- NEAR traded at $5.79 at press time, gaining 12% in seven days with $712M daily trading volume and $7B market cap.

- Futures Open Interest dropped 5% while TVL hit $260M, signaling steady ecosystem activity despite volatility.

As a seasoned crypto investor with a knack for spotting trends and patterns, I find myself intrigued by NEAR Protocol’s [NEAR] recent performance. With a 12% gain in seven days and a market cap of $7B, it’s hard not to notice this sleeper hit in the crypto space. The daily trading volume of $712M is a testament to its growing popularity among traders.

In the last week, the value of NEAR Protocol (NEAR) has increased by 12.33%, currently being traded at around $5.79. Over the past day, its trading volume amounts to approximately $712.5 million.

Even though there was a slight drop of 0.97% in the last 24 hours, the price has stayed within the band of $5.54 to $5.99, indicating a period of stability following the previous bullish trend.

The current supply of NEAR Protocol’s circulating tokens, which amounts to approximately 1.2 billion units, gives it a market capitalization of around $7.05 billion. This positions it amongst the leading performing assets in the market.

The current surge in the value of this asset is consistent with past cycles in its pricing trend. Earlier, it had peaked around $7.50 to $8.00, but later found a base between $3.00 and $3.50.

As a researcher, I myself have observed that Michael van de Poppe suggests a potential breakout beyond the crucial resistance level might trigger additional growth. He also points out that astute traders are eyeing areas around $4.25 to $5.00 as possible accumulation zones for the upcoming bullish run.

Consolidation and potential upside?

Today’s NEAR/USDT graph indicated a slight bearish trend, with the price moving away from the resistance around $6.00 towards its current position.

Currently, the Relative Strength Index (RSI) stands at 61.45, suggesting the asset is still in a bullish phase yet showing some signs of decreasing momentum.

In simpler terms, the MACD (Moving Average Convergence Divergence) graph showed a bullish situation, as the MACD line moved above the signal line and had larger, positive blocks. Yet, the diminishing size of these blocks hinted at less momentum, which seems to coincide with the recent market downturn.

Experts advise that keeping the price above $5.50 is crucial for buyers to continue their upward trend, whereas falling below this point could lead to more price stabilization.

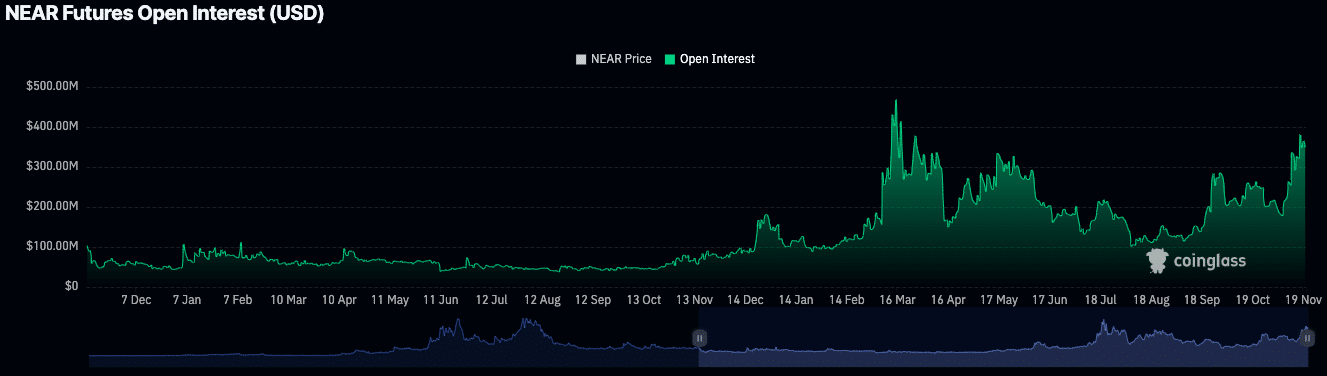

Futures market activity shows slight decline

At the moment of reporting, the NEAR Protocol’s Futures market demonstrated a decrease of 5.03%, with an Open Interest of approximately $345.50 million, as per Coinglass.

After a modest drop, which occurred following increased market activity earlier in the month, suggests a possible reduction in speculative enthusiasm.

The trading volume dropped by 19.30% to reach approximately $597.67 million, while the Open Interest continued to be elevated compared to past months.

Based on my years of trading experience, this suggests to me that even when short-term gains seem scarce and trading activity slows down, traders tend to stay involved with their chosen asset. This could be due to a long-term strategy or a belief in the asset’s potential for future growth. I have seen this pattern many times in my career – traders may temporarily step back from active trading, but they rarely abandon their investment altogether. Instead, they wait patiently for the right opportunity to strike.

Steady ecosystem growth

According to on-chain information from DeFiLlama, the Total Value Locked (TVL) in NEAR stands at approximately $260.05 million. Meanwhile, the market cap of stablecoins has surpassed $677.77 million.

Read Near Protocol’s [NEAR] Price Prediction 2024–2025

In the last day, our platform earned $23,430 through fees and income, underscoring persistent engagement within our system.

The presented data shows a consistent progression of the decentralized financial structure for the NEAR Protocol network.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-11-21 06:16