- NEAR recently entered a symmetrical triangle formation, and a breakout to the upside could propel its towards $5.8

- Market sentiment largely bullish at press time, with a majority of traders showing confidence

As a seasoned analyst with over two decades in the crypto market under my belt, I’ve seen my fair share of market patterns and trends. The current situation with NEAR is intriguing, to say the least.

Despite its recent bullishness, NEAR’s movement on the price chart has been fairly limited. It registered modest gains of just 0.14% over the last 24 hours and an uptick of 0.36% over a 7-day period.

During this phase, which is referred to as consolidation, traders might be stockpiling NEAR in readiness for a significant price shift. Given our analysis, AMBCrypto decided to delve deeper into possible upcoming actions for NEAR.

Support level is key to NEAR’s projected price swing

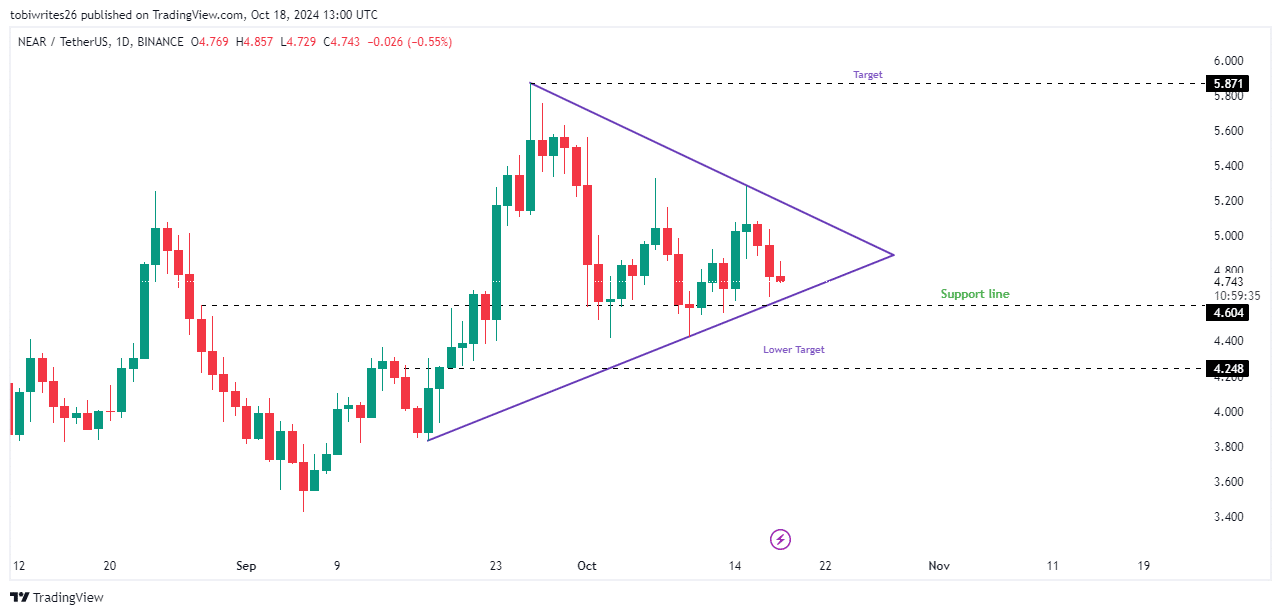

Currently, NEAR is being traded inside a symmetrical triangle – a pattern created by the convergence of support and resistance lines. This shape suggests a period of consolidation, during which investors are gradually building their positions in the asset.

If the current trend line is breached from above, there’s a possibility that NEAR could surge towards its peak of approximately $5.871. Yet, prior to this anticipated uptrend, NEAR might first encounter the significant support level at $4.604. This level will significantly influence the direction of the next move.

If the support at $4.604 doesn’t manage to stay strong, it’s possible that the price of NEAR might decrease more, falling beneath the support boundary and landing on a nearby support point – approximately $4.248.

