-

NOT stagnated near $0.12 as demand and inflows flattened

However, +10% potential gains would be at stake if $0.014 is retested

As a seasoned researcher with a knack for deciphering cryptocurrency market trends, I find myself intrigued by the recent developments surrounding NOT. The listing on Binance and the overall market rebound have certainly given this token a boost. However, the stagnation near $0.12 is a bit concerning, especially considering the potential 10% gains at stake if we revisit $0.014.

Beyond the general market recovery, tokens associated with projects tied to Telegram and The Open Network (TON) saw growth following Toncoin‘s listing on Binance. This positive impact extended to games like Notcoin [NOT], as well.

The initial jump and surge of 15% didn’t occur, instead hitting a mark of $0.012 upon its debut on August 8th. Since then, however, the price has remained relatively steady. So, what can we expect next for this popular Telegram game?

NOT – Key levels to watch

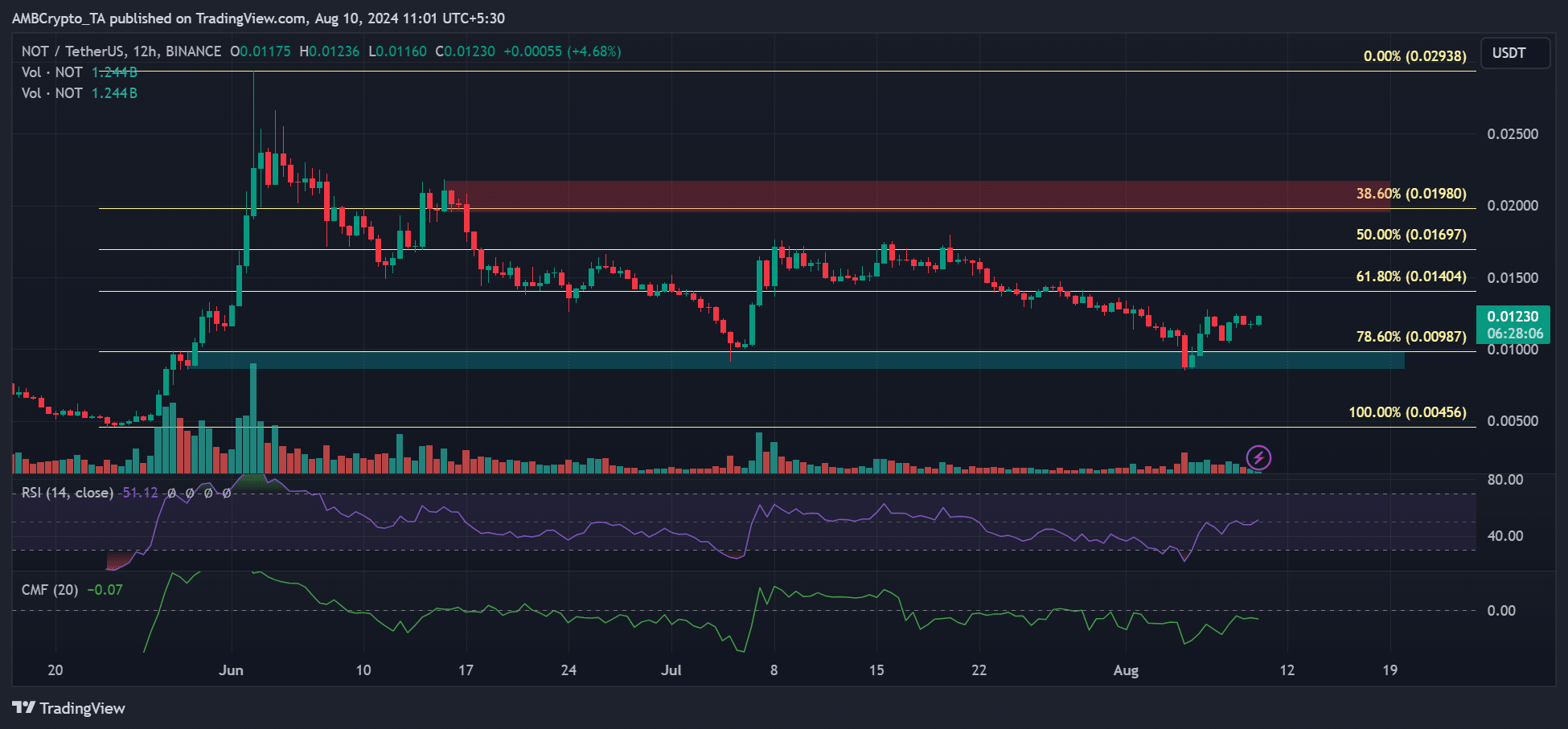

Over the last two months, the price of $0.01 has served as a crucial support point on the 12-hour chart. This level attracted bulls significantly as it combined a bullish order block (OB) with the 76.8% Fibonacci level.

