-

NEAR’s bullish market structure seemed contrary to the disappointing market demand

Spot CVD presented some hope that the bulls could defend $3.85

As an analyst with over a decade of experience in the crypto market, I have seen countless bull and bear runs that have left me both exhilarated and exhausted. Observing NEAR Protocol’s current market structure, it presents a paradoxical situation – a bullish chart structure contrasted by disappointing demand.

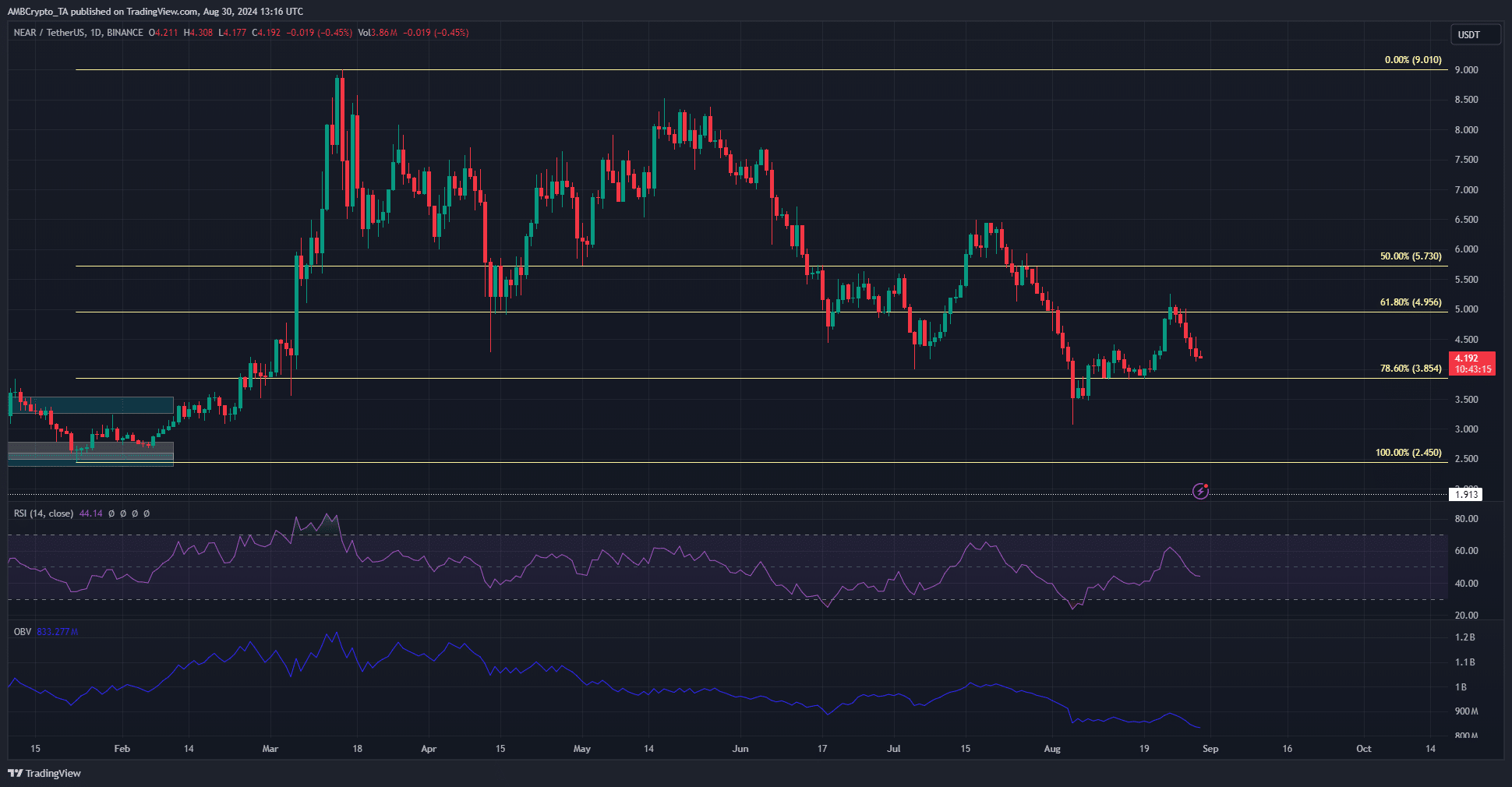

Currently, NEAR Protocol (NEAR) is showing a downtrend on larger timeframes. On the price charts, the bulls have found support near the $3.85 mark, which corresponds to the 78.6% Fibonacci retracement level derived from the rally that took place between $2.45 and $9 in February and March.

After that point, the market has experienced a few reversals towards being bullish. Currently, the market is showing a bullish structure, but the forecast for the token remains bearish.

Rejection from $5 and sustained bearish pressure

In simpler terms, this pessimistic viewpoint essentially stems from the ongoing decline in On-Balance Volume (OBV). With a constant flow of sellers, NEAR‘s price, though currently trading above its long-term average, needs to maintain the support level at $3.85 to avoid further downward movement.

Last week, the price fluctuated from $3.85 to $5.25 for the cryptocurrency token, but unfortunately, it failed to establish that higher price as a new level of support in the following days.

