-

Notcoin regained its short-term bullish market structure.

The volume indicators of NOT signaled a lack of buying pressure despite enthusiasm in the Futures markets.

As a researcher with experience in analyzing cryptocurrency markets, I’m observing Notcoin (NOT) with a critical eye. The technical findings suggest that NOT has regained its short-term bullish market structure, but there are some concerning indicators that I cannot ignore.

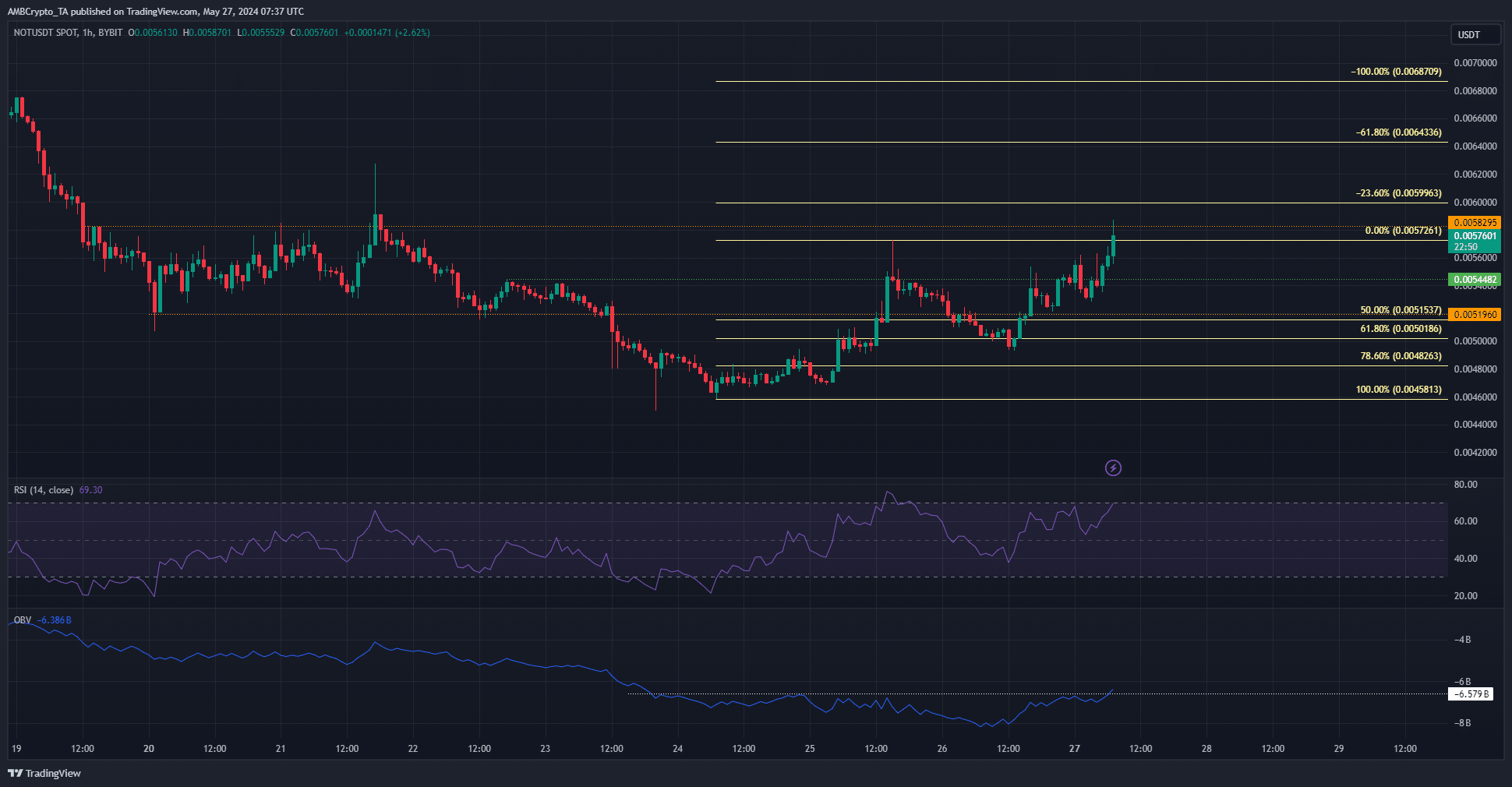

The price of Notcoin [NOT] picked up momentum again, displaying a bullish pattern on shorter charts. It surpassed a significant resistance point at $0.0054.

Notcoin had been in a downtrend a week ago but began to shift its trend in the past four days.

The AMBCrypto article noted that the token had experienced a significant decrease, amounting to over 50%, in value since its debut on May 16th.

The activity on Toncoin (TON) picked up significantly following the NOT airdrop, yet it has since decelerated noticeably over the last week.

The technical findings showed bullishness

As a crypto investor, I’ve noticed that the price had reached a significant support level at $0.00544, which was indicated by a green marking on my chart. This level represented the downtrend’s lowest peak since the 22nd of May.

On May 25th, Notcoin dropped below a certain threshold and then bounced back up to $0.00493, marking a new low that was higher than the previous one. This move suggested a potential change in trend towards optimism or bullishness.

