- Bitcoin faces pressure amidst Mt. Gox repayments, with experts like Alex Thorn highlighting potential impacts on Bitcoin Cash.

- Contrasting repayment strategies by Mt. Gox, Gemini, and FTX raised questions about market stability and investor sentiment.

As a seasoned crypto investor with several years of experience in the market, I’ve seen my fair share of ups and downs. The current situation with Bitcoin (BTC) and its decline amidst Mt. Gox repayments is a cause for concern, but it’s important to delve deeper into the matter before jumping to conclusions.

As a researcher studying the cryptocurrency market, I can tell you that the year 2024 was particularly fortunate for Bitcoin [BTC]. Notable events included the launch of the Bitcoin ETF, which brought new investors into the market, and the digital currency reaching an unprecedented all-time high price of $73,000. Moreover, the highly anticipated halving event added to the excitement and optimism within the community.

While the crypto world eagerly anticipates the complete and definitive green light for a Bitcoin [BTC]-linked Ethereum [ETH] ETF in July, it appears that BTC has momentarily stepped out of the spotlight.

At present, as I pen down this analysis, Ether (ETH) has experienced a noteworthy growth of 1.58% over the last 24 hours. In contrast, Bitcoin (BTC) displays bearish tendencies on its daily charts, with a trading price of $61,000.

What’s behind Bitcoin’s downfall?

