-

Per AMBCrypto’s NEAR Protocol price prediction, the token’s first target might be $7.8.

A few market indicators hinted at a continued price rise.

As a seasoned crypto investor with a knack for spotting trends and interpreting market signals, I find myself intrigued by the current bullish momentum of NEAR Protocol (NEAR). After a series of ups and downs, it seems the tide has turned, and the token is back on an upward trajectory.

Following several days of downtrend, the bulls regained control in the Near Protocol (NEAR) market, causing its charts to turn green. Our team at AMBCrypto analyzed the token’s key performance metrics and technical signals to forecast the potential price movement for Near Protocol.

NEAR remains bullish

Over the past week, the bulls maintained dominance, pushing the token’s price up by more than 2%. This positive trend continued in the last 24 hours with the token’s value rising by approximately 3% further.

As I’m typing this, the price of NEAR was hovering around $4.02, and its total market value surpassed $4.5 billion.

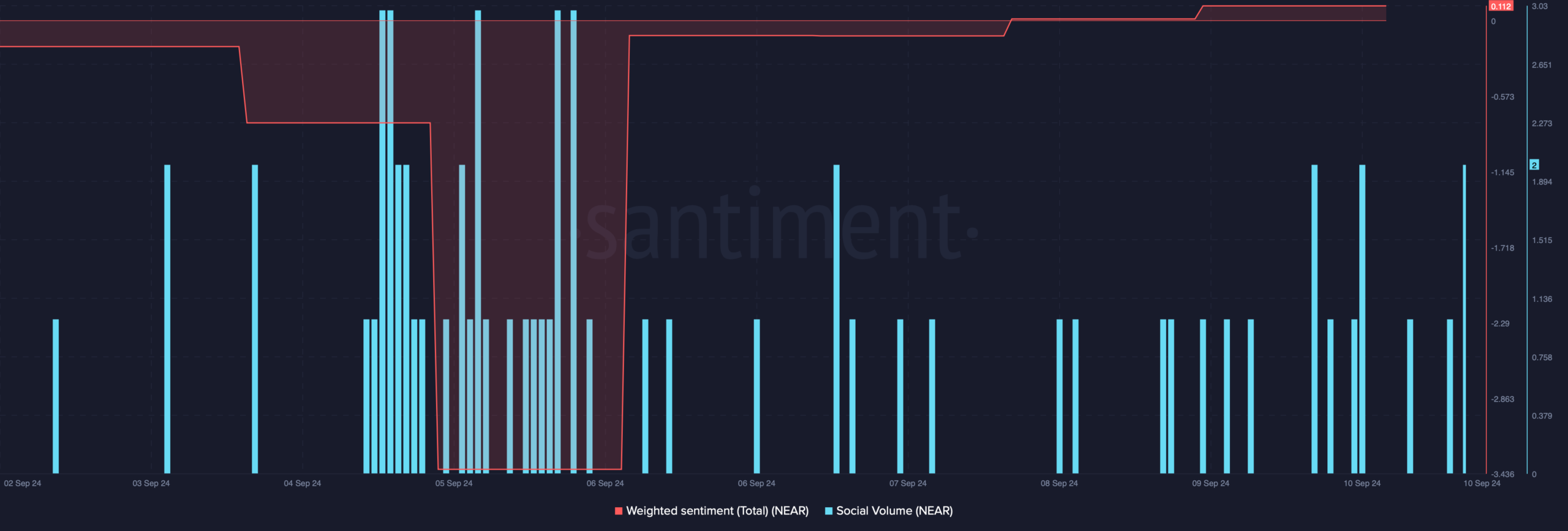

The price increase also had a positive impact on the token’s social metrics. For instance, NEAR’s Weighted Sentiment slid into the positive zone.

This meant that bullish sentiment around the token was dominant in the market. Its Social Volume also remained stable last week, which indicated that the token’s popularity remained intact.

As the price of the token surged with a bullish trend, the value secured by the NEAR protocol decreased instead.

