-

Notcoin is likely to fall towards the short-term range lows

NOT swing traders could look for buying opportunities, but can wait for lower timeframe bullish sentiment before entering

As a seasoned crypto investor with several years of experience under my belt, I have learned to read between the lines when it comes to market analysis and price predictions. And based on the current state of Notcoin (NOT), I believe we are in for some short-term bearishness.

Notcoin’s bulls have experienced favorable conditions recently. The successful breach above the trendline resistance has been sustained, yet a price range has emerged as well. This situation presents numerous trading possibilities, but for investors, it’s crucial to practice patience.

In the upcoming days, swing traders might consider adjusting their positions based on Notcoin’s predicted price range. However, insights from the Futures market indicate a potential lack of optimism among bulls.

Good chance of a 5.6% price drop

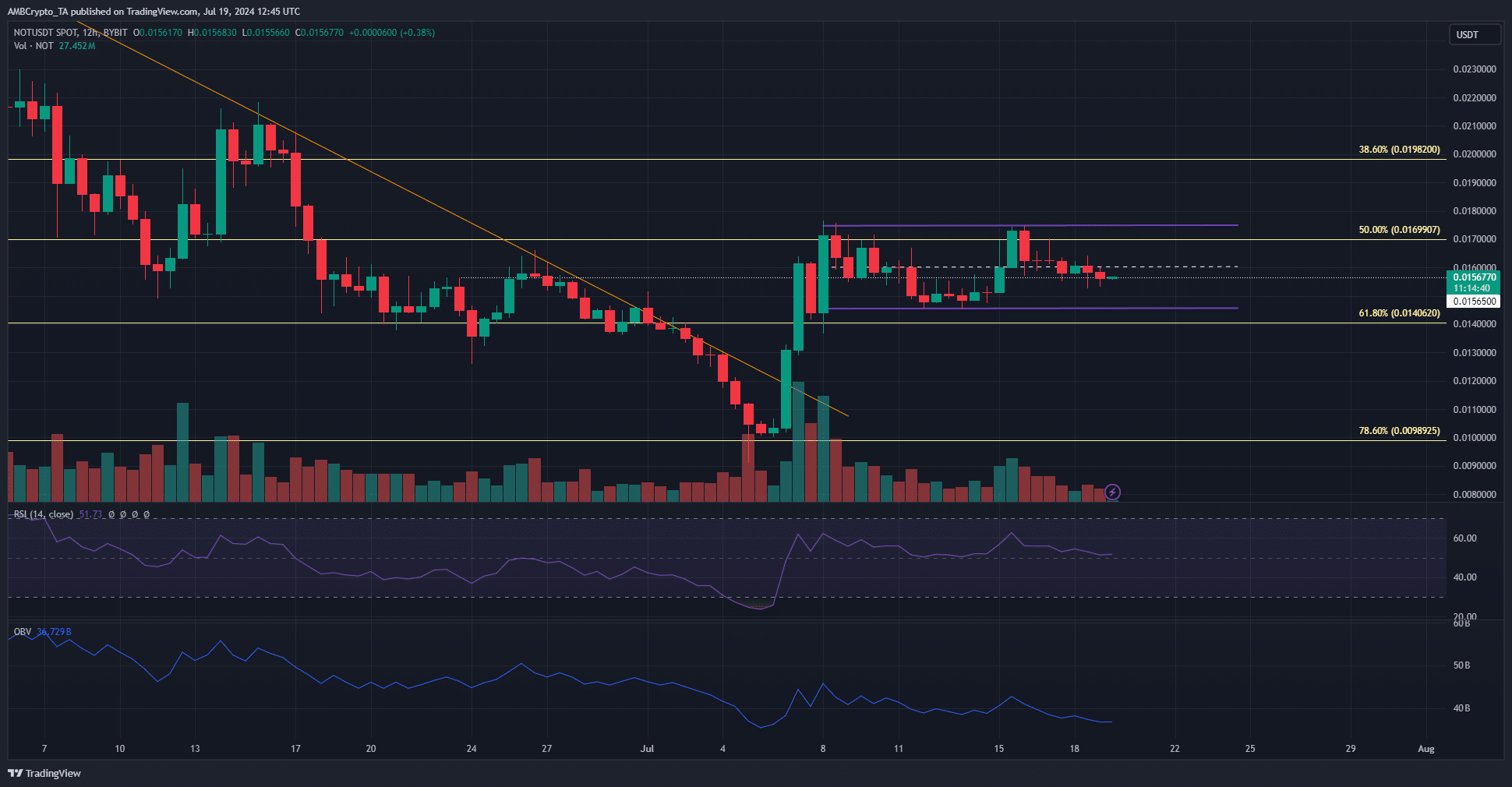

On the chart, a range marked in purple for Notcoin’s price action since July 8 stands out. It spans from $0.0145 to $0.0175, with the midpoint being at $0.016. This particular level has now shifted into resistance after acting as support previously.

At the moment of publication, the Relative Strength Index (RSI) stood at 53, precariously clinging above the neutral threshold of 50. This implies that the momentum is currently neutral but could potentially turn bearish if the price dips below the $0.156 mark.

Although the price surpassed the trendline resistance (signified in orange) on July 6th, the On-Balance Volume (OBV) has scarcely regained ground since its prolonged downtrend in July. This observation implies that buying power has been insufficient and short-term losses may be imminent.

Notcoin price prediction is bearish due to unenthusiastic buyers

Despite a nominal positive funding rate, recent market behavior didn’t indicate bullish sentiment. The chart for liquidations revealed a surge in long positions being closed following the recent price rejection at the upper range three days prior.

Read Notcoin’s [NOT] Price Prediction 2024-25

Additionally, the Open Interest has been tepid after the move past the $0.014 resistance.

As a crypto investor closely monitoring the market trends, I’ve noticed that the most prominent bearish sign comes from the persistent downtrend in the CVD (Crypto Value Dollar) spot price. Based on this technical indicator, a potential drop below the $0.014 mark could be imminent.

Read More

2024-07-20 11:03