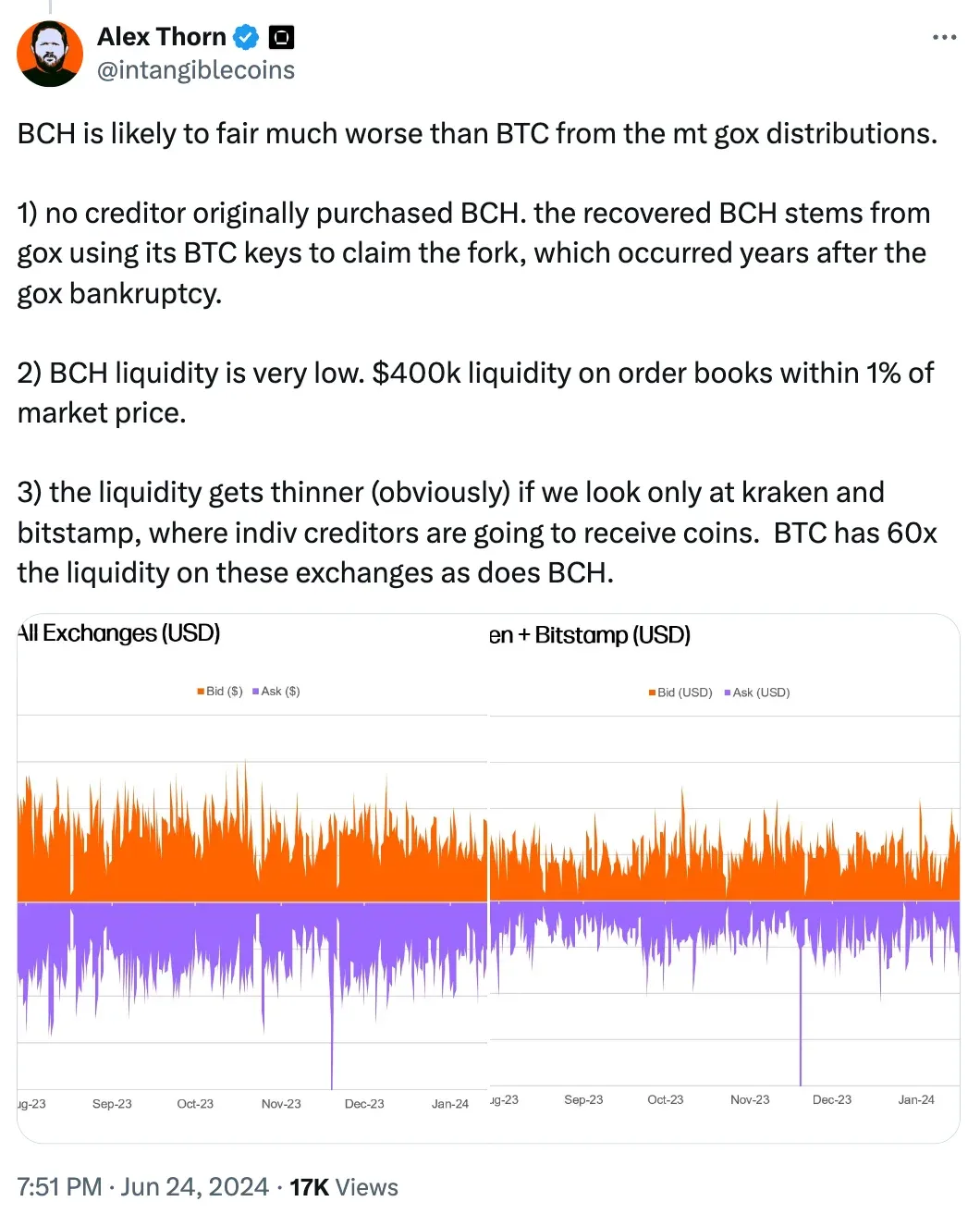

Instead of pointing fingers at the Mt.Gox repayment plan as the cause of Bitcoin’s recent downturn, Alex Thorn, the Head of Firmwide Research at Galaxy Digital, presented an alternate viewpoint.

As a crypto investor, I’ve noticed that Bitcoin Cash (BCH) was disproportionately impacted according to Thorn’s analysis. To provide some context, he expressed this perspective on his preferred social media platform X (previously known as Twitter).

I’m an expert in analyzing cybersecurity incidents. In this context, Thorn is discussing the large-scale hack that occurred against Mt. Gox back in 2014. This unfortunate event led to the theft of approximately 740,000 Bitcoins, which at today’s value, equates to a staggering $15 billion.

Starting from July 2024, I will make my repayments using Bitcoin and Bitcoin Cash. Consequently, the supply of these digital currencies in circulation might experience a surge due to creditor sales, potentially leading to increased market pressure.

