- Morpho is expected to continue its uptrend and sally past the $3.6 local resistance.

- The lower timeframe momentum and sentiment were firmly bullish, and a dip would be a buying opportunity.

As a seasoned analyst with over a decade of experience in the crypto market, I see Morpho (MORPHO) continuing its uptrend and breaking past the $3.6 local resistance, given its strong bullish momentum and sentiment. The lower timeframe charts are particularly promising, and any dip would be an excellent buying opportunity.

At present, Morpho is trading at $3.38, having made a new all-time high at $3.61 on the 31st of December. In the short term, the $3-$3.2 zone seems likely to function as a demand zone in case of a retest. Bitcoin‘s [BTC] performance will play a significant role in Morpho’s bullish chances, with a sustained drop below $91.5k potentially hurting its prospects, while a BTC recovery would bolster buyer sentiment.

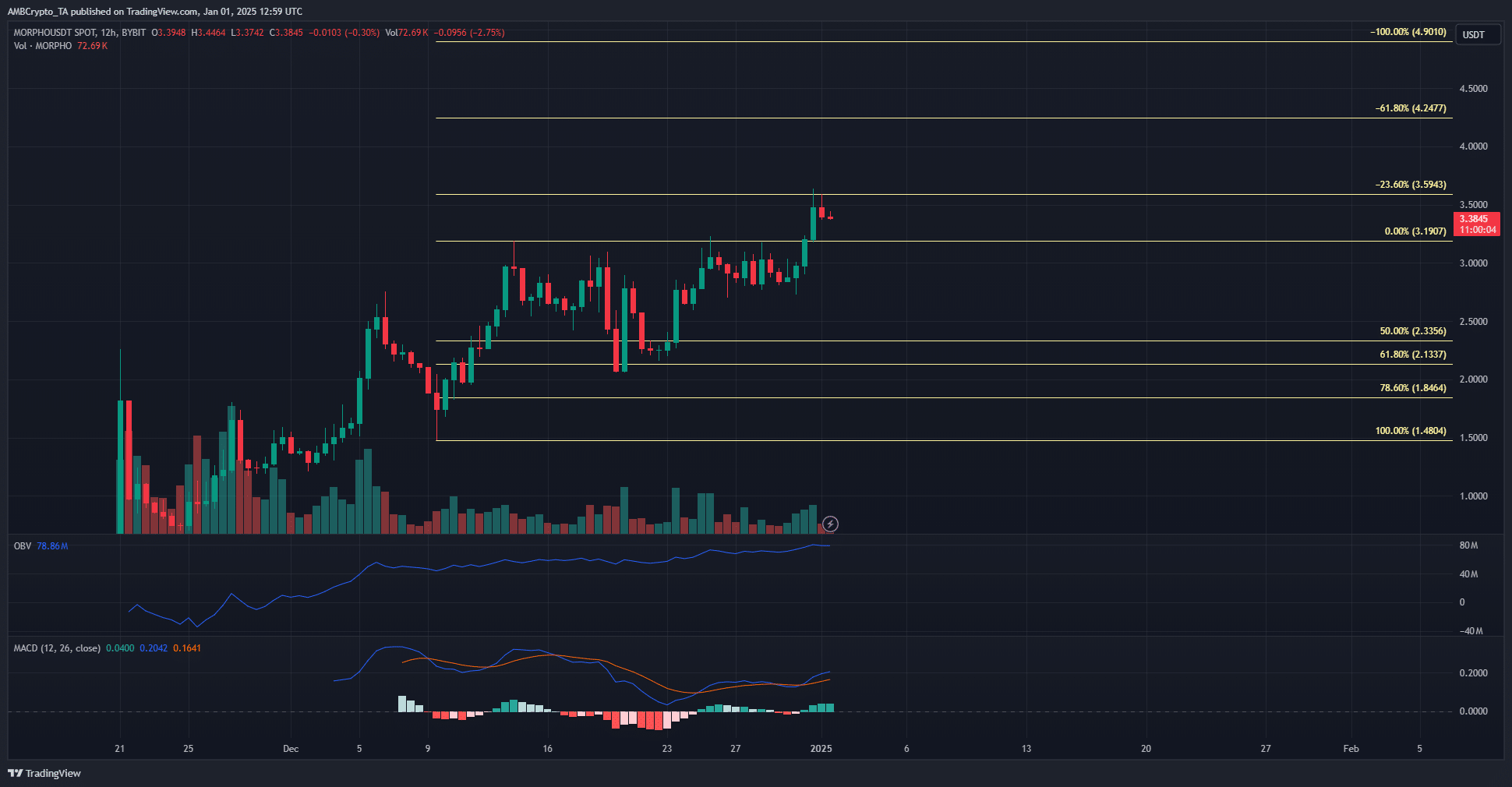

Moving forward, Morpho appears poised to test the 23.6% extension and aim for new highs, with potential targets at $4.24 and $4.9. The market structure on the 12-hour chart is strongly bullish, with sustained buying pressure pushing Morpho to new highs despite resistance at $3.19.

