-

Mt. Gox transferred $2.7B in BTC to a new address.

The transfer has caused panic with fears of massive sell-offs.

As a researcher with extensive experience in the cryptocurrency market, I’m closely monitoring the recent developments surrounding Mt. Gox and their transfer of $2.7B in Bitcoin to a new address. This news has understandably caused panic among investors due to fears of massive sell-offs.

I’ve observed a significant drop in Bitcoin‘s value lately, with the cryptocurrency reaching a two-month low of $54k after experiencing a weekly loss of 11.715%. The selling pressure in the market has been intense, resulting in this downturn.

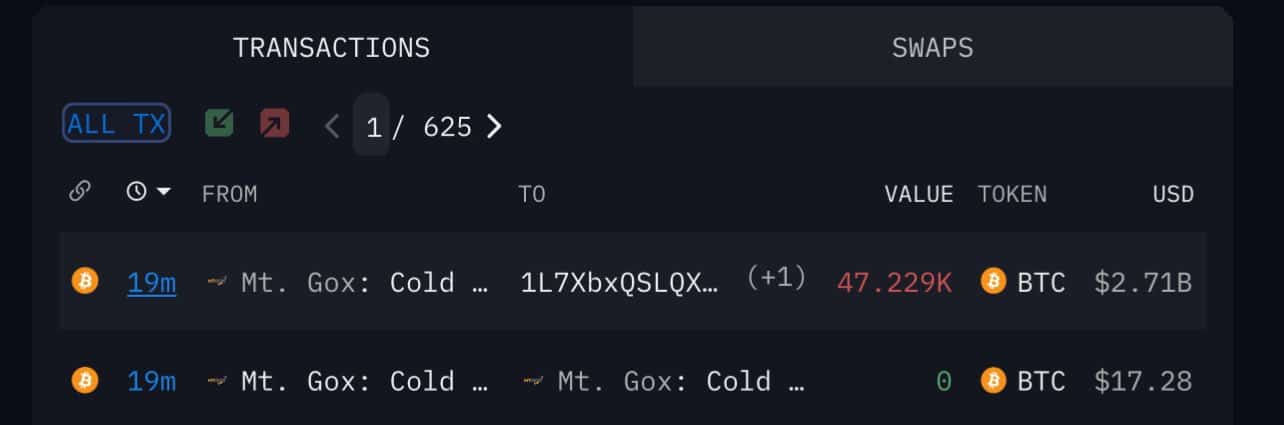

Based on information from Arkham Intelligence, it is reported that the insolvent Japanese Bitcoin exchange, Mt. Gox, has moved approximately $2.7 billion worth of Bitcoin to a newly created wallet.

Arkham announced the transfer on their official X (formerly Twitter) page, stating,

“Mt Gox moves 47,228 BTC ($2.71 billion dollars) from cold storage to a new wallet.”

As a researcher examining the latest developments in the cryptocurrency world based on Lookonchain’s report, I have come across some interesting news regarding Mt. Gox. Lately, this troubled exchange has been making preparations to fulfill its debt obligations to its creditors. According to their post, they are taking steps towards resolving the long-standing issue.

As a researcher, I’ve recently discovered that approximately 47,229 Bitcoin (equivalent to around 2.71 billion USD) was transferred out of the MtGox wallet about half an hour ago. This transaction might be related to potential repayments scheduled for July.

Why is Mt. Gox transferring funds?

As a seasoned crypto investor, I’d put it this way: Mt. Gox held the crown as the world’s leading crypto exchange prior to its disastrous downfall in 2014. At that time, it dealt with around 80% of Bitcoin transactions against the USD. Regrettably, a string of high-profile heists left the company with no choice but to file for bankruptcy, resulting in a staggering loss of approximately 950,000 BTC.

Ten years on, the entity is readying approximately $9 billion in Bitcoin for the reimbursement of heist victims. Thus, this most recent transaction serves as an encouraging sign for those who have long awaited restitution.

Last month, the company declared that it had finished all required procedures to initiate the overdue repayments following setbacks and lawsuits.

As a crypto investor, I can tell you that the repayment is a significant development for those creditors who unfortunately lost their Bitcoin back in 2014 when its value was around $600. Now, with Bitcoin’s impressive growth over the past decade, they are poised to reap the rewards of this steady rise in value.

Concerns over potential sell-off

After the announcement about refunds, several parties have voiced their worries, claiming that Mt. Gox is behaving similarly to how Germany acted previously, allegedly offloading their holdings.

As a researcher studying the cryptocurrency market, I’ve observed that recent events have sparked concern among analysts, leading to increased selling pressure. This pressure, in turn, has contributed to the decline in Bitcoin (BTC) prices.

Angelo expressed her apprehensions regarding X, emphasizing that the market may show a greater downward trend.

As a market analyst, I would rephrase that statement as follows: The current market trend indicates a mass sell-off, with Mt. Gox’s move to compensate its early Bitcoin holders likely to prolong this downturn.

As a researcher studying the effects of BTC transfers on market dynamics, I can confidently assert that these transactions will undeniably lead to an influx of Bitcoin in the market. Consequently, this surge could potentially result in inflation due to the increased supply. Furthermore, many individuals who receive this compensation are likely to sell their newly acquired assets after a considerable delay.

Such sell-offs would have a considerable negative impact on BTC prices.

Overall market implication

Significantly, the reversal in price for Bitcoin at Mt. Gox is expected to influence the market as affected customers may choose to liquidate their holdings and realize profits from their cryptocurrency investments.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a crypto investor, I can tell you that this month is likely to bring significant downward pressure on cryptocurrency prices due to creditors cashing out and selling their tokens. On top of that, Germany’s decision to transfer $310 million in Bitcoin only adds fuel to the market sell-off.

Despite the current losses in August, the indications suggest a recovery, implying that these setbacks are only temporary. Market dynamics will ultimately curb any further escalation.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-05 14:16