-

NEIRO’s price surge broke a key resistance, but the overbought RSI pointed to a potential pullback

Rising Open Interest and liquidation data highlighted hike in volatility

As a seasoned analyst with over two decades of market experience under my belt, I must say that NEIRO‘s recent surge has certainly piqued my interest. A 50%+ price increase in a single day is not something we see every day, and it’s always intriguing to witness such market movements.

As a crypto investor, I’ve witnessed an exhilarating leap of 50.64% for Neiro Ethereum [NEIRO] today, reaching a price point of $0.09058 at the press time. This surge has boosted its market capitalization to a staggering $90.58M and significantly increased trading volume by an impressive 309.73%. The question now is whether NEIRO can continue this upward trend, or if a potential correction might be on the horizon. Is this rally sustainable or could we see a reversal soon?

The significant surge in trading activity for NEIRO by 309.73% indicates increased investor attention towards it. This increase in trading volume could also suggest a positive trend, often referred to as “bullish,” as an influx of buyers enters the market.

As a crypto investor, I’m always on my toes, for sudden surges in the market could often be followed by volatility, resulting in swift adjustments. Although a significant increase in trading volume is encouraging, it’s crucial to keep a close eye on price fluctuations. After all, caution is always a valuable companion in the crypto world.

Bollinger Bands and RSI – Is a reversal likely?