AMBCrypto’s look at DeFiLlama’s data revealed that both NEAR’s fees and revenue registered a decline over the last few months.

NEAR Protocol price prediction

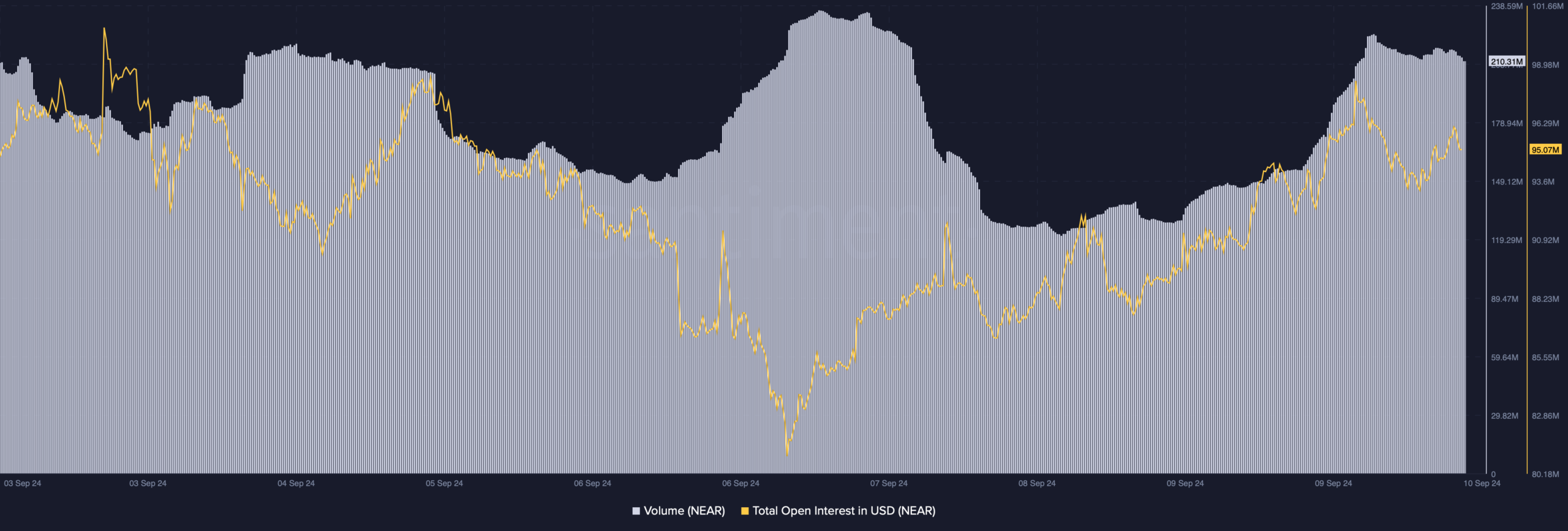

After examining the token’s blockchain information, AMBCrypto determined if a further price increase was plausible. From our investigation, it appears that the trading volume for NEAR has grown alongside its price, and so has its Open Interest.

When the Open Interest rises, it often indicates a higher probability of the current market trend persisting, in this case, pointing towards an upward trend or a bullish market condition.

Yet, there were several factors working against the token. To illustrate, its Long/Short Ratio showed a decrease.

This situation indicated a higher number of traders taking a bearish stance (short positions) compared to those taking a bullish stance (long positions), implying an increase in pessimism or bearish feelings among market participants.

