-

NOT breached the trendline resistance, resulting in a bullish market structure.

The drop below $0.015 might continue if the buying pressure does not increase.

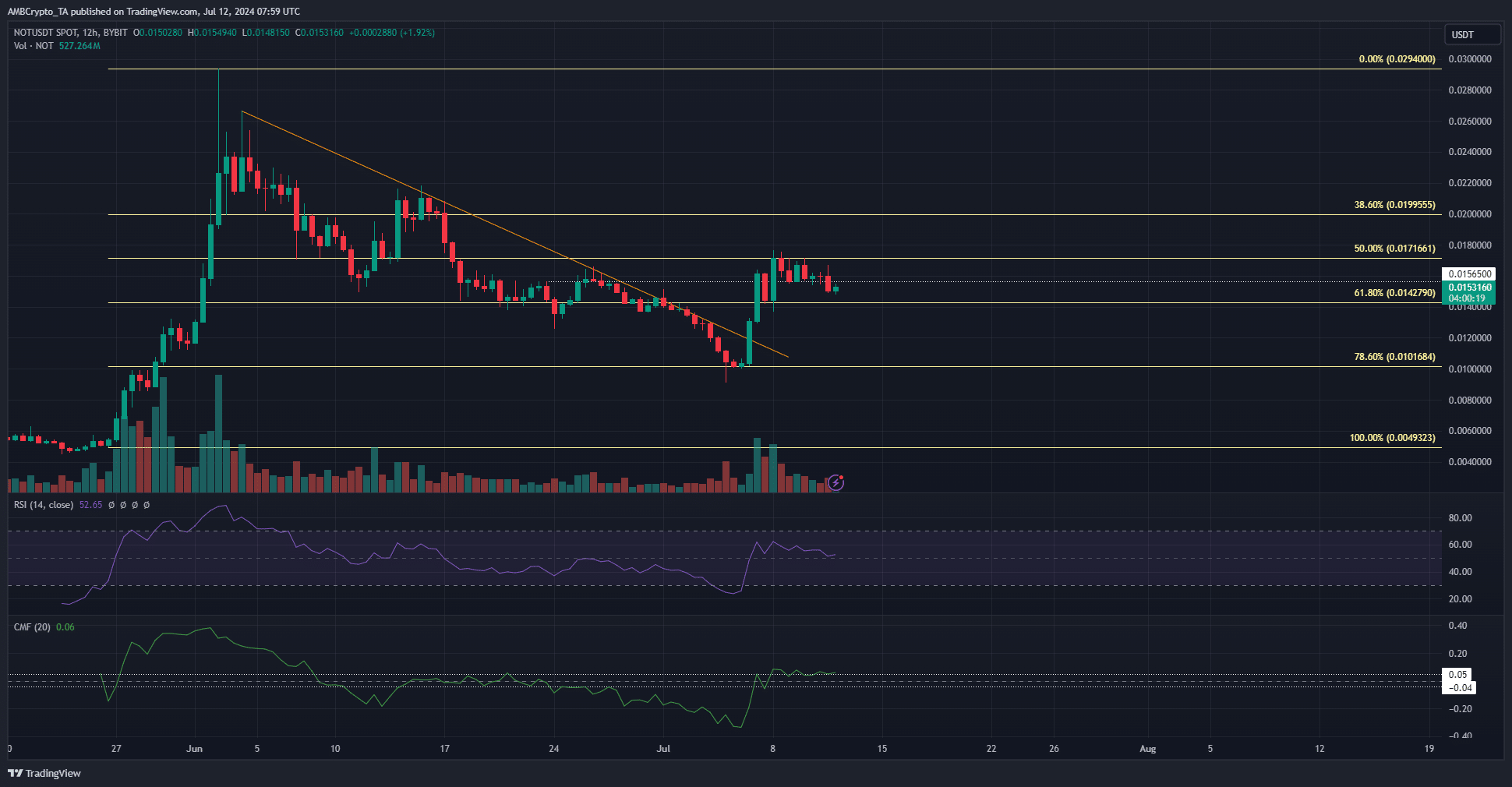

As an experienced market analyst, I have seen many situations where trends can stall and even reverse unexpectedly. The recent price action of Notcoin (NOT) has given me pause, as it failed to hold on to the $0.0156 level after breaching the trendline resistance.

🚨 RED ALERT: EUR/USD Forecast Shattered by Trump’s Moves!

Markets react violently to tariff news — stay ahead of the shockwaves!

View Urgent ForecastRecently, Notcoin [NOT] had been making a strong comeback from its bearish trend, with buying power in the driver’s seat. However, progress came to a halt within the last week, preventing the price from achieving the optimistic predictions made for it.

With decreasing trading activity raising concerns, it indicated uncertainty among market players. Was the token’s price increase merely a temporary recovery within an ongoing downtrend, or would it persist in gaining value?

NOT falls below $0.0156- is it beginning to slip once more?

As a crypto investor, I anticipated that after breaching the trendline resistance at around $0.0156 (signified by the orange line), NOT would carry on rising and maintain this price point as a crucial support level.

