- Mt. Gox, the infamous bankrupt crypto exchange, is returning $9 billion worth of Bitcoin to creditors.

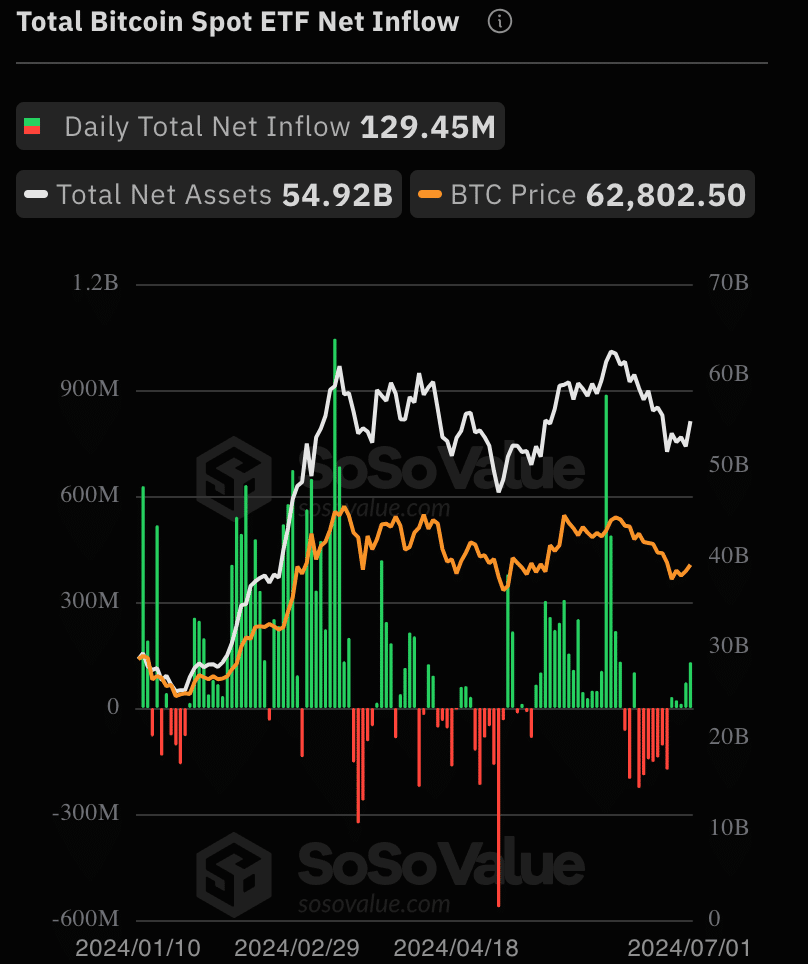

- Interest in Bitcoin ETFs also surged significantly over the last few days.

As a seasoned crypto investor, I’ve seen my fair share of ups and downs in this volatile market. The news about Mt. Gox returning $9 billion worth of Bitcoin to its creditors brings back memories of the 2014 hack that shook the entire community. While it’s a positive development for those affected, I can’t help but feel apprehensive about how this might impact the price of Bitcoin.

The recent rise in Bitcoin’s [BTC] price has sparked renewed enthusiasm among crypto investors. Yet, this positive sentiment might not last long.

Will Mt.Gox lead to more loss for Bitcoin?

After a disastrous cyberattack ten years ago, the defunct Bitcoin exchange is at last set to restore approximately $10 billion in cryptocurrency to its original owners.

In early July, Mt. Gox, a now-bankrupt Bitcoin exchange based in Tokyo that previously held a significant presence in the marketplace, will initiate refunds for thousands of its users.

Approximately $9 billion in tokens are the total payouts, which is just a small fraction of the 650,000 to 950,000 bitcoins that were stolen back in 2014. At that time, those stolen coins held relatively little value. However, with today’s prices, they would amount to more than $59 billion.

After a lengthy and exhausting bankruptcy proceedings filled with setbacks and legal obstacles, I am thrilled to share that on July 1st, the trustee in charge of the Mt. Gox case made an announcement: distributions to the approximately 20,000 creditors, including myself, will begin.

The payments will be made in part Bitcoin and part Bitcoin Cash, an earlier form of the original cryptocurrency.

As a researcher studying the cryptocurrency landscape, I’m pleased to report that affected Bitcoin users will soon receive compensation following the recent hack. However, this development comes with some apprehension as the broader crypto market is currently experiencing turbulence.

Last week, the price took a nose dive to hit $59,000, representing the second most significant weekly drop this year. The sudden surge of bitcoins into circulation from Mt. Gox has the potential to deepen the price slump, instilling unease among certain investors.

Not all hope is lost

Despite the potential price fluctuations caused by the Mt.Gox dump in the immediate future, institutional investors and significant cryptocurrency players continue to express strong interest in Bitcoin. This was evidenced by the substantial increase in Bitcoin-related ETF investments observed within the past day.

On the first day of July, Bitcoin spot ETFs experienced an influx of funds for the fifth consecutive day, with a total inflow of approximately $129 million.

Read Bitcoin’s [BTC] Price Prediction 2024-25

On that particular day, Fidelity’s FBTC Exchange-Traded Fund (ETF) attracted the largest investment of $65.034 million. Similarly, Bitwise’s BITB ETF experienced substantial inflows with a total of $41.4022 million being added on the same day.

As of the current moment, Bitcoin’s price stood at $62,788.49. In comparison to the previous day, its value dropped by a modest 0.78%. Conversely, the trading volume experienced a noticeable increase, amounting to a 5.5% growth.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-07-02 18:15