As a crypto investor with some experience under my belt, I’ve seen the Bitcoin market go through its fair share of ups and downs. The current situation feels like deja vu, as we’re witnessing another price drop after hitting record highs. It’s disheartening to see the massive gains we’ve made over the past few months dwindling away.

Bitcoin traders have faced a turbulent journey this year as the value of the coins has seen wild swings, touching new highs before experiencing significant drops over the past fortnight.

Are market bears taking over bulls this time? What is happening to the Bitcoin price?

The excitement surrounding Bitcoin spot ETFs appears to be waning as the cryptocurrency market experiences a steady decline. Notable coins such as Bitcoin, Ethereum, Binance Coin, and Solana have lost much of the momentum and significant value they had gained in recent months.

Let’s delve into the causes of Bitcoin reaching its lowest point and explore the prospects for cryptocurrency investors moving forward.

Why is Bitcoin’s Price Dropping?

In the beginning of 2024, Bitcoin experienced a strong surge, surpassing its previous record price of $73,000 for the first time ever in the first quarter. The reasons behind this remarkable growth include the acceptance of BTC ETF spot trading applications, the upcoming Bitcoin halving event in April, and the approval of Ethereum spot ETFs.

During this period from March to June, Bitcoin traders experienced significant annual gains due to the coin reaching or surpassing the $70,000 threshold at least monthly.

As an analyst, I’ve observed that unlike previous short-term declines following price peaks, this current downtrend has persisted since late June. The cryptocurrency market has witnessed a significant sell-off causing Bitcoin to plummet from approximately $70,000 to under $60,000 within three weeks.

Significant BTC Market Events

A few occurrences have contributed to the recent drop in coin prices. Previously, every price decline was preceded by significant events that fueled investor anticipation and purchasing power. In contrast, presently, there are no major upcoming events to excite traders, leading to a decrease in interest for short-term investments.

Besides this speculative reason, two events have triggered this move.

As a crypto investor, I’ve noticed some significant transactions in the Bitcoin market starting from June 21st. The German government reportedly sold off hundreds of millions of dollars’ worth of Bitcoins that they had seized from illegal piracy websites. These sales, which returned approximately $400 million to the crypto market, had a noticeable impact on Bitcoin’s price. The influx of this large amount of Bitcoins into the market caused its value to drop and temporarily flatten the overall price trend.

Mt. Gox, a Japanese cryptocurrency exchange that was hacked in 2011 and declared bankruptcy in 2014, has announced a recovery program after a decade-long process. This means that clients who lost their crypto holdings, primarily in Bitcoin and Bitcoin Cash during the incident, will now be reimbursed.

Millions of Bitcoins were moved from offline wallets to clients, who aim to profit from the significant increase in Bitcoin value over time by selling their coins and securing profits. This action instigated a surge in selling across the market.

Bitcoin Price Analysis: Short-Term vs Long-Term

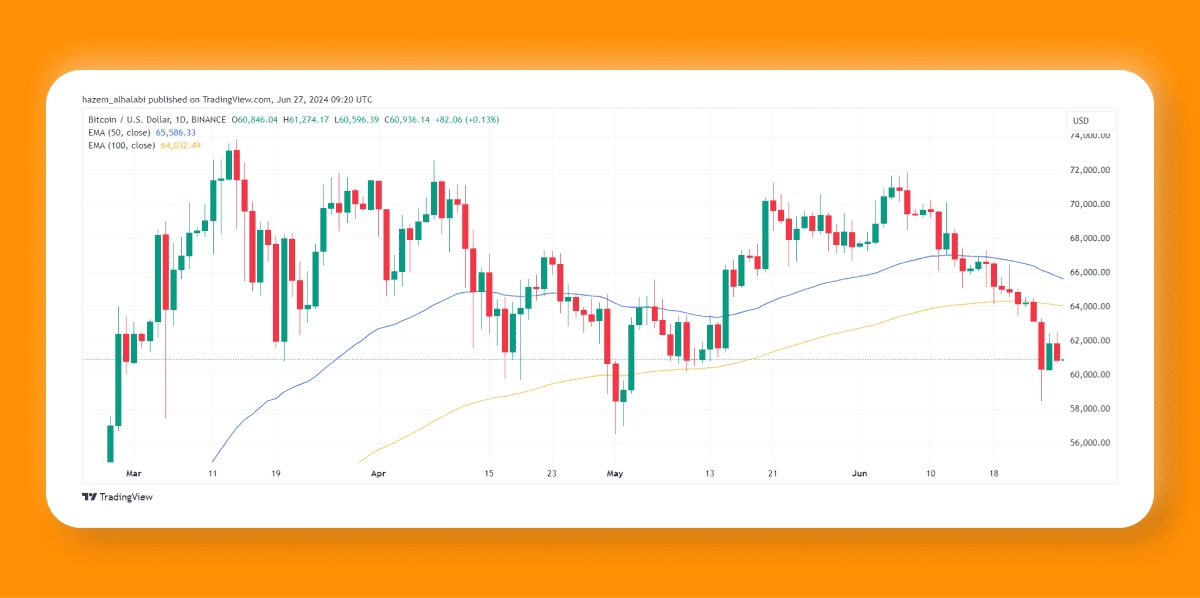

Let’s examine the BTC/USD TradingView price chart and interpret both the long-term and short-term tendencies. By employing the exponential moving average (EMA) indicator, we assess its behavior across various time frames.

