- NEAR can gain 33% following its recent rally.

- However, this upward momentum depends on NEAR breaking through its current resistance level.

As a seasoned crypto investor with battle-tested patience and a knack for spotting promising opportunities, I see the current situation with NEAR as an exciting prospect. The recent rally has been impressive, but it’s crucial to remember that every bull run is followed by a consolidation phase or even a correction.

Over the last seven days, Near Protocol [NEAR] has stood out as one of the top gainers in the market, recording a significant rise of 41.23%. Even more impressively, within the past day alone, it has managed to grow by 12.78%, suggesting a continued upward trend in its market performance.

The upward trend of NEAR depends significantly on one crucial aspect, but AMBCrypto points out several signs suggesting it will keep moving upwards.

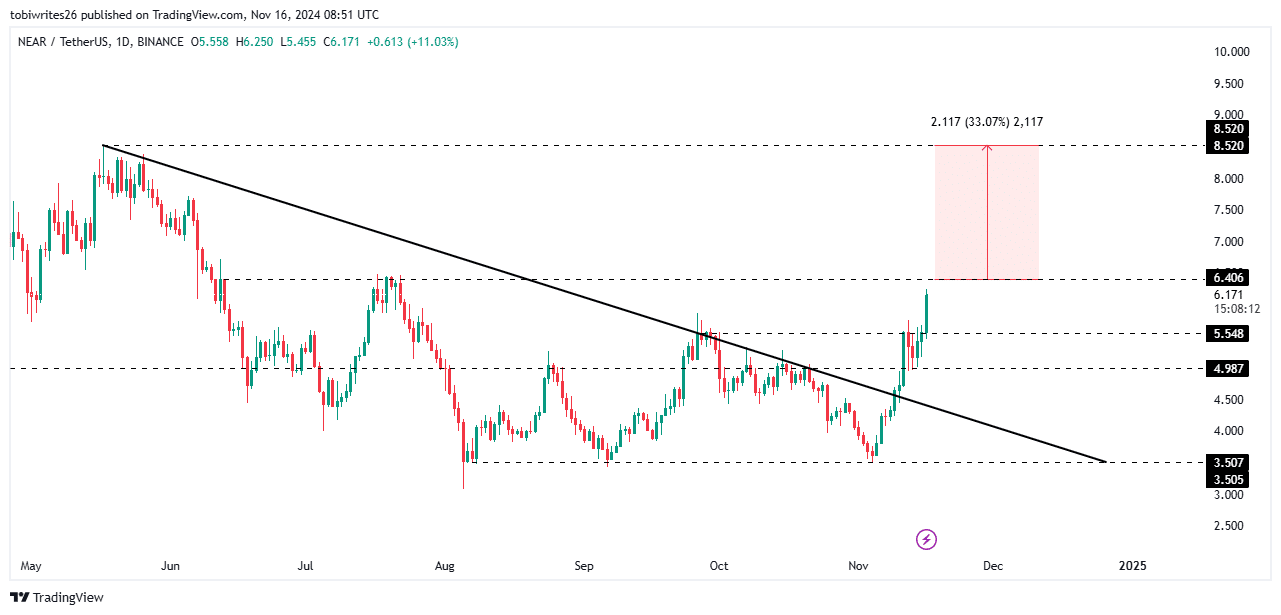

NEAR could gain 33%, but…

NEAR recently broke out of a descending trendline, driving its weekly gains, and extended this momentum after surpassing the resistance level at $5.548.

Currently, the price of NEAR has reached a critical point at approximately $6.406. This level might cause a pause in its upward trend due to potential heavy selling pressure, potentially limiting its further advancement.

Should the positive trend persist, the value of NEAR might shatter this level, possibly rising by approximately 33% to reach around $8.520.

If NEAR doesn’t manage to exceed $6.406, it could potentially enter a period of sideways movement, with prices fluctuating between approximately $6.406 and $5.548.

Regardless of the obstacles, AMBCrypto sees NEAR as generally bullish, backed by advantageous market circumstances.

Bullish momentum for NEAR

According to technical analysis, it appears that NEAR is maintaining a positive trend, which could lead to further price increases.