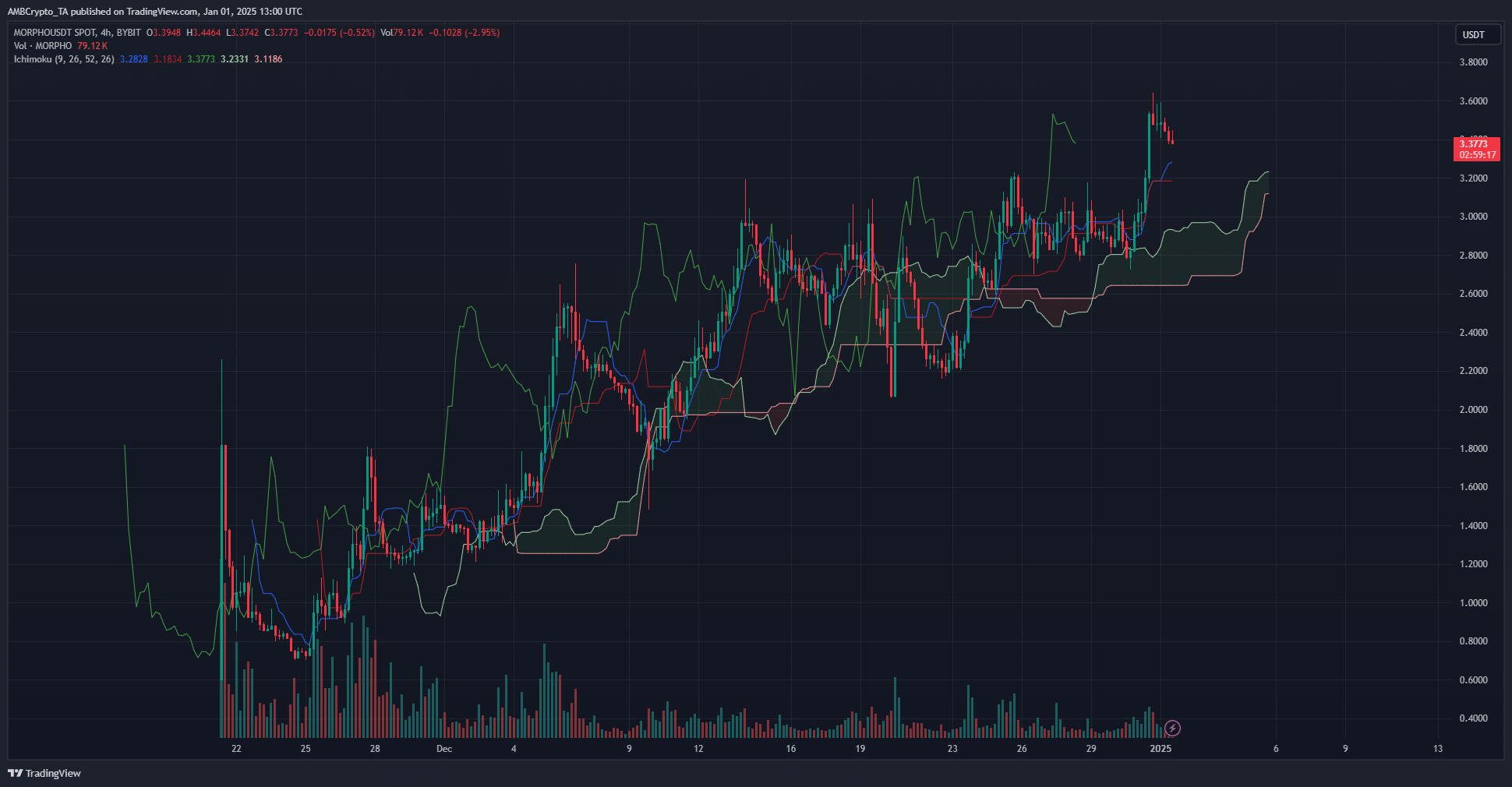

In the lower timeframes, we can observe the Ichimoku Cloud indicator’s bullish trend, although its thickness has decreased recently. The Tenkan-sen line crossing above the Kijun-sen confirms the uptrend and highlights potential dynamic support levels at $3.18 and $3.28.

