-

The price can be attributed to different factors, including panic selling and declining trader interest.

NOT was oversold, and might soon begin a recovery toward $0.012.

As a seasoned crypto investor, I’ve seen my fair share of market volatility and price swings. The recent plunge in Notcoin (NOT) from $0.011 to its current price of $0.098 was a harsh reminder of the unpredictable nature of this asset class.

As an analyst, I’d rephrase that sentence as follows:

Unexpectedly, the price of Notcoin dropped by 18.38% within the past 24 hours, causing it to be traded at a lower rate. As of now, Notcoin is being exchanged for $0.098.

As a researcher studying market trends, I noticed that the price hit its lowest point since the initial sale and airdrop event.

What’s behind Notcoin’s plunge?

As a researcher studying the recent price fluctuations of Notcoin, I can’t ignore the fact that there are multiple reasons for its decline. However, one aspect we must consider is the ongoing situation with Bitcoin (BTC). Lately, the defunct exchange Mt.Gox has been making preparations to distribute Bitcoin to its creditors. This event may have an impact on Notcoin’s market value due to the interconnectedness of these two cryptocurrencies.

Fourth of July saw the firm transferring several billion dollars from cold storage for initiating the payouts.

As a crypto investor, I felt a wave of anxiety wash over me when that development unfolded. Many other investors, myself included, felt compelled to sell off some of our cryptocurrencies in response. Even those holding Notcoin weren’t exempt from this market panic.

As an analyst, I’ve observed a striking contrast between the buzz generated for this project through its Telegram community and the subsequent decline in NOT‘s value. Yet, it’s essential to note that this downward trend extended beyond the cryptocurrency exchanges.

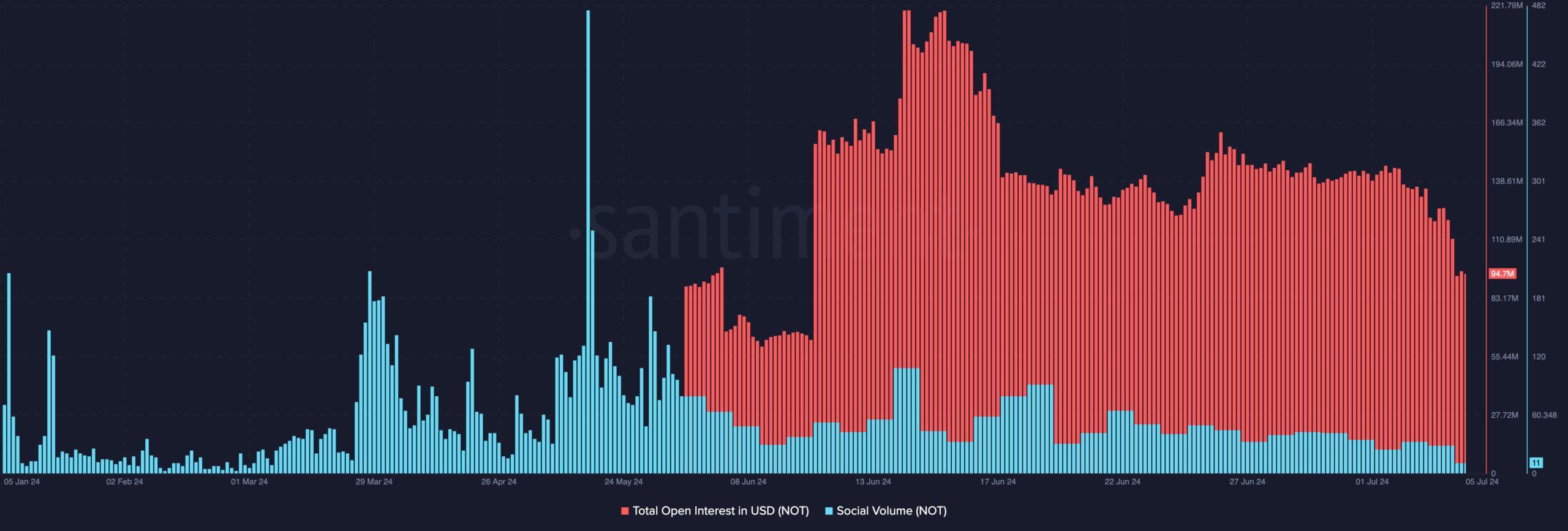

As an analyst, I’ve examined AMBCrypto’s insights and found that the derivatives market significantly influenced Notcoin’s price behavior. A critical factor keeping Notcoin’s price near previous highs was Open Interest (OI). In simpler terms, the presence of numerous open positions in derivative contracts contributed to Notcoin’s resilience at those levels.

From my perspective as a researcher, at present, Open Interest (OI) for Notcoin has dipped below the $100 million threshold. I’m referring to Open Interest here as the total value of ongoing derivative contracts in the market.

An uptick indicates that traders are increasing the market’s liquidity by opening new positions. Conversely, a downturn, such as what NOT experienced, signifies that traders are closing positions and withdrawing funds.

As a crypto investor, I’ve noticed that Notcoin’s current trend might make it challenging for the asset to recover some of its recent price losses. One significant factor contributing to this downturn is the decrease in Social Volume, which has further intensified the selling pressure on NOT.

