-

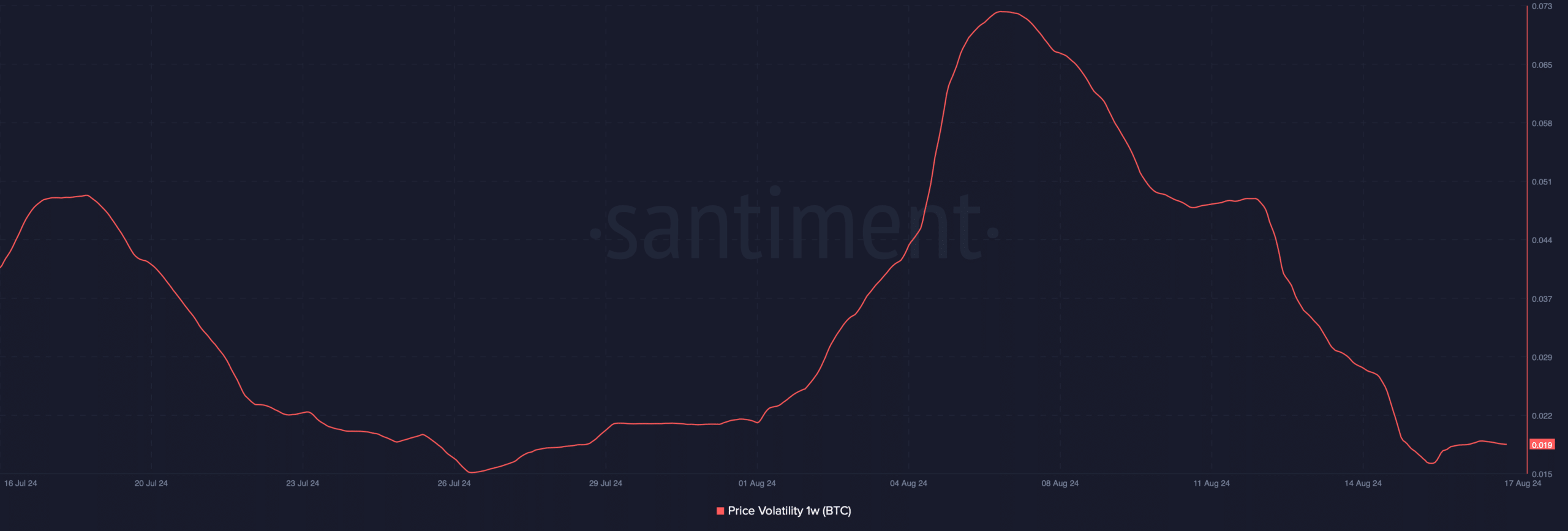

BTC’s price volatility dropped last week as it was in a consolidation phase

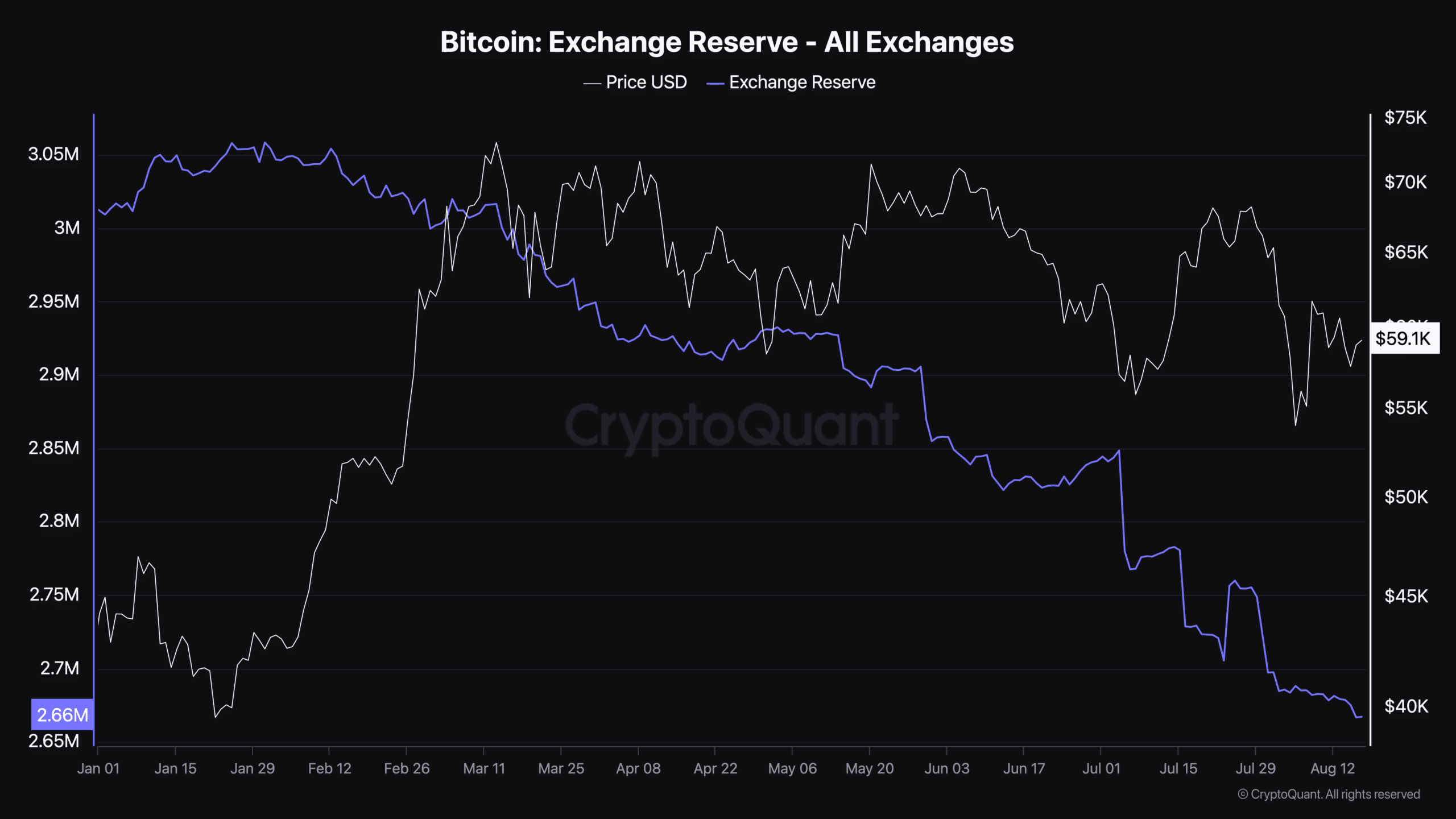

Meanwhile, BTC’s exchange reserve fell too, indicating its rising demand

As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, I find myself intrigued by the current state of Bitcoin (BTC). The past week has seen a drop in BTC’s price volatility, which is often a precursor to significant price movements. However, this consolidation phase has also coincided with a decrease in exchange reserves, indicating rising demand for the cryptocurrency.

Over the past several days, Bitcoin‘s [BTC] price has remained relatively stable near $60,000, but there’s been a significant surge in demand for it. This growing interest might influence Bitcoin’s price in the near future.

Hence, it’s worth taking a closer look at what’s going on.

Why is Bitcoin consolidating?

As a researcher, I’ve found some intriguing trends in the cryptocurrency market. Over the past week, Bitcoin’s price dipped by approximately 2%, but it’s not a significant drop we should be overly concerned about. Interestingly, within the last 24 hours, its value has climbed back up by 1%. At this moment, Bitcoin is being traded at $59,172.68, with a market capitalization surpassing $1.17 trillion.

Last week’s decrease in the cryptocurrency’s volatility was clearly demonstrated by the significant drop in its one-week price volatility graph during the past few days.

Quinten, a well-known cryptocurrency expert, recently posted on Twitter an explanation for the recent drop in market volatility.

Based on previous patterns, Bitcoin (BTC) may be continuing a long-standing trend following each halving event. This analyst suggests that given the current consolidation phase BTC has been in for several weeks, if history repeats, we could potentially witness a significant price increase for Bitcoin around Q4 of 2024.

The bull rally might as well allow the king of cryptos to touch an all-time high on the charts.

BTC’s demand is on the rise

As Bitcoin consolidated, demand for the cryptocurrency rose too.

According to AMBCrypto’s examination of CryptoQuant’s data, Bitcoin (BTC) exchange reserves decreased substantially in the year 2024. This suggests that BTC has been experiencing a supply shortage. When demand rises and supply falls, it often indicates a potential price rise in the upcoming weeks or months.

