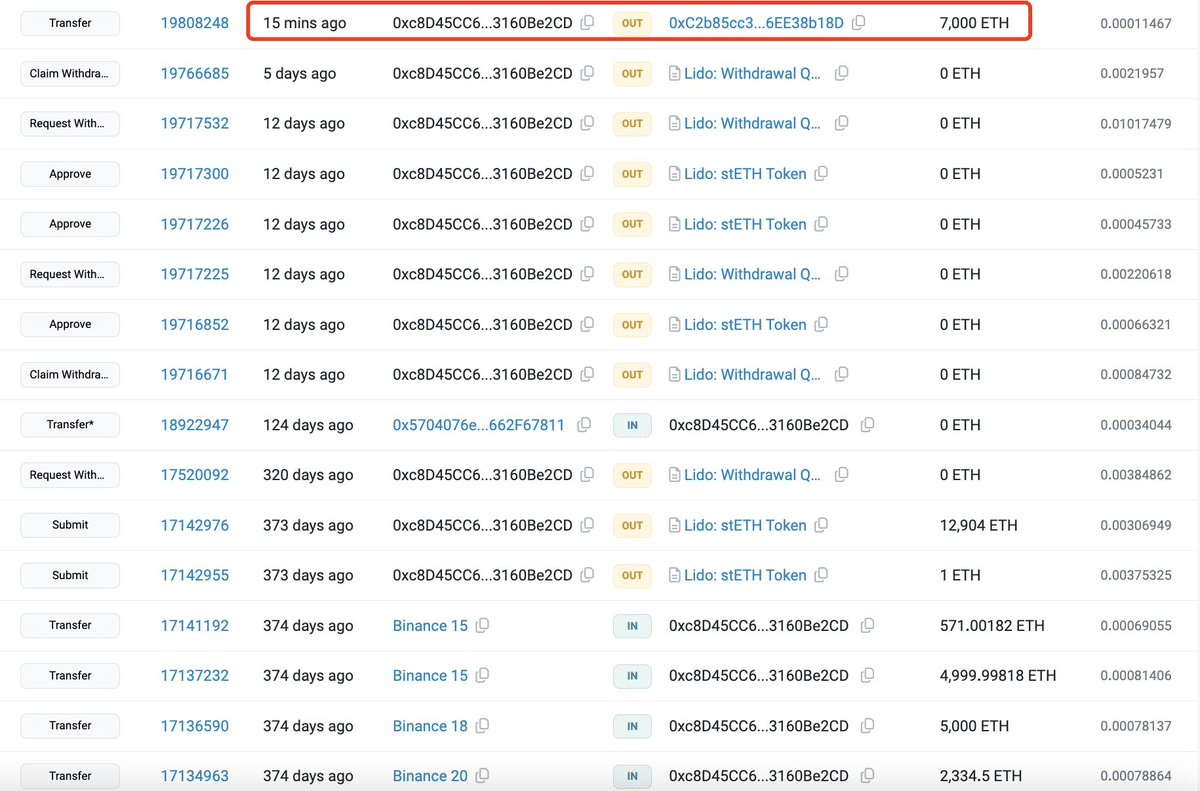

As a researcher examining blockchain data from Lookonchain, I’ve come across an intriguing finding. Approximately one year ago, a significant Ethereum investor purchased a large quantity of this cryptocurrency. Now, they are selling it, indicating potential profits from their initial investment.

Last year, the whale transferred 12,906 ETH, equivalent to approximately $24 million based on current market prices, from Binance (BNB) and moved it into Lido (LDO), depositing it there instead.

I pulled out 7,000 units of cryptocurrency from my Lido wallet when the market took a dip on the 30th of April. I then transferred this amount to Binance. My earnings from this transaction exceeded $16 million.

