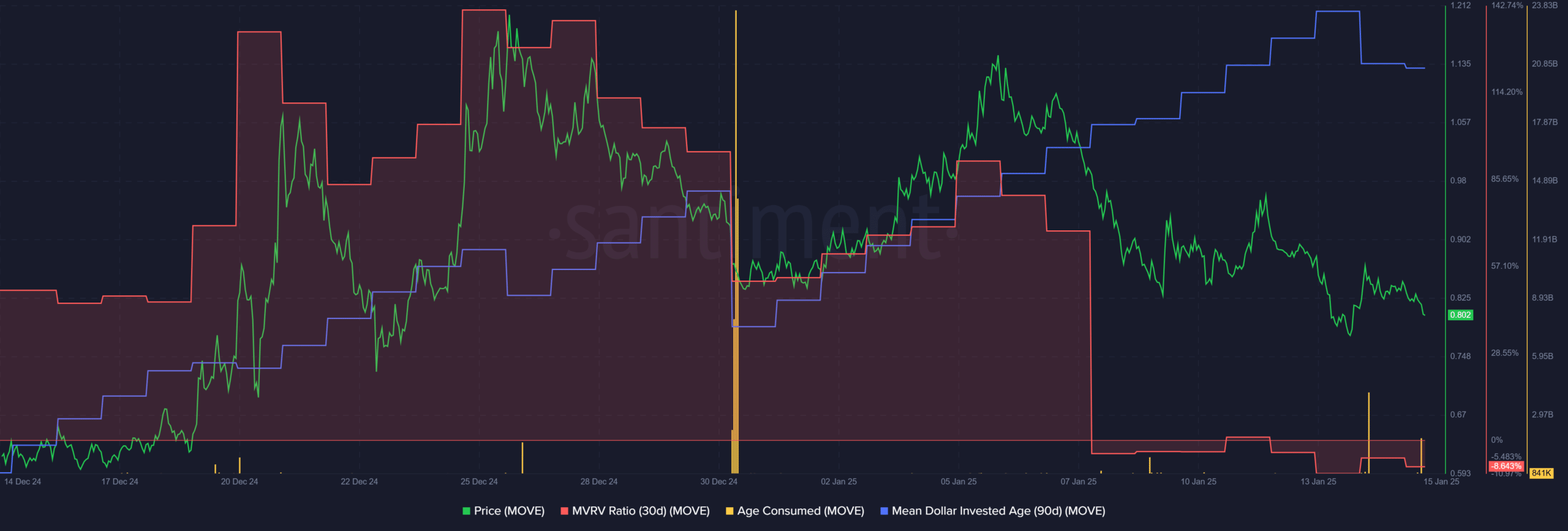

- MOVE fell below the short-term range lows and hasn’t reclaimed it yet

- Rising MDIA meant new investments aren’t entering and holders weren’t moving their tokens

16-hour period following Monday’s $0.786 low saw a 11.16% increase for Movement [MOVE]. However, the subsequent 36 hours witnessed a 9% decline. As of now, at press time, MOVE was trading only slightly above Monday’s lows, being just under 1% away.

Currently, Bitcoin (BTC) has increased by 8.7% from its lows on Monday. It appears that the $92.4k level is being strongly defended as a demand area, and Bitcoin seems to be moving towards its resistance at around $102k. The contrast between the price movements of these two assets offers an interesting perspective. Specifically, it highlights the relative weakness that MOVE has been showing compared to Bitcoin.

Sifting through Movement’s signals, the bears have an advantage

The 4-hour price chart shows a price range that has been around for nearly a month, between $0.83 and $1.13. Previously mentioned, the recent surge didn’t manage to hold up the lower end of this range as a support level. The drop below $0.83 since then raises some red flags.

Over the past fortnight, the A/D indicator has been trending downwards as well. This consistent decline suggests strong selling pressure and a lack of buying interest, leading us to anticipate that MOVE might drop to $0.728 or even lower within the next few days.

The data from the blockchain didn’t show signs of optimism either. A 30-day MVRV ratio slightly below zero suggests that short-term investors have less incentive to sell their assets because they are already in the red. Yet, this minor relief wouldn’t be much comfort.

In my experience as a crypto investor, the average age of tokens has been rather subdued during January. However, it’s essential to note that this metric tends to surge when significant quantities of tokens, particularly older ones, are transferred. The more dramatic the spike, the older the collective age of the moved tokens.

Read Movement’s [MOVE] Price Prediction 2025-26

1) Over the past 90 days, the average amount of money invested has been consistently rising, suggesting that investors are holding onto their coins rather than selling them. This could potentially point towards a slowdown in the network’s growth or activity.

Due to Movement being a relatively new addition to trading for approximately a month, the ongoing upward trend of MDIA doesn’t bother the optimistic investors. Yet, it’s plausible that substantial price drops in MDIA could lead to subsequent increases.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Gold Rate Forecast

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-01-16 17:43