-

Mt. Gox transferred 13,265 BTC as Bitcoin neared its 200 EMA.

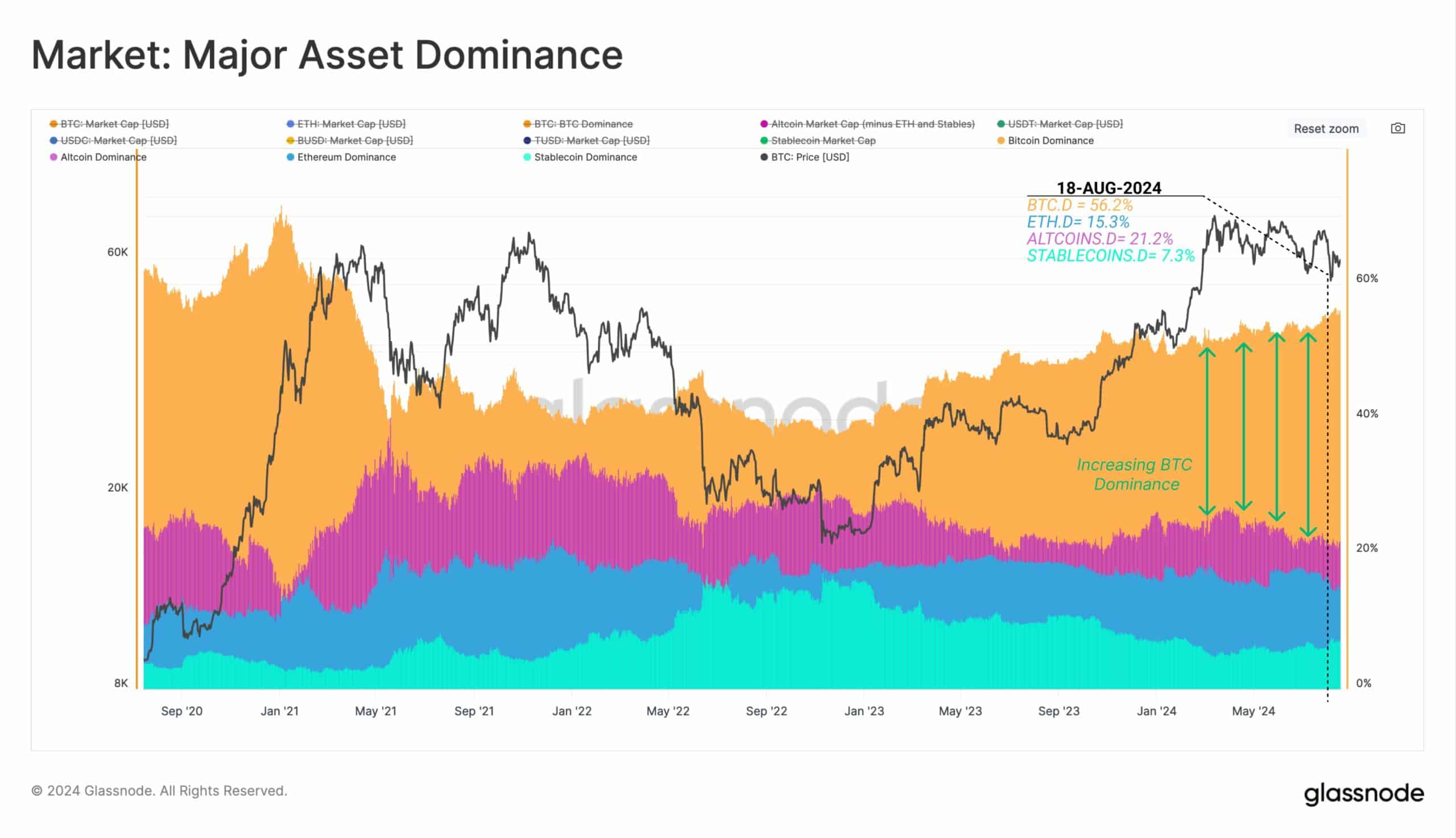

Bitcoin’s 56% dominance led major markets since the 5th of August.

As a seasoned analyst with years of experience navigating the volatile and ever-changing world of cryptocurrencies, I find the recent developments surrounding Mt. Gox and Bitcoin intriguing. The transfer of 13,265 BTC by Mt. Gox, despite the current market dynamics, could potentially signal a significant shift in the price trend for the world’s leading digital asset.

