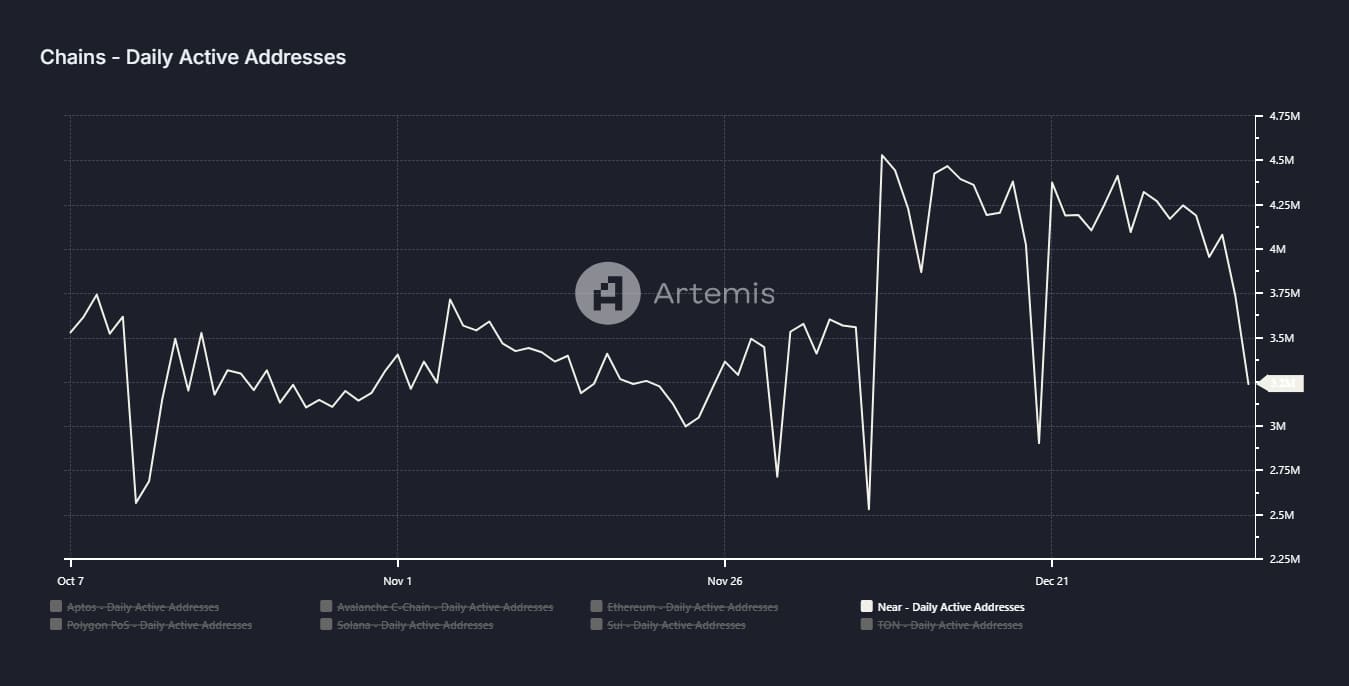

- The number of active addresses on the Near Protocol has seen a significant decline, raising concerns.

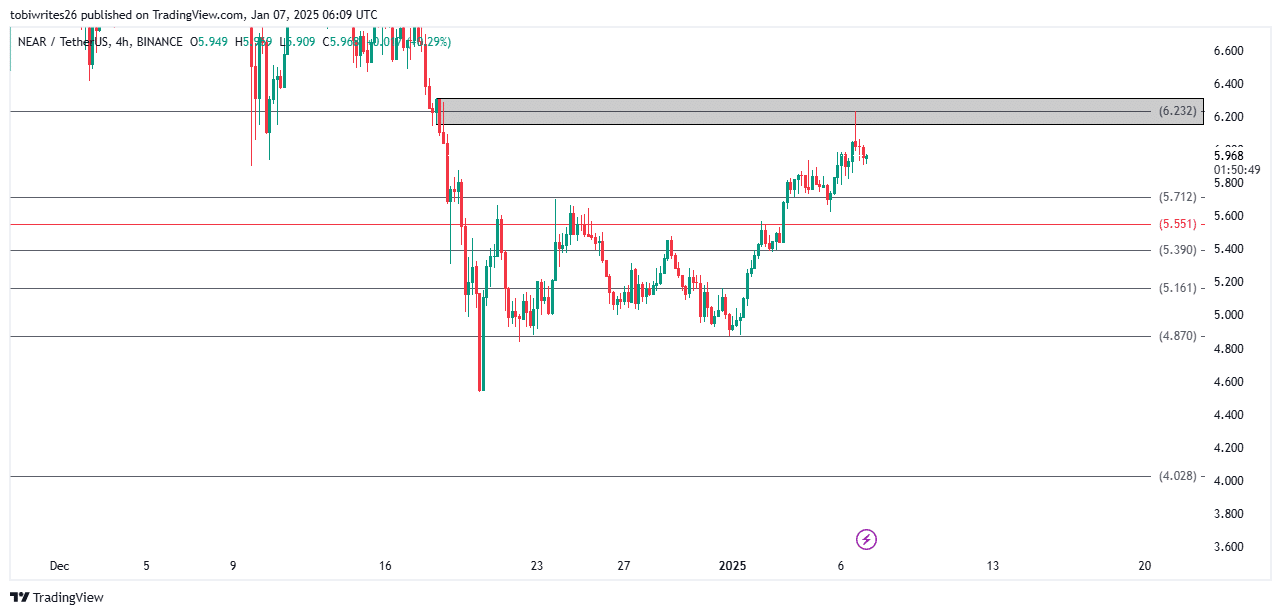

- NEAR has now entered a critical supply zone and faces the risk of falling further as a “death cross” takes shape.