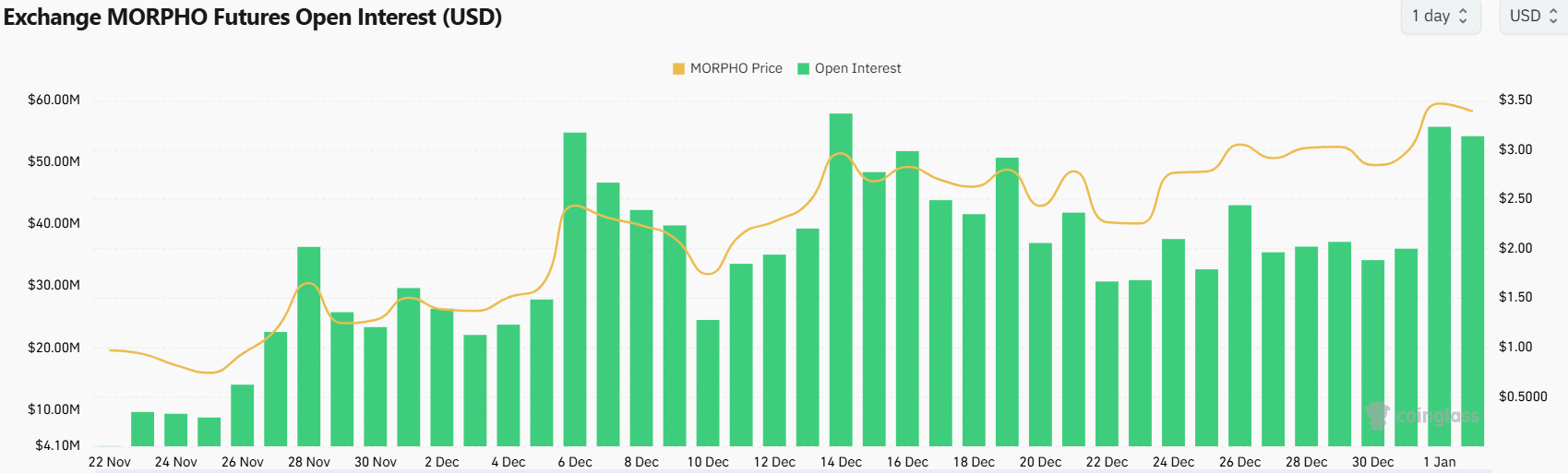

Open Interest (OI) surged on December 31st, signaling strong speculative interest and bullish sentiment. While the OI has dropped slightly since then, the overall trajectory for Morpho remains firmly bullish. A move toward $3-$3.2 would represent a great buying opportunity, especially if Bitcoin recovers.

And now, for a bit of humor: Remember, the market can be as unpredictable as a roller coaster, but it’s always a thrilling ride! So buckle up and enjoy the crypto journey!

As someone who has been following the stock market for over two decades now, I have learned that keeping a close eye on key indicators like the current trading price and historical highs can be crucial to making informed investment decisions. In the case of Morpho [MORPHO], it’s interesting to see that it reached an all-time high of $3.61 on the last day of 2022, a testament to its strong performance in recent months. However, I would advise caution when considering investments as the short term outlook suggests that the $3-$3.2 zone may act as a potential demand zone if there is a retest. With my past experiences, I know that market trends can be unpredictable and it’s essential to remain vigilant and adaptable in order to make successful investments.

In simpler terms, Bitcoin (BTC) hasn’t shown strong bullish signals in its shorter time periods. If Bitcoin falls significantly below $91,500, it might negatively impact MORPHO’s optimistic outlook. Conversely, a recovery of Bitcoin would boost the confidence of potential buyers.

MORPHO tests the 23.6% extension, set for new highs

On the 12-hour timeframe, the market pattern for MORPHO displayed a robust bullish trend. In December, buyers faced challenges at the $3.19 resistance point and made several attempts to break through it. The dominance of buyers was clear in the OBV, which showed a consistently ascending line, indicating increasing buyer activity.

In simple terms, the continuous demand for shares of Morpho kept growing, pushing its price to record highs of $3.61. However, it dropped slightly to $3.38 by the time news was released. The Moving Average Convergence Divergence (MACD) suggested a surge in positive momentum without warning signs of a bearish trend or an overly stretched market.

The next Fibonacci extension targets are $4.24 and $4.9.

Lower timeframe support zones to watch

In simpler terms, the Ichimoku Cloud signal displayed a positive outlook yesterday, but its density has lessened over the last 24 hours. The momentum observed on Tuesday hasn’t held up recently, however, the overall trend still indicates a robust bullish movement.

The intersecting line (Tenkan-sen) has risen above the base line (Kijun-sen), indicating a positive trend in the market. These lines can also serve as temporary levels of support, with $3.18 and $3.28 being potential points where the price may hold steady or rebound, at the current moment.

On December 31st, there was a significant increase in open interest (OI). This surge coincided with a rally that surpassed the $3.2 resistance level, indicating a high level of speculative activity. This bullish trend suggested optimistic market sentiments.

Is your portfolio green? Check the Morpho Profit Calculator

In the last day, the Open Interest (OI) decreased from $56.57 million to $53.73 million, indicating a slight decrease in future investment enthusiasm. However, the overall trend for MORPHO continues to point upward, suggesting a strong bullish outlook.

A move toward $3-$3.2 would represent a buying opportunity.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-01-02 04:07