-

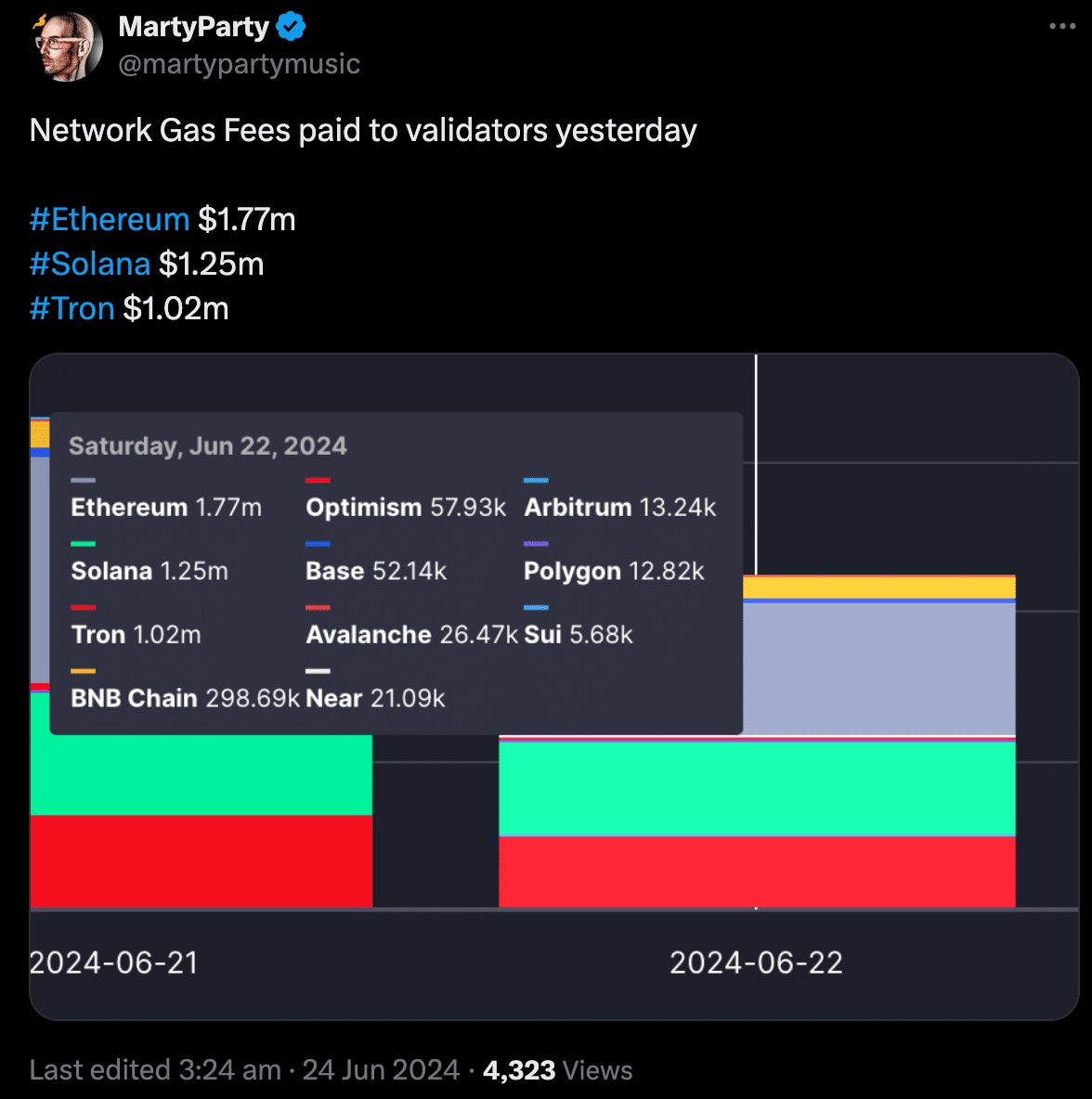

Ethereum gas prices declined, but fees paid out to validators rose.

