-

Mt. Gox’s recent transfer has left it with a $3B BTC balance.

BTC continued its sell-off ahead of the U.S. July jobs report set for the 2nd of August.

As a seasoned crypto investor with battle scars from Mt. Gox’s past fiasco and a keen eye for market trends, I must admit that the recent $3.1 billion BTC transfer by Mt. Gox to BitGo has brought a sense of relief. The looming supply pressure from the defunct exchange seems to be nearing its end, similar to the German government finally deciding to take a vacation and stop pressuring us with their surplus Bitcoin!

The latest transfer of approximately $3.1 billion worth of Bitcoin (BTC) from Mt. Gox to BitGo has further reduced the defunct exchange’s bitcoin holdings, suggesting that the excess supply of Bitcoin from Mt. Gox may be depleted shortly.

Based on information from Arkham, a transfer via BitGo on July 30th increased the Trustee’s account balance to approximately $3.06 billion.

Last night, approximately 33,960 Bitcoin (worth around $2.25 billion) were transferred from Mt. Gox’s addresses to ones we suspect belong to BitGo. Following these transactions, Mt. Gox now has control over about 46,160 Bitcoin (around $3.06 billion), including the newly-created Mt. Gox wallet.

Mt. Gox supply pressure is almost over

Due to a significant decrease in the trustee’s assets, it was expected that the perceived danger facing Mt Gox, similar to the influence of the German government, would come to an end shortly.

It turns out that the latest release from the closed exchange did not have the anticipated effect on the market, contrary to earlier expectations.

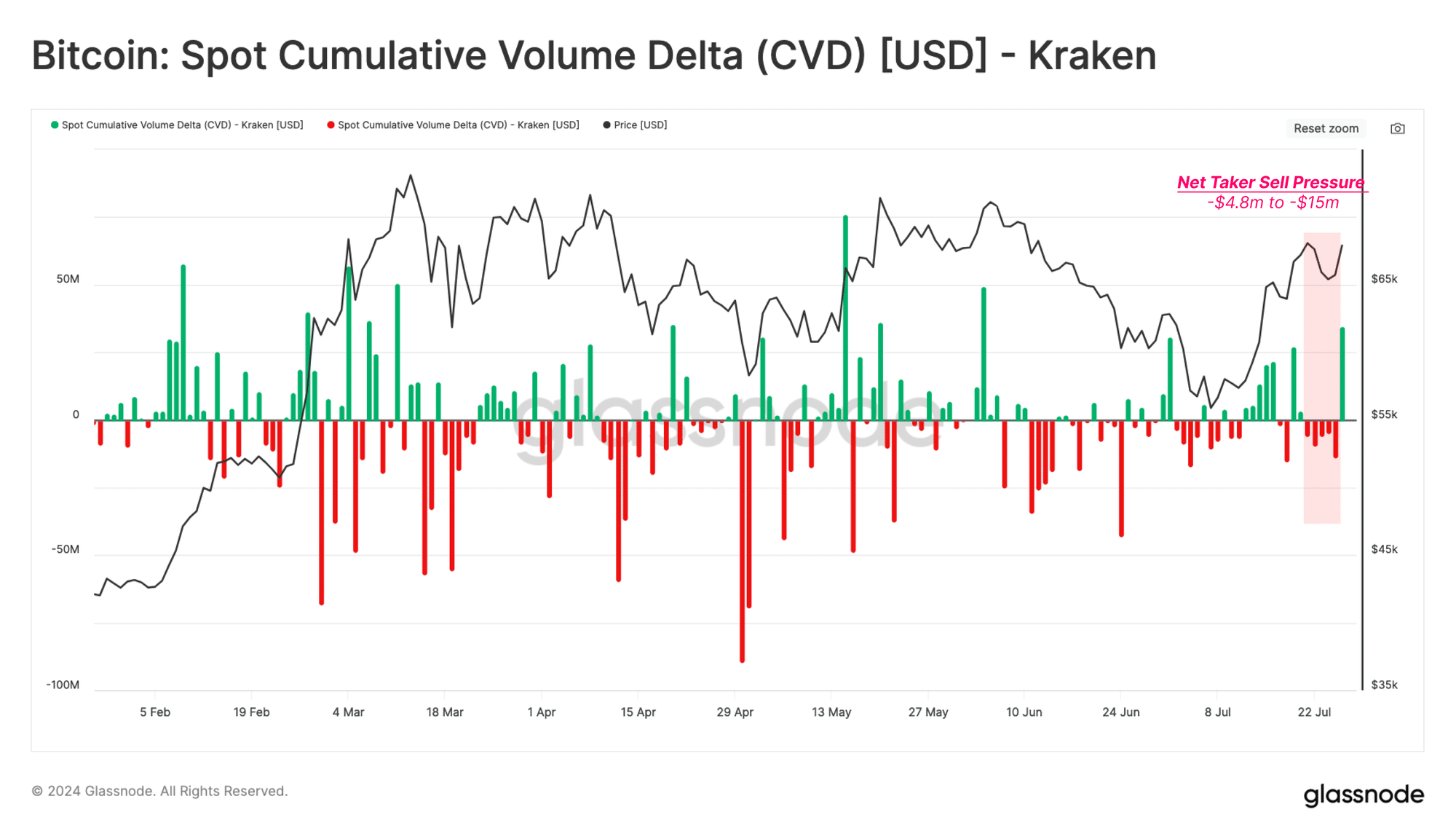

Based on information from Glassnode, it appears that significant selling actions were not observed among key exchanges like Kraken and Bitstamp when it came to transactions made by the trustee estate during its repayment process.