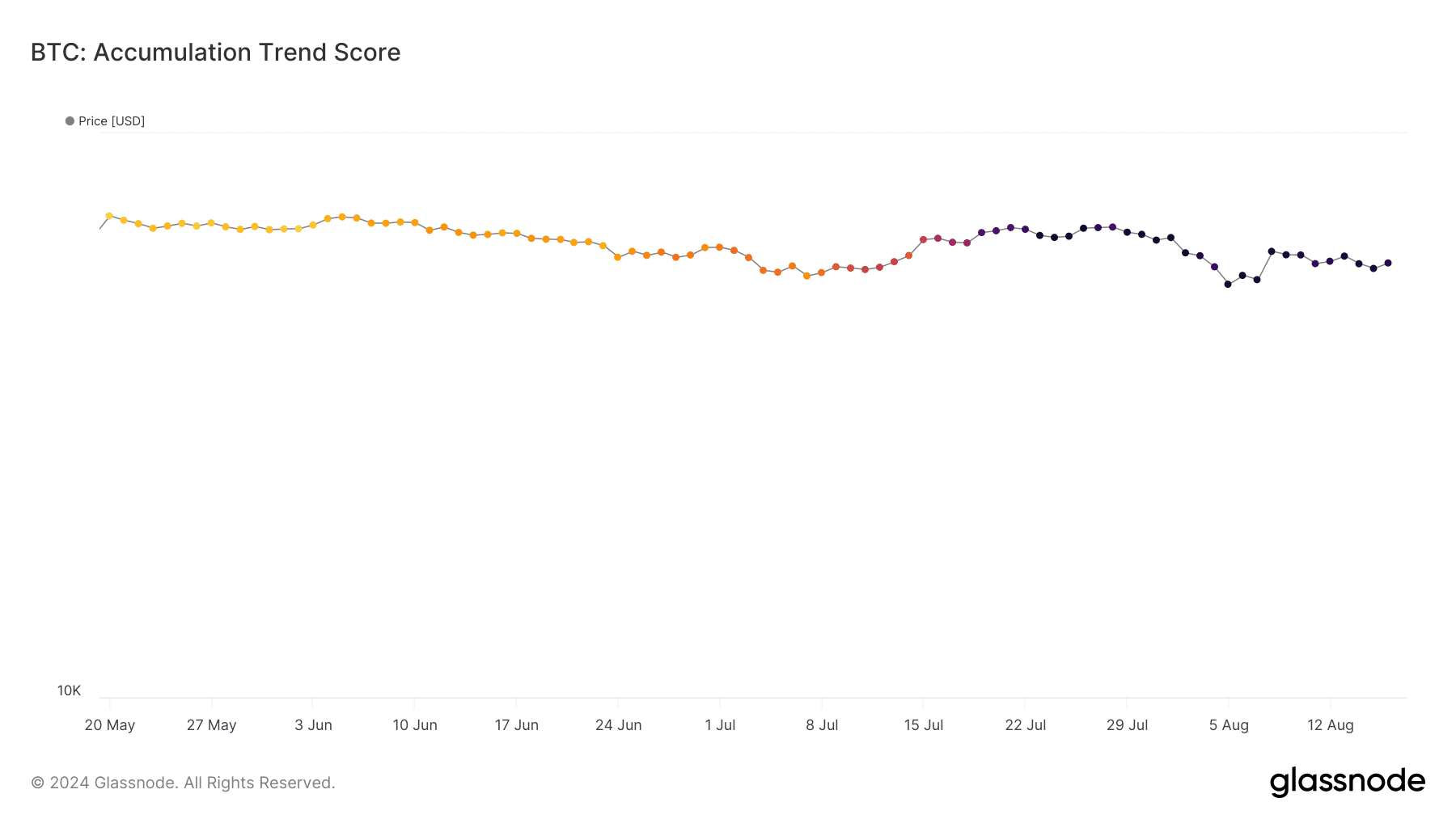

First, we examined Glassnode’s statistics to confirm the growing interest in Bitcoin. As per our assessment, the accumulation trend indicator stood at 0.94 for the cryptocurrency at the current moment.

Initially, this measure represents how much larger one entity’s Bitcoin holdings are compared to another when it comes to the amount of coins they are actively adding on-chain. A figure near 1 indicates strong buying activity, meaning investors are accumulating a significant amount of Bitcoin, while a number closer to 0 implies that investors are not actively increasing their Bitcoin holdings.

Consequently, this measurement indicates an increase in Bitcoin’s demand, potentially leading to a bullish trend in the fourth quarter.