As a researcher, I’ve observed that my daily Relative Strength Index (RSI) has dipped below the neutral 50 threshold following the recent price decline. This suggests a change in momentum that could potentially pave the way for a consolidation phase around the $4-zone. Furthermore, I’m keeping an eye out for a gradual increase in On-Balance Volume (OBV), as this might signal accumulation among investors, which could lead to a slow rise in price.

Unless these work out as stated, the higher timeframe outlook would appear bleak for NEAR’s price.

Spot CVD keeping up, despite NEAR’s price drop

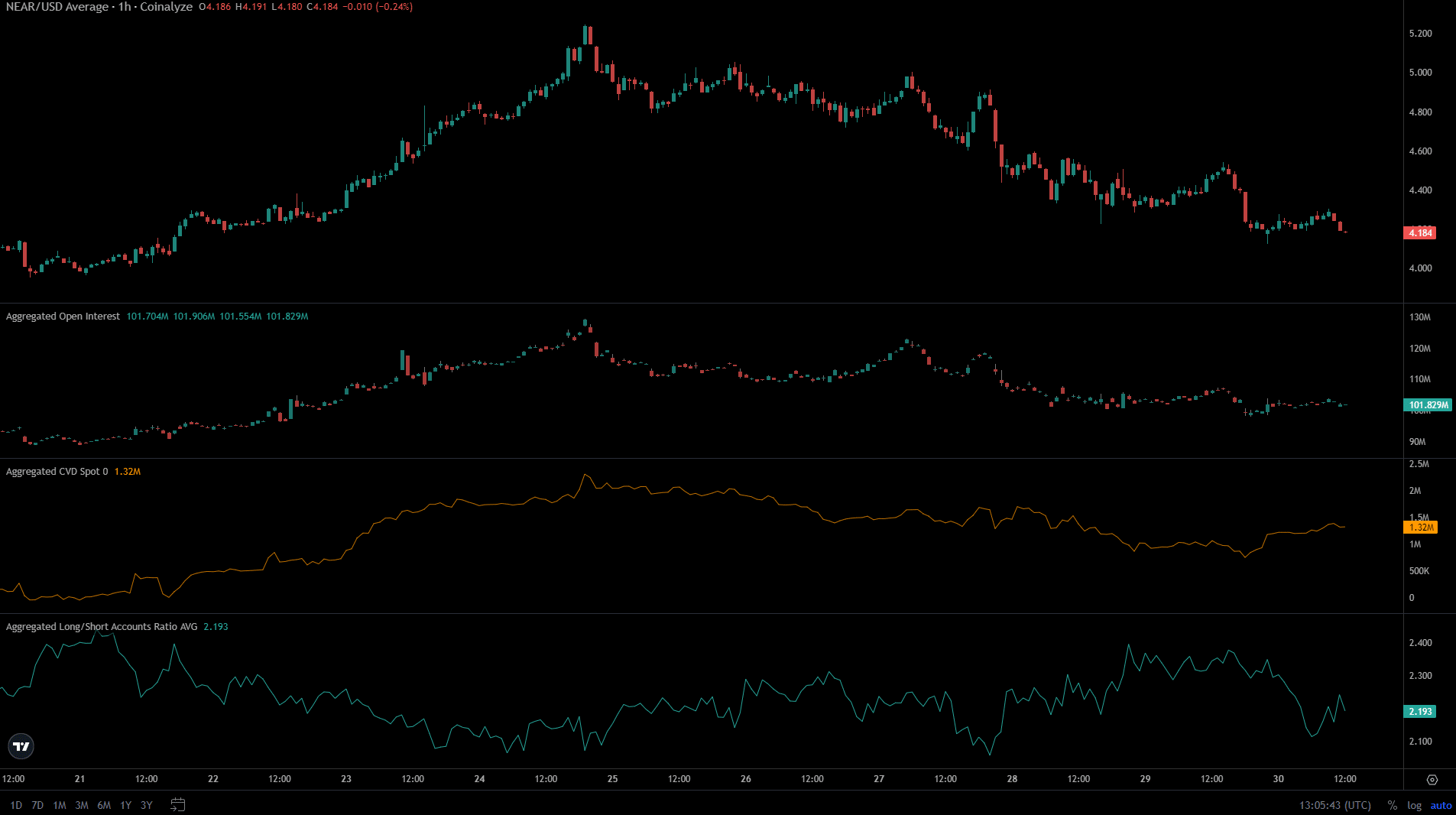

For several days now, the Open Interest linked to NEAR Protocol has been decreasing together with its price, suggesting a pessimistic attitude among traders in the Futures market.

Over the last day, we observed a decrease in the long-to-short account ratio, yet it still stands strong at approximately 2.19, implying a higher number of long positions compared to short ones.

Realistic or not, here’s NEAR’s market cap in BTC’s terms

It’s worth noting that while the price was experiencing a temporary dip, the demand for the spot CVD was actually increasing. This surge in buying interest may instill optimism in traders that the NEAR token might recover yet again from its $4 support level.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-30 20:07