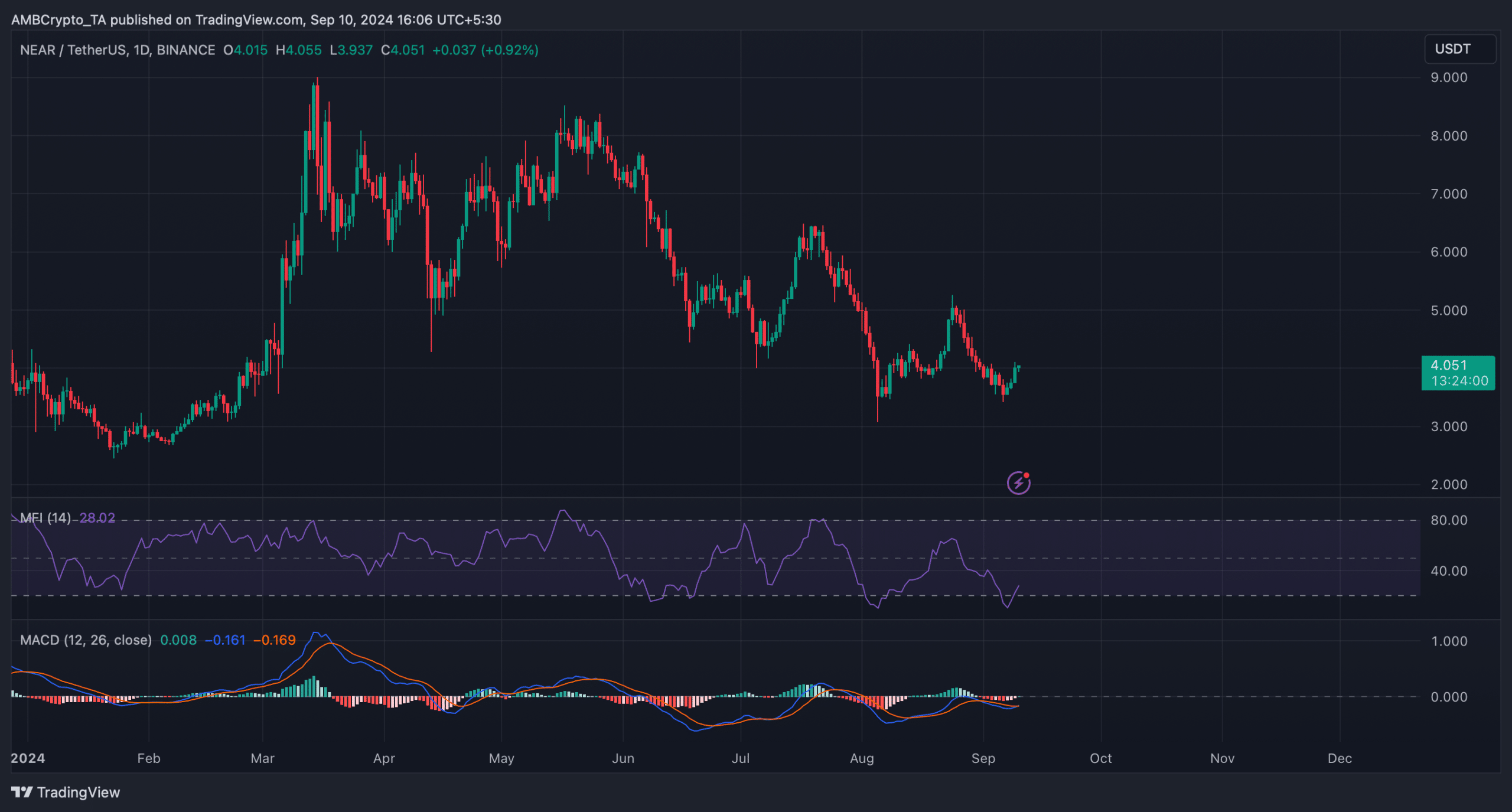

However, the technical signals were optimistic. The Moving Average Convergence Divergence (MACD) showed a positive crossover, while NEAR‘s protocol’s Money Flow Index (MFI) increased, suggesting a potential prolongation of the price increase in the forthcoming days.

Realistic or not, here’s NEAR’s market cap in BTC’s terms

Based on current predictions at the reporting time for NEAR protocol, it’s advisable for investors to closely monitor the $7.8 price point, as it serves as a significant resistance level.

If we see a surge beyond the current levels, it might lead to a complete rebound, potentially driving the price of NEAR up to around $15 in the near future. On the other hand, if the bears regain control, it’s not unlikely that we’ll see NEAR dropping down to approximately $1.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-09-11 05:11