Indicators signal active buying for NEAR

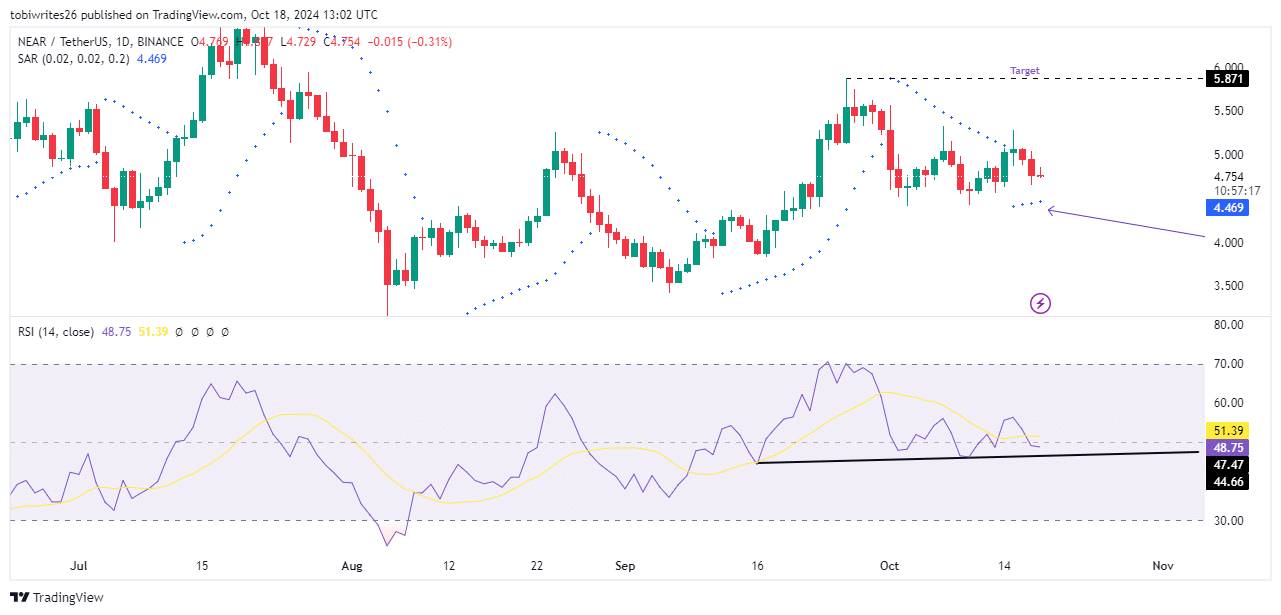

Based on the analysis of both the Parabolic SAR (which indicates a potential halt and reversal) and the Relative Strength Index (a tool to measure the strength of a stock), it seems that the price of NEAR could experience an upward trend as well.

During the time of NEAR’s pricing, the Parabolic SAR (Stop and Reverse) was showing dots just below the price, suggesting persistent buying activity and a bullish market trend. If these dots keep appearing and extend beyond four consecutively, it’s likely to validate NEAR’s continued upward trend.

Simultaneously, as the RSI appeared to head downwards, it exhibited a bullish stance. It’s anticipated to encounter the uptrend support line which has been propelling it, with the price of NEAR following suit.

Consequently, a temporary decrease in RSI might cause the price to fall toward the $4.604 support point. Following this dip, it’s expected that NEAR will turn around and continue climbing again.

Massive liquidity outflows favor NEAR

NEAR has experienced significant outflows across exchanges, according to data from Coinglass.

Over the last week, NEAR experienced inflows of approximately $1.62 million, suggesting a positive perspective among investors who are transferring their assets from exchanges for potential long-term investments or accumulation purposes.

Should this pattern of persistent outflows persist across a wider time period, it would add more weight to the belief that the market is overwhelmingly optimistic, indicating a strong bullish trend.

Implying this, it seems to suggest an upcoming surge might be possible, while at the same time emphasizing the robustness of Near’s system as a whole.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-19 12:39