-

Bitcoin dropped 3.89% amid Mt. Gox repayments and the German government’s sell-off.

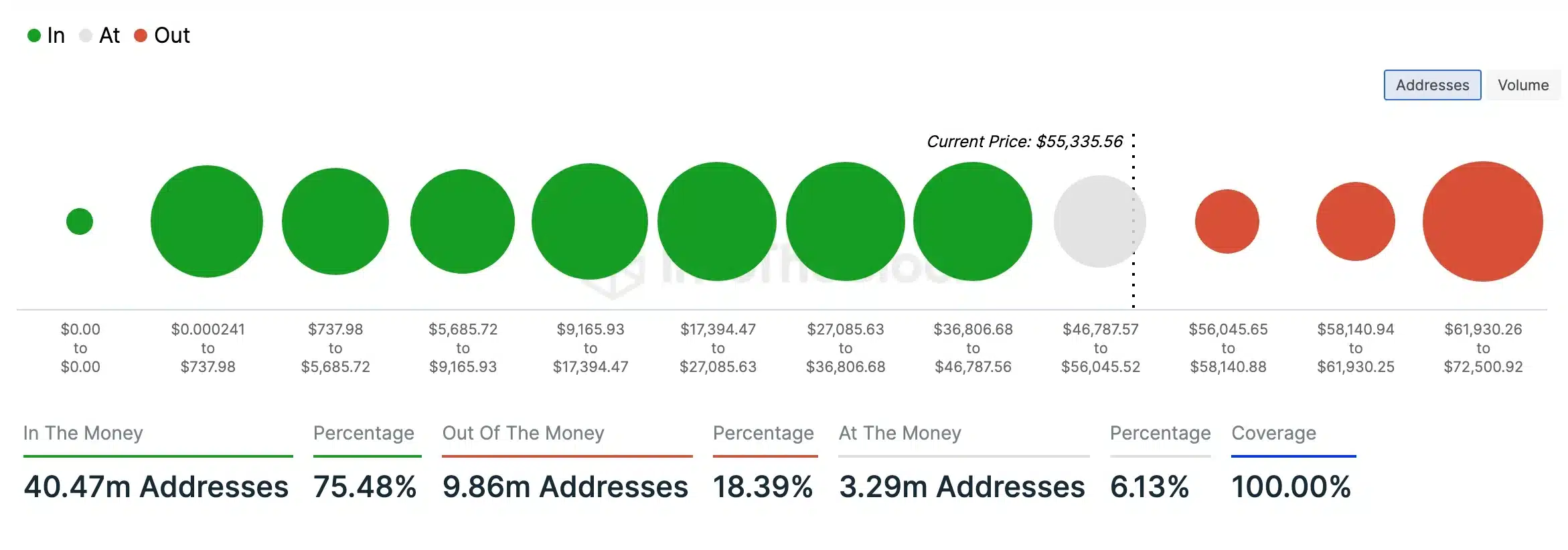

75.48% of BTC holders were “in the money,” indicating potential bullish sentiment.

As a researcher with a background in cryptocurrencies and market analysis, I have closely monitored the recent developments in the crypto market, particularly focusing on Bitcoin [BTC] and Bitcoin Cash [BCH]. The past week has been quite turbulent for both assets, with Bitcoin experiencing significant volatility due to rumors surrounding the Mt. Gox repayment process and the German government’s sell-off.

In simple terms, the value of cryptocurrencies took a hit once again, with the total market capitalization dipping to $2.04 trillion – representing a 3.33% decline in just one day.

Bitcoin takes a hit!

As a crypto investor, I’ve noticed that Bitcoin (BTC) has been making headlines lately due to its recent sharp drop in value. This downward trend can be largely attributed to mounting speculation regarding the ongoing repayment process for Mt. Gox, the troubled bitcoin exchange.

On the 5th of July, I observed that as Mt. Gox initiated repayments, Bitcoin plunged to its minimum price since February.

At the same time, adding to the turmoil, Germany decided to dispose of its Bitcoins, intensifying anxiety, apprehension, and skepticism (FUD) among the cryptocurrency circle.

Remarking on the same, Devchart, Co-Founder ChartAlerts noted,

“An uncomfortable dilemma arises when you consider needing to add more to your Bitcoin stash, yet become aware that Mt Gox and the German government hold approximately $10 billion worth of Bitcoin, poised for release into the market imminently.”

I recently checked the current price of Bitcoin, and it stood at $55,459.62 according to the latest update. This represents a 3.89% decrease from its price during the previous 24-hour period.

The RSI’s reading, which is an indicator used to determine overbought or oversold conditions in a security, has dropped significantly below the neutral threshold and was approaching the oversold territory at the current moment.

Previously, financial markets have experienced price corrections following oversold or overbought conditions in Bitcoin (BTC). Thus, there’s optimism that BTC could rebound after the completion of the Mt. Gox repayment process.