As a crypto investor, I had my eyes set on two significant resistance levels: the 61.8% Fibonacci level at $0.014 and the 50% Fib level at $0.016. The 50% Fib level was particularly important because it acted as a barrier, preventing any further price surge in July. These levels were my immediate bullish targets, and I closely monitored them for potential opportunities.

So, where could NOT head next?

In simple terms, when I was composing this, the price charts showed no clear bias towards either a rise or fall in value. This was evident as both the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) were close to their average values, suggesting minimal demand and little money flow movement.

Nevertheless, it’s plausible that we might see a further push towards our projected bullish peak at approximately 61.8%, or $0.014. This represents a potential increase of about 10%.

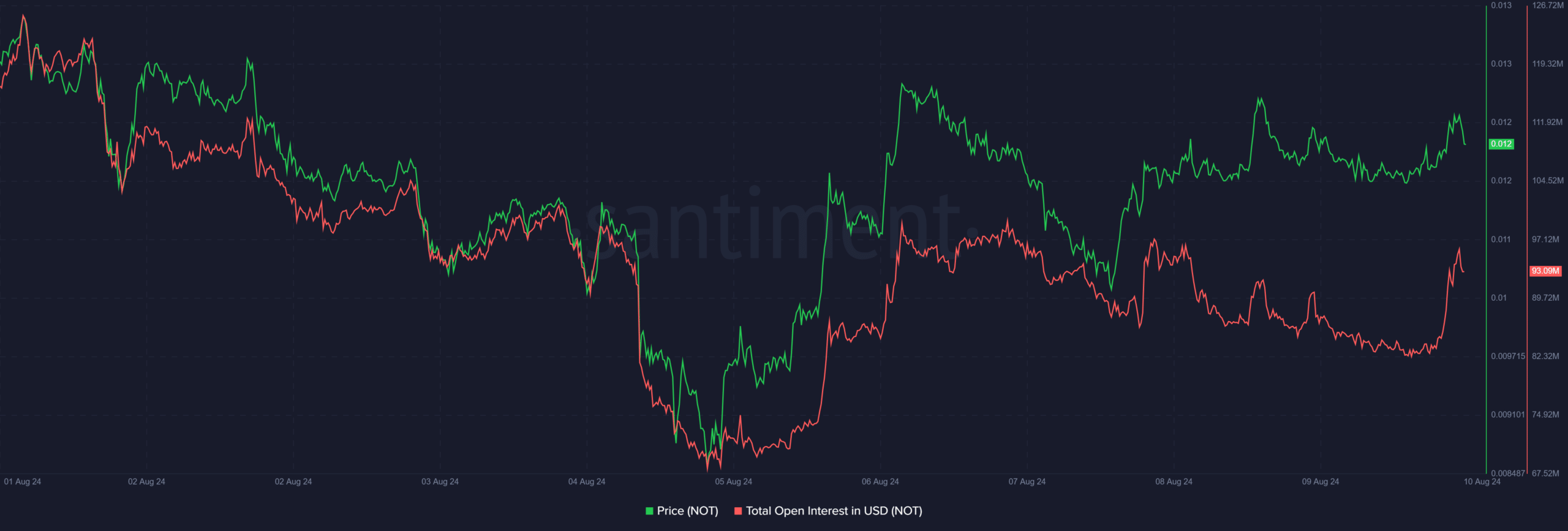

As a crypto investor, I’ve noticed that an increase in Open Interest (OI) can serve as evidence supporting the bullish thesis. On August 10th, I saw that the OI for NOT‘s Futures market surged by approximately 10%, rising from $80 million to over $90 million. This spike indicates a surge of liquidity flowing into our market, which could potentially contribute to its recovery.

