- While the asset seemed to be trading within a bullish pattern, it faced significant downward pressure too

- Market participants contributed to this trend by moving NEAR to exchanges

As a seasoned crypto investor with battle scars from numerous market cycles, I find myself standing at the precipice of uncertainty when it comes to NEAR. While the bullish pattern on the chart has caught my attention, it’s hard not to be wary given the recent downward pressure. It feels like a game of tug-of-war between the bulls and the bears, with the latter seeming to have the upper hand as of now.

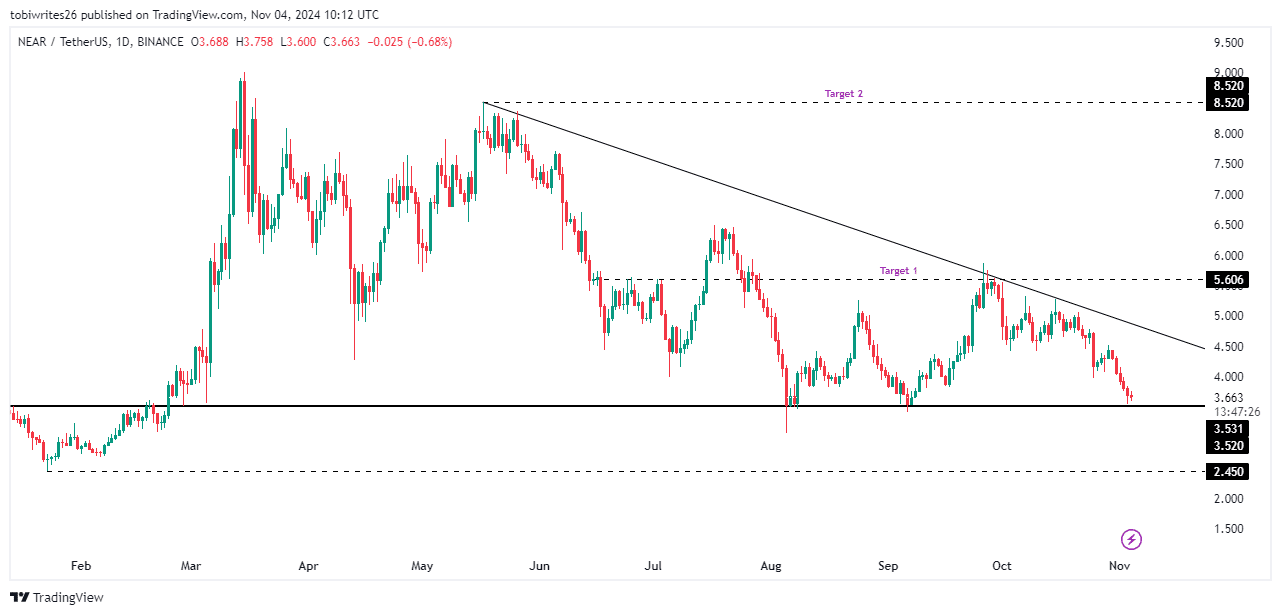

For about a month now, NEAR has faced difficulties, dropping by 25% as shown on price charts. In the past day alone, this altcoin also experienced a decrease of around 2.80%. However, despite this persistent bearish trend, there are emerging bullish signals that could potentially lead to a halt in the downward spiral.

The crucial issue at hand is if optimistic predictions will be able to hold up against the continuous selling force coming from market players.

NEAR shows bullish potential on the chart

On a day-to-day basis, NEAR has been forming a bullish triangular pattern, which typically signals an upcoming price surge. This pattern is characterized by a diagonally ascending resistance level and a flat support level.

To make progress, NEAR should examine its resistance at approximately $3.520. Following this examination, the asset could either rebound within the current pattern or shatter through it. If a breakthrough happens, two potential targets may materialize – a short-term objective around $5.606 and a long-term goal of $8.520.

If bears take control, there’s a possibility that the price of NEAR could drop towards the low of $2.450 reached in January 2024. It’s important to note that this decline could potentially extend beyond this point.

To predict the potential direction of NEAR’s upcoming price fluctuations, AMBCrypto examined various on-chain indicators to offer some perspectives on future price patterns.

Liquidation data disparity a sign of rising sell pressure on NEAR

The potential for increased selling pressure on NEAR could rise, given that major signals suggest a dominant bearish attitude that might push the asset’s value downward.

As I write this, NEAR’s liquidation data shows a significant skew: there are over $1.02 million in long liquidations compared to only $45.81k in short liquidations. This stark difference indicates a strongly bearish market sentiment, potentially pointing towards further declines for the asset.

Data on liquidations, indicating the compulsory shutdown of overleveraged trades due to insufficient margin levels, offers insights into market sentiment as it highlights areas where significant losses are currently occurring – specifically within long (buying) positions.