Following a seven-day surge that yielded a 17.12% increase, the positive trajectory for Near Protocol’s [NEAR] seems to be slowing down. Over the last day, there has been a minimal uptick of merely 0.18%, while the overall price trend has been downwards.

Considering the present market mood, it seems likely that NEAR might soon revert its modest growth, as decreasing enthusiasm for the asset suggests a move towards more pessimistic trends.

Potential price drop coming?

The active address count on Near Protocol has noticeably decreased, suggesting waning user engagement, a situation that typically puts downward pressure on its value.

According to Artemis, the number of active addresses dropped from approximately 4.2 million at the start of January to around 3.2 million by the current time.

The drop indicates a decrease in the number of people trading the token or interacting with the Protocol, potentially leading to an even greater decrease in the price of NEAR.

To determine if this trend aligns with price fluctuations, AMBCrypto analyzed the chart patterns and noticed indications suggesting a possible drop in prices.

Supply zone exerts downward pressure on NEAR

On the 4-hour timeframe, it seemed like NEAR found itself in a potentially weak spot as it transacted within a region offering resistance between roughly $6.154 and $6.311.

A supply zone refers to a location where a large number of sellers have amassed their orders, often resulting in a drop in the asset’s price when it hits this level. In simpler terms, it’s an area where selling is abundant and can lead to a decrease in the asset’s value.

Based on the Fibonacci retracement analysis, there’s a possibility that the asset could see a decrease in price. If selling activity increases significantly, the price might dip down to approximately $4.870.

Furthermore, it’s important to note that potential bounce points for the price could also be found at certain levels, as depicted on the graph. These significant support levels are located at approximately $5.712, $5.551, $5.390, and $5.161.

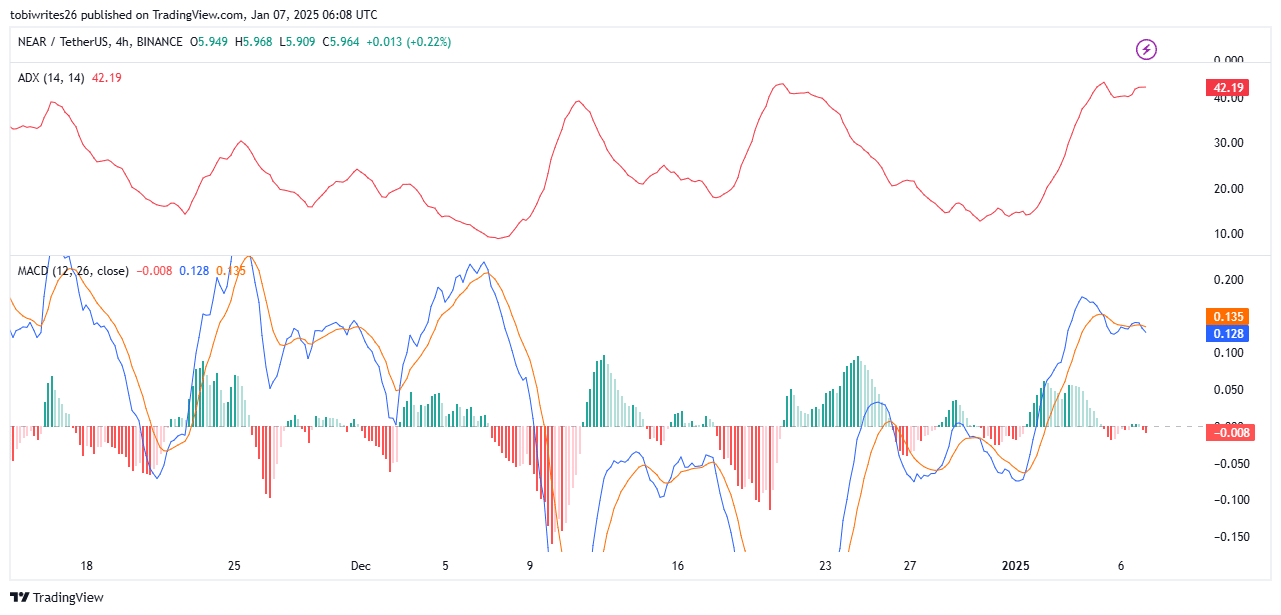

Further analysis of technical indicators suggests bearish outlook for NEAR holders

Bearish trend confirmed

In simpler terms, the graph’s Average Directional Index (ADX) suggested a robust negative stance, with the ADX line significantly rising to 42.19 at the moment of this report.

As a researcher delving into market trends, I utilize the ADX (Average Directional Movement Index) as a valuable tool to assess the robustness of a particular trend. A rising ADX value signals a strong trend, whereas a declining ADX value implies a weaker trend.

As a crypto investor, I’m keeping a close eye on the development of the “death cross” formation. This pattern occurs when the orange signal line crosses above the blue MACD line, which typically signals a bearish trend. Currently, the orange line stands at 0.135, while the blue line is at 0.128, reinforcing this downward momentum.

Read NEAR Protocol’s [NEAR] Price Prediction 2025–2026

A “death cross” is usually preceded by a drop in price and the appearance of red bars (indicating selling pressure) on the graph.

If the ADX line keeps rising and the signaling line persists above the MACD line, it’s probable that the value of the asset will keep decreasing further.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- The Battle Royale That Started It All Has Never Been More Profitable

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

2025-01-08 07:39