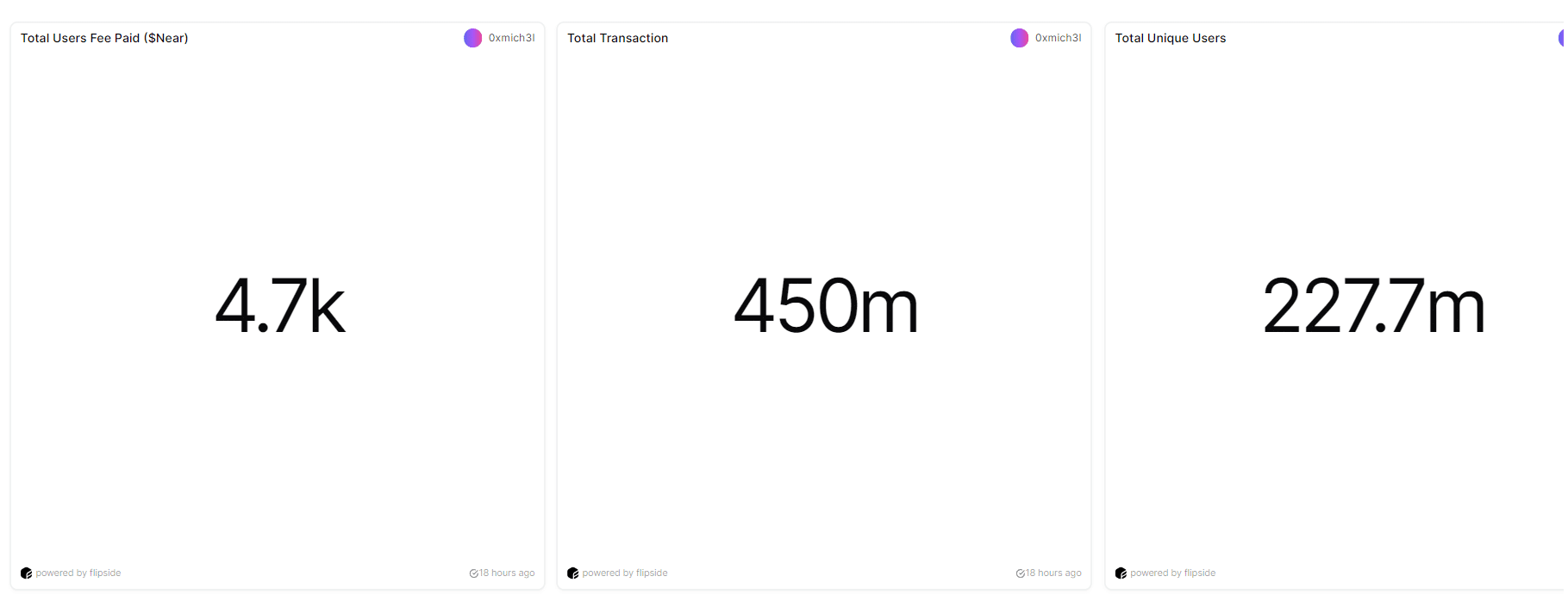

- NEAR Protocol has recorded 450 million transactions and 12.3 million unique addresses.

- The increased user engagement has shifted market sentiment

As an experienced analyst, I believe that NEAR Protocol’s recent surge in user engagement is a significant development that has shifted market sentiment towards the cryptocurrency. With over 450 million transactions and 12.3 million unique addresses, it’s clear that NEAR is experiencing rapid growth.

The crypto community at large has shown increased interest in NEAR Protocol due to a significant increase in transaction volume and the emergence of numerous new wallets.

I’ve noticed an intriguing trend in my NEAR cryptocurrency investments lately. Based on recent analysis, the number of NEAR addresses has been growing steadily over the past two months. Masi, a respected figure in the crypto community, brought this to my attention on platform X, formerly known as Twitter.

In June, NEAR Protocol outshone other well-known chains in several key aspects: it had the most number of active addresses at 16.9 million. It offered the least expensive fees, under $0.005 per transaction. Its success rate was an impressive 99.9%. In terms of average transactions per second (STPS), NEAR Protocol handled 94. And it processed a tremendous number of transactions totaling 239 million. Approximately 55% of the users from May returned, bringing in 12.3 million new users.

As a researcher examining the latest developments in the blockchain industry, I’ve come across some intriguing news on Flipside’s X page regarding NEAR’s impressive expansion. According to their announcement, this promising project is currently undergoing significant growth.

In the last year, the number of new users joining the NEAR Protocol community has surpassed the growth rates of all other leading blockchains. Since early 2023, NEAR has held the second position in terms of total new user count.

Increased transactions and address activities have helped NEAR prices recover from recent losses.

As engagement levels rise, bullish forces are making significant efforts to surmount resistance, resulting in a grand total of 450 million transactions and 227.7 million distinct users. In the month of June alone, NEAR witnessed an influx of 12.3 million new wallet addresses, while May saw an addition of 5.8 million newcomers.

What’s driving user engagement

As a crypto investor, I’ve noticed the significant surge in adoption and usage of various cryptocurrencies. One major reason for this is the innovative work being done by the NEAR AI R&D Lab. By focusing on creating simple, secure, and scalable technology, they’re promoting an environment that attracts more users and developers to the platform.

The significant capability of AI has been instrumental in drawing users towards NEAR and establishing it as a major contender in the field of AI and blockchain convergence.

As a NEAR Protocol analyst, I can share that one of the ways this project stands out is through its advancements like chain signatures and the addition of the HERE wallet. These enhancements have significantly boosted the platform’s user experience and made it more approachable for a wide range of users.