As a researcher studying Bitcoin’s price trends, I begin by examining the 50-day and 100-day moving averages (EMAs). When the market price drops below both these lines, it signals that the short-term trend is heading towards a new bottom for Bitcoin, with prices dipping under the $60,000 threshold.

When observing the relationship between the 50-day moving average (represented by the blue line) and the 100-day moving average (signified by the yellow line), we notice that the blue line sits above the latter. This arrangement is considered bullish as it suggests an uptrend. Nevertheless, the downward slope and proximity to the 100-day moving average may hint at developing bearish tendencies.

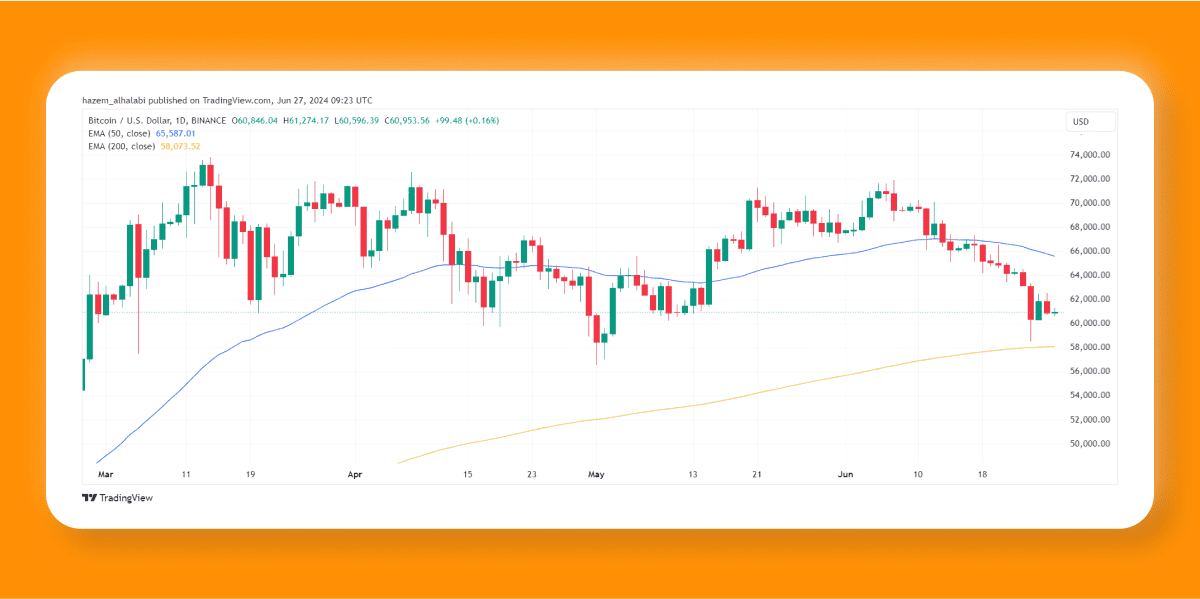

One way to rephrase that in a conversational and clear manner is: “Let’s examine the power of this trend by looking at how the 50-day moving average (MA) and the 200-day MA differ from each other. There’s a noticeable gap between these two lines.”

The yellow line, which represents a price lower than the current market value, is ascending. Meanwhile, the blue line is descending and approaching the yellow line. Though this indicates a downward trend, it’s unlikely for these lines to collide. Consequently, significant selling pressure seems improbable.

Conclusion

The crypto market is currently going through a fresh drop, leaving investors perplexed about the future direction of Bitcoin and cryptocurrencies as a whole. This downturn follows recent record-breaking highs that Bitcoin reached over the past few months.

Many skeptics sold off their Bitcoin holdings when the price dipped below $60,000. Yet, this dip might be a minor correction following the market’s dramatic surge and notable occurrences that boosted Bitcoin’s circulating supply.

Caution: The following article is intended to provide information only and does not represent financial guidance. The process of investing in cryptocurrencies, such as meme coins, involves inherent risks which prospective investors are advised to thoroughly examine before making any investment-related decisions.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-06-28 17:04