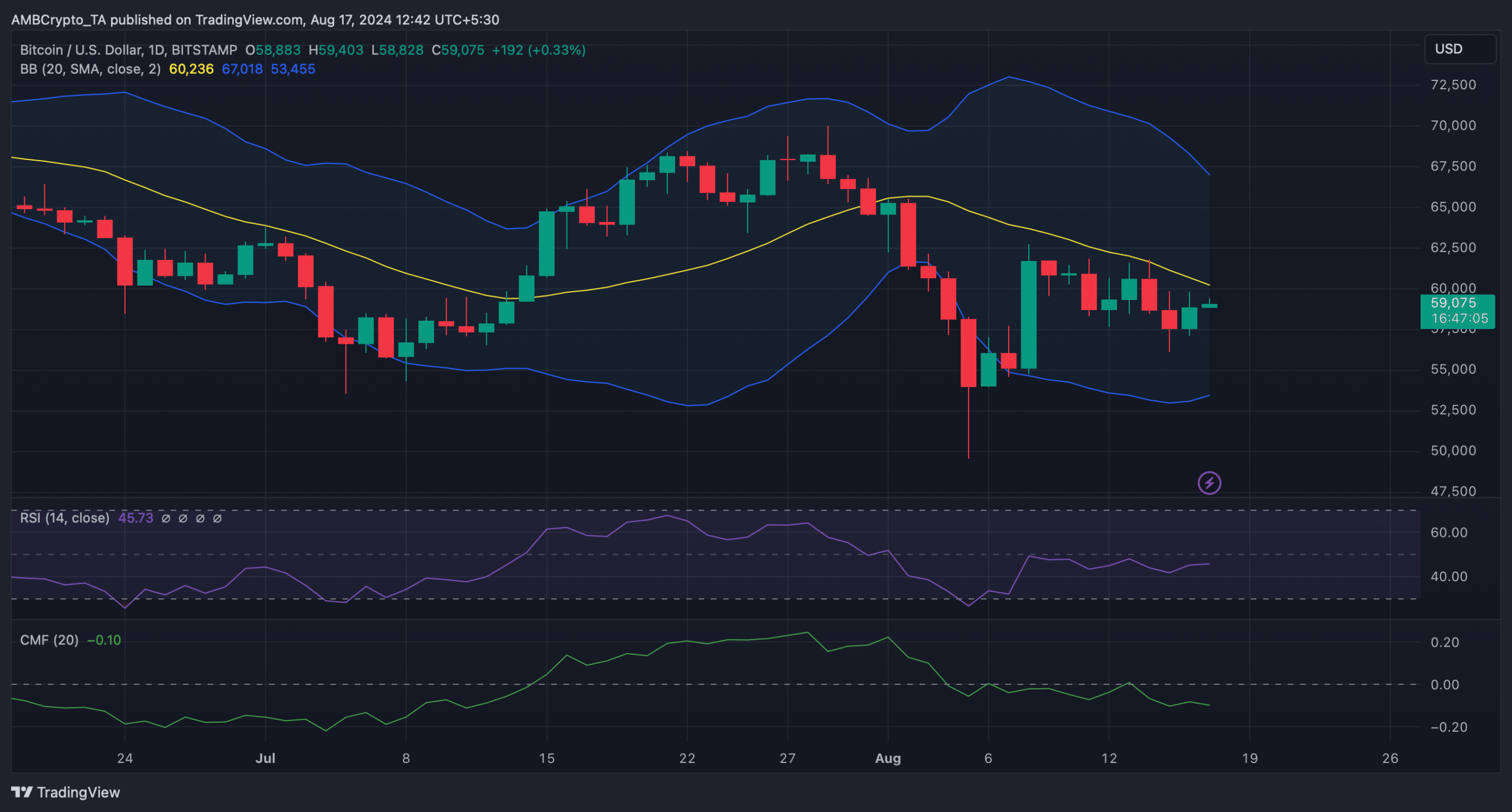

Finally, we assessed the cryptocurrency’s daily chart to find out what to expect in the near term.

Based on the Bollinger Bands analysis, Bitcoin seemed poised to encounter a potential resistance level close to its 20-day Moving Average.

The Relative Strength Index (RSI) increased, indicating a potential surge in Bitcoin’s price beyond its 20-day Simple Moving Average (SMA). However, the Chaikin Money Flow (CMF) seemed pessimistic as it trended downward on the graphs.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-17 23:04