- Notcoin’s bullish falling wedge hinted at a 60% rally if it broke the crucial $0.0076 level.

- 79% whale control and low BTC correlation could amplify Notcoin’s potential upside breakout trajectory.

As a seasoned researcher with years of experience in analyzing the crypto market, I find myself intrigued by the bullish potential of Notcoin (NOT). The falling wedge pattern and the 60% rally hinted at if NOT breaks the crucial $0.0076 level is indeed an interesting development.

In simpler terms, Notcoin isn’t behaving as usual. It’s forming a pattern called a “falling wedge,” which is typically associated with a bullish turnaround. This pattern is identified by two downward-sloping lines that gradually converge. If crypto analyst Ali is correct, if Notcoin manages to break above its resistance level at $0.0076, there’s potential for its price to jump by approximately 60%.

The wedge shape in prices has been developing since early July, implying that the prolonged downward trend could be nearing its conclusion.

Should the price exceed the upper trendline, potential future resistance points can be located by applying Fibonacci retracement ratios.

Important thresholds to keep an eye on are found at $0.0231667 (level of 0.236), $0.01619219 (level of 0.382), $0.01347901 (level of 0.5), $0.01122045 (level of 0.618), and $0.00864199 (level of 0.786).

The measurement of the wedge’s height, either at 0.00450413 or approximately 60.68%, implies a potential breakout point near the 0.618 Fibonacci level.

Current price and trading volume

Currently, Notcoin (NOT) is being exchanged at $0.007009, representing a decrease of 1.68% in the past day and a more significant drop of 9.57% over the last week. In the last 24 hours, the trading volume has climbed to $128,079,916, suggesting that there’s been considerable market activity, even with the ongoing downtrend.

At $0.00619681, the lowest point on the graph could serve as a possible floor for prices should they decline any more. Furthermore, the bottom edge of this wedge shape also functions as a support line, strengthening the overall structure of the bullish reversal pattern.

Technical indicators point to low volatility

On the daily chart, the Bollinger Bands indicate a period of low price fluctuations. At present, the price is close to the lower band, suggesting that it could be undervalued or oversold. This positioning may potentially trigger a price movement towards the middle band.

Currently, the Relative Strength Index (RSI) stands at 41.58, signifying a lack of strong momentum, but not yet in the oversold territory. If the RSI rises above 50, it might suggest a move towards stronger bullish momentum. Conversely, a fall below 30 could indicate increased bearish pressure.

The Aroon indicator suggests a weak upward trend at around 35.71% (as it’s barely moving up) and a more substantial downward trend making up about 64.29% (it’s moving down quite noticeably), indicating that the market is currently under bearish influence.

To indicate a possible change in direction, it’s important for the Aroon Up indicator to rise. This suggests an increasing strength of buyers in the market, potentially signaling a bullish trend.

Large holders maintain control, impact on Bitcoin

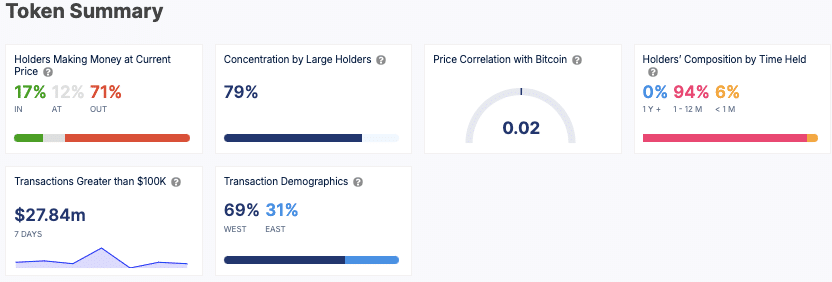

According to IntoTheBlock’s data analysis, approximately 71% of Notcoin owners are experiencing a financial loss right now, whereas just over 17% are seeing profits with the current pricing.

This demonstrates that most investors are currently below their entry points, a factor that could influence trading behavior.

To add on, about three-quarters (75%) of this supply is managed by substantial investors, indicating that these ‘whales’ have a substantial chunk of the total circulating supply under their control.

A high level of this substance might lead to greater price fluctuations, particularly when there are major shifts in the market.

The relationship between Notcoin and Bitcoin is remarkably weak, as demonstrated by a correlation coefficient of just 0.02. This suggests that Notcoin generally behaves differently from Bitcoin’s price fluctuations.

Read Notcoin’s [NOT] Price Prediction 2024–2025

The holding composition reveals that 94% of holders have retained the token for 1-12 months, indicating a mid-term commitment to the asset.

In contrast, only 6% of holders are new, suggesting limited recent adoption or interest.

Read More

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- OM PREDICTION. OM cryptocurrency

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Jay-Z and Diddy Celebrate as Rape Lawsuit is Shockingly Dismissed!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

2024-10-30 16:08