- NEAR Protocol rallied 6.69% this week, targeting $7.50–$9.00 after breaking out of a long-term downtrend.

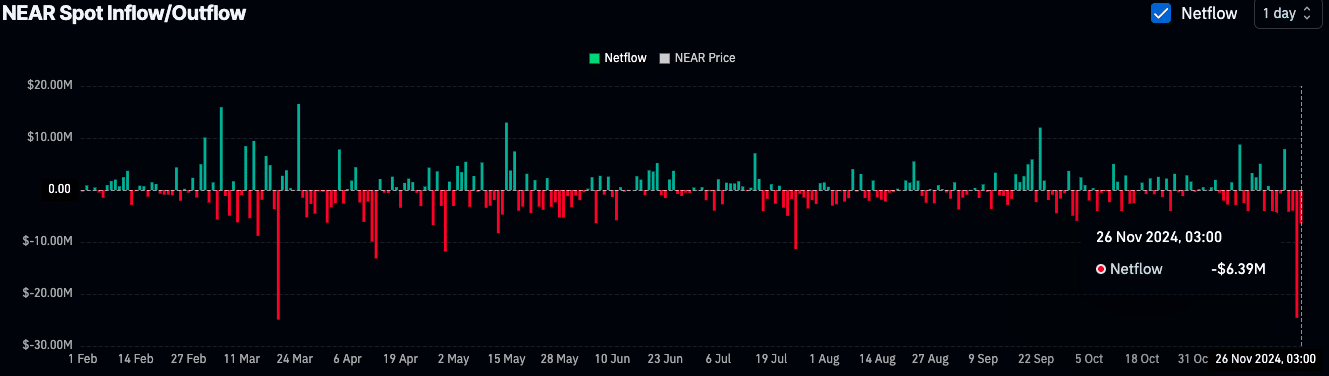

- On-chain data showed $6.39M outflows, signaling accumulation as Futures Open Interest stays elevated.

As a seasoned crypto investor who has witnessed the rise and fall of many digital assets, I must say that NEAR Protocol’s recent performance has caught my attention. Having closely observed its breakout from a prolonged downtrend in late October, I can confidently say that it has been an exciting ride so far.

💣 Urgent EUR/USD Warning: Trump’s New Tariffs Unleashed!

A massive forex shakeup could be moments away. Get the inside story!

View Urgent ForecastThe cryptocurrency NEAR Protocol (NEAR) is showing strong optimistic movement, reinforcing its escape from a lengthy downward trending channel.

NEAR was trading at $6.28 at the time of writing, with a 24-hour trading volume of $1.18 billion and a market capitalization of $7.67 billion.

Although it dropped by 9.03% within the last day, it had increased by 6.69% during the previous week.

Following an approach to around $7.00 (resistance level), Near experienced a slight retracement, a pattern that’s common following a robust surge, often associated with normal consolidation periods.

The cost continues to climb, boosted by consecutive high peaks and high valleys, indicating a possible continuation of its upward trajectory as it nears the next significant barrier for potential increase.

With NEAR Protocol continuing its positive trend, investors are keeping a close eye on the potential resistance levels between $7.50 and $8.00.

If we surpass this current level, it might open up opportunities for even more growth, with $9.00 potentially becoming our next significant milestone.

As a crypto investor, I recognize that maintaining a stable price between $6.00 and $6.50 is essential to keep up the positive vibes in the near future. If we can hold this ground, it could fuel our optimism for further growth.

Breakout sparks uptrend

In late October, NEAR made a breakout from a downward-sloping channel, marking an end to a prolonged period (since May 2023) characterized by successively lower peak values and trough values – a trend known as lower highs and lower lows.

The breakout occurred near the $5.00 level, a critical point that has since become a support area.

After the surge, the price of NEAR increased significantly, climbing from approximately $4.00 in early October to nearly $7.00 more recently. This rise exceeded anticipated resistance levels at $5.50 and $6.00.

The zone between $6.00 and $6.50 now serves as immediate support.

Important resistance points are still found around $7.50-$8.00, and if the positive market trend continues, there could be an aim for $9.00 as the next potential peak.

Cooling before the next move?

The technical analysis suggests that NEAR is currently in a stage of stabilization, as indicated by the indicators. Specifically, the Relative Strength Index (RSI) is at 61.54, signaling that the previous overbought state may have relaxed, potentially paving the way for another surge in its performance.

Right now, the MACD (Moving Average Convergence Divergence) continues to show a bullish trend, with a positive crossover suggesting that the positive trend, or upward movement, is still strong and ongoing.

The amount of trading has slightly decreased during the dip, indicating less activity following the robust price movements we’ve recently observed.

On the other hand, traders might look out for an increase in trading activity (volume) as a sign that the upward trend is still valid, particularly when the price nears its upcoming resistance levels.

On-chain data point to accumulation

The latest on-chain analysis shows a somewhat conflicting scenario for NEAR. The volume of open futures contracts has decreased by approximately 12.97%, now standing at $393.88 million. This decrease suggests that traders are either realizing their profits or closing their positions, potentially indicating reduced exposure to leveraged positions.

Even though there’s a decrease, the sustained High Open Interest suggests that market engagement is still robust, making NEAR an important asset to monitor for potential future shifts.

Read NEAR Protocol’s [NEAR] Price Prediction 2024–2025

Furthermore, the detection of net outflows amounting to $6.39 million hints at tokens being taken off exchanges, implying a withdrawal trend.

Such actions typically indicate that investors are stockpiling the asset while reducing the urge to sell, a scenario that usually coincides with NEAR’s upward trend in price movement.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-11-27 02:16