The possible solution

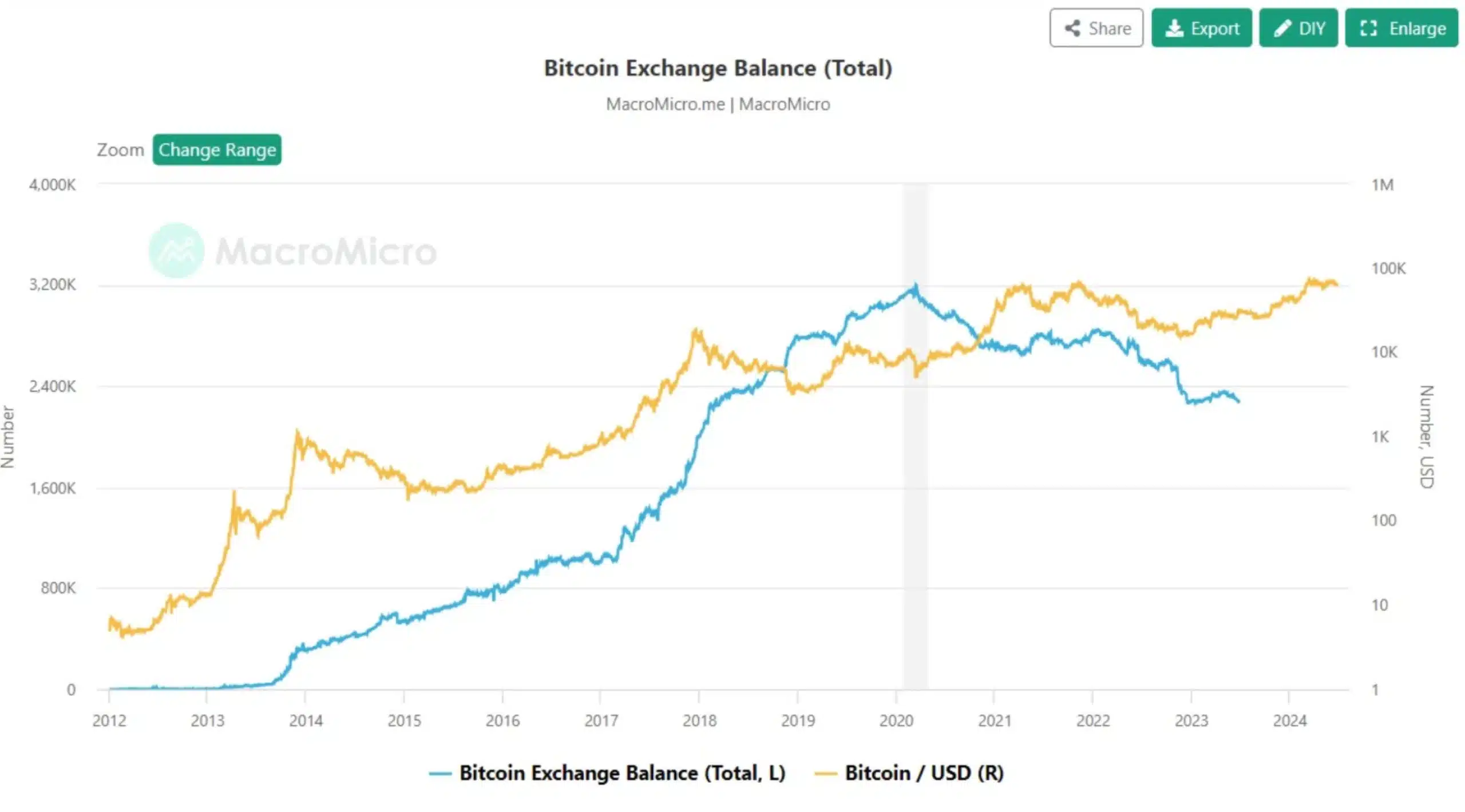

One effective method for monitoring the state of the Bitcoin market is by closely watching Bitcoin exchange balances as they can serve as a valuable reflection of Bitcoin’s pricing power.

In a recent post on X, renowned commentator Matthew Hyland downplayed the importance of shrinking exchange supplies. He expounded on this viewpoint by labeling it as “overrated.”

In my opinion, the importance of supply in Bitcoin’s (BTC) price movements is exaggerated. Despite a drop in BTC quantities on exchanges throughout the entire bear market, the downward trend in BTC’s price continued unabated. While it plays a significant role in the long term, the short to medium-term price fluctuations suggest that supply doesn’t have a substantial impact within multi-year timeframes.

Well, it’s important to note that it’s not the first time Mt. Gox has done such a thing.

Mt.Gox, not the only one!