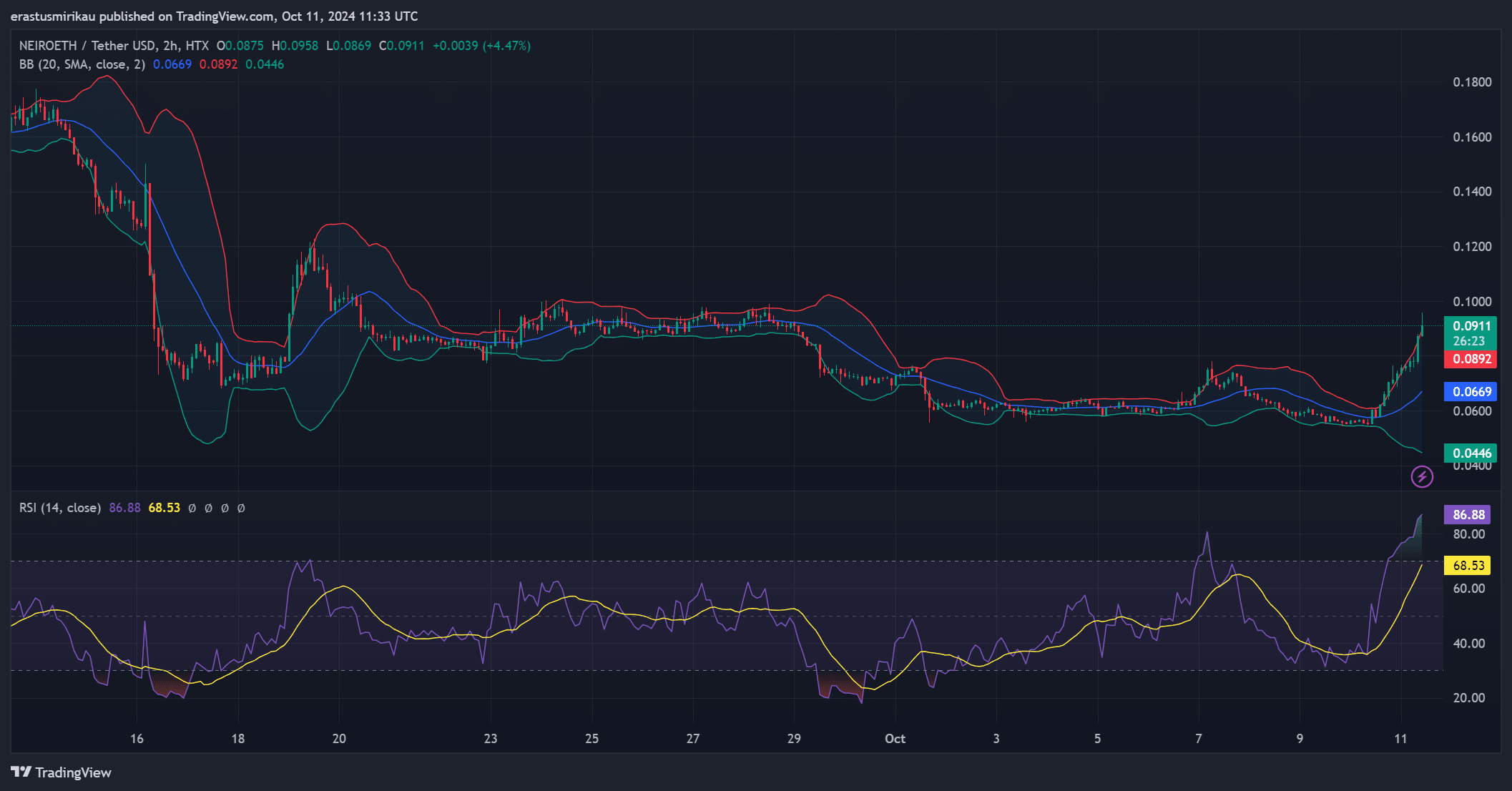

NEIRO’s price has soared beyond its upper Bollinger Band, suggesting robust bullish energy, yet it might be approaching an overextension. Furthermore, the Relative Strength Index (RSI) reading at 86.88 indicates that the asset is significantly overbought, leading to speculation of a temporary correction.

Although the current trend might drive prices up, traders are advised to exercise caution, considering the possibility of a price drop or stabilization. Both signals suggest that the market may be overextended.

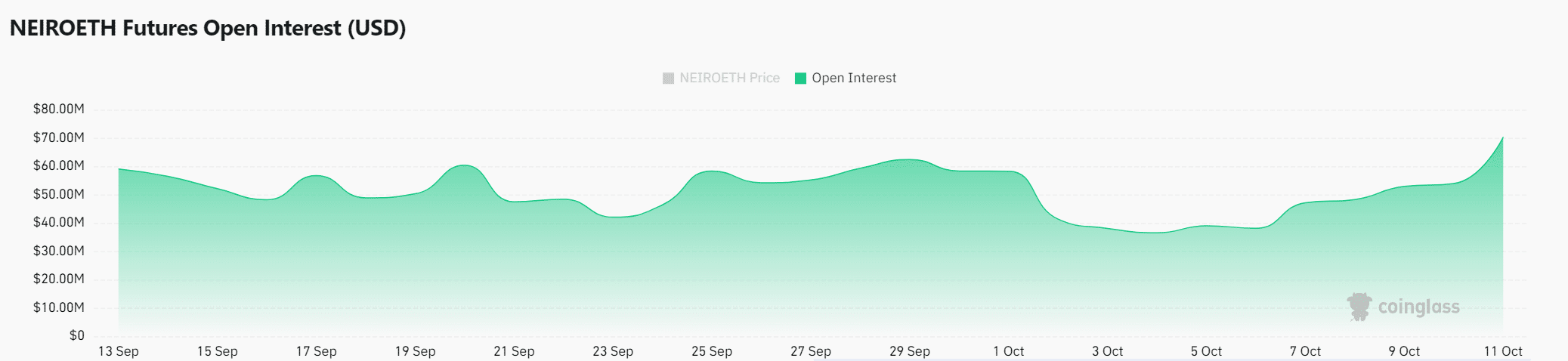

NEIRO’s rising Open interest: Increased volatility ahead?

Open interest jumped by 101.22%, reaching $119.49M. This surge is a signal that more traders are entering the market, anticipating continued volatility. However, a hike in Open Interest often leads to greater market fluctuations.

As a result, investors ought to anticipate possible abrupt price fluctuations since the market may respond dramatically to fresh trading positions.

