-

NOT’s momentum was bearish, and this could lead the price to $0.015.

The project’s development team plans to buy unclaimed tokens, suggesting a bullish price in the near future.

As a researcher with some experience in analyzing cryptocurrency markets, I’ve been following NOT closely due to its unique characteristics. Based on the latest data, it seems that NOT’s price has taken a bearish turn, with the token currently trading at $0.017. This represents a 12% decline in the last 24 hours.

As a crypto investor, I’ve noticed that the broad market downturn has rendered obsolete many previous Notcoin (NOT) price forecasts, according to AMBCrypto’s findings. Currently, NOT is trading at $0.017, reflecting a 12% decrease in value over the past 24 hours.

Sixteen days ago, we shared that NOT bucked the general market trend as its price rose. Yet, it was unexpected that this uptrend was short-lived. Notably, this token has previously gone against the wider trend on various instances.

NOT goes back to its old ways

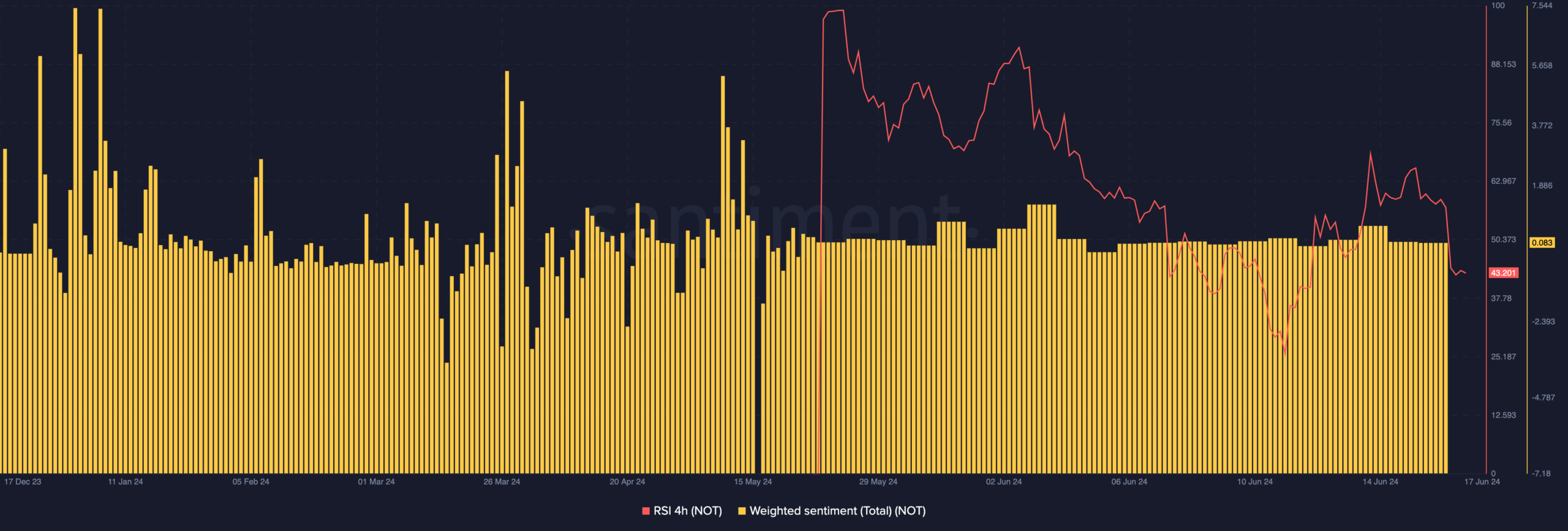

Based on our analysis, a decrease in purchasing pressure contributed to Notcoin’s price drop. The Relative Strength Index (RSI) on the 4-hour chart stood at 43.20 as of now.

As a market analyst, I would explain that the Relative Strength Index (RSI) is a technical indicator that quantifies the size and frequency of price changes in a particular financial instrument, such as a cryptocurrency. It helps in identifying potential overbought or oversold conditions by comparing the recent gains to the losses over a specified period. When the RSI reading reaches 70 or above, it suggests that the cryptocurrency has experienced significant gains and may be considered overbought, potentially setting the stage for a price correction.

However, when the RSI is below 30, it means that it is oversold.

With a reading under $0.50 for the coin, it signals that sentiment towards NOT has turned bearish, implying potential price decreases for Notcoin. Further declines in the reading may lead to increasingly pessimistic Notcoin price forecasts.

Despite this, the Weighted Sentiment score remains above the threshold for negativity. The Weighted Sentiment measure reflects the general sentiment of most market players regarding a particular project.

