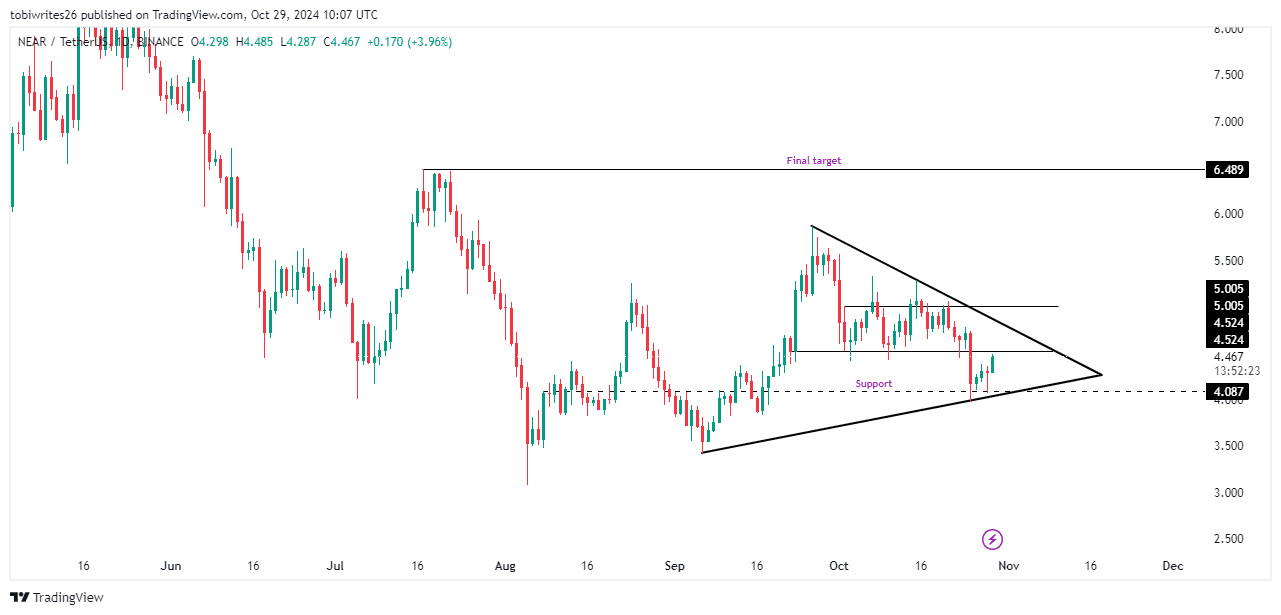

- The token has recently entered a bullish pattern known as a symmetrical triangle, often a precursor to a potential rally.

- However, market sentiment is mixed, with technical and on-chain indicators failing to align.

As a seasoned analyst with over two decades of market experience under my belt, I find myself intrigued by Near Protocol’s [NEAR] current predicament. The symmetrical triangle pattern suggests a potential bullish breakout, yet the mixed market sentiment and conflicting technical indicators present a complex picture.

For the past month, the Near Protocol [NEAR] has experienced a setback, recording a significant decline of 17.85%, which in turn affected its weekly performance by dropping by 4.83%. This downturn suggests a general lack of investor enthusiasm towards the crypto market.

In spite of the obstacles, a sense of hopefulness is starting to emerge. Notably, NEAR registered a notable increase of 5.83% over the past 24 hours. The critical point at hand: can this growth sustain and transform the outlook from negative to positive?

Rally ready, but obstacles await

NEAR experienced a robust surge, initially rebounding from the support area of an ascending triangle and a horizontal line at $4.087. This rebound has played a substantial role in its daily growth and conforms to the general bullish trend of a symmetrical triangle formation.

As a crypto investor, I’ve noticed that NEAR’s surge encounters significant hurdles near crucial resistance levels, which might lead to a potential dip. The initial resistance barrier stands firm at around $4.524, with another one appearing slightly higher at approximately $5.005.