What’s the impact on price charts

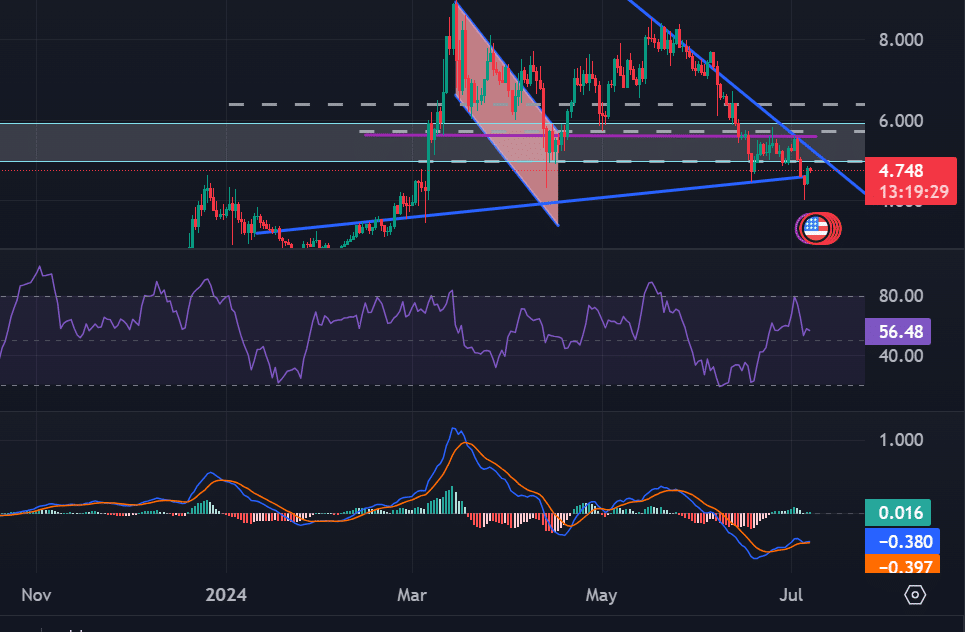

At present, the price of NEAR is $4.74 – representing a 5.27% increase over the past day. In contrast, there has been a significant drop in trading volume during this timeframe, amounting to a decrease of 51.75%.

Based on AMBCrypto’s assessment, the NEAR token’s downward trend may be losing strength, opening up a possibility for an upcoming price increase.

At present, the Money Flow Index stands at 56. This indication signifies that more money is currently entering the altcoin market than leaving it. While this level is considered moderate, it suggests a growing demand for the altcoin, which could lead to an increase in buying pressure and further inflow of crypto funds.

Similarly, the MACD indicator hints at a possible shift in trend. The MACD histogram sits at 0.016 with a positive value, while the MACD line lies above its signal line. This pattern suggests that the bearish momentum may be losing steam, often preceding a bullish reversal in the trend.

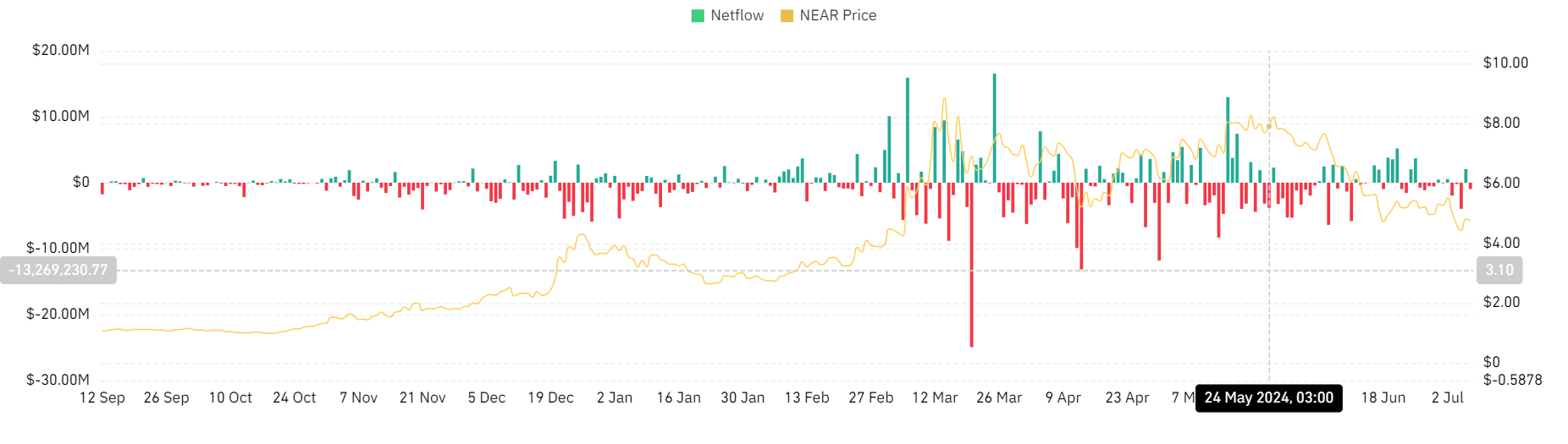

As a researcher conducting an analysis using CoinGlass data, I have discovered that NEAR’s netflow has shown a predominantly negative trend over the past week. Currently, the net flow amounts to a deficit of approximately $-940.42k.

A minus value signifies investors’ intent to maintain a long-term position, implying faith in the altcoin’s prospective growth.

Is NEAR set for an uptrend?

As a market analyst, I’ve observed a 5.56% decrease in NEAR’s value over the past week. Should this downward trend persist, I anticipate the price may drop further towards the next support level, approximately around $4.15.

As a researcher, I’ve observed that when significant transactions take place and there’s an uptick in active addresses, these events can influence price movements. Conversely, if market conditions were to change direction, prices might revisit the resistance level previously encountered around $5.602.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-07-08 07:04