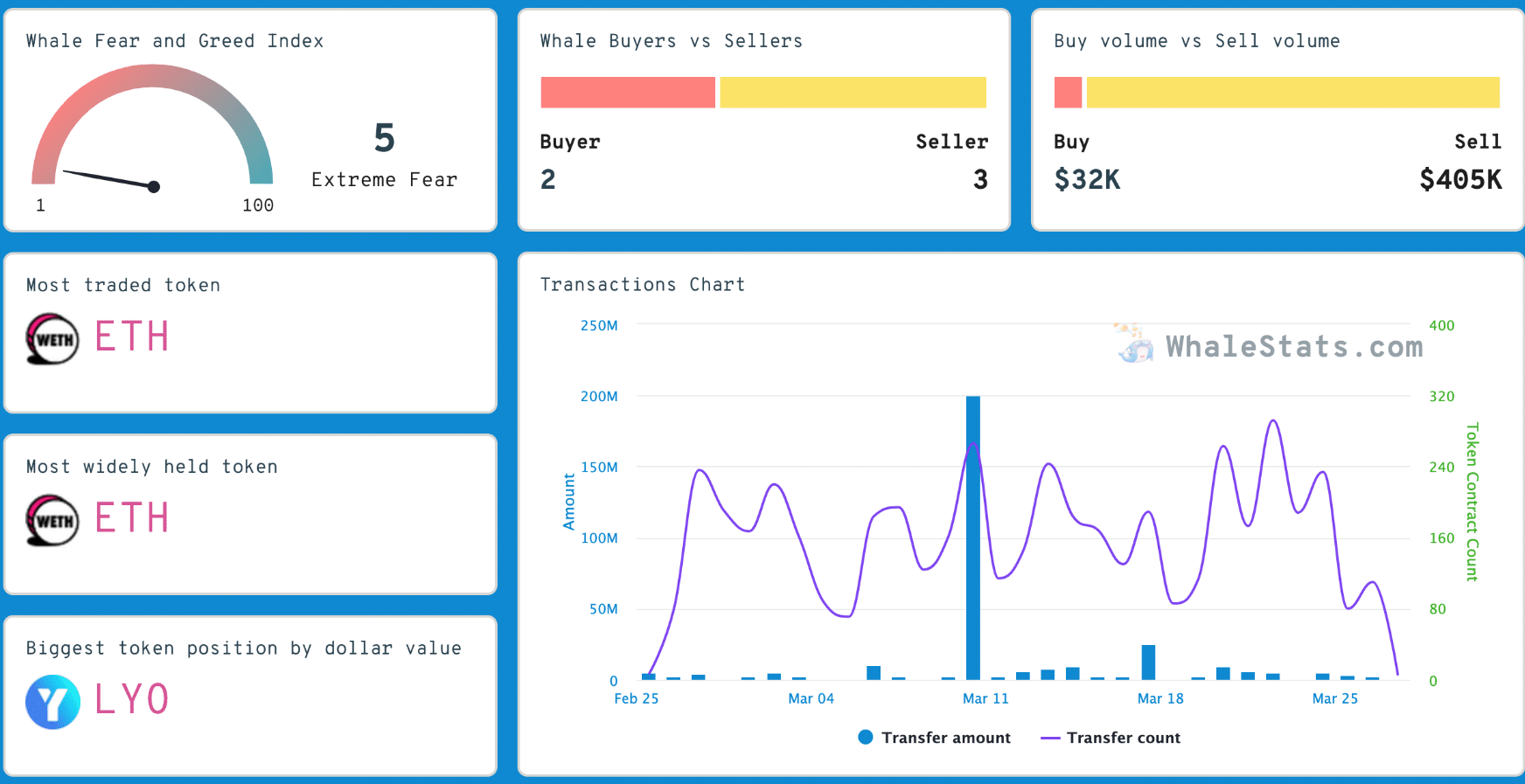

At the present moment, according to data provided by WhaleStats, the Fear and Greed Index for Ethereum whales on the Binance Smart Chain is indicating an overwhelming sense of fear.

Among all tokens, Ether continues to be the most frequently bought and stored by large investors. however, these investors appear nervous, keeping a close watch for any new market developments.

Ethereum’s performance in a gloomy market

The cryptocurrency market is currently experiencing losses following Bitcoin‘s achievement of new peak prices, implying a potential commencement of a bull market.

As an analyst, I would put it this way: Right now, the downtrend is prevailing for Ethereum. The cryptocurrency is priced at $3,208 at the moment of writing, representing a slight daily gain of 0.02% and a more substantial weekly increase of 0.8%.

Prominent crypto analyst Ashcrypto updated his outlook for Ether’s price.

Based on the historical price patterns I’ve observed in Ethereum from 2020 and 2021, I believe we can expect another breakout for Ether in the third quarter of this year. According to my analysis of the charts, Ethereum could potentially reach a price of $4,000 during this timeframe.

According to Ken Crypto, a well-known cryptocurrency analyst, there seems to be a subtle shift in the attitudes of investors recently.

Despite its predominantly negative outlook, he maintains that a faint bullish feeling is starting to surface. This optimism arises due to the digital currency continuing to hover above the 100 Simple Moving Average (SMA).

Despite this fact, Ethereum bulls have been facing significant opposition as they attempt to surpass important upper thresholds.

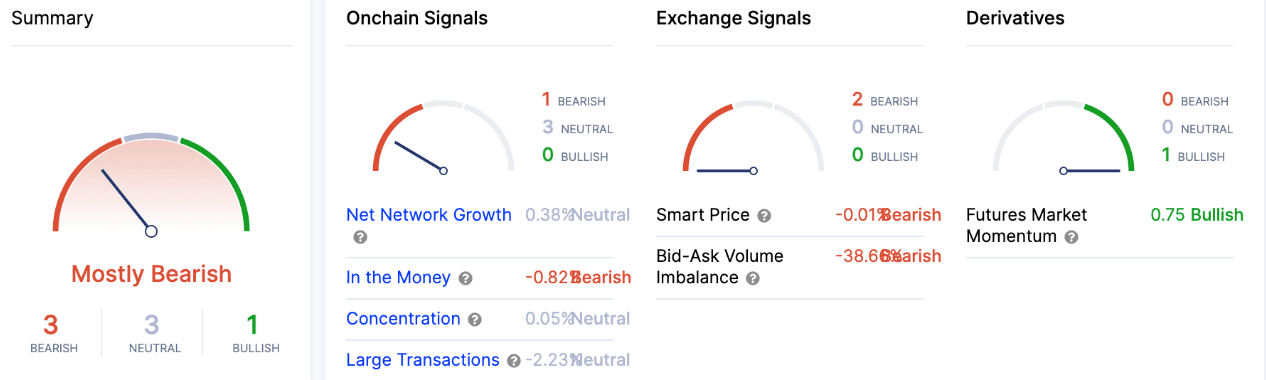

Based on the data from IntoTheBlock, it appears that there is a significant correlation between the price of Ethereum and the amount of large transactions taking place. These substantial transactions play a key role in shaping Ethereum’s price trends.

As a crypto investor, I’ve observed that a notable decrease in Ethereum transactions in April coincided with a drop in its price. It’s clear to me now that large investors, or “whales,” are exerting their influence on the market by ramping up selling pressure.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

2024-05-07 07:03