Should NEAR manage to exceed both boundaries, it might transition into a bullish trend, possibly climbing up to around $6.40. At this point, trader profit-taking could become commonplace. Conversely, if NEAR fails to surpass these levels, it will continue moving within the symmetrical triangle pattern.

Uncertainty among market participants

The possible rise in NEAR’s value could be jeopardized due to the market’s ambiguity, since technical signs are sending mixed messages.

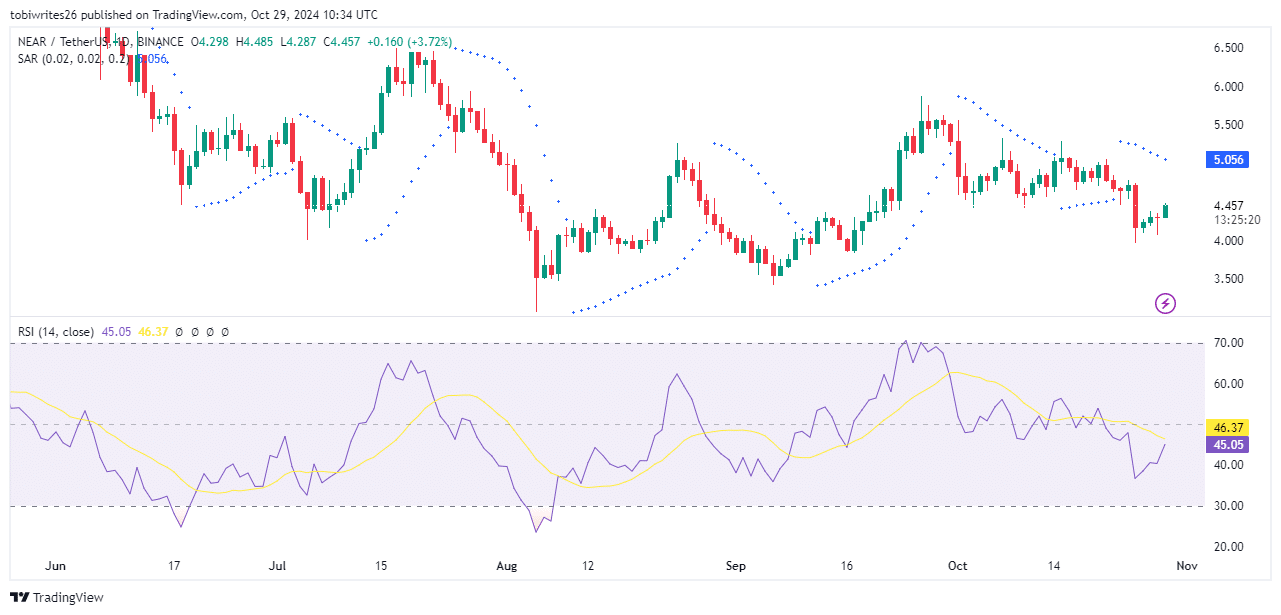

The Parabolic Stop and Reverse (SAR) is a type of indicator that tracks an asset’s price trend and pinpoints possible turning points. If the SAR marks are positioned beneath the price, it suggests an upward trend; conversely, if they’re above, it hints at a downward trend.

At present, the SAR dots on NEAR are situated above its current price, indicating a potential bearish outlook that could potentially slow or reverse the asset’s upward trend.

On the flip side, the Relative Strength Index (RSI) has experienced a significant increase and is currently moving upward, standing at 45.03. If this rising trend persists and the asset breaks into bullish territory, NEAR might witness additional gains.

The conflicting signals suggest that it’s unclear which way traders are leaning when it comes to predicting NEAR’s next price movement.

Read NEAR Protocol’s [NEAR] Price Prediction 2024–2025

Open interest is bullish

As reported by Coinglass, the current Open Interest for NEAR indicates a bullish trend, suggesting a favorable market momentum. Over the past 24 hours, this figure has risen by approximately 5.19%, resulting in a total value of $212.45 million.

This suggests that there’s a higher tendency for traders to buy rather than sell, potentially leading to an upward price movement if this trend persists.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-10-30 03:38