In simpler terms, if the majority of comments express optimism towards a particular topic, we can interpret this as a positive reading. Conversely, if the comments indicate pessimism or negativity, then we have a negative reading. These readings suggest that the overall sentiment towards the topic is bullish in the case of positivity and bearish when there’s a negative reading.

The Weighted Sentiment’s capacity to remain positive may hinder NOT from undergoing additional adjustments. If this occurs, the price of NOT could climb up to $0.021.

From my perspective as a crypto investor, if the Notcoin price fails to hold its ground and drops significantly, we could be looking at a catastrophic fall in its value. If this unfavorable prediction comes true, the price of Notcoin may plummet down to $0.015.

Notcoin’s proposal fuels traders’ conviction

During this period, the Notcoin team declared that the NOT airdrop redemption process has come to an end. Let me remind you that NOT was initially distributed through a tap-to-earn game.

A project distributes cryptocurrency rewards to eligible recipients through an airdrop.

Alongside the revelation, the project announced a total of 11.5 million token holders. Unclaimed tokens were indicated to be destroyed, while stakeholders were promised additional incentives. The announcement was made on platform X.

As a crypto investor, I’d interpret this as follows: The majority of the price decrease has already been distributed to token holders. Any unclaimed tokens will be allocated towards future project development. Furthermore, investors who staked at the Gold and Platinum levels will receive an added reward.

Should the mechanism be set ablaze, Notcoin’s supply would decrease, making it less prevalent in the market. Consequently, this scarcity could contribute to an optimistic outlook on its pricing trend.

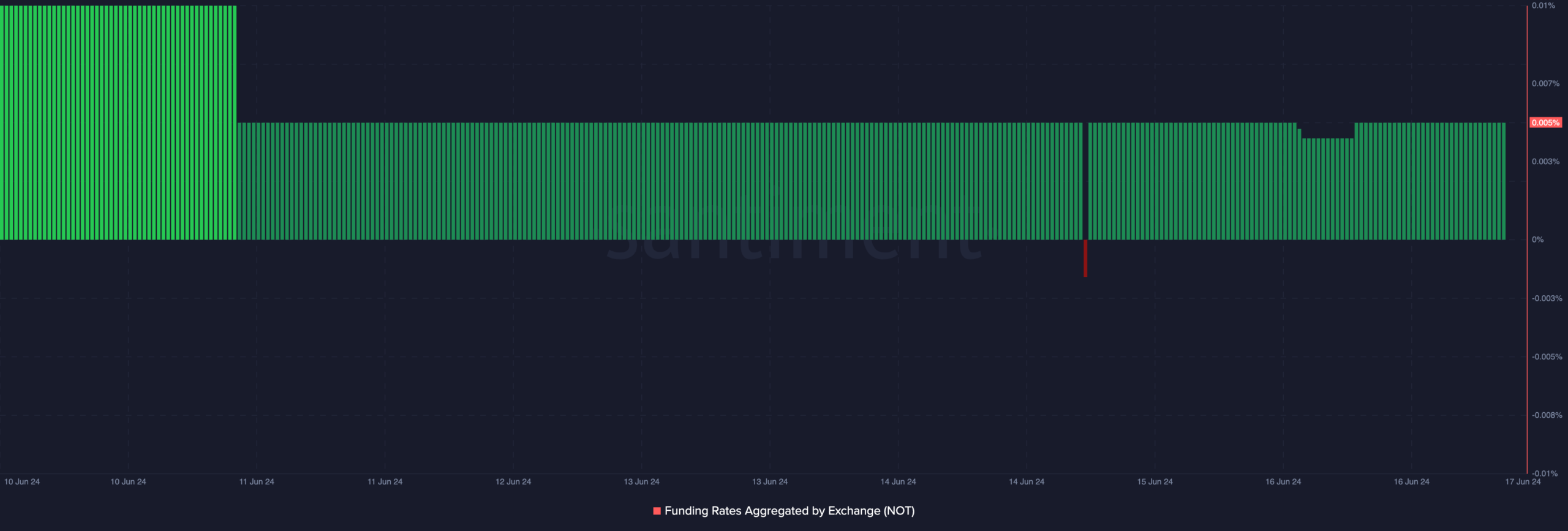

Additionally, it seemed that traders held a positive outlook regarding NOT‘s price, as indicated by the Funding Rate.

Realistic not, here’s NOT’s market cap in TON terms

As a crypto investor, I’d interpret it this way: At the current moment, Notcoin’s Funding Rate is showing a positive figure. A favorable reading of this metric signifies that long investors are compensating short investors to maintain their positions. In simpler terms, long traders are essentially paying a premium for shorts to hold their bets open. This situation reflects an overall optimistic outlook among traders towards Notcoin.

If buying demand continues to grow in the spot market as things stand, Notcoin’s price could surpass earlier predictions.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-06-18 09:11