- Notcoin has dropped over 70% since its peak in January, trading at $0.008488 at press time.

- Technical indicators showed that the asset was oversold, pointing to a possible rebound to key levels before continuing its downtrend.

As a seasoned researcher with years of experience in the unpredictable world of cryptocurrencies, I’ve learned to never underestimate the volatility of this market. Notcoin (NOT) has been on quite a rollercoaster ride lately, plummeting over 70% since its peak in January and currently trading at $0.008488.

Since attaining its peak at $0.02836 in January, Notcoin [NOT] has been on a continuous slide, shedding over 70% of its worth.

At the moment I’m typing, the price wasn’t sitting at $0.008488, representing a 4.8% drop over the last 24 hours. However, even with this continuous fall, technical analysis hinted that a possible recovery could be imminent.

Possible rebound ahead?

As a researcher studying the cryptocurrency market, I’ve noticed that Notcoin is currently experiencing a bearish trend. However, some technical indicators hint at an imminent short-term recovery for this asset.

The chart showing the asset’s price movements indicates a persistent pattern of decreases, culminating in a situation where the asset is undervalued or overbought, depending on the specific market analysis.

In financial markets, if an asset is heavily sold, it can suggest that there might be a potential price increase coming up.

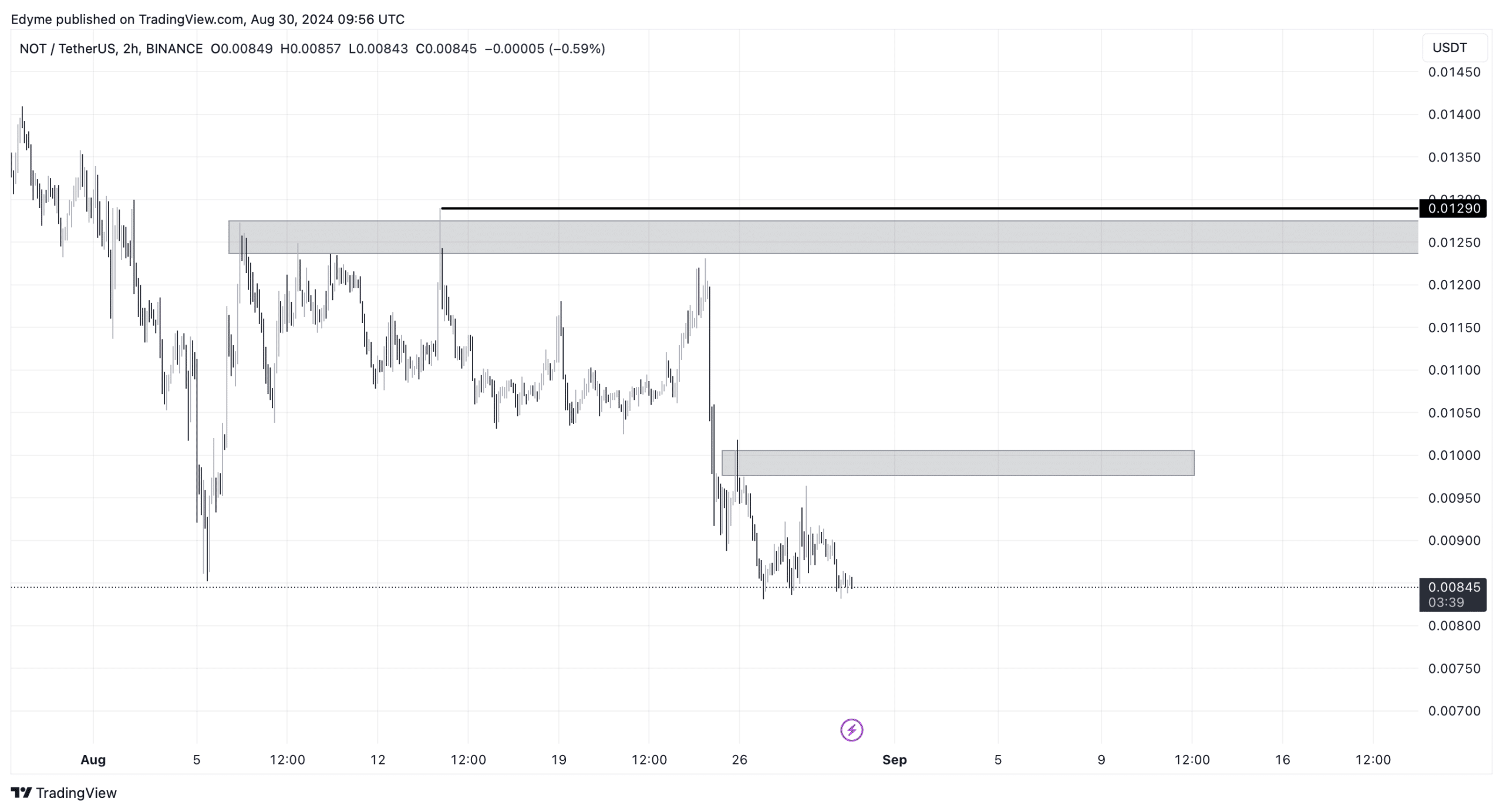

In this 2-hour timeframe chart for NOT, we can spot possible points where the price might bounce back. These points correspond to zones of market activity (liquidity) and are strategically located within the higher-high, higher-low pattern (a specific swing structure).

Lately, Notcoin’s price has dipped beneath a significant swing low, a situation frequently followed by an upward trend. The initial point worth observing for a possible recovery lies between $0.0975 and $0.01018.

If this level is breached, the next target is higher at $0.0123 to $0.0129.

If Notcoin surpasses these two price points, including the $0.0129 area, it might suggest a shift in market structure, possibly hinting at the onset of an uptrend.

Notcoin provides mixed signals

Looking past just technical analysis, it’s important to consider the fundamentals when deciding if a potential recovery awaits NFTs.

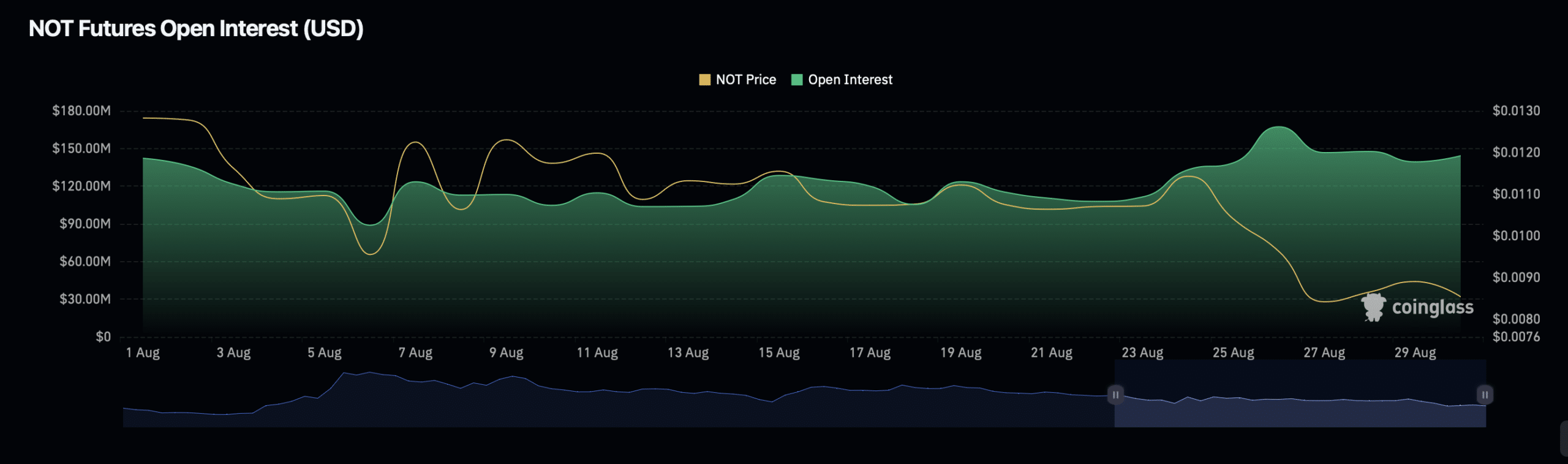

According to data from Coinglass, there was a modest 0.53% rise in the Open Interest for NOT during the previous day, which currently values it at approximately $145.80 million as of now.