As a researcher studying the price movement of NOT, I’ve observed that since hitting its higher low, the token has experienced a 16% increase and appears primed for further growth. However, the $0.0058-$0.006 range may present resistance to NOT’s upward trajectory. Additionally, the Relative Strength Index (RSI) on the one-hour chart signals robust bullish momentum for NOT.

The OBV (On Balance Volume) failed to surpass a previous resistance level at the time of writing. A breakthrough above this level would indicate significant buying activity and potentially lead to further price gains.

The Fibonacci extension levels at $0.006, $0.0064, and $0.0068 are the next targets for the buyers.

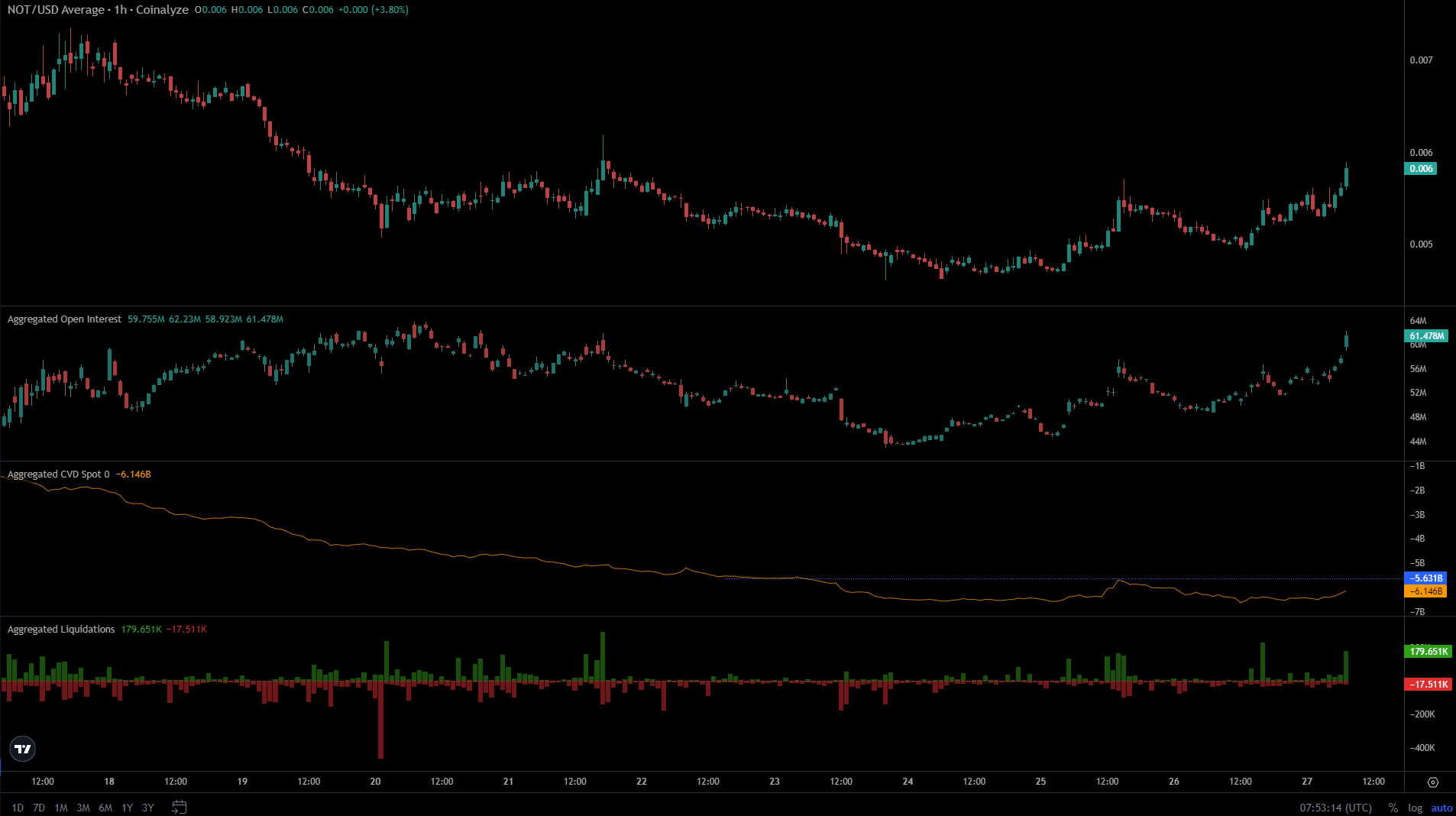

The spot CVD saw the same trouble as the OBV did

As an analyst, I’ve noticed a significant increase in open interest within the last 24 hours, with the figure rising from $44 million to $61 million. Simultaneously, prices have surged past the 10% mark during this same time frame.

This was a sign of bullish conviction in the Futures market and showed traders willing to go long.

A sudden increase in activity led to numerous brief sell-offs, further boosting prices. Surprisingly, the physical CVD market remained fairly tranquil amidst this intensity.

Realistic or not, here’s NOT’s market cap in BTC’s terms

The price has seen an upward surge, while it hasn’t followed suit, raising questions about the presence of sufficient buyers in the spot market. There’s a worry that much of the recent price increase might be attributed to derivative markets.

This would need to change for a sustainable rally to take place.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-05-28 00:07