- Memecoins face a fresh debacle over the community’s impact on the price action

- Short-term positions could be the most vulnerable

As a seasoned researcher who has witnessed the rollercoaster ride of the crypto market for the past decade, I can’t help but feel like a spectator at a high-stakes poker game where the chips keep getting shuffled and redistributed. The latest developments involving memecoins have added another layer of complexity to an already intricate scene.

If Elon Musk wasn’t enough to “dodge” accusations of market manipulation, ZachXBT, a crypto investigator, has uncovered 11 wallets linked to Murad Mahmudov, a prominent memecoin advocate on X (formerly Twitter), holding over $24 million in memecoins.

This situation highlights the ongoing debate about memecoins in the crypto scene, weighing their potential to draw in new investors against the risks that come with them.

Revisiting the 2021 cycle

Back in April 2019, when Elon Musk initially mentioned Dogecoin on Twitter, its value was a tiny $0.003 and its total market capitalization stood at only $300 million.

Yet, his backing significantly propelled the meme-token, causing it to soar and achieve an all-time high (ATH) of $0.73 in May 2021. Today, Dogecoin continues to lead the market as the most prominent meme-coin, carrying a market capitalization exceeding $15 billion.

Source : IntoTheBlock

It’s apparent that Musk’s impact has drawn a large number of market players, as evidenced by the graph above. Furthermore, there was also a noticeable upsurge in trading transactions on various platforms subsequent to his tweet.

Consequently, some people made gains by supporting DOGE when it was at its peak, but those who got in later may have suffered losses as the price dropped back to $0.164 a month after reaching its all-time high. This volatile situation caused many traders to sell their holdings.

Approximately four years have gone by since Dogecoin hit its all-time high, and during this period, the coin has generally moved downwards in value. Despite Elon Musk’s ongoing endorsement, Dogecoin has found it challenging to recapture that surge, as the digital currency currently trades at $0.107 at the present moment.

Briefly, there’s worry expressed in the market when only a handful of wallets accumulate substantial amounts of memecoins. This is significant because memecoins are known for their extreme volatility and vulnerability to abrupt price fluctuations.

Impact on memecoins’ price action

Previously mentioned, memecoins are heavily influenced by the community, and individuals who promote these tokens can have a substantial impact on their price movements.

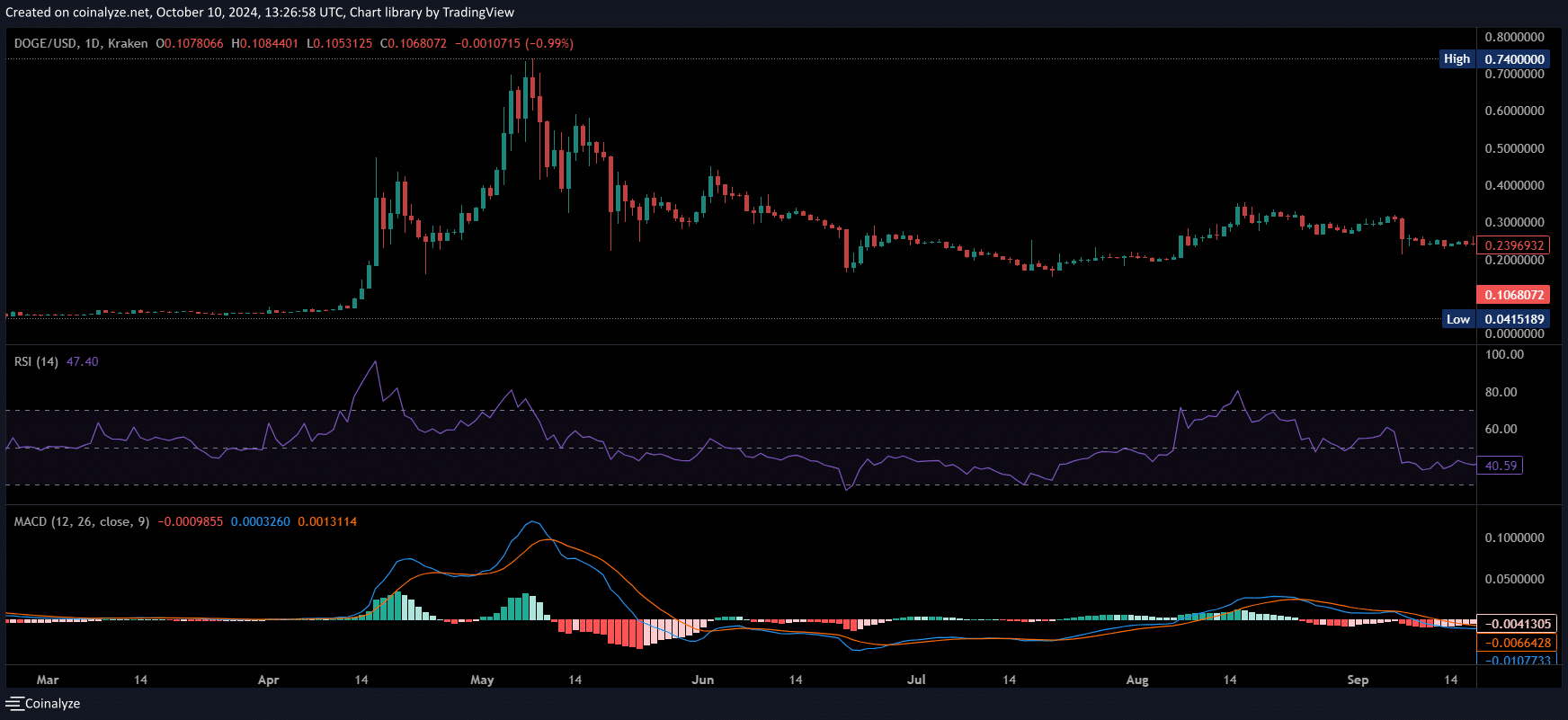

Initially, Elon Musk’s support sparked Dogecoin’s initial skyrocketing trend, a move it hasn’t replicated since. Moreover, a positive MACD convergence and a growing Relative Strength Index (RSI) reinforced this upward momentum. However, these indicators suggested that the market was becoming excessively heated.

Source : Coinalyze

As an analyst, I’ve observed that when influential figures endorse memecoins, it can indeed create a stir, much like a cultural phenomenon. However, lesser-known influencers advocating for these digital assets through their online following can also trigger temporary profits in the market.

Yet, these communities aren’t just shaping the memecoin market alone. Other investors too exert an influence on it, as they make investment choices based on diverse sets of criteria.

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

In case a conflict occurs, it might pose a risk to the expected strategy, especially for traders who aim to secure maximum gains within a compact time span, such as swing traders.

In my analysis, maintaining vigilance over various factors becomes crucial when investing in meme coins. To be clear, the recent uproar may bear resemblances to last year’s cycle, but given the influx of new data emerging, definitively predicting a complete trend reversal will prove difficult.

Even so, short-term positions may remain particularly vulnerable to such advocacy.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-10-11 11:08