In a locked chamber fit for fable, our venerable Federal Reserve plots its scheme of trimming interest rates. Imagine our dear crypto folks rubbing their hands, delighted like cats at a fish market—such cuts might entice a stampede of risky bets, and even give that mighty dollar a most artful shove downward. 🤑

Ah, Fed Chair Jerome Powell! He sits like a cautious churchwarden, hesitant to lower those rates, yet hounded by every manner of impatient investor. Meanwhile, that noble baron of BlackRock, Lord Larry Fink, grumbles that these so-called reductions might even vanish altogether this year. Quite the jolly forecast, indeed. 🤨

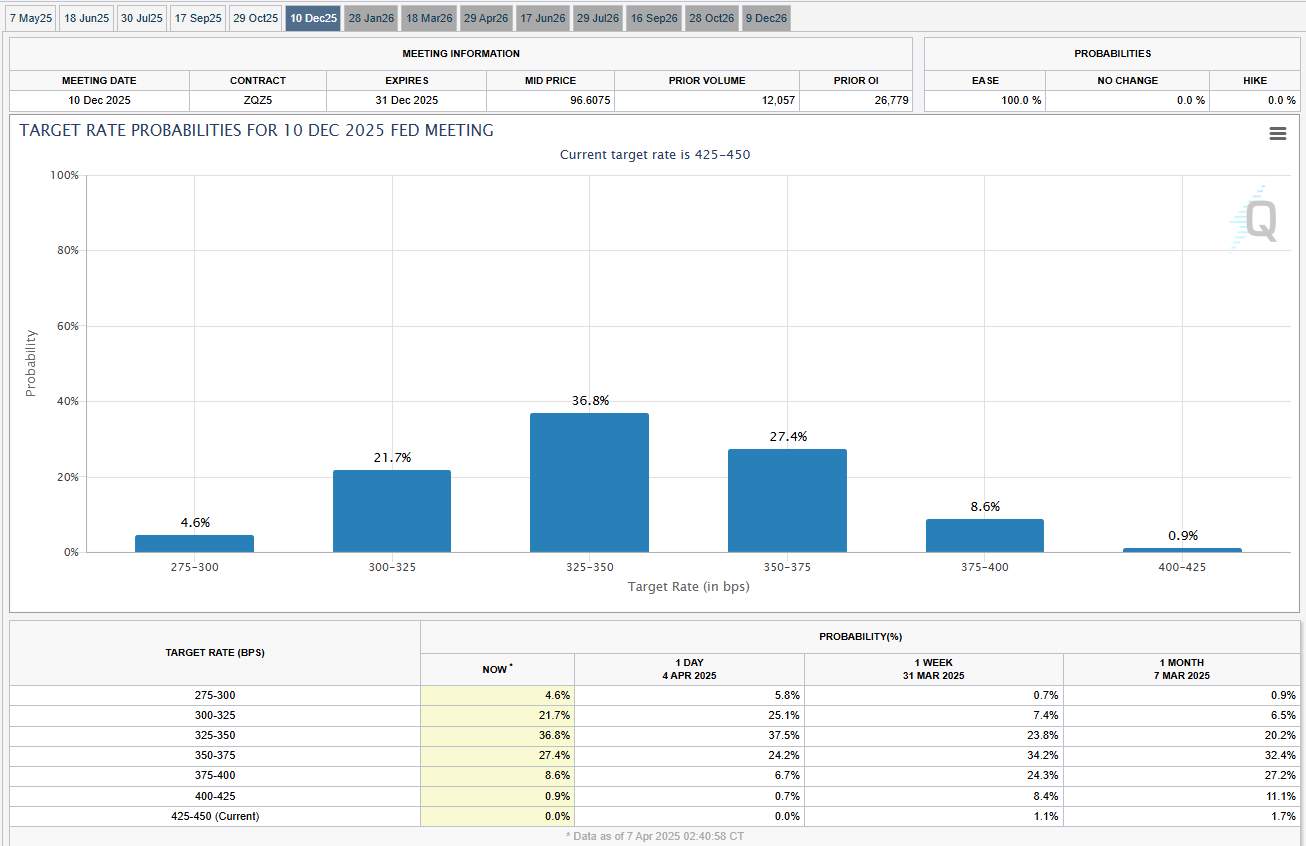

Will the Fed Consider Rate Cuts?