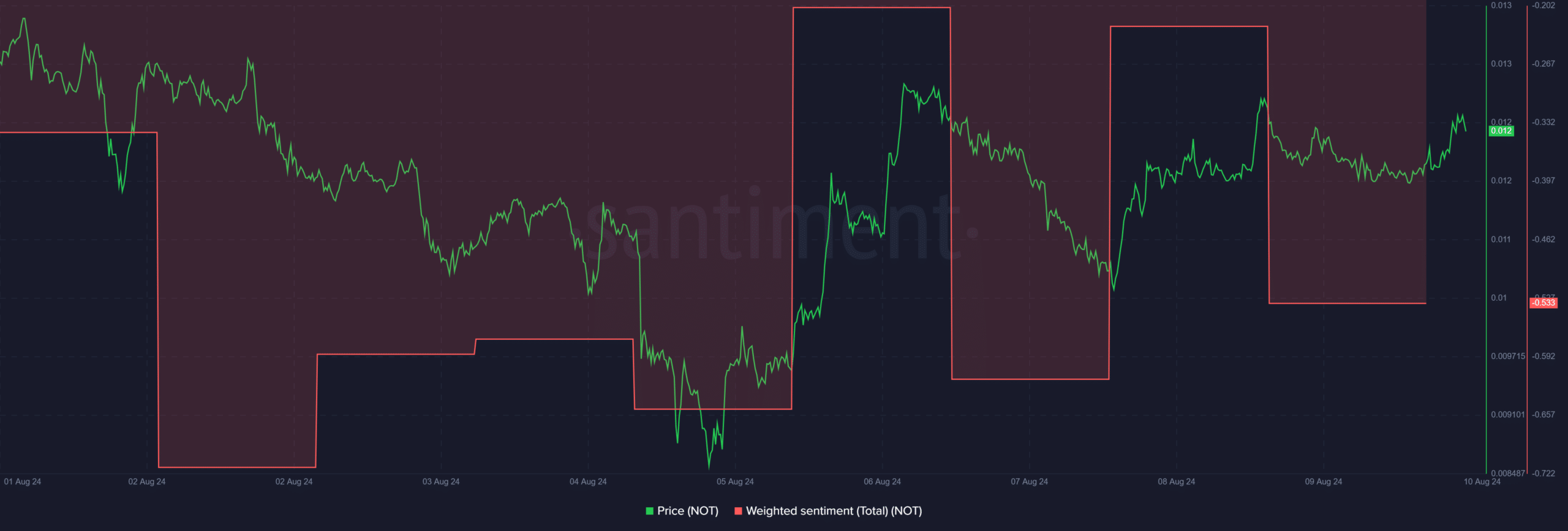

As a crypto investor, I’ve noticed an increase in Open Interest (OI), suggesting a bullish outlook. However, when considering NOT‘s weighted sentiment, it has dipped below the neutral point and moved into negative territory. This means that although there is increased activity, the general sentiment among investors seems to be bearish.

Initially, additional declines in NOT‘s sentimental value hindered its price recovery, and a comparable pattern might prolong the test to reach $0.014 again.

Read Notcoin Price Prediction 2024-2025

To summarize, NOT has been propelled by two primary factors: a general market upturn and increased attention towards Telegram-related projects following the listing of Toncoin on Binance. Although it’s probable that the price may revisit $0.014, pessimistic sentiment over the weekend could postpone this scenario temporarily.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-08-10 18:15