- Nigeria has a 6.50% crypto-ownership rate, signaling rapid growth amid regulatory challenges

- Nigeria’s SEC has now implemented new rules and ARIP to secure digital asset markets effectively

As a crypto investor with a background in emerging markets and Africa, I’m particularly intrigued by the rapid growth of cryptocurrency adoption in countries like Nigeria. The 6.50% crypto-ownership rate is a testament to the resilience and adaptability of Nigerians in the face of regulatory challenges.

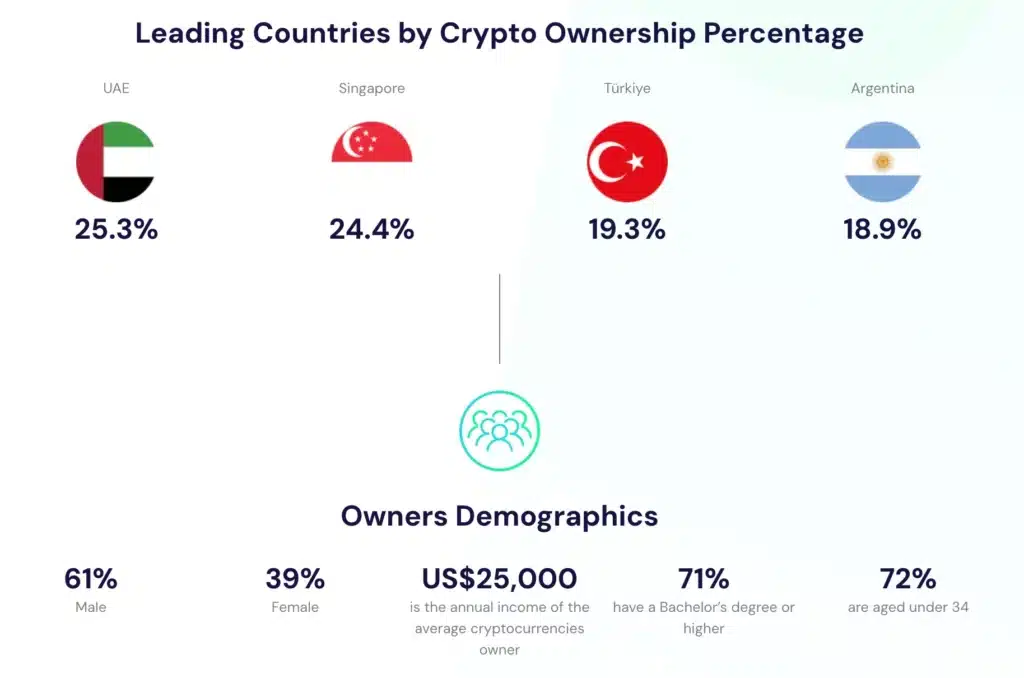

The global adoption of cryptocurrencies is increasing significantly, according to recent reports from Triple.A. By the year 2024, it’s projected that approximately 6.8% of the world’s population, or over 560 million individuals, will own cryptocurrencies.

Among the countries making notable strides in cryptocurrency adoption, Nigeria distinguishes itself with a 6.50% population owning digital currencies. This underscores Nigeria’s expanding role and recognition within the international crypto community.

Nigeria’s SEC moves towards cryptocurrency adoption

The Securities and Exchange Commission (SEC) of Nigeria has recently made headlines following its revision of the rules governing the issuance of digital assets, as well as the establishment of platforms for offering and trading these assets, along with their custody.

In a recent announcement, the Securities and Exchange Commission (SEC) outlined changes intended to enhance our regulatory structure, specifically designed to address the unique complexities of digital asset markets.

As a crypto investor, I would interpret this amendment as an expansion of regulatory reach to encompass the current state of the market.

I propose that we adopt these amended guidelines with a focus on managing the intricacies and potential risks associated with digital assets. By doing so, we aim to create a safe, regulated ecosystem where every participant can thrive with confidence.

Is there more to it?

To further strengthen its control over the cryptocurrency sector, the Nigerian Securities and Exchange Commission (SEC) has initiated the Accelerated Regulatory Incubation Programme (ARIP). This programme is specifically designed for virtual asset service providers (VASPs), who will undergo a streamlined regulatory process to meet the SEC’s new compliance standards.

The Securities and Exchange Commission (SEC) has made the process more streamlined by providing a specific application period on its ePortal for Virtual Asset Service Providers (VASPs) joining the program. This application window comes with a requirement that the onboarding process must be finished within thirty days of the circular’s release.

“This endeavor simplifies the regulatory procedure, enabling Virtual Asset Service Providers (VASPs) to function in accordance with the revised regulatory guidelines.”

Nigeria’s long-standing efforts

As a crypto investor, I’ve observed that despite the regulatory hurdles Nigeria has faced in the past, the country has experienced remarkable expansion in cryptocurrency usage.

As a crypto investor in December 2023, I’m elated to learn that the Central Bank of Nigeria (CBN) has lifted its ban on cryptocurrency transactions, enacting new regulations to prevent money laundering and terrorist financing. However, I can’t help but feel a pang of unease as these rules necessitate Virtual Asset Service Providers (VASPs) to comply with stringent Know Your Customer (KYC) procedures. While these measures are crucial for safeguarding the financial system, I’m concerned about the potential implications for user privacy.

As a researcher studying the cryptocurrency market, I’ve observed an intriguing trend: Nigeria has emerged as a trailblazer in peer-to-peer (P2P) crypto trading volume and overall transaction growth. This surge can be attributed to the widespread adoption of stablecoins as a means to mitigate inflation.

Should the U.S learn from Nigeria?

As the crypto market continues to develop, Nigeria’s regulatory strategy is becoming a benchmark for countries such as the United States. Given that both nations are grappling with regulating digital assets in the face of increasing popularity.

Robinhood CEO Vlad Tenev probably put it best when he claimed,

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- OM PREDICTION. OM cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Bobby’s Shocking Demise

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Gold Rate Forecast

2024-06-22 14:15