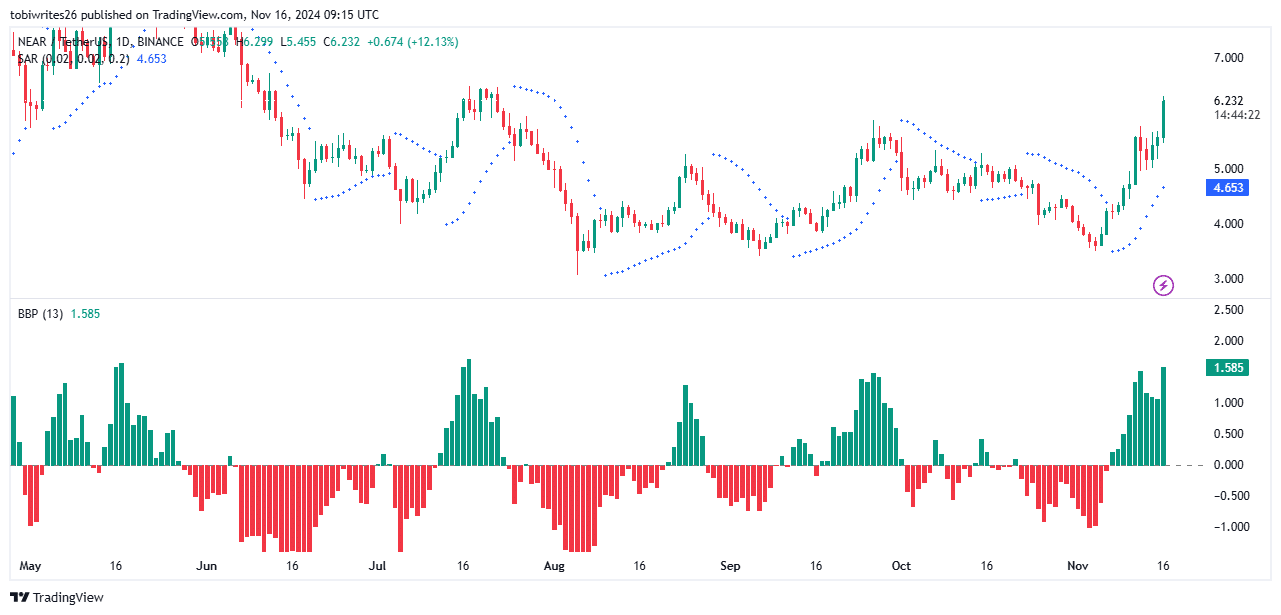

The Parabolic SAR (Stop and Reverse) is used to identify trend direction and reversal points by plotting dots above (bearish) or below (bullish) price movements.

Currently, the trend has shifted to a bullish one, as the graph shows points beneath the current price, implying that the positive momentum is growing and suggesting further price increases may follow.

Just like the Bull-Bear Power (BBP), this metric reflects the equilibrium between those who are buying (bulls) and those who are selling (bears). Essentially, it signals a growing dominance in the market by the bulls.

The successive green bars on the graph underscores this point, indicating that the bulls are dominating and hinting at the possibility of a continued upward trend in NEAR.

Multiple confluences support NEAR’s rally

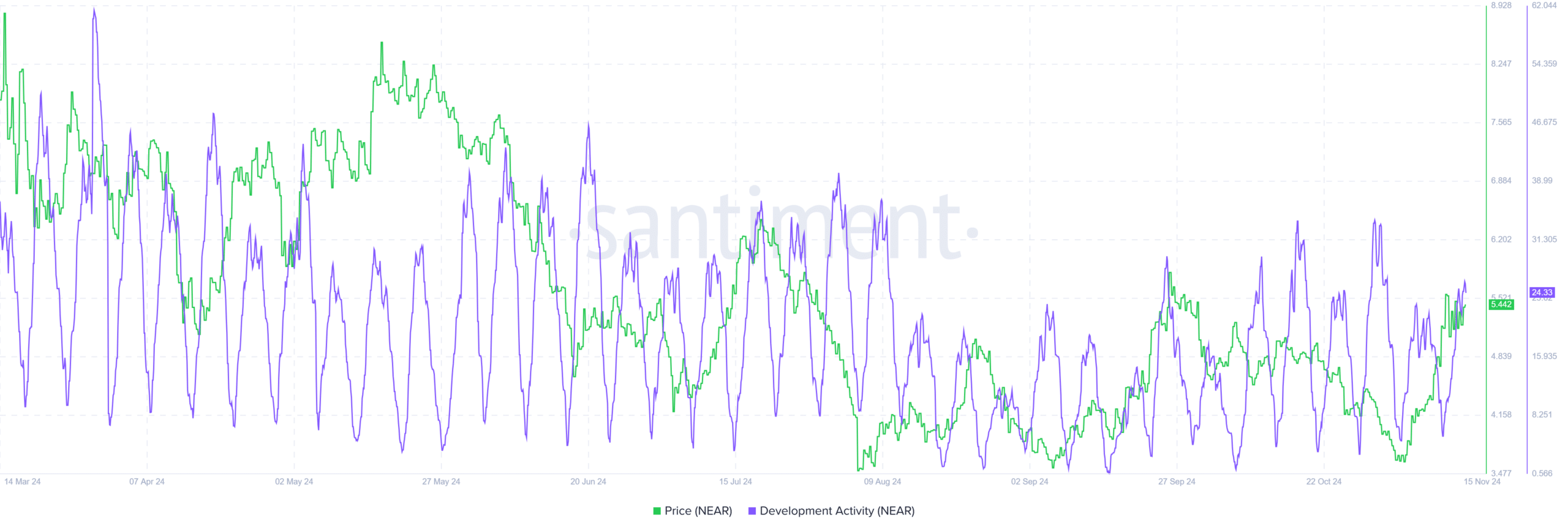

The progress being made in the continuous advancement of NEAR Protocol’s environment, often referred to as development activity, has been steadily increasing. This upward trend is a good sign and indicates positive momentum.

From my perspective as an analyst, I’ve observed that when there’s a surge in development activities, prices tend to rise accordingly. Given the current momentum surrounding NEAR, it seems poised for additional growth.

Moreover, as per Coinglass, the Open Interest and Long-to-Short ratio are showing signs of agreement for NEAR. This alignment suggests that NEAR might have the strength to surpass its resistance thresholds.

Read Near Protocol’s [NEAR] Price Prediction 2024–2025

NEAR’s Open Interest has risen by 20.58% in the last 24 hours, reaching a value of $398.10 million.

Currently, the Long-to-Short ratio is leaning towards the bulls with a value of 1.0358. This suggests that there are more buy orders being placed compared to sell orders as we speak.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-17 12:39