The end of June saw this level put up a strong fight against the advancing bulls, but they failed to seize complete control over it.

This might be because of the rapid pace of the recovery from the 78.6% Fibonacci level.

As an analyst, I’ve observed that the recent price bounce created a noticeable disparity in fair value. The substantial liquidity accumulated in the vicinity of $0.01 to $0.012 could potentially attract downward pressure on prices and cause them to revert to this level before any upward movement occurs.

In simpler terms, the Consensus Money Flow (CMF) indicated a slight advantage for buyers with a value of +0.06. However, the Relative Strength Index (RSI) of 52 suggested only a modest bullish trend.

Sentiment remained muted despite the structure break

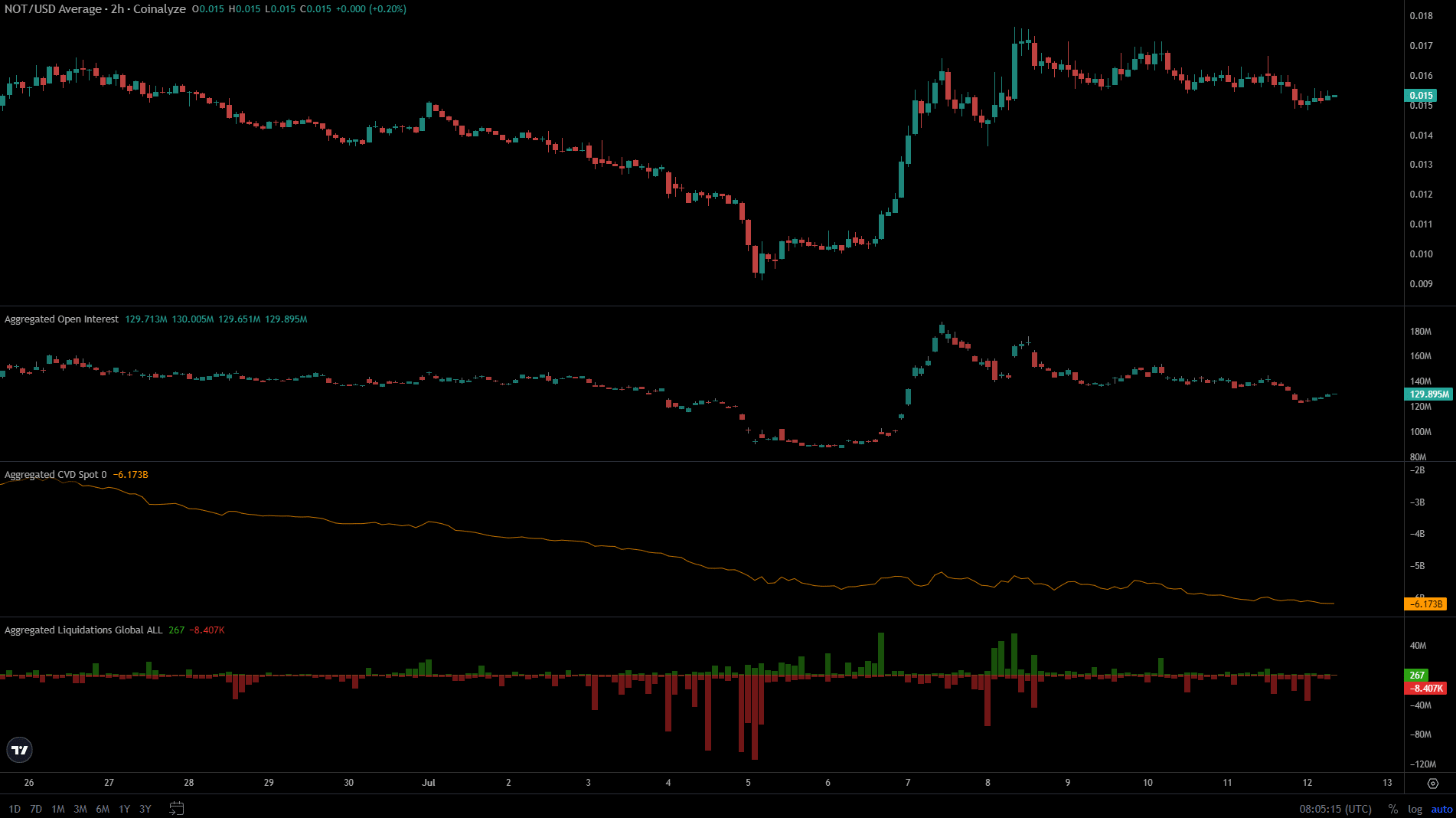

As a crypto investor, I’ve noticed that the open interest spiked along with the price increase a week ago. However, recently, it’s shown signs of bearishness, suggesting potential selling pressure in the market. Simultaneously, there has been a consistent downtrend in the spot CVD (Cost Basis Deviation), which could be an indicator of investors’ profit-taking actions or increasing uncertainty in the market.

On the 11th of July, prolonged selling occurred as prices dipped beneath $0.015. This decline signified an earnest search for more sellers looking to offload their positions.

However, the evidence does not support a renewed bullish effort in the near term.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-07-13 04:07