After the distribution, the Spot Cumulative Volume Delta (CVD) figure on Kraken showed a slight increase, indicating that there was no significant pressure to sell following the exchange’s receipt of the repayment.

In simpler terms, CVD (Cumulative Volume Delta) records the total amount that is being bought rather than sold on an exchange, as a positive number means there’s more buying activity compared to market orders.

Glassnode set up a situation comparable to Bitstamp, thus allowing for the repayment without significantly impacting the market, much like how the German government’s sell-off didn’t disturb the market. In simpler terms, the approximately $3 billion in Bitcoin could be moved without causing market disruption.

At present, significant selling of Bitcoin is being driven by the U.S. government. Last week, it sold around $2 billion worth of Bitcoin, causing market uneasiness, and currently holds approximately $13 billion in Bitcoin.

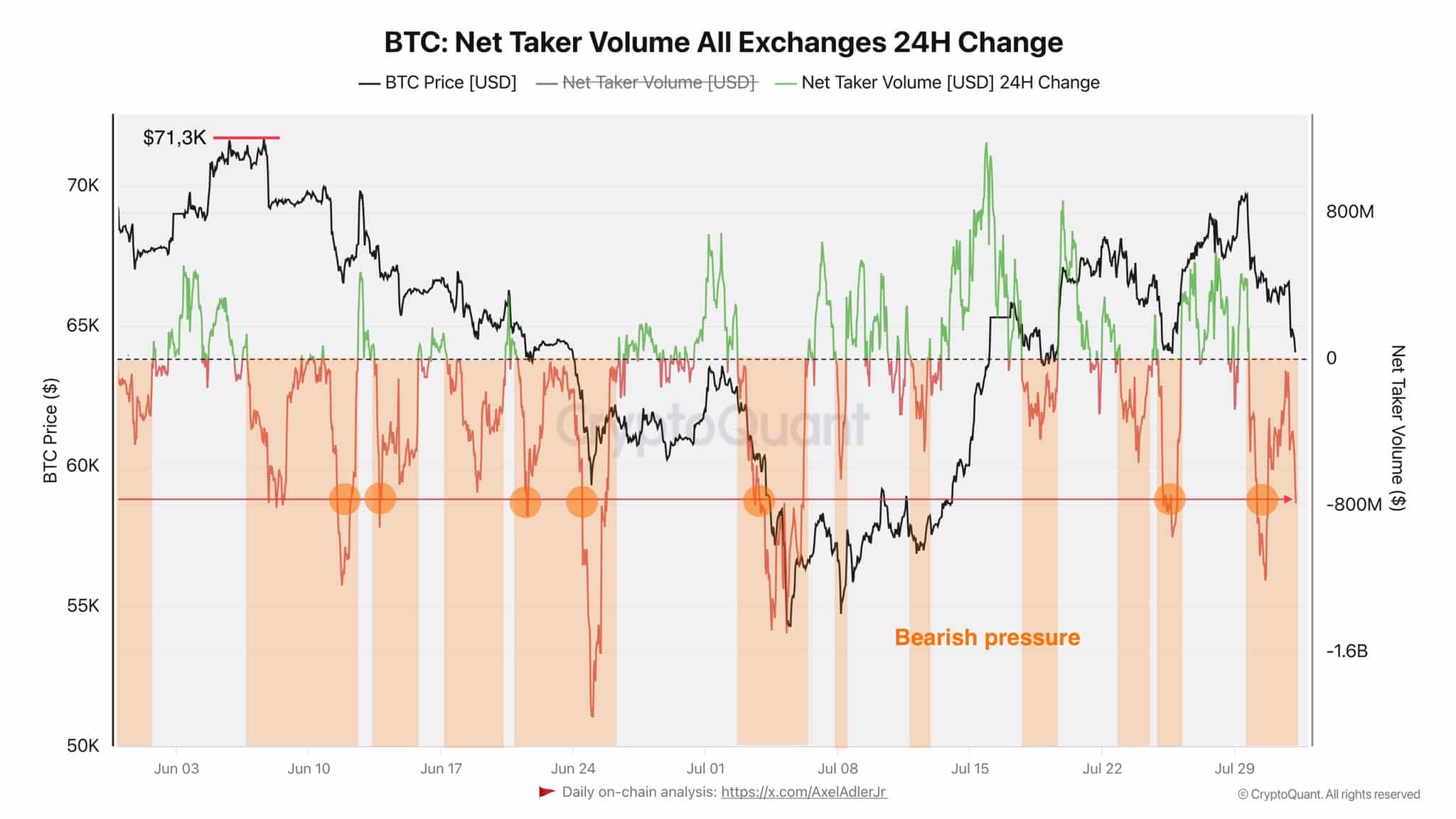

Since June, the German and US sell-off fears have offered bears more edge in the market.

Based on analysis by Axel Adler from CryptoQuant, a persistent selling pressure has given confidence to the ‘bears’ (market participants who expect prices to fall) over the summer, as indicated by the Net Taker Volume.

“It’s clear that the bears have been quite strong since the start of summer. The bulls will need to stay vigilant until the measurement exceeds zero.”

In simpler terms, when the total amount sold (Net Taker Volume) was greater than the total amount bought, it indicated that the market was primarily experiencing selling activity, with more buying orders being cancelled or not filled compared to those being executed.

Currently, at the time this information was published, Bitcoin reached $63,000 and showed signs of potentially dropping more, in anticipation of the upcoming U.S. July Jobs Reports, due out on August 2nd.

We’ll have to wait and see if the employment data can help halt the rapid market drop, given that the Federal Open Market Committee (FOMC) meeting was more lenient than expected.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

2024-08-02 09:12