Conversely, there’s been a substantial drop in the Open Interest volume, falling by approximately 42% to reach $783.92 million.

A drop in the number of trades (Open Interest) might indicate decreasing enthusiasm or faith among traders, potentially leading to a decrease in NOT‘s price even though Open Interest slightly grew.

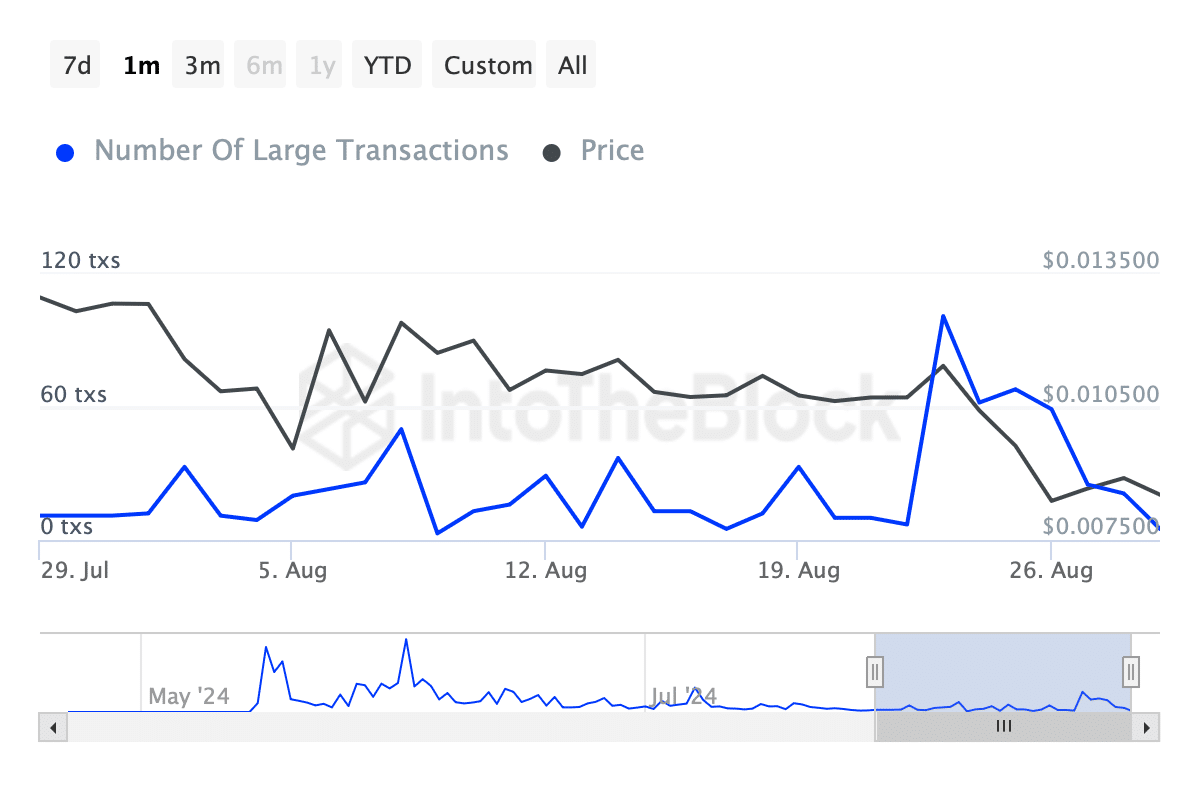

As a crypto investor, I’ve noticed a substantial decrease in whale activity within the Notcoin market. Based on data from IntoTheBlock, the number of large transactions, specifically those valued over $100,000, has dropped dramatically.

Read Notcoin’s [NOT] Price Prediction 2024–2025

The transaction count reached a high of 101 last week, but it’s dropped significantly since then, standing at only five transactions as we speak (at the time of publication).

A significant drop in big deals may signal diminished trust from key investors, potentially impeding a swift recovery in the short run.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PGA Tour 2K25 – Everything You Need to Know

2024-08-30 19:36