Impact on Bitcoin Cash can’t be overlooked

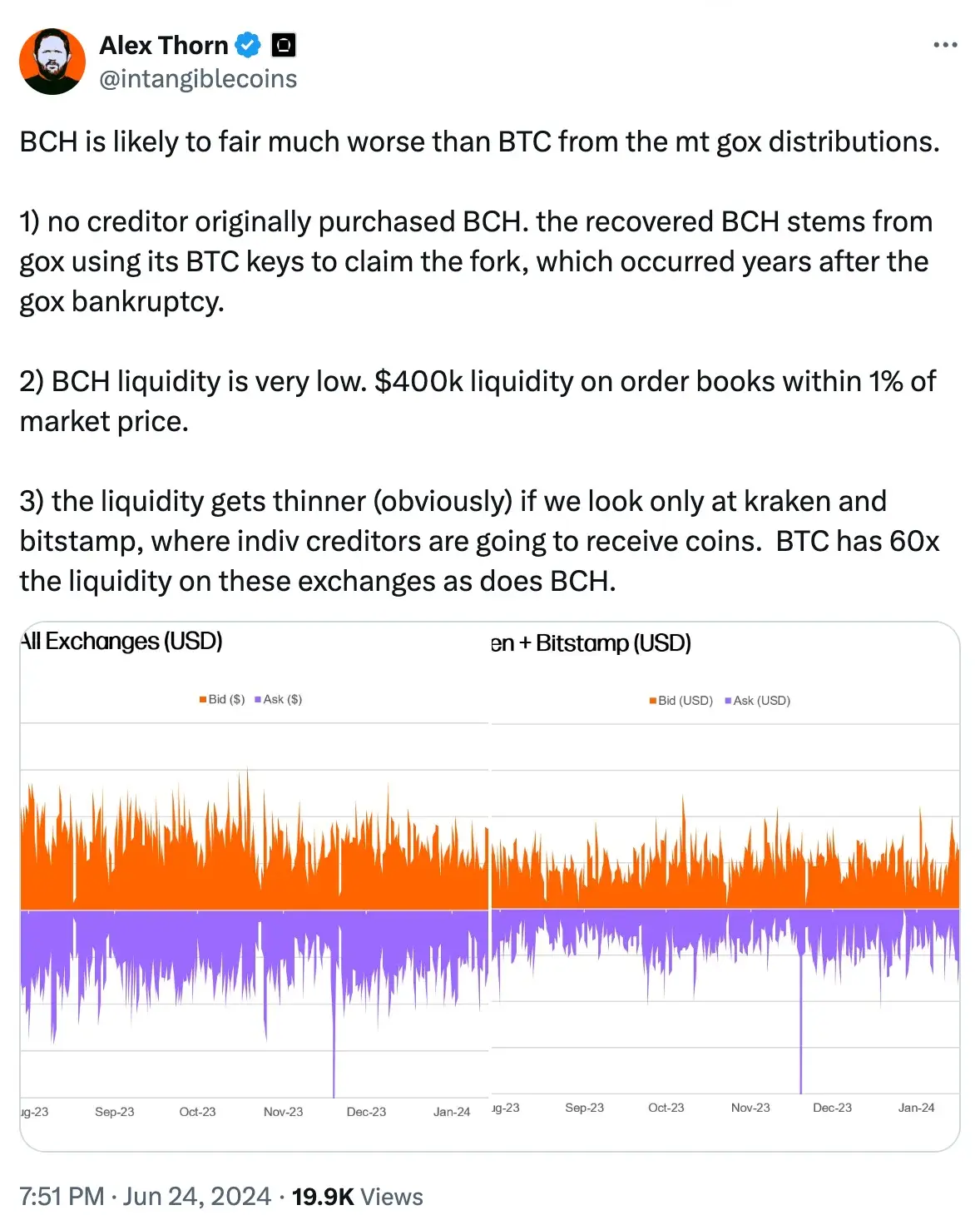

Bitcoin Cash [BCH] was also down by 6.79%, changing hands at $311.35 at press time.

As a crypto investor, I’ve observed that the magnitude of the price drop for Bitcoin Cash (BCH) was more pronounced than that of Bitcoin (BTC). To put it another way, BCH experienced a steeper decline compared to BTC. This observation was previously brought up by Alex Thorn, who holds the position of Head of Firmwide Research at Galaxy Digital.

According to AMBCrypto’s examination ofIntoTheBlock statistics, approximately 75.5% of Bitcoin owners currently possessed cryptocurrencies worth more than what they initially paid, signifying their profits exceeded their initial investment at the current moment.

Instead of “In contrast,” you could say “On the other hand.” And instead of “placing them ‘out of the money,”” you could say “18.39% owned BTC tokens that were currently valued below their original purchase price.” This change maintains the original meaning but uses more common and natural phrasing. Additionally, instead of “suggested a bullish sentiment or potential upcoming price surge for Bitcoin,” you could say “indicated a possible buying opportunity or optimism among investors regarding Bitcoin’s future price trend.”

CEX HTX summed it up well when they noted,

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-07-08 15:03