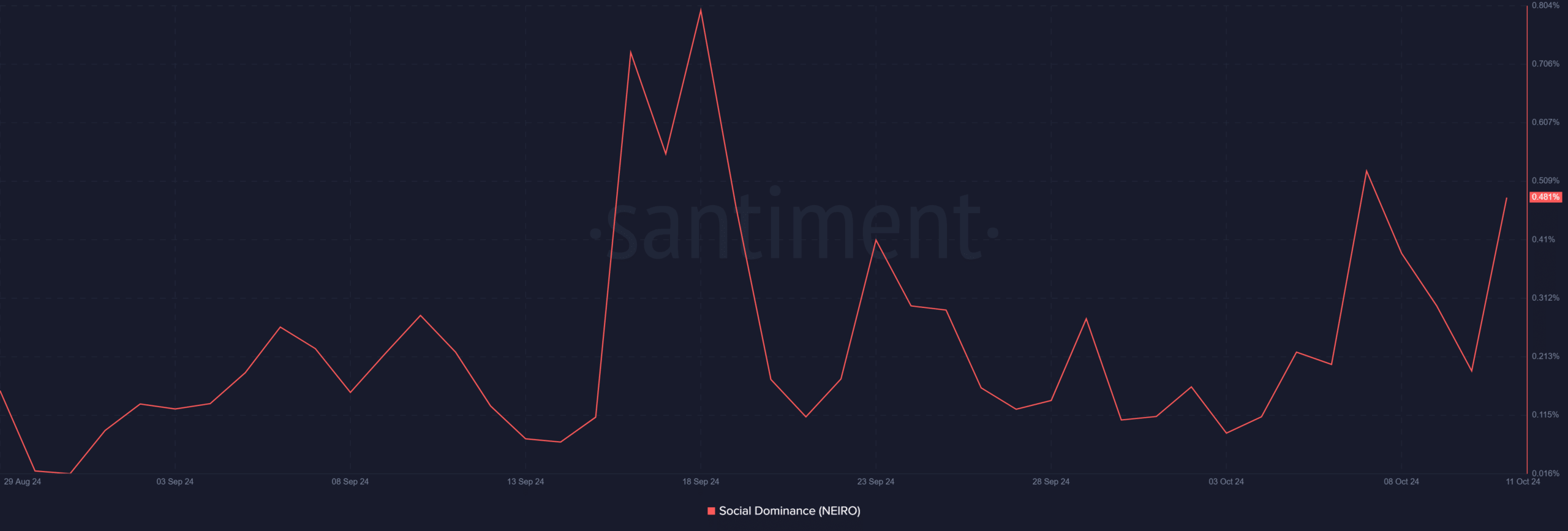

Social dominance: Is NEIRO gaining popularity?

NEIRO’s social influence increased to 0.481%, showing a surge in popularity on various social media networks. With this increasing online visibility, there’s potential for heightened market curiosity and continuous price increases.

Indeed, the opinion of society can shift rapidly, which is why it’s crucial to monitor the reactions of the community towards future price fluctuations as well.

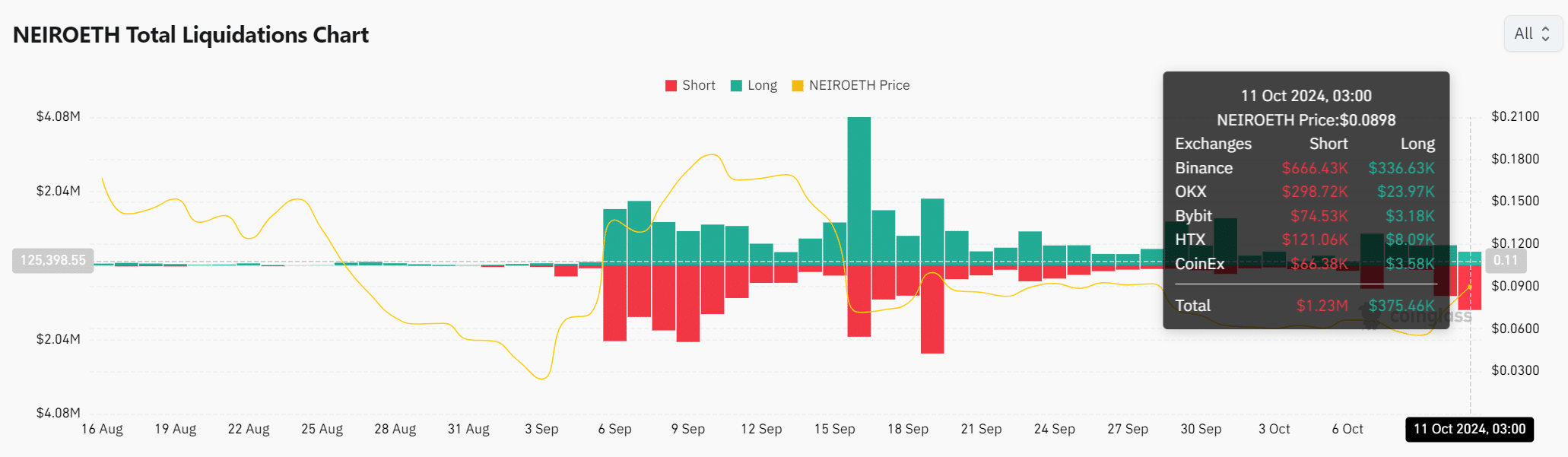

NEIRO Liquidation data: What are traders facing?

Recent liquidation data revealed $1.23M in short liquidations as traders betting against NEIRO’s rise were caught off-guard.

Conversely, prolonged liquidation amounts stand firm at around $375,460. Given the escalating fluctuations in the market, it’s likely that these liquidation figures will climb as traders readjust their trading strategies.

Read Neiro Ethereum [NEIRO] Price Prediction 2024–2025

Is the rally sustainable?

NEIRO’s 50.64% increase and the rising curiosity in the market suggest a positive outlook. Nevertheless, due to overextended Relative Strength Index (RSI) values and escalating Open Interest, there’s a significant risk of a temporary decline.

It’s wise for investors to approach with care, keeping a close eye on important technical signals to determine if this upward trend will persist or encounter a potential reversal.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2024-10-12 12:07