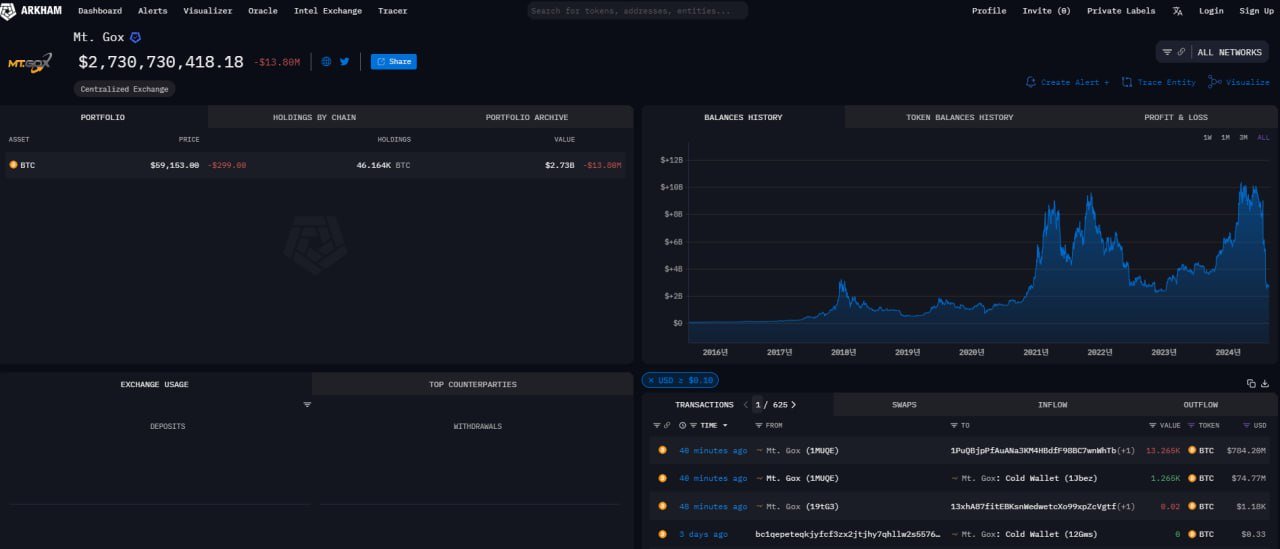

Once a leading cryptocurrency platform during the early years of Bitcoin (BTC), Mt. Gox has persisted in making transfers, most recently shifting approximately 13,265 BTC valued at around $784 million.

12,000 Bitcoin were transferred to a fresh address, while 1,265 Bitcoin were stored in a cold wallet. This leaves an unchanged amount of approximately 46,164 Bitcoin, currently valued at around $2.73 billion, still untouched.

The actions taken by Mt. Gox might have a substantial impact on future Bitcoin prices and trends, particularly when the present pace of Bitcoin is beginning to decelerate.

In the current situation, Bitcoin was being traded close to its daily 200 exponential moving average ($63,000), a significant point, as it also coincides with its recent peak levels at the moment of reporting.

To indicate a robust uptrend, the bulls must surpass this current threshold. However, if the price falls beneath $56,500, the bears could potentially reassert their dominance temporarily.

In simpler terms, we’re hoping that Bitcoin will climb higher than its 200-day Moving Average (EMA) and continue to stay above it, which would signal a consistent upward momentum or bullish market condition.

As an analyst, I’ve observed that following Mt. Gox transferring approximately 13,000 BTC to exchanges, Bitcoin initiated a minor upward trend. However, for this bullish sentiment to be confirmed, it is crucial for the price of Bitcoin to surpass both its 200-day and 20-day Exponential Moving Averages (EMAs), or alternatively, it should maintain a value greater than $60,000.

In simpler terms, the RSI for each day’s trading has indicated a potential breakout followed by a retest, while the eight-hour analysis suggests that the price is likely to increase.

Yesterday’s market dip didn’t seem to faze altcoins either, suggesting a potential rise for both Bitcoin and the overall cryptocurrency sector in the upcoming months.

Bitcoin dominance and markets correlation

At the moment of reporting, Bitcoin’s influence within the crypto market was significantly expanding, representing approximately 56% of the entire cryptocurrency market’s value.

The growing control over Bitcoin was bolstered by long-term investors who kept buying more Bitcoin, demonstrating a high level of faith in its future potential.

Regardless of the ups and downs in the market, these investors stayed dedicated, indicating a potential buildup of demand that might push Bitcoin’s worth upward.

In my experience as a crypto investor, Bitcoin’s dominance persists, steadily amplifying its impact across the entire digital currency landscape.

Since the market downturn in early August, Bitcoin and other markets such as Gold, Silver, Nasdaq, S&P 500, and Ethereum (ETH) have shown a similar trend in their movements.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin has outperformed them all, recovering strongly from its lows despite a significant drop. While stocks are now up for the month, cryptocurrencies, including Bitcoin, still have room to catch up.

Based on my personal experience as a long-time cryptocurrency investor, I believe that the recovery we are currently witnessing in the crypto market is not just a temporary blip but rather a promising sign of sustained growth. I have seen similar patterns before and understand the underlying forces at play – the influx of institutional investors, increasing mainstream adoption, and technological advancements driving innovation. It’s an exciting time for cryptocurrency enthusiasts like myself, as we eagerly anticipate continued expansion in the near future.

Read More

2024-08-21 17:44