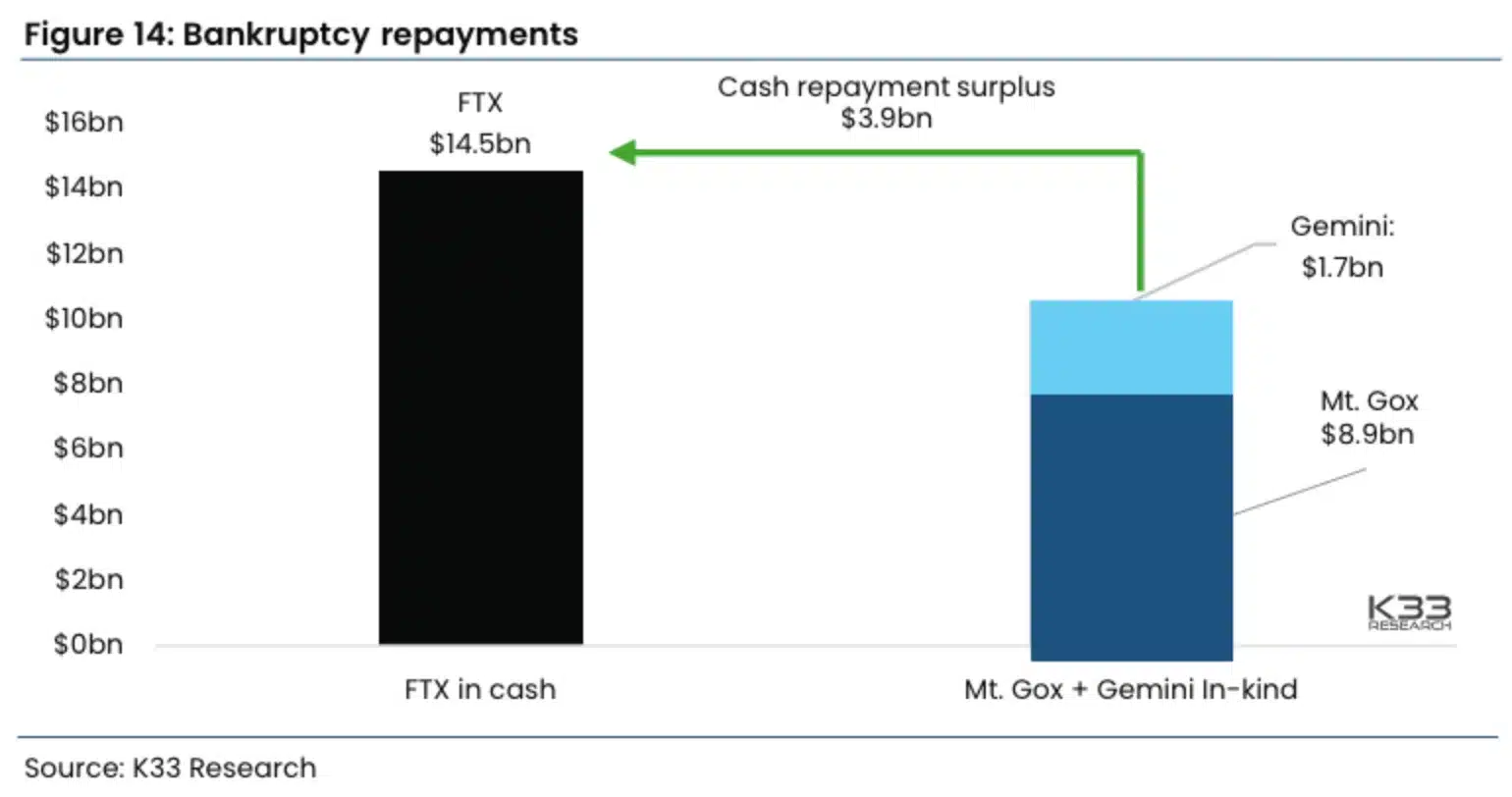

As a crypto investor, I’m pleased to hear that Gemini has joined the ranks of exchanges looking out for their affected users. Similar to Mt. Gox, Gemini announced its intention to compensate those individuals who were negatively impacted by the termination of their Gemini Earn program.

The founders emphasized on X, formerly known as Twitter, that on May 29th, Earn users were awarded a total of $2.18 billion in digital assets.

As a crypto investor, I’ve noticed that FTX, a cryptocurrency exchange which went through bankruptcy proceedings last year, has announced a plan to pay off its outstanding debts.

Based on the assessment of experts at K33 Research, the market reaction to these debt repayments could vary from other creditor negotiations.

FTX, unlike companies such as Mt. Gox and Gemini, does not intend to reimburse its creditors using cryptocurrencies; instead, it plans to carry out repayments in cash.

As a researcher studying the financial markets, I have observed that the varying repayment methods can significantly influence investor perspectives and market equilibrium in distinct manners.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-26 06:15