Then there’s the court jester, Tariff Trump, brandishing his taxes and sending the market tumbling like tipsy dancers at a grand ball. One rumor—of a 90-day tariff ceasefire—briefly lifted everyone’s spirits, until the White House shouted, “No!” and the market collapsed once more. But lo and behold, another secret Fed meeting is upon us, perhaps heralding that magic wand of rate cuts:

“A closed meeting of the Board of Governors of the Federal Reserve System will be held at 11:30 am on Monday, April 7, 2025. Among the topics: the sacred rite of reviewing and determining interest rates,” the stony Fed site proclaims. ⏰

The Federal Reserve, in its infinite wisdom, might cut rates for a hundred and one reasons. Higher rates have been wooing funds away into bonds and instruments as stiff as Victorian cravats—leaving more daring pursuits like crypto and stocks to languish. Conversely, lowering them might set these straying assets free to prance wildly back to the markets. 🤡

We’ve seen this waltz before—every time the Fed flirts with a rate slash, entire markets fling confetti. Recall how zero interest rates after 2008 made bulls leap with joy. These days, many soothsayers foresee a recession: what better time for the Fed to unleash a cheerleading spectacle with rate cuts? Yet, the FOMC slapped that notion away not too long ago. How rude! 😱

Mr. Powell, no rookie to intrigue, initially balked at convincing rate slashes. But the drums of discontent thump louder every day. One might suspect, however, that fate sometimes ignores even the loudest demands. Meanwhile, Lord Larry Fink remains as gloomy as a raven perched upon a crypt. His televised prophesies ring forth: the nation is in recession, the markets swirl like a broken compass, and rate cuts are as likely as finding a clown in a cathedral. 🤔

To intensify the row, Fink declares a 0% chance of multiple rate cuts, predicting rates might even climb! Good heavens, such a spectacle. Prepare for the fainting couch. 🛋️

BREAKING: Blackrock CEO Fink frets that Trump’s tireless tweets are fueling inflation faster than a samovar boils water. The US economy is teetering, he says, and these illusions of many rate cuts are about as likely as goats dancing ballet.

He hands out gloom like a candy vendor, spreading the word that rates may rise, not fall…

— Ed Krassenstein (@EdKrassen) April 7, 2025

Are Interest Rate Cuts Always Bullish for Crypto?

One mustn’t assume the Fed’s scissor-snipping of rates is automatically a magic goose for crypto. True, a weaker dollar—like a deflated balloon—may bounce well for adventurous assets. But the Fed’s not exactly winking at the crypto crowd, nor are they expecting Bitcoin to waltz in and join their board meeting. 😂

Of course, wise cynics doubt Fink’s predictions, suspecting that resourceful Powell might indeed yield to the chorus demanding a rate slash. Investors’ hopes have soared so high, they might sprout wings and fly—a sudden rate hike now would be about as popular as a fly in one’s soup. 🤢

History, that meddlesome teller of tales, tells us the Fed’s previous rate-lowering escapades often yield a blossoming of markets. After 2008, we saw equities and newfangled assets revived like wilted flowers after a good rain. Lower rates mean cheaper credit, and so money flows like gravy at a banquet—spreading across riskier assets, including our beloved crypto. 🍗🤑

Hence, with a Fed nod to lower rates, we might see traders uncork the champagne bottles. If conventional stocks calm their jitters, crypto often follows, prancing along like an eager sidekick. For the anxious investor class, such a move might soothe those rattled nerves and usher in a dash of hearty optimism. 🥂

Most intriguingly, the battered knights of institutional investment, weary of the market’s mood swings, may consider joining the crypto carnival under a gentler interest regime. Low returns in fixed-income corners might nudge them onto the dance floor of alternative assets, including digital coins. And nothing says “respectable” like suits and ties waltzing with Bitcoin. 💃🏽

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-04-07 23:12