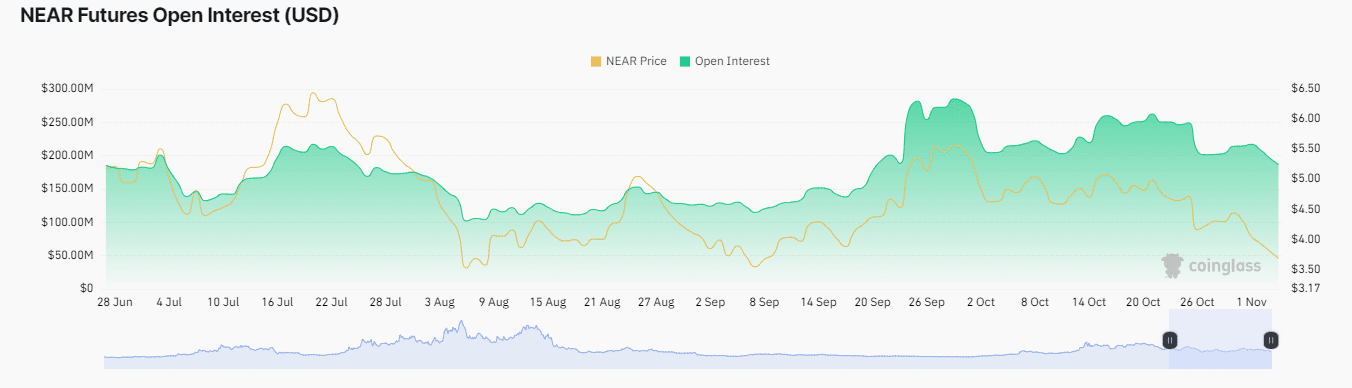

Over the past day, the Open Interest for NEAR, which reflects sentiment through active derivative contracts, decreased by 1.65%, reaching a total of approximately $185.65 million. This decrease provides support for the notion that NEAR’s market may be headed downwards.

Given that liquidations and Open Interest figures indicate persistent bearish trends, there’s a chance the expected bullish support for NEAR might not be strong enough to withstand.

Bearish trend persists as key indicators confirm downside

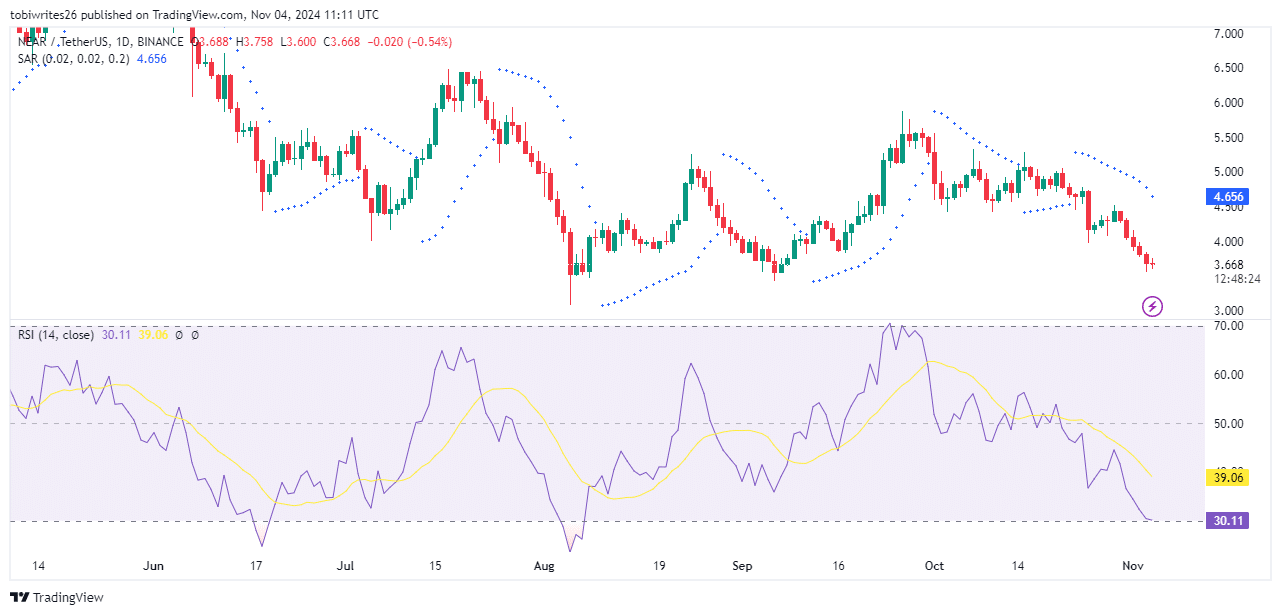

Currently, the predominant direction for NEAR is bearish, according to major technical signs. Specifically, both the Relative Strength Index (RSI) and the Parabolic Stop and Reverse (SAR) suggest a prolonged decline.

Translated: If the Relative Strength Index (RSI) drops below the significant level of 30.69, this might signal a further decline in the price trend for NEAR.

In a similar fashion, the Parabolic SAR’s dots were placed noticeably higher than the price bars – another indication of a bearish trend.

Given the warning signals from both blockchain data (on-chain metrics) and standard trading tools (technical indicators), it seems more probable that the price could drop to around $2.45.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-05 11:35