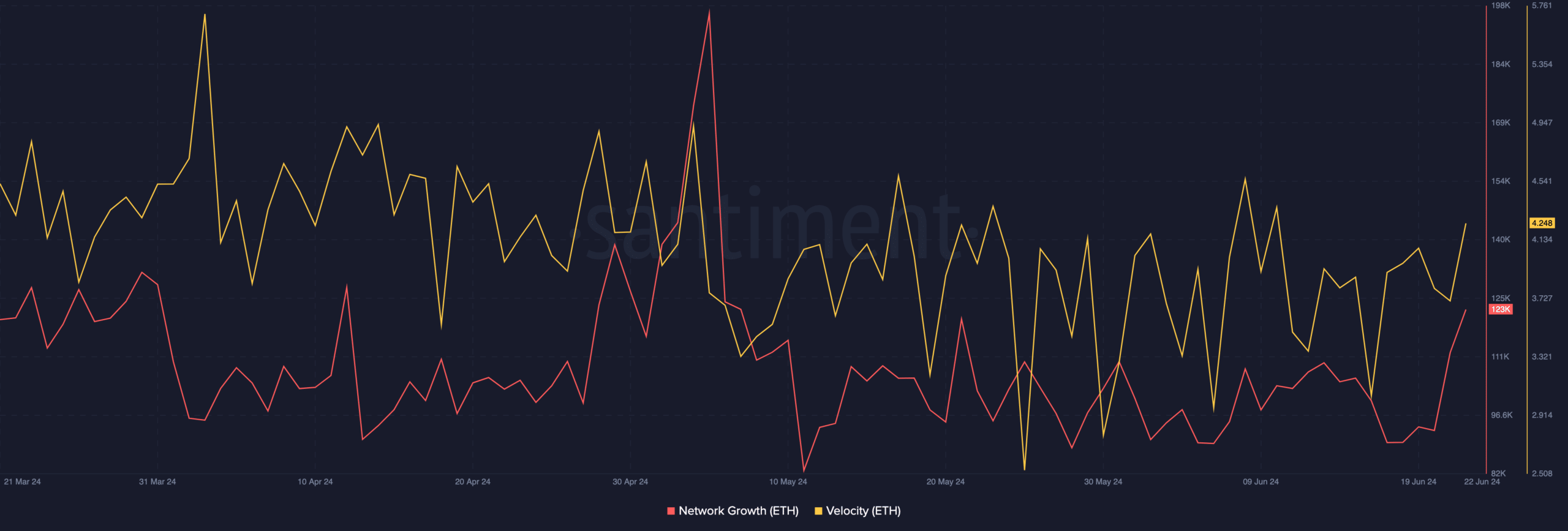

The price of ETH declined, however, Network Growth surged.

As a researcher with experience in blockchain and cryptocurrency analysis, I’ve been closely monitoring the recent developments in the Ethereum (ETH) network. While it’s true that ETH’s price experienced a significant decline below $3400, an interesting trend has emerged in terms of Ethereum gas prices and validator fees.

Ethereum [ETH] was notably affected by the latest market decline, causing its price to drop beneath the $3400 threshold.

Low Ethereum gas, high fees

In conjunction with this development, Ethereum’s gas prices saw a decrease. Surprisingly, even with reduced gas fees, Ethereum managed to significantly outspend validators on other networks like Solana (SOL) and Tron (TRX).

As a crypto investor, I’ve noticed that even though gas prices have decreased, the higher validator fees on Ethereum suggest robust network activity. This means that more transactions are being processed and validated, indicating a strong demand for the Ethereum blockchain.

As an analyst, I would put it this way: Though validators face lower costs for each transaction processed, a larger transaction volume translates to greater revenue in total fees earned.

Though validator fees are currently expensive, they may not fully compensate for Ethereum’s overall price decrease.

When I penned down these words, Ethereum (ETH) had experienced a 4.14% decrease in value within the preceding 24-hour period. One possible explanation for this price drop is Ethereum’s close connection to Bitcoin (BTC). Over the past few days, Bitcoin’s value also underwent a significant decrease.

Based on AMBCrypto’s interpretation of the data from IntoTheBlock, the relationship between Ethereum and Bitcoin was strongly correlated, with a correlation coefficient of approximately 0.78.

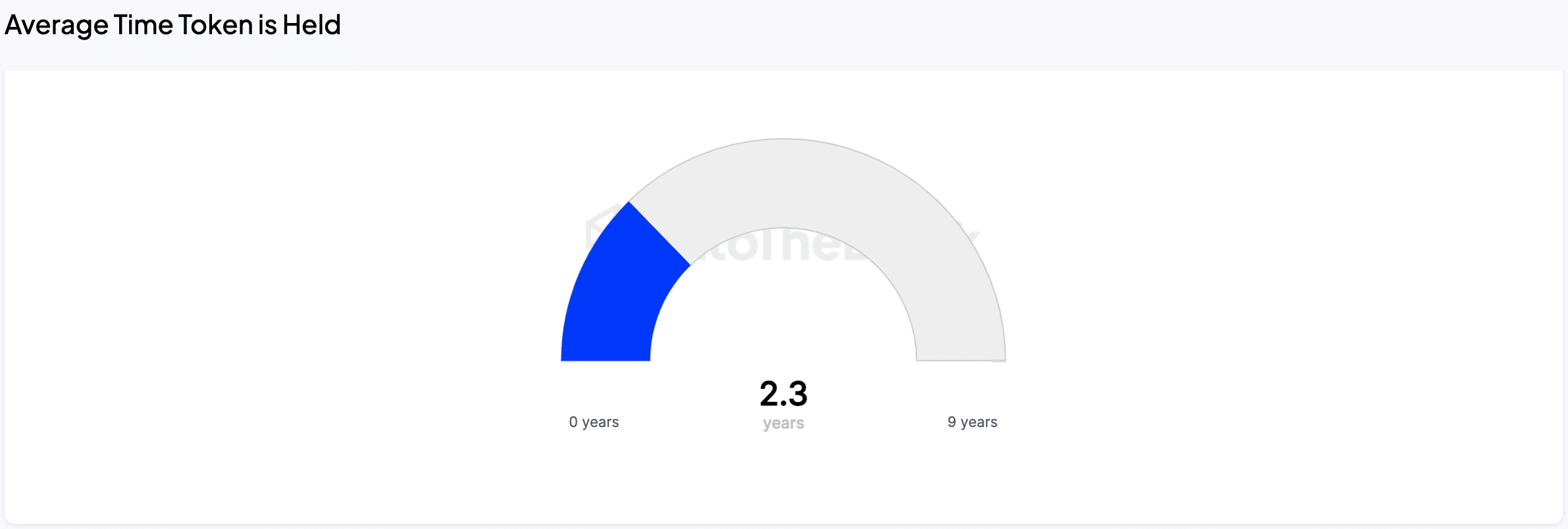

Despite Ethereum’s (ETH) price decrease, many investors remain committed to their holdings for an extended period. On average, they have held onto their ETH for approximately 2.3 years.

As a long-term crypto investor, I’ve observed that the average holding period for actively traded coins is around two months. This suggests to me that many investors are hesitant to sell, implying a belief in the potential future growth of their investments.

The average holding time of traded coins offers valuable insights into investor confidence.

As a long-term Ethereum investor, I hold onto my coins with confidence in the project’s future growth. My decision to keep my assets indicates my faith in Ethereum’s potential and my readiness to weather any market fluctuations.

Alternatively, an abundance of trading transactions could signal a preference for earning short-term gains over a longer time frame and potentially expressing doubt about the market’s prospects.

On-chain data

Network Growth for ETH surged materially over the last few days.

Read Ethereum’s [ETH] Price Prediction 2024-2025

At the moment of observation, a significant number of new addresses were engaging with Ethereum (ETH), indicating a strong interest from a substantial group of investors to acquire ETH at the present discounted prices.

As a researcher observing the Ethereum market, I noticed an increase in the speed at which ETH trades were taking place. This indicates a surge in the number of transactions being processed on the Ethereum network.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-24 18:15