As a researcher studying the relationship between social media activity and cryptocurrency prices, I’ve observed that an increase in social volume – the number of text documents or search queries related to a particular asset – often results in a corresponding rise in the asset’s price. However, at the current moment, social volume for this cryptocurrency has reached an unusually low level.

The need for NOT was significantly less than the market’s supply pressure, resulting in a subsequent price decrease.

On-chain indicators

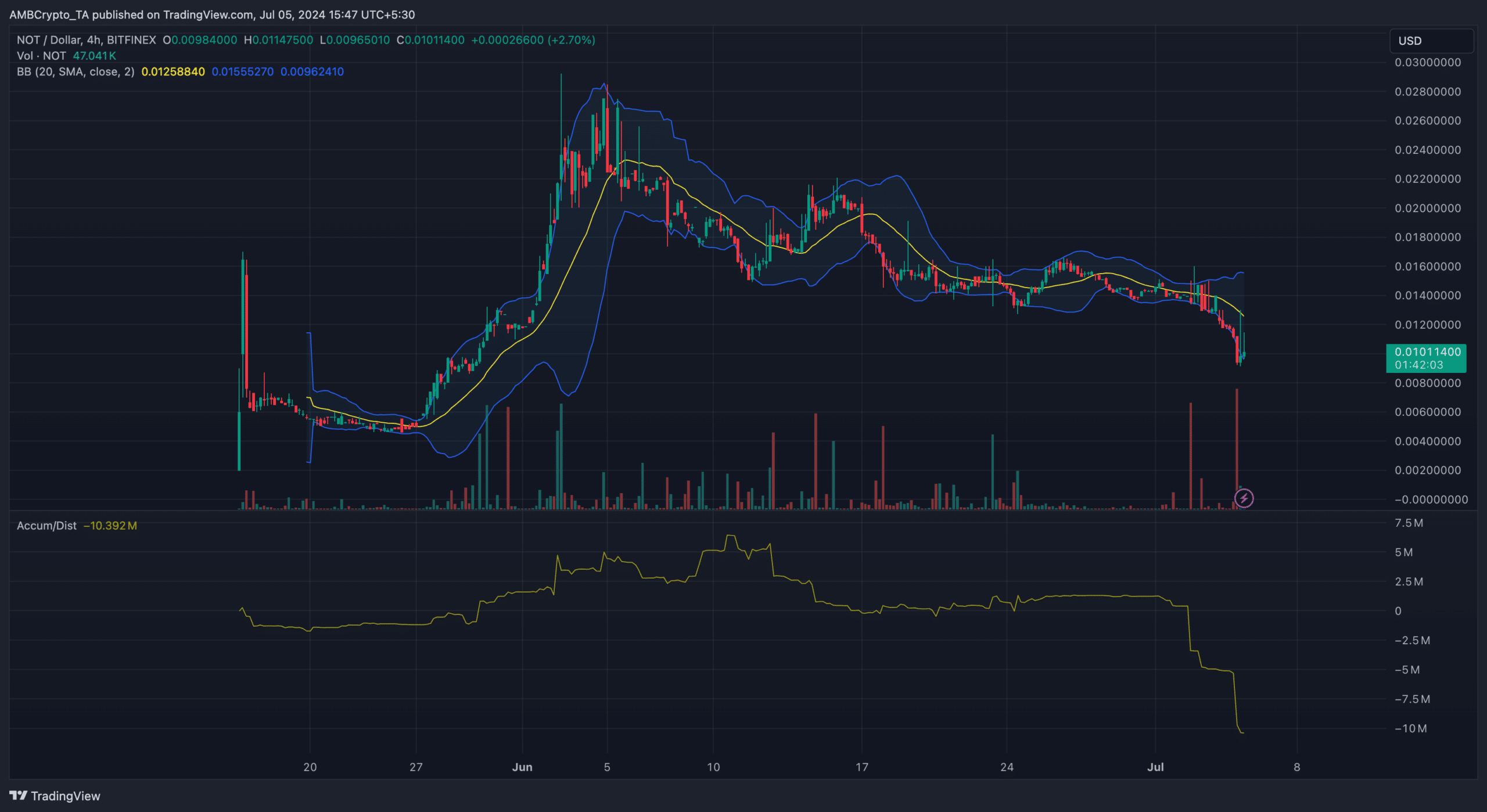

Based on a technical examination, the NOT/USD 4-hour chart as analyzed by AMBCrypto revealed a downturn in the Accumulation/Distribution (A/D) line, specifically at a reading of approximately -10.38 million.

As a crypto investor, I’ve noticed that a significant number of people holding the cryptocurrency have been selling the token since the 2nd of July. When I examined the Bollinger Bands (BB), I saw that the volatility had increased, with the bands expanding to indicate greater price swings.

Realistic or not, here’s NOT’s market cap in TON’s terms

As an analyst, I’ve observed the Bollinger Bands (BB) for Notcoin reaching its lower boundary at approximately $0.093. This signifies that the token has been oversold in the market. Should buying pressure emerge at this juncture, Notcoin could potentially initiate a trend leading it to around $0.012.

As a researcher, I would caution that if the overall market sentiment persists in fear, my previous projection for Notcoin’s value at $0.12 may not materialize. Instead, it is possible that Notcoin could reach a low of $0.086.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-07-05 21:12