-

Dell Technologies didn’t add BTC to its holdings in Q2

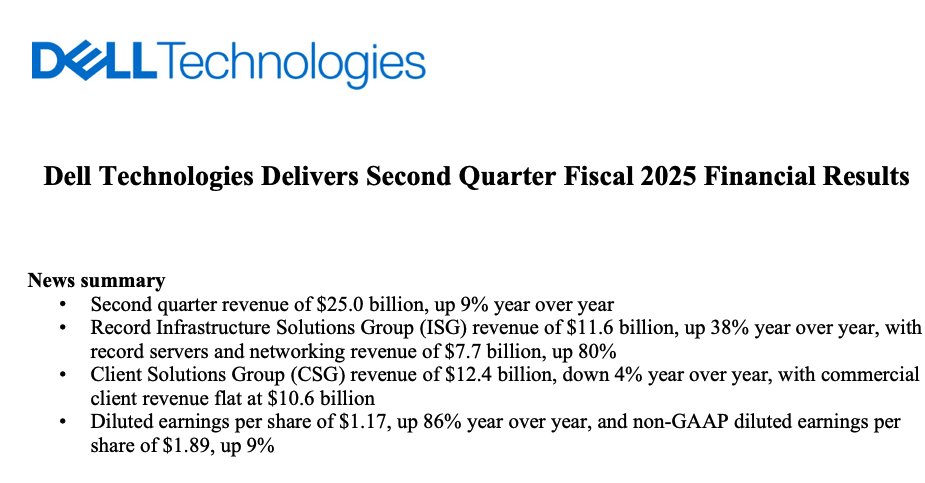

On the other hand, AI was the biggest driver of the firm’s earnings

As an analyst with over two decades of experience in the tech industry, I must admit that Dell Technologies’ decision not to add BTC to its holdings in Q2 left me somewhat perplexed. Given Michael Dell’s public support for Bitcoin on Twitter and the results of the company’s poll on AI versus Bitcoin, it seemed like a natural progression for the tech giant to follow in the footsteps of companies like MicroStrategy.

Michael Dell, head of tech giant Dell Technologies, fell short of Bitcoin supporters’ expectations when it was disclosed that the company hadn’t implemented a Bitcoin strategy during Q2. The crypto community had anticipated that Dell would announce Bitcoin holdings in their Q2 earnings report on August 29, given the CEO’s vocal support for the leading cryptocurrency on his social media platform (previously Twitter).

Dell’s ‘public support’ for BTC

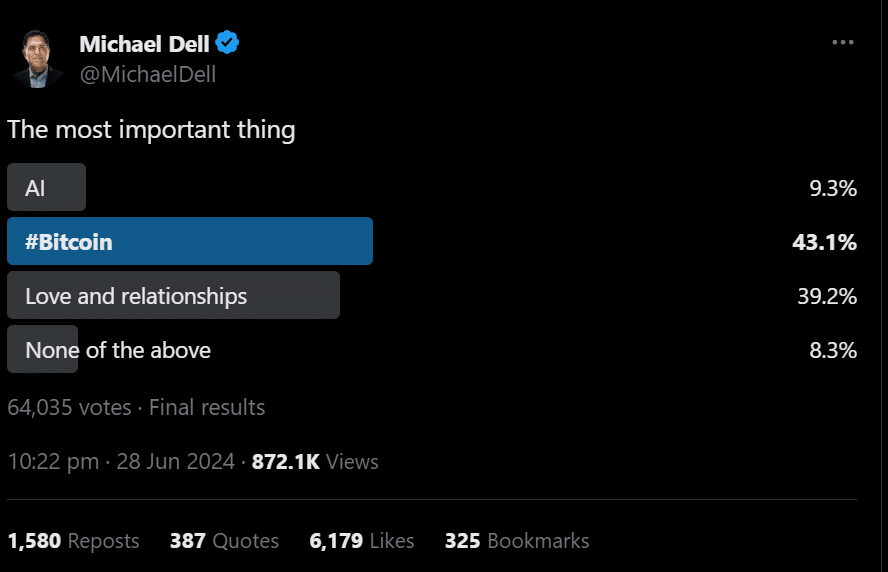

In June, Dell conducted an X poll to determine ‘the most important thing’ between AI, BTC, and love/relationships. The poll results ranked BTC higher than the rest of the items and attracted positive reactions from some of the top BTC bulls like Michael Saylor.

Just a week prior to the mentioned survey, the Chief of Dell Technologies shared an enigmatic statement: ‘Scarcity increases worth.’ This saying is often linked with Bitcoin due to its limited supply of only 21 million units.

Through these posts, it seemed as though the executive was favoring cryptocurrency assets. This led some to speculate that Dell might follow in the footsteps of Michael Saylor and MicroStrategy by implementing a well-known Bitcoin (BTC) strategy.

Nevertheless, Bitcoin (BTC) was not included in the company’s Q2 earnings report, leading many cryptocurrency observers to express their dismay as their expectations for BTC were unmet.

Intriguingly, it’s worth noting that Bitcoin outranked AI in a recent poll, but it wasn’t AI that significantly influenced our company’s Q2 earnings. Instead, AI played a pivotal role. Reflecting on our Q2 performance, Dell Technologies’ Vice Chairman Jeff Clarke commented on this paradoxical situation.

In the second quarter, our AI progress has picked up speed significantly, and we’ve observed a consistent rise in corporate clients adopting AI technologies on a quarterly basis.

It’s noteworthy that MicroStrategy’s approach to Bitcoin management, where they hold Bitcoin within their reserves, has been followed by companies such as Semler Scientific and Metaplanet.

As an analyst, I’m sharing that as of the current press time, MicroStrategy holds approximately 226,500 Bitcoins, valued at over $13 billion. The primary objective behind this strategic move is to enhance the value of our underlying stock, particularly in light of the growing institutional adoption of Bitcoin through ETFs. This observation was made by Eric Semler, Chairman of Semler Scientific, who has highlighted this trend.

“We’re heartened by the rising number of institutions adopting Bitcoin. In a recent development, these institutions hold over 20% of Bitcoin ETF assets – a first. We anticipate that this growing institutional presence will boost Bitcoin’s value, benefiting both its price and our shareholders.”

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-08-31 10:15