The stock, once a titan of the tech world, now lies prostrate, its price plunging like a disgraced minister in a Soviet bureaucracy. 🧢💸

Strategy, the company that once danced with the stars of Wall Street, now cowers beneath the weight of its own Bitcoin obsession. 🧙♂️

- MSTR stock price retreated to its lowest level since October 14. 🕵️♂️

- Bitcoin price crashed and formed a death cross pattern on the daily chart. 🕯️

- Strategy bought 8,178 Bitcoins last week as the price crashed. 🧨

Strategy stock dropped to $192, its lowest level since October last year, and 57% below its highest level this year. This crash has led to a $72 billion wipeout, with the market capitalization dropping from $128 billion in August to $57 billion today. 📉

Strategy, formerly known as MicroStrategy, continued its Bitcoin (BTC) buying spree last week, a sign that Michael Saylor believes that the coin will rebound. 🧩

He bought 8,178 coins valued at over $835 million, bringing his total hoard to 649,870. Its total holdings are now valued at over $61.7 billion. It is still profitable, as its average purchase price was $48 billion. 💰

Strategy has acquired 8,178 BTC for ~$835.6 million at ~$102,171 per bitcoin and has achieved BTC Yield of 27.8% YTD 2025. As of 11/16/2025, we hodl 649,870 $BTC acquired for ~$48.37 billion at ~$74,433 per bitcoin. $MSTR $STRC $STRD $STRE $STRF $STRK

– Michael Saylor (@saylor) November 17, 2025

In an appearance on CNBC last week, Saylor maintained that the Bitcoin price has more room to run, citing its strong fundamentals, including the rising institutional demand and the falling supply. He also noted that the ongoing volatility was part of the game, pointing to past drawdowns. 🎭

We are ₿uying.

– Michael Saylor (@saylor) November 14, 2025

Saylor believes the ongoing Bitcoin price retreat is due to investor deleveraging, as evidenced by falling futures open interest. Bitcoin’s daily open interest has dropped to $64 billion from the October high of $94 billion. 🧼

Saylor believes that Bitcoin price will outperform gold and the S&P 500 Index over time, calling it a digital capital with a limited supply and strong demand. 🏦

Strategy’s acquisition happened as the company’s market Net Asset Value (mNAV) has plunged in the past few months. Its mNAV has crashed to 0.94 from the year-to-date high of over 3. 🚨

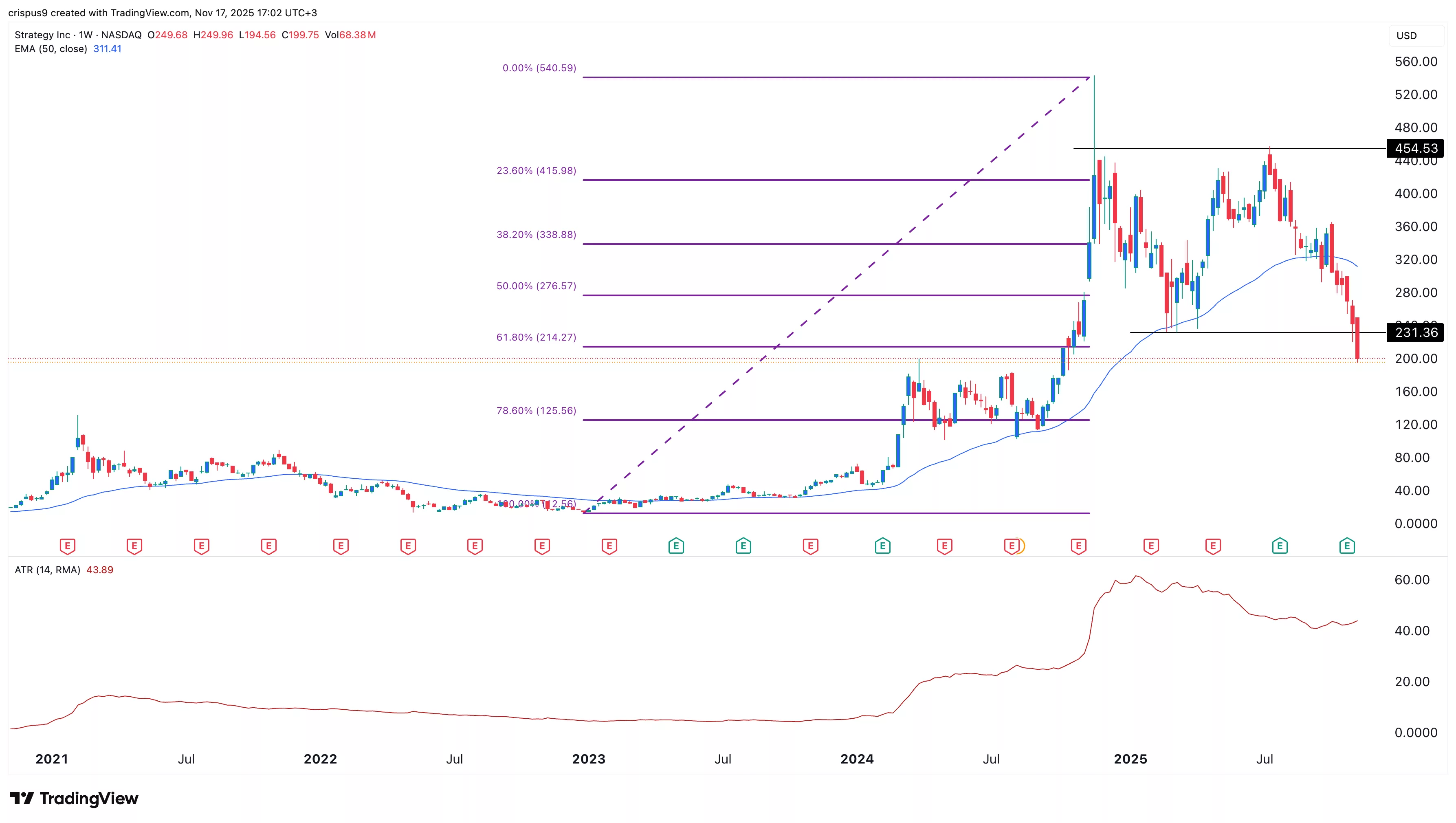

MSTR stock price technical analysis

The MSTR stock will likely remain under pressure in the near term now that the Bitcoin price has formed a death cross pattern as the 50-day Exponential Moving Average has dropped below the 200-day average. 🕯️

The weekly timeframe chart shows that the MSTR stock price remains under intense pressure. It formed a double-top pattern at $455 and a neckline at $231, its lowest level in February. 🧱

Strategy stock has plunged below the important 61.8% Fibonacci Retracement level at $214, confirming the bearish outlook. 🐍

Also, the Average Directional Index (ADX) has remained above 40, a sign that the downtrend is continuing. Therefore, the stock will likely continue falling as bears target the 78.6% retracement level at $125. 🧠

The bearish MSTR stock price will become invalid if it moves above the important resistance level at $230. A move above that level will point to more upside in the near term. 🚀

Read More

- Best Controller Settings for ARC Raiders

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- Dan Da Dan Chapter 226 Release Date & Where to Read

- ‘Crime 101’ Ending, Explained

- Ashes of Creation Mage Guide for Beginners

- James Gunn Teases the Future of the DCU